Modeling of Asymmetry between Gasoline and Crude oil

advertisement

Modeling of Asymmetry between Gasoline and Crude oil

prices: A Monte Carlo Comparison

Afshin Honarvar

University of Calgary

An Engle-Granger two-step procedure is commonly used to estimate

cointegrating vectors and consequently error-correction models. This paper uses Monte

Carlo methods to demonstrate that the Engle-Granger two step method leads to biased

estimates of asymmetric parameters and in some cases suggests symmetry in the

estimated parameters. In contrast, the single equation error correction model (SEECM)

and nonlinear least square (NLS) methods for simultaneous estimation of the

cointegrating vector and the ECM, perform better in estimating the asymmetric

parameters and making inferences on existence of asymmetry when the error terms in

DGP are white noise. When the error terms in DGP are auto-correlated, NLS estimations

are less biased and inferences are less likely to be misleading compared with SEECM

and the Engle-Granger two-step procedures.

1. Introduction:

Some observers perceive that retail gasoline prices are more responsive to

increases in crude oil prices than they are to decreases. The perceived asymmetric

relationship between gasoline and crude oil prices has been interpreted by some authors

as the evidence that the petroleum industry is monopolistic and takes advantage of its

market power. Thus consumers and politicians in countries like U.S., Canada and the

Netherlands have called for policies to put a stop to what is seen as unfair pricing

practices for petroleum products.1 There is no consensus as to the existence of asymmetry

between gasoline and crude oil prices. Bacon (1991) finds evidence of asymmetry for the

U.K. gasoline market; Karrenbock (1991); Borenstein, Cameron, and Gilbert (1997);

Balke, Brown, and Yücel (1998); Brown, and Yücel (2000); Borenstein and Shepard

(2002) and Radchenko (2005) all find evidence of asymmetric responses in U.S. gasoline

markets to changes in crude oil prices. Galeotti, Lanza and Manera (2003) find some

1

evidence of asymmetry between crude oil and spot gasoline prices in international

markets.2

In contrast with the other studies, Godby, Stengos, Lintner and Wandschnider

(2000) find no evidence of asymmetry in the Canadian retail gasoline market. Shin

(1994), Bachmiere and Griffin (2003) find a symmetric response in U.S. gasoline market.

Bettendorf, Van der Geest and Varkevisser (2003) find mixed evidence of symmetry and

asymmetry for Dutch retail gasoline market.

Confounding our ability to determine from the literature whether the asymmetric

relationship between gasoline and oil prices exists is the fact that studies listed above use

data sets for different time spans, different locations and different market stages. The

studies also employ a range of estimation strategies for accounting for the existence of

cointegration and asymmetry.

It is difficult to assess whether the variation in findings

across studies is due to the data set used or statistical procedure employed.

We also lack a basic understanding of which estimation strategies can be expected

to yield the “best” results. In fact the focus of debate in this literature (gasoline – crude

oil price asymmetry) is concentrated on seeking for the most reliable and powerful tests

of determining asymmetry. For instance Bachmiere and Griffin (2003) use two different

models to test for asymmetry in one data set and faced contradictory results. Godby et al.

(2000) believe that using a threshold of zero for splitting the direction of movements in

prices (which is frequently used by researchers) imposes too much restriction on the

model; therefore they suggest threshold autoregressive (TAR) models.

Meanwhile

Granger and Yoon (2002) suggest that asymmetry might exist in cointegrating vectors as

2

well as in adjustments, so they propose a CECM (crouching error correction model)

based on a hidden cointegrated vector.3

In the current econometric literature there are many nonlinear approaches to the

estimation of asymmetry, and in Hamilton’s (1993) words “an unbounded universe of

alternative different specifications”. Asymmetric ECM and threshold regime switching

models (TAR,MTAR,…) are two general types of models that have been frequently

employed in the literature of gasoline and crude oil price asymmetry. According to Fan

and Yao (2003), “the usefulness of TAR models is due to the fact that the class of

piecewise linear functions, may typically provide a simple and easy-to-handle

approximation to a more sophisticated nonlinear function”. Furthermore, most of the

