Efficient Within Country Estimation of the Theories Brant Abbott May 11, 2008

advertisement

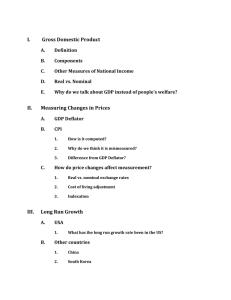

Efficient Within Country Estimation of the Theories of Nominal Rigidity - Draft Brant Abbott May 11, 2008 Abstract A fixed effects panel data approach is used to estimate the output gap solution implied by theoretical models that attempt to explain the short run inflationoutput trade-off. This is accomplished by adopting the method of Defina (1991) and Khan (2004), which overcomes the problematic aspects of the cross-country framework, but viewing some coefficients as fixed across countries. The efficiency gain from using the panel data method overcomes the multicollinearity problems that have plagued past studies of this nature. The results depend on what measure of money is used. When the IMF’s money variable is used the results support the Lucas imperfect information model, and when nominal GDP is used as a proxy for money the results support the sticky price model. 1 –Draft– 1 Introduction The source of the short-run trade-off between inflation and output observed in the data is a longstanding and ongoing debate. The benchmark candidates to explain the tradeoff are the imperfect information model of Lucas (1972) and the sticky price model, usually attributed to Calvo (1983). The empirical literature that tests the validity of these models has traditionally used a problematic two-stage cross-country approach to test the qualitative implications of the output gap solutions. To circumvent the two-stage method’s problems recent contributions have embedded the second stage regression in the first stage and estimated a single equation for each country individually. The results of these studies have been inconclusive and have suffered from a multicollinearity problem. The main contribution of the present study is to show that some of the coefficients in the output gap solution can be considered fixed across countries, allowing for more efficient fixed effects estimates. This is quite similar to some recent contributions to the exchange rate pass through literature that have shown that the traditional two-stage method in that literature is better estimated in a panel data framework (Goldfajn and Werlang, 2000; Frankel, Parsley, and Wei, 2005). A secondary contribution of this paper is to demonstrate the impact that using log nominal GDP as a proxy for log money supply may have on statistical results. To justify the proxy variable, past studies have generally made the assumptions that the aggregate demand curve is unit elastic, and that log nominal GDP is neither observable or predictable. The substitution of nominal GDP for the money supply in past studies was largely due to the lack of data availability. The two-stage method requires a large cross-section of countries in order to have reasonable degrees of freedom in the secondstage, and comparable monetary data for such a set of countries did not exist. In this study a smaller set of countries is used (n = 14) for which comparable quarterly data from the IMF’s Monetary Survey exist. When log nominal GDP is used as a proxy the 1 –Draft– results weakly support the sticky price model, but when the monetary variable is used the results strongly support the Lucas imperfect information model. The frictions that cause nominally driven real fluctuations in the benchmark models operate in substantially different ways. In the imperfect information model agents must adjust output in response to price shocks before they know whether the shock is nominal or real. A rational expectations response is to adjust output by an amount based on the relative volatilities of real and nominal disturbances, and thus output responds regardless of what type the shock turns out to be. In the sticky price model, unlike the Lucas model, firms have full information about the source of aggregate demand disturbances, but if they choose to adjust their price they incur a cost. Firms will only adjust their prices when the benefit of