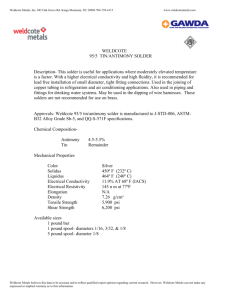

Cross-Functional Environmental Initiatives: Addressing Restriction ... Hazardous Substance (RoHS) Technical Challenges ...

advertisement