authors in the literature of gasoline and crude oil asymmetry believe that, there is a longrun equilibrium between prices of these two commodities and any deviation from it will

result into the adjustment to the equilibrium sooner or later.4

In line with this literature, I follow the common belief of existence of a long-run

equilibrium between prices of gasoline and crude oil and investigate the properties of the

asymmetric ECM and TAR models. Asymmetric ECM and TAR models have not been

compared in a single study under the same conditions. The purpose of this research at the

first step is to compare these two simple asymmetric models by using Monte Carlo

experiments to determine which one uncovers asymmetry better. It is well known that

tests of asymmetry suffer from low power of the test, but there are comparative

advantages for some of these techniques.

This paper is structured as follows. In the next section, I will describe the

implications of this study on past applied studies. A brief overview of asymmetric ECMs

3

is presented in section 3. In section 4, I review the small sample bias in Engle-Granger

two-step procedure which is frequently used in asymmetric ECMs for estimations. Two

currently used methods of simultaneous estimations of cointegrating vector and ECM are

extended to an asymmetric environment in section 5. Section 6 presents Monte Carlo

experiments and simulation results for different assumptions about the error terms and

some cases of interest. Concluding remarks close the paper.

2. Implications for the empirical research:

Most of the empirical studies address asymmetry between gasoline and crude oil

prices by questioning whether gasoline prices symmetrically respond to an increase or

decrease in crude oil prices. Among these studies most of the researchers concentrate on

estimates of different short-run adjustments and speeds of adjustments to positive and

negative shocks in crude oil prices. Due to fact that most of the economic data series are

integrated with order one, this type of research is embedded in the literature of

cointegration and ECM.5 The major findings and methodologies of the most cited studies

are summarized in table (1). As a result, table (1) shows that the majority of the

estimations are based on Engle-Granger two-step procedure to uncover the asymmetry.

However, Borenstein et al. (1997) and (2002) are exceptions such that their specifications

are non-standard with respect to general form of asymmetric ECM and they are incapable

of tracking asymmetries in speeds of adjustment. In both of these papers short-run

adjustments are modeled asymmetrically but speeds of adjustment are modeled

symmetrically. Therefore in my study I avoid unnecessary complexities and specifically

designed models and concentrate on general and commonly used forms of asymmetric

models to show the inappropriateness of Engle-Granger two-step. Meanwhile using

4

Engle-Granger is very common not only in this literature but also in recent time series

literature for instance MTAR modeling introduced by Enders and Siklos (2001).

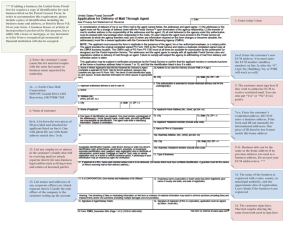

Table 1- A summery on some of the previous empirical papers

Author(s)

Data /

methodology

Estimation Major findings related to asymmetry

Country

1-Bacon (1991)

Fortnightly

Quadratic partial

Asymmetry between retail price of gasoline and its cost

NLS6

1982-1989

adjustment

of production.

U.K.

model

2- Galeotti,

Monthly

Asymmetric

Evidence for asymmetry between prices of “retail

Lanza, Manera

1985-2000

ECM based on

gasoline and spot gasoline” and also “spot gasoline and

OLS

(2003)

Germany,

EG two-step and

crude oil” for 5 European countries.

France, UK, bootstrapped

Italy, Spain

F-tests

3- Godby,

Weekly

Error correction

No Asymmetry between retail gasoline prices (regular or

Stengos, Lintner, 1990-1996

TAR model

premium) and crude oil prices.

Wandschnider

Canada

based on EngleOLS

Granger two-step

(2000)

method

Evidence of asymmetry depends on the choice of the

4-Bettendorf,

Weekly

Asymmetric

day in the week, as a representative price of the week.

Van der Geest

1996-2001

ECM based on

OLS

Choice of Monday, Thursday & Friday reveals asymmetry

and Varkevisser

Netherlands EG two-step

between retail and spot gasoline prices in Dutch market.

(2002)

5- Karrenbock

Monthly

Distributed lag

Asymmetry between retail and wholesale gasoline prices.

