A Comparison of Structural and Non-Structural Econometric Models in the... by Kimberly Gole

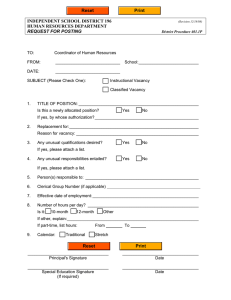

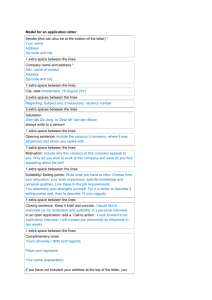

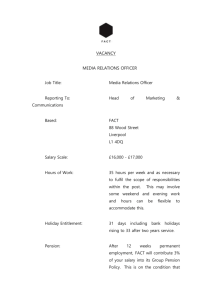

advertisement