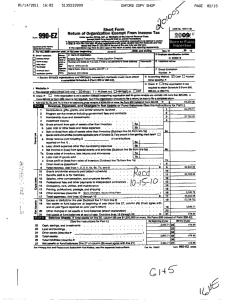

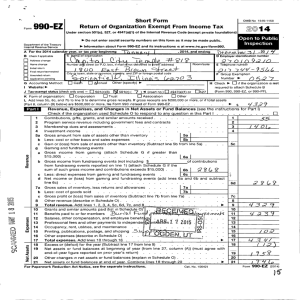

½½´ À¾µµ Return of Organization Exempt From Income Tax

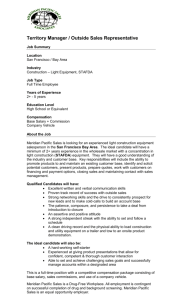

advertisement