(1991)

1983-1990

model

OLS

USA

6- Shin (1994)

Monthly

Quadratic partial

No asymmetry between wholesale gasoline and crude oil

NLS

1986-1992

adjustment

price.

USA

model

Asymmetry between prices of :

7- Borenstein,

Weekly &

Non-standard

spot gasoline & spot crude oil (inventory adjustment)

Cameron, Gilbert Semi

Asymmetric

retail gasoline & wholesale gasoline (indication of market

(1997)

monthly

ECM

power).

1986- 1992

2SLS

No strong evidence of asymmetry in other relationships.

USA

They treat price of crude oil as endogenous and use crude

oil price in international markets and futures market as

instruments.

Asymmetry between retail gasoline price and crude oil

8- Balke, Brown, Weekly

VAR in levels

price, when using first difference data.

and Yücel (1998) 1987-1996

and Asymmetric

OLS

No asymmetry when using data in levels.

USA

ECM based on

EG two-step

Asymmetry between crude oil price and gasoline terminal

9- Borenstein,

Weekly

Non-standard

prices. They treat price of crude oil as endogenous and use

Shepard (2002)

1986-1992

asymmetric

2SLS

crude oil price in international markets and futures market

USA

ECM & VAR

as instruments.

model

10-Bachmiere,

Daily

Asymmetric

No evidence of asymmetry in the response of regional

Griffin (2002)

1985-1998

ECM based on

OLS

spot gasoline prices to crude oil price shocks.

USA

EG two-step

11- Radchenko

Weekly

Asymmetric

Asymmetry between crude oil price and retail regular

OLS

(2005)

1991-2003

ECM based on

gasoline price is attributed to oligopolistic theory.

USA

EG two-step7

5

In table 1 we find mixed results of symmetry and asymmetry, such that existence

of asymmetry and its magnitude remains as a question. This is partly due to inability of

asymmetric ECM to find asymmetry. In Galeotti et al. (2003) word “A few applied

studies employing the asymmetric ECM model have recently documented that the

commonly used F-tests of equality among coefficients accounting for the asymmetries are

biased toward accepting null of symmetry in small samples”. Consequently, Galeotti et

al. bootstrapped F-tests to overcome this problem. As we will see later, this problem

might be due to modeling approach and estimation method; not in F-test tabulations.

Therefore there are grounds to be suspicious of the obtained results in tables 1 and 2.

Hence new applied investigations based on different specifications and estimation

methods are required. In summary; even if asymmetry is found we have to be suspicious

about the magnitude of the asymmetry (bias in estimations).

In table 2, the reported asymmetric short-run and speed of adjustment parameters

are presented. Only the studies that potentially can report such parameters are included.

Note that these parameters are incomparable because of the different approaches;

different time data sets, different market stages and so on.

Finally; the diversity of the obtained results and presence of a wide range of

estimated parameters persuade us to perform a new empirical study in this literature in

the next chapter.

6

Table 2- Summary of the parameter estimates in the related papers

Asymmetric Short-run parameters

Lagged dependent variable

Study

Borenstein, Cameron,

Gilbert (1997)(spot-crude)

(retail – crude)

Bachmiere and Griffin

(2002)(spot-crude)

Borenstein and Shepard

(2002)

Godby et al. (2000)

Galeotti, Lanza, Manera

(2003)(spot crude)

(retail-crude)

Bettendorf and Van der

Geest and Varkevisser

(2002) (retail-spot)

Radchenko (2005)

Asymmetric Speed of

adjustment parameters

Contemporaneous Independent

variable

Positive

Negative

movements

movements

Positive

movements

Negative

movements

-0.055

-0.314

-0.070

0.127

0.888

0.549

1.088

-0.181

0.139

0.154

0.748

0.799

Positive

movements

Negative

movements

-0.183

-0.175

-0.017

-0.025

They did not report these coefficients because their paper designed to answer lags in adjustment.

Therefore they just test asymmetry but did not report the results in the way to be useful for us.

They just report P-Values of the test and nothing more.

