Strategies for Japanese Developers in Potential International Markets By Mitsuhiro Nomura

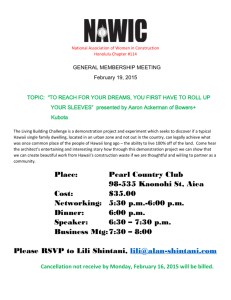

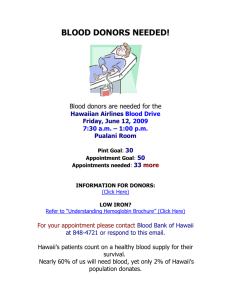

advertisement