FEAR OF SUDDEN STOPS: LESSONS FROM AUSTRALIA AND CHILE

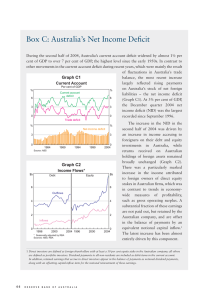

advertisement