doing so exceeds the cost. If there is an increase in the nominal money stock and prices are sticky due to adjustment costs there will be an increase in aggregate demand resulting in a short-run increase in real output. The question of which (if either) candidate best represents the true underlying process behind the inflation-output trade-off has significant policy implications. The Lucas model implies a New-Classical short-run Phillips Curve that maps predetermined expectations to current inflation, whereas the sticky price model implies a NewKeynesian Phillips curve that maps current expectations of future inflation to current inflation. Svensson (1999) shows that an optimal commitment monetary policy is inflation-targeting if the New-Classical Phillips Curve holds, and Clarida et al. (1999) and Vestin (2006) show that price-level-targeting is an optimal commitment if the New-Keynesian Phillips Curve holds. The optimal policy when a ‘hybrid’ Phillips Curve maps a weighted average of the New-Keynesian and New-Classical versions to current inflation is inflation-targeting with some price-level consideration (Barnett and Engineer 2001).1 Information as to the correct specification of the Phillips Curve would 1 These optimal policies are derived by maximizing a standard quadratic loss function subject to a Phillips Curve. This is discussed by Barnett and Engineer (1999). 2 –Draft– then be of great importance to monetary authorities when considering their policy regime. With few exceptions, a two stage cross-country methodology has been used to assess the competing theories empirically (Lucas 1973; Ball et al., 1988; Kiley, 2000).2 Both the sticky price and the imperfect information models imply that the output gap is function of itself lagged and first differenced log money supply. The first stage of the cross-country method is to fit regressions similar to equation (1) for a number of countries individually: yt = α + βyt−1 + τ ∆xt + vt . (1) The variables y and ∆x are the output gap and first differenced nominal GDP, respectively, and v is an error term. In these studies ∆x is used in lieu of ∆m, first differenced money supply, for reasons discussed above. The parameter β is referred to as the persistence coefficient and τ is referred to as the impact coefficient. In the second stage the estimated impact coefficients from the first stage are regressed on some specification of nominal variability, σ∆x , and/or mean inflation, π, calculated over the entire sample period for each country.3 Both the sticky price and imperfect information models imply that the impact coefficient should be decreasing in the standard deviation of aggregate demand changes, σ∆x , and the sticky price model further implies that it should be decreasing in trend inflation, π T . The model of Kiley (2000) has implications similar to the sticky price model. When these variables are included individually their coefficients are generally less than zero and significant, but results are less consistent when both are included. Ball et al. (1988) report that when both are included the coefficients on π terms are significant and the coefficients on σ∆x terms are not. They argue that this implies mean inflation is the relevant variable and that the variability of 2 These three references are far from exhaustive, but are the three most instructive with regard to this study. Kiley (2000) provides references to further examples. 3 Mean inflation is the sample average which is different from trend inflation, π T . 