Public-Private Partnerships and the Privatization of Financing: An Incomplete Contracts Approach

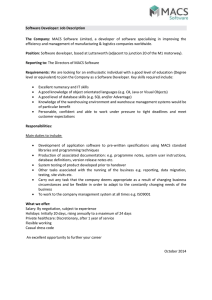

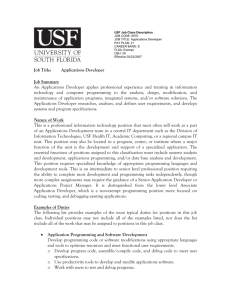

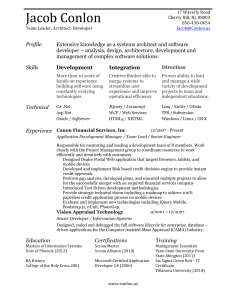

advertisement