NA

NA

NA

NA

[0.76 0.88]

[0.20 0.79]

[0.58 1.16]

[0.16 0.55]

NA

NA

[0.27 0.717]

[0.41 0.50]

[-0.85 -0.35]

[-1.37 -0.15]

[-0.58 -0.27]

[-1.36 -0.12]

[-0.918 -0.836]

Although he use asymmetric ECM but he does not report the coefficients because he introduces

some measures based on unreported coefficients and reports the measures instead.

3. An overview of test procedures:

The asymmetric ECM and asymmetric ECM with TAR are extensions of the

symmetric ECM that model asymmetry as the existence of two or more different linear

regimes. Thus, the simplest way to motivate the strategy for estimating asymmetric

ECMs and to demonstrate the potential advantages and disadvantages with two-step

versus single step estimation methods is to begin with a presentation of the symmetric

ECM.

Equation (1) shows a cointegration between two I(1) series of Y and X. Engle and

Granger (1987) propose a two step procedure for estimating the ECM in (4). In the first

step, equation (1) is estimated by OLS to yield the estimates α̂ and β̂ . These estimates

are used to calculate Zt, the sequence of residuals (estimates of ut), as shown in (2). A

7

unit root test is performed to assess if Zt is stationary as per equation (3) where the null

hypothesis for the test is one of no cointegration (HN: ρ=0). So long as the Zt are

stationary, according to Granger’s Representation Theorem (Engle and Granger (1987)),

we can estimate the ECM as per equation (4) by OLS in the second step. 8 Note that

when cointegration exists, Zt can be used as error correcting term in equation (4). Thus Zt

is stationary in the presence of cointegration and ε1t is a white noise disturbance term.

(1)

(2) OLS estimations

(3) Unit root test:

(4)

⇒

Yt = α + β Xt + u t

Zt = Y t − αˆ − βˆ X t

∆Zt=ρZt-1+εt

k

n

i =1

i =1

∆Yt = θ0 + θ1 Zt −1 + ∑ β ix ∆X t −i + ∑ β iy ∆Yt −i + ε1t

Equation 4 specifies that any changes in Yt can originate from one of three sources; first

from Zt-1 (i.e. deviations from equilibrium in last period); second, from ∆Yt-i and third,

from ∆Xt-i (i.e. changes in lagged dependent and independent variables). θ1 is interpreted

as the coefficient of speed of adjustment to the long-run equilibrium; however βxs and βys

are called short-run adjustment coefficients with respect to short-term dynamics of Yt and

∆Xt.

Moving beyond the symmetric ECM environment to an asymmetric ECM

increases the complexity of the estimation problem, but these models are commonly

based on existence of a linear cointegration between levels of two I(1) series as in

equation (1).9 Zt is a stationary process, ε1t is a white noise disturbance and X and Y are

integrated I(1). As described in (5), in its general form, the asymmetric error correction

8

model specifies the response of Yt to positive and negative shocks to right hand side

variables.

(5)

k

n

k

n

i =0

i =1

i =0

i =1

∆Yt = θ1+ Z+t −1 + θ1− Z−t −1 + ∑ β ix+ ∆X t −i + ∑ β iy+ ∆Yt −i + ∑ β ix− ∆X t −i + ∑ β iy− ∆Yt −i + ε1t

Where Z +t −1 = max{0,Zt-1} and Z −t − 1 = min{0,Zt-1}.

β +x applies when ∆X t −i > 0

; β +y applies when ∆Yt −i > 0

β −x applies when ∆X t −i < 0

; β −y applies when ∆Yt −i < 0

We estimate equation (5) by OLS, and if β +x ≠ β −x and β +y ≠ β −y and θ+≠ θ-, then we can

say that asymmetry exists. This is an application of Engle-Granger two-step procedure,

because, the estimated residuals in equation (2) are used as error correcting terms in (5).

Hence the conventional testing procedure for asymmetry in the adjustment speed

coefficients is to begin with following null and alternative hypothesis.

HN: θ+= θHA: θ+≠ θThreshold autoregressive (TAR) in ECM: Godby, Lintner, Stengos and Wandschneider

(2000) have a model based on threshold adjustments to estimate the relationship between

retail gasoline prices and crude oil prices. Their TAR model can be described as follows.