3 –Draft– nominal GDP differences is significant in isolation only because it is highly correlated with mean inflation. The inability to distinguish between the effects of inflation and nominal volatility volatility due to their strong correlation is only one of several problems with the two stage cross-country method. The criticism by Akerlof et al. (1988) that the method incorrectly assumes the second stage regressors are constant over time has been widely cited. They argue that because in reality those variables are not constant over time the value of the impact coefficient is not either, and also that average inflation may not be a good approximation for trend inflation. A more subtle problem with the cross-country method is that the estimated marginal effects of σ∆x and π on τ are strictly between country effects and may not be reflective of within country relationships. The following example clarifies this potential problem. Suppose that τ is entirely determined by how autonomous the central bank is in each country, and that the less autonomous the central bank is the higher inflation is on average. In figure 1, a scatter plot of this hypothetical case for two countries, the large dots represent the means and the small dots represent time series observations. Clearly a fit through the means would indicate a negative relationship between τ and π, even though within each country there is no relationship. To address the problems pointed out by Akerlof et al. (1988), Defina (1991) moves away from the two stage estimation framework. Defina’s method is to replace the parameter τ in equation (1) with the functional form that was formerly fitted in the second stage. If τ = f (σ∆x , π) then the following regression is fit for each country: yt = α + βyt−1 + f (σ∆x,t , πtT )∆xt + vt . (2) The variables σ∆x,t and π t are calculated as the standard deviation of ∆x and average 4 –Draft– Figure 1: Hypothetical τ vs π 3 2.5 2 τ 1.5 1 0.5 0 0 0.5 1 1.5 2 2.5 π 3 3.5 4 4.5 5 of π, respectively, over the five years t − 4 to t.4 In this framework the significance is determined by formally considering what proportion of countries yield estimates of coefficients on a particular variable that are significant. Defina reports that when f is specified as a linear function 28/43 countries have negative coefficients on π and 35/43 countries have negative coefficients on σ∆x . However, only 13/43 π and 11/43 σ∆x coefficients are significnatly less than zero at the 90% level, and for only 3/43 countries were both coefficients significant. Khan (2004) adopts Defina’s method when assessing the theoretical work of Kiley (2000), and follows Kiley’s own empirical work in dropping σ∆x terms from regressions. This omission creates a strong potential for bias in the estimates of π T coefficients because of the correlation between the variables. Kiley and Khan both argue that the loss of efficiency when both variables are included justifies dropping one of the variables and accepting some bias. 4 Defina uses actual inflation, π, rather than trend inflation. 5 –Draft– The present paper estimates Kiley’s (2000) model in a fixed effects panel data framework, which vastly increases efficiency, eliminating the need to drop one of the variables. This framework maintains Defina’s (1991) solution to the criticisms of Akerlof et al. (1988), and ensures that slope estimates are based on within country variation. Estimation is carried out using ∆x in lieu of ∆m, as has traditionally been done, as well as an actual measure of the money supply. The results vary substantially with the different measures. When nominal GDP is used the persistence and impact coefficients are both decreasing in π T and σ∆x , but the restriction that the relevant coefficients are constant across countries is rejected. When money supply data is used the impact coefficient is decreasing in σ∆x but not π T , and the persistence coefficient is not decreasing in either. The restriction that coefficients are constant across countries cannot be rejected for any of the relevant variables. 2 Theoretical and Empirical Frameworks The theoretical foundation of the estimated model is exactly that of Kiley (2000). The supply side of the economy follows Calvo (1983) by assuming a continuum of monopolistically competitive price setting firms that choose a constant probability, γ, that they will be able to adjust their price in any given period. Firms in this model can choose a new γ in every period that they adjust their price, but because there is a fixed cost of price adjustment, F , it is suboptimal to choose γ = 1. When firms adjust their prices they choose their desired price p∗i,t , which depends on the money supply, mt , and an idiosyncratic shock, ui,t : p∗i,t = mt + ui,t . 