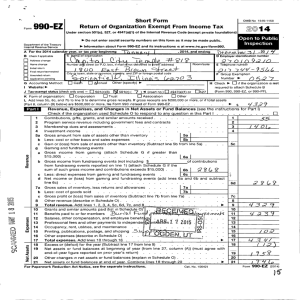

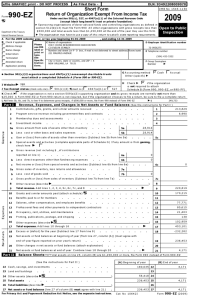

Return of Organization Exempt From Income Tax

advertisement