First, they test for the existence of the cointegration (1) between levels of variables.

After finding the cointegration they specify an asymmetric ECM that embeds a TAR

model in it (6). Therefore this is an application of Engle-Granger two-step procedure,

because the obtained residuals from (2) are used as error correcting terms in (6).*

* Hereafter, in order not clutter notation I try to maintain the same symbols for coefficients and disturbance

terms as long as it does not mislead the reader. But this does not mean that coefficients have the same

values in all models.

9

(6)

k

∆Yt = γ 0 + γ sp Z t −1 + ∑ γ i ∆X t − i + ε1t

i =1

k

∆ Yt = δ 0 + δsp Z t −1 + ∑ δi ∆ X t − i + ε1t

i =1

∆X<τ

∆X≥τ

Zt-1 is the error correcting term Y t −1 − αˆ − βˆ X t −1 and τ is the threshold value. The TAR

model is less restrictive in the sense that the threshold is not necessarily set equal to zero.

In this model the null hypothesis of symmetry is expressed as:

H N : γ = δ

H A : γ ≠ δ

Where γ = (γ0,γSP, γ1 ,…, γ k ) and δ = (δ0,δSP, δ1 ,…, δk ). They use a test based on

bootstrapped critical values of Hansen’s (1997) Wald type heteroskedasticity-consistent

test of the above null hypothesis against TAR alternative. In this investigation, existence

of asymmetry in the unit-root test for cointegration is not investigated and TAR is applied

only for ECM.10

4. The problems of small sample bias and low power in Engle-Granger two-step:

In the last section we saw that asymmetric ECM and asymmetric regime

switching models are mainly based on Engle-Granger two-step procedure, where the

estimated residuals of the long-run equilibrium were used as the error correcting term in

ECM. Although Engle-Granger two step estimations are consistent for estimating the

symmetric ECM, Banerjee et al. (1986) present Monte Carlo simulation results showing

that the Engle-Granger procedure may lead to substantial biases in the estimation of

cointegrating vector in finite samples, when there is a symmetric regime. To show this,

they start with the following Data Generating Process (DGP) for their experiments.

10

(7)

Yt=γ0+γ1Yt-1+γ2Xt+γ3Xt-1+ε1t

(8)

Xt=Xt-1+ε2t

Equation (8) states that Xt is a random walk process and is an exogenous variable.

Equation (7) satisfies existence of ECM with an underlying cointegrating vector like

equation (1). It can be shown that existence of cointegrating vector β=1, requires γ1+γ2+γ3

=1.11 A stability condition requires that -1<γ1<1. As a result we can derive equation (9)

from equations (7) and (8) when β=1 and Xt is exogenous. Subtracting Yt-1 from both

sides of (7), adding and subtracting (γ1 -1)Xt-1 to its right hand side, and imposing the

homogeneity condition γ3 =1-(γ1+γ2) yields:

(9)

∆Yt= γ0+ (γ1 -1) (Yt-1 - Xt-1) +γ2 ∆Xt+ε1t

Adding Yt-1 to both sides of (9), and adding and subtracting Xt to the right hand side

yields (10):

(10) Yt= γ0+Xt +γ1(Yt-1 - Xt-1) + (γ2-1) ∆Xt+ε1t

Comparison between (10) and (1) shows that estimation of (1), when β=1, results in the

dynamics described by ∆Xt and (Yt-1 - Xt-1) are all captured in the residual Zt.

(11)

Zt = γ1(Yt-1 - Xt-1) + (γ2-1) ∆Xt+ε1t

In general, the Zt’s will be serially correlated, and then Banerjee et al. (1986) propose to

estimate the long-run parameters of (10) by estimating the specification (12) in a single

stage.