6 –Draft– Money growth and the idiosyncratic shock are assumed to follow simple non-stationary processes, ∆mt = µ + m,t , ui,t = ui,t−1 + u,i,t , 2 where m,t and u,i,t are mean zero disturbances with variances σm and σu2 , respectively. In periods that a firm does not adjust their price they incur a quadratic loss, L, due to deviation of their actual price, pi,t , from their desired price: L = (1/2)K(pi,t − p∗i,t )2 . A further cost per period is incurred by firms if they wish to maintain perfect information about the state of the economy. Firms that pay this cost otherwise operate in the same setting as the Calvo model, i.e. at time t they know the entire history of shocks up to and including period t. If firms do not pay the information cost then at time t they know the history of shocks only until time t − 1, and must make pricing decisions in a manner similar to the Lucas model. The cost of perfect information, α ∈ (0, ∞), is different for each firm and drawn from a distribution G. Kiley shows that there is a threshold information cost, α, below which firms choose to acquire perfect information and above which they choose not to. There is then a fraction of the firms that has perfect information, Θ = G(α), and a fraction that does not, 1 − Θ. Kiley further demonstrates the the optimal choice of γ is the same for all firms regardless of whether or not they acquire perfect information. The solutions imply the following relationships: ∂Θ 2 ∂σm > 0, ∂γ 2 ∂σm > 0, ∂γ ∂µ > 0. Quite simply, information and price adjustment are more desirable in a more volatile environment, and optimal price adjustment becomes faster if trend inflation becomes 7 –Draft– faster. A closed form solution for the output gap can be attained: yt = (1 − γ)yt−1 + (1 − γΘ)∆mt + et , (3) where et is a mean zero supply shock. Equation (3) is similar to equations (1) and (2) where log nominal GDP (xt ) is a proxy for the money supply (mt ). The persistence coefficient is (1 − γ) and the impact coefficient is (1 − γΘ). The estimation framework calls for a functional form to be assigned to these coefficients. Here they are assumed to be linear: (1 − γ) = β0i + β1i πitT + β2i σ∆xit (4) (1 − γΘ) = τ0i + τ1i πitT + τ2i σ∆xit . (5) Defina (1991) and Khan (2004) make similar substitutions and add a constant term, then fit a regression of equation (6) for each country i: yit = αi + β0i yit−1 + β1i (yit−1 πitT ) + β2i (yit−1 σ∆xit ) + τ0i ∆xit + τ1i (∆xit πitT ) + τ2i (∆xit σ∆xit ) + vt . (6) Defina’s model differs from (6) in that (1 − γ) is replaced by a single coefficient, and Kahn’s model does not include σ∆xit terms in the substitutions. The present study tests whether restrictions that the coefficients can be fixed across countries are valid. To do this a single panel regression, rather than several independent regressions, is fit. Two variations of this approach are taken. In the first nominal GDP is used as a proxy for money, and in the second an actual measure of money is used. The T × n matrices ∆M and YL are constructed as follows, where n is the number 8 –Draft– of countries and T = ∆m1 ∆M = 0 .. . .. . 0 0 Pn i=1 Ti is the total length of the stacked data: ... ∆m2 . . . .. . 0 ... ... 0 ... 0 .. . ∆mn−1 0 0 ∆mn YL = yL1 0 .. . .. . 0 0 ... yL2 . . . .. . 0 ... ... 0 ... 0 .. . yLn−1 0 0 yLn Each ∆mi is a vector of length Ti containing the change in money (or log nominal GDP) for country i, and each yLi is a similar vector containing the lagged output gap. A matrix of dummy variables is denoted by D, and stacked variables are denoted by boldface characters without subscripts. A ‘period’ between two vectors indicates “element-by-element” multiplication, as opposed to matrix multiplication. Using this notation, a model in which the restrictions that β1 , β2 , τ1 and τ2 are constant across countries in equation (6) can be written as follows: y= D YL yL.