A wave of protectionism? An analysis of economic and political considerations

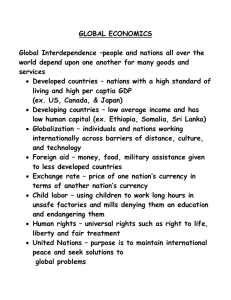

advertisement