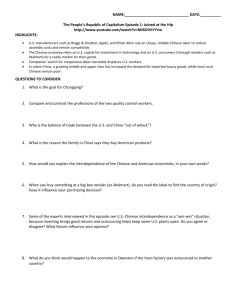

CHAPTER 1 THE U.S.-CHINA TRADE AND ECONOMIC RELATIONSHIP SECTION 1: TRADE AND ECONOMICS

advertisement