π T yL.σ∆m ∆M ∆m.π T ∆m.σ∆m Ω1 + v, (7) where Ω1 0 = [ α1 . . . αn β0,1 . . . β0,n β1 β2 τ0,1 . . . τ0,n τ1 τ2 ]. The αi parameters are country specific intercept terms; the β0,i and τ0,i are the country specific constant terms of equations (4) and (5); and the τ1 , τ2 , β1 and β2 parameters are the country-invariant slope terms of equations (4) and (5). This is equivalent to the usual fixed-effects estimator. In total 3n + 4 coefficients are estimated in this version of the model, however, that is 4n − 4 less coefficients than were estimated by Defina 9 . –Draft– (1991) or Khan (2004). If the restriction that the constant terms in equations (4) and (5) are fixed across countries the matrices YL and ∆X are replaced by vectors yL and ∆x containing stacked data. This version of the estimator can be written as y= D yL yL.π T yL.σ∆m ∆m ∆m.π T ∆m.σ∆m Ω2 + v, (8) where Ω2 0 = [ α1 . . . αn β0 β1 β2 τ0 τ1 τ2 ]. In this case only n + 6 coefficients are estimated, a substantial increase in degrees of freedom. If the restrictions that equation (8) imposes on equation (6) cannot be rejected, a test for the suitability of a random effects model can be carried out. Random effects would be the most efficient estimator, but if some of the restrictions are rejected the fixed effects estimator is efficient. In terms of past literature there is a subtle interpretation of the difference between equations (7) and (8). The traditional two stage cross-country method requires that the second stage be estimated with a fixed intercept term. The country-invariant τ0 and β0 terms in equation (8) make this same restriction, while it is relaxed in equation (7). This restriction is related to the question of within and between country variation discussed in the introduction. Fitting equation (8) would result in the bold line illustrated in figure 1, whereas fitting equation (7) would fit a different regression line for each country that is indicative of the within country variation. Because equation (8) is nested in equation (7), formal testing is straightforward. The methodology of Defina (1991) and Khan (2004) captures within country variation, however it does not allow for formal testing of such restrictions. 10 –Draft– Table 1: Data Sample 3 Country Time Period Country Time Period Australia Canada France Germany Italy Japan Mexico 1971Q1-2007Q2 1971Q1-2007Q1 1976Q1-1998Q2 1960Q4-1989Q2 1976Q1-1998Q4 1961Q1-2006Q4 1977Q1-2007Q1 Netherlands 1973Q1-1997Q1 New Zealand 1982Q2-2007Q1 South Africa 1968Q1-1992Q3 Spain 1970Q1-1999Q1 Switzerland 1977Q4-2007Q2 United Kingdom 1961Q1-2007Q2 United States 1960Q4-2007Q2 Data Quarterly seasonally adjusted nominal GDP, GDP deflator and percent change in money data for 14 countries spanning the years 1956-2007 were retrieved from the IMF’s International Financial Statistics. The definition of money in the series used is narrow and includes transferable deposits and currency outside banks. A list of included countries and time periods is provided in table 1. The raw data were used to calculate log real GDP and log nominal GDP in the usual way. The output gap is formulated as the cyclical component of Hodrick-Prescott (HP) filtered log real GDP as in Kiley (2000) and Khan (2004). Inflation was computed as percentage changes in the GDP deflator, and trend inflation is computed as the trend component of HP filtered inflation. Because the data was quarterly the filtering parameter was set to 1600. The time varying measures of the standard deviation of the percent change in money and first-differenced log nominal GDP were calculated using using three years of data as: # 21 t X 1 = (∆mi,s − ∆mi,s ) , 4 s=t−11 " σ∆m,i,t 11 –Draft– where ∆mi,s is the mean of ∆mi,s over the period t − 11 to t. 4 Results To create a basis for testing nested restrictions equation (6) was estimated as a single panel regression, in which none of the slope coefficients were restricted to be constant across countries. This is equivalent to fitting a separate