(12)

∆Yt=a+ b (Yt-1 - Xt-1) +c ∆Xt+ dXt-1 + υt

Then the cointegrating coefficient β is estimated by computing 1 −

d̂

b̂

. This single equation

estimation of long-run parameter and its variants is known as Single Equation ECM or

11

(SEECM).12 Finally Phillips and Loretan (1991) suggest that simultaneous estimation of

cointegrating vector and ECM should be estimated by non-linear least square (NLS)

methods since NLS estimators are asymptotically consistent, normally distributed and

efficient.13

Cook, Holly and Turner (1999) explain that it is difficult to reject the null

hypothesis of symmetry when Engle-Granger two-step procedure is employed. Using a

Monte Carlo simulation they conclude that tests of asymmetry which start from the null

of symmetry are likely to have low power, and if we incorrectly accept the null of

symmetry then we choose models which ignore important information about the short run

dynamics of the variable of interest. As a result Holly, Turner and Weeks (2003), suggest

that simultaneous estimation of long-run equilibrium and adjustments process using NLS

estimator decreases long-run equilibrium estimation bias and increase power of the test in

asymmetric ECM.

5- Simultaneous estimation of ECM and cointegrating vector in a TAR asymmetric

environment:

For the case of a linear ECM, Banerjee et al. (1986) claim using single equation ECM

gives better small sample estimations than Engle-Granger two-step procedure. Also

Phillips and Loretan (1991) use nonlinear least square estimators to correct

misspecification of Engle-Granger two-step procedure in a linear environment. To my

knowledge these models have not been developed for application in an asymmetric

adjustment movement or at least have not been applied to the study of gasoline and crude

relationships. Since the performance of these approaches in the asymmetric environment

12

has not been investigated, I suggest using of Banerjee’s SEECM and Phillips and

Loretan’s NLS in a TAR asymmetric environment.

In single equation ECM (SEECM), long-run and short-run adjustments are

estimated by running an OLS on (12), and then cointegration coefficient is computed by

expression 1 −

d̂

b̂

.

We can extend Banerjee’s SEECM for a single regime to an

asymmetric TAR model which is based on two different regimes. The asymmetric model

with TAR is presented as two SEECM for two different regimes as follows:

(13)

∆Yt = It[γ0+ γSP(Yt-1 - Xt-1) +γ2 ∆Xt+ γ3Xt-1]

+ (1- It) [δ0+ δSP(Yt-1 - Xt-1) +δ2 ∆Xt+ δ3Xt-1] +εt

Where It =1 if ∆Xt>τ and It =0 if ∆Xt≤τ. In this case γ0, γSP, γ2, γ3, δ0, δSP, δ2 and δ3 are

estimated by OLS. Then we can compute long-run equilibrium coefficients (like β in

equation (1)) for two different regimes by 1 −

ˆ

γˆ 3

and 1 − δ3 . Note that there is a small

γˆ sp

δˆ sp

difference between (6) and (13). The error correcting term in (6) is ( Y t −1 − αˆ − βˆ X t −1 ) and

in (13) is (Yt-1 - Xt-1). Finally if γSP ≠δSP and γ2≠δ2 we have asymmetry in speeds and

short-run adjustment.

A nonlinear least square estimation method is applied to general form of equation

(9) with an unknown cointegrating vector.14 Starting from DGP (7) and (8) we can derive

the following ECM for a cointegrating vectorβ.

(14)

∆Yt= γ0+(γ1 -1) (Yt-1 -β Xt-1) +γ2 ∆Xt+ε1t

13

As a result we estimate single equation of (14) by using NLS. Therefore I suggest to

estimate (15) by NLS for each regime.

(15) ∆Yt= a+b (Yt-1 - βXt-1) +c ∆Xt+ε1t

Comparison between (4) and (15) shows that these two models are basically the same.

But (4) is estimated by using Engle-Granger two-step procedure and (15) is estimated by

NLS. Here is the specification for an asymmetric two-regime model with TAR.

(16) ∆Yt = It[γ0+γSP(Yt-1 -β1Xt-1) +γ2 ∆Xt]

+ (1- It) [δ0+δSP(Yt-1 -β2Xt-1) +δ2 ∆Xt] +εt

Where It =1 if ∆Xt>τ and It =0 if ∆Xt≤τ. In this case γ0, γ1, γ2, γsp, β1, δ0, δ1, δ2, δsp and β2

are estimated. Evidently by comparing (14) and (16), γSP= γ1 -1 and δSP= δ1 -1. Therefore

γSP and δSP are speeds of adjustments and γ2 and δ2 are short-run adjustments under two

different regimes. Note that this model is equivalent to Godby et al.’s model, except that

we estimate cointegrating vector and ECM in this model in a single step. If γSP= δSP and

γ2 = δ2, relationship is symmetric.