regression for each country, like Defina (1991) did. Table 2(a) presents these results for the case of using nominal GDP as a proxy, and Table 2(b) presents the the results for the case of using the IMF’s money variable. Standard errors are given in parentheses below slope coefficients. When the nominal GDP data is used the majority of coefficients have the sign implied by the sticky price theory, however these coefficients are seldom significant. Even less common that significant coefficient with the correct sign are significant coefficients with the wrong sign, the presence of which is troubling. These results for the nominal GDP case are very similar to those of Defina (1991) and Khan (2004). The results for the case of using IMF money data are similar, however correctly signed coefficients are in the majority only for τ2 , τ0 and β0 . Tables 3(a) and 3(b) presents a subset of the results from fitting equation (7) by OLS when nominal GDP and IMF money data are used, respectively. In equation (7) coefficients τ1 , τ2 , β1 and β2 are fixed across countries. If the restrictions cannot be rejected, the results of these regressions are quite different depending on which variable is used. In the case of nominal GDP as a proxy the results highly support sticky price models. In that case the persistence and impact coefficients are decreasing in both trend inflation and nominal volatility, with highly significant coefficients. On the other hand, if IMF money is used the only significantly negative coefficient is on the nominal volatility term in the impact coefficient. This result is highly supportive of the Lucas 12 –Draft– Table 2(a): No coefficient restrictions, Nominal GDP data. Country β0 β1 β2 τ0 Australia 0.98 (0.16) 0.98 (0.14) 0.87 (0.18) 1.33 (0.36) 1.09 (0.09) 0.84 (0.13) 1.27 (0.13) 1.14 (0.09) 1.03 (0.32) 1.20 (0.19) 0.90 (0.27) 0.94 (0.19) 0.88 (0.12) 0.88 (0.17) -6.23 (6.37) 3.23 (8.19) 3.04 (7.31) -35.59 (24.41) -7.87 (2.97) -0.37 (4.69) -2.81 (0.64) 16.90 (4.76) -10.83 (53.23) -5.07 (6.45) -6.76 (6.04) -7.47 (24.65) -5.35 (5.47) 2.17 (7.94) -9.74 (29.24) -38.44 (38.57) -7.27 (10.33) -22.99 (33.76) -4.69 (4.64) -9.05 (16.59) -17.62 (4.44) -70.23 (16.73) -18.65 (44.18) -11.44 (8.03) 12.04 (40.37) -4.03 (16.18) -6.62 (23.93) -3.36 (33.64) 2.78 (0.36) 2.78 (0.44) 3.14 (0.42) 3.25 (0.70) 2.67 (0.27) 1.59 (0.29) 2.59 (0.14) 2.47 (0.39) 2.21 (0.93) 2.70 (0.34) 1.88 (0.40) 2.31 (0.59) 2.83 (0.30) 2.86 (0.47) Canada France Germany Italy Japan Mexico Netherlands New Zealand South Africa Spain Switzerland United Kingdom United States R2 = 0.785 13 τ1 τ2 -42.86 -48.47 (9.93) (49.53) -40.99 -162.91 (12.33) (82.85) -75.42 -26.28 (13.71) (16.39) -82.94 -61.67 (36.28) (64.45) -39.68 -13.80 (4.98) (10.45) -28.93 -33.98 (9.22) (25.66) -11.25 -17.67 (0.57) (3.78) 19.84 -102.04 (27.45) (35.52) -37.98 14.12 (132.89) (101.72) -26.27 9.97 (8.02) (15.47) -31.97 81.31 (6.77) (45.03) -111.03 56.25 (71.32) (44.59) -33.50 -67.31 (9.74) (31.46) -53.97 -45.85 (17.29) (83.29) –Draft– Table 2(b): No coefficient restrictions, IMF Money data. Country β0 β1 β2 τ0 τ1 τ2 Australia 0.81 (0.20) 0.83 (0.19) -0.05 (0.20) 0.53 (0.38) 0.78 (0.14) 0.71 (0.18) -0.08 (0.10) 0.31 (0.13) 0.76 (0.23) 0.88 (0.30) 0.62 (0.39) 0.63 (0.43) 0.62 (0.27) 0.75 (0.30) -1.29 (8.57) -0.07 (10.36) 8.04 (13.66) -14.24 (40.87) 0.12 (4.48) -1.47 (7.01) 3.31 (0.81) 13.12 (4.33) -24.81 (37.92) -3.52 (12.03) -0.32 (8.89) 2.65 (36.76) -1.32 (6.64) 3.79 (12.39) -0.01 (0.04) 0.01 (0.03) 0.07 (0.03) 0.07 (0.08) -0.02 (0.02) 0.01 (0.03) 0.00 (0.00) 0.07 (0.02) 0.01 (0.04) -0.01 (0.02) 0.02 (0.07) 0.00 (0.04) 0.02 (0.05) 0.03 (0.07) 0.08 (0.04) 0.02 (0.05) 0.00 (0.06) 0.05 (0.08) 0.09 (0.04) 0.07 (0.04) -0.01 (0.02) -0.23 (0.09) 0.04 (0.06) 0.14 (0.05) 0.05 (0.05) 0.03 (0.10) 0.00 (0.04) 0.07 (0.10) 0.76 (1.17) 0.81 (2.00) -2.63 (2.97) 4.14 (6.13) 0.31 (0.75) 0.16 (1.00) -0.02 (0.07) -13.31 (4.73) 0.08 (3.35) -2.58 (1.61) -0.56 (0.87) -12.64 (6.06) 0.25 (0.92) -1.02 (3.65) -0.006 (0.004) -0.003 (0.004) -0.002 (0.008) -0.021 (0.016) -0.011 (0.004) -0.008 (0.004) 0.000 (0.000) 0.048 (0.016) 0.001 (0.007) 0.000 (0.002) 0.000 (0.006) -0.002 (0.009) 0.003 (0.007) -0.009 (0.020) Canada France Germany Italy Japan Mexico Netherlands New Zealand South Africa Spain Switzerland United Kingdom United States R2 = 0.539 14 –Draft– Table 3(a): Coefficients τ1 , τ2 , β1 and β2 fixed, Nominal GDP data Coefficient Estimate Standard Error p(H0 = 0; Ha < 0) β1 -2.86 0.60 0.00 β2 -11.46 2.55 0.00 τ1 -12.26 0.57 0.00 τ2 -11.91 3.22 0.00 R2 = 0.762 imperfect information model, which has no implications for the other terms. For the results presented in Table 3 to be meaningful the restrictions imposed on the regression must be accurate. To check this a simple F -test of the null hypothesis that the restrictions are true was performed, the results of which are presented in Table 4. In the case of nominal GDP data the null is strongly rejected, but in the case of the IMF money data it cannot be rejected. This implies that the results presented in Table 3(a) are not likely to be accurate, and the best results for the case of the nominal GDP data are those in table 2(a). However, for the IMF money variable the results presented in Table 3(a) can be considered, and are more efficient than those in Table 2(a). More efficiency could be gained if the coefficients β0 and τ0 are fixed across countries. The last line of Table 4 gives results for testing the null hypothesis that those coefficients are fixed for the IMF money data case. This is in essence testing the restrictions that are imposed on equation (7) to arrive at equation (8). The restrictions are strongly rejected. The last result in Table 4 implies that each country should have a unique τ0,i , which 15 –Draft– Table 3(b): Coefficients τ1 , τ2 , β1 and β2 fixed, IMF Money data Coefficient Estimate Standard Error p(H0 = 0; Ha < 0) β1 3.18 0.75 1.00 β2 0.0025 0.0029 0.85 τ1 -0.0433 0.0725 0.29 τ2 -0.0005 0.0003 0.07 R2 = 0.525 Table 4: Hypothesis Testing Restrictions F -value p-value 3.64 0.00 β1,i = β1 , β2,i = β2 , τ1,i = τ1 , τ2,i = τ2 , ∀i 1.17 0.19 β0,i = β1 , τ0,i = τ0 , ∀i 3.10 0.00 Nominal GDP data β1,i = β1 , β2,i = β2 , τ1,i = τ1 , τ2,i = τ2 , ∀i IMF Money data 16 –Draft– Figure 2: Predicted τ vs. σ∆ m (Money Data) 0.035 CAN USA UK 0.03 0.025 τ 0.02 0.015 0.01 0.005 0 2 4 6 σ∆ m 8 10 12 14 further implies that each country has a unique intercept in τ σ∆x space. Here τ is defined as the total impact coefficient, that is τit = τ0,i + τ1 πitT + τ2 σ∆xit . Figure 2 provides a scatter plot of τ̂ vs. σ∆x , for Canada, the United States and the United Kingdom, where τ̂t is the predicted impact coefficient from equation (7) fit with IMF money data. The subtle negative marginal effects of nominal volatility on the impact coefficient is apparent in this scatter plots, however, it is clear that the difference between countries has far more to do with the intercept than the slope. One can imagine a line fit through the means of the plotted data as having an almost vertical slope, whereas the within country slopes are closer to horizontal. 17 –Draft– 5 Discussion and Conclusion The framework presented above successfully deals with many of the complications that have plagued the empirical literature on nominal rigidities. The method makes use of the suggestion by Defina (1991) that allows measures of nominal variability and trend inflation to vary over time, but increases efficiency to circumvent the problematic multicollinearity that has made inference in previous studies difficult. Because this method estimates the marginal effects using only within country variation, it provides more compelling evidence that the theoretical relationships exist at the country level than estimates based on cross-country variation. This paper has also provided evidence that the use of nominal GDP as a proxy for the money supply effects the statistical results. When the IMF’s measure of money was used the results strongly supported the Lucas imperfect information theory. The coefficient for which Lucases theory has implications had the was significant in the hypothesized direction, and the coefficients that have implications unique to the sticky price theory were not. When nominal GDP was used a proxy for money, estimated coefficients from equation (7) were all as predicted by the sticky price theory, however the restrictions were strongly rejected. Without the restrictions imposed the results gave weak evidence in favor of the sticky price theory (Table 2(a)). The result that τ0 and β0 cannot be restricted to be constant across countries indicates a further problem with past uses of the two-stage method. The two stage method the assumption that those parameters are fixed across countries is being made. This is related to the difference between measuring within and between country variation. Because the impact and persistence parameters have different intercepts in each country, fitting a regression with the restriction of non-unique intercepts will bias estimated marginal effects. The empirical specification used in the present study posits that the persistence 18 –Draft– and impact coefficients are simple linear functions. The results of this study would be strengthened by considering non-linear specifications. Many past authors have considered quadratic specifications, however such specifications have little more theoretical grounding than do linear ones. Akerlof et al. pointed out that the impact parameter should be a hyperbolic function of mean inflation and nominal volatility. Implementation of such a specification in the panel data framework would be beneficial. Furthermore, the route to distinguishing between hybrid and pure sticky price models may be through the implied functional forms. These forms are likely to be non-linear and rely on asymptotic properties for inference. The substantial improvement in degrees of freedom offered by the panel data framework will be of great benefit in such a study. It would be prudent for replications and extensions of this study to be done using monetary data. This study has indicated that the results when nominal GDP is used as a proxy may be misleading. However, further studies using different measures of money and different samples would be helpful in determining how generalizable this result is. References Akerlof, George, Andrew Rose, and Janet Yellen (1988) ‘The New-Keynesian economics and the inflation-output trade-off: comments and discussion.’ Brookings Papers on Economic Activity 1, 66–75 Ball, Laurence, Gregory Mankiw, and David Romer (1988) ‘The New-Keynesian economics and the inflation-output trade-off.’ Brookings Papers on Economic Activity 1, 1–65 Barnett, Richard, and Merwan Engineer (2001) ‘When is price-level targeting a good idea?’ In ‘Price Stability and the Long-Run Target for Monetary Policy’ (Bank of Canada) pp. 101–149 19 –Draft– Calvo, Guillermo (1983) ‘Staggered prices in a utility-maximizing framework.’ Journal of Monetary Economics 12, 383–398 Clarida, Richard, Jordi Gali, and Mark Gertler (1999) ‘The science of monetary policy: A new keynesian perspective.’ Journal of Economic Literature 73(4), 1661–1707 DeFina, Robert H. (1991) ‘International evidence on a new keynesian theory of the inflation-output trade-off.’ Journal of Money Credit and Banking 23, 410–422 Frankel, Jeffrey, David Parsley, and Shang-Jin Wei (2005) ‘Slow passthrough around the world: A new import for developing countries?’ NBER working paper No. 11199 Goldfajn, Ilan, and Srgio Ribeiro da Costa Werlang (2000) ‘The pass-through from depreciation to inflation: A panel study.’ Banco Central do Brasil working paper 5 Lucas, Robert (1972) ‘Expectations and the neutrality of money.’ Journal of Economic Theory 4, 103–124 (1973) ‘Some international evidence on output-inflation trade-offs.’ American Economic Review 63, 326–334 Svensson, Lars (1999) ‘Price-level targeting versus inflation targeting: A free lunch?’ Journal of Money, Credit and Banking 31(3), 277–295 Vestin, David (2006) ‘Price-level versus inflation targeting.’ Journal of Monetary Economics 20