Note that both models (13) and (16) are based on single equation estimations of

cointegrating vector and ECM but (13) is estimated by OLS and (16) is estimated by NLS

estimators. Meanwhile cointegrating vectors are estimated differently in these two

models. In (16) they are estimated directly along with other parameters, but in (13) they

are computed by using the estimated parameters.

6. Monte Carlo simulations:

6.1. When error terms are white noise:

To compare the performance of the asymmetric estimation methods I perform

Monte Carlo experiments. I compare the estimates obtained from an asymmetric error

14

correction model, a TAR model which is used by Godby et al. (2000) and two single

stage estimation variants of TAR model.

To compare the models, I expand the autoregressive-distributed lag (ARDL)

model in (7) along with the equation (8) from Banerjee et al. (1993) to generate data for

two different regimes. Thus I use the following asymmetric DGP to generate data for two

different regimes.15

if ∆Xt >0

(17)

Yt=γ0+γ1Yt-1+γ2Xt+γ3Xt-1+ε1t

(18)

Yt=δ0+δ1Yt-1+δ2Xt+δ3Xt-1+ε1t if ∆Xt ≤ 0

(19)

Xt=Xt-1+ε2t

Where γ1+γ2 +γ3 =1, δ1+δ2 +δ3 =1, -1<γ1<1 and -1<δ1<1. Meanwhile ε1t and ε2t are

generated by using normal distribution with mean zero and standard deviation of 1.

Satisfaction of the above restrictions guarantees existence of two cointegrating vectors

with β=1 and two ECM’s with different speed and short-run adjustments in two different

regimes. Different speeds of adjustment and short-run adjustments, is interpreted as

asymmetric response of Y with respect to positive and negative shocks to X.

Based on DGP in (17), (18) and (19) we have the following cointegrating vectors

for each of the above regimes (β=1).

(20)

Yt=αi+Xt+uit i =1,2

When cointegration exists uit’s are stationary terms. In appendix one it is shown

that when Y and X are cointegrated with same cointegrating vector in two sub-samples,

Y and X will be cointegrated in the whole sample. As a result this type of DGP allows me

to generate one unique data set for whole sample, which is created by two different

regimes, and guarantees existence of cointegration and ECM’s for whole sample.

15

Remember that estimating asymmetric ECM and asymmetric TAR model requires

existence of cointegration between data at the first stage.

Hence γ1≠δ1 and γ2≠δ2 mean different speed and short run adjustment in Y to

positive and negative shocks in X (i.e. there is asymmetry). However values of γ1=δ1 and

γ2=δ2 means that we have symmetry in adjustments with respect to changes in X.

Therefore when ∆Xt >0, the first regime is active and we have the following ECM.

From (17) →

(21) ∆Yt=γ0+γSP (Yt-1 - Xt-1) +γ2 ∆Xt+ε1t where γSP= γ1 -1

And when ∆Xt ≤ 0, the second regime is active and we can derive the following ECM:

From (18) →

(22) ∆Yt= δ0+δSP (Yt-1 - Xt-1) +δ2 ∆Xt+ε1t

where δSP = δ1 -1

Derivation of (21) and (22) helps the reader to understand how our DGP creates different

speeds of adjustment (i.e. γSP and δSP) and different short-run adjustments (i.e. γ2 and δ2 )

to the equilibrium.

For example when γ2 =0.4 and δ2=0.3, it means that a change in Xt (crude oil

price) will be reflected in Yt (gasoline price) more quickly in the first regime (21) than in

the second one (22). Also values of γ1 = 0.9 and δ1 =0.5 (γ1-1 = -0.1 and δ1 -1= -0.5) mean

that in the positive shocks regime, (when we have positive deviation from equilibrium, so

Yt will be falling to move toward equilibrium) the adjustment of Y to the equilibrium will

be slower than in the negative shocks regime.

I generate 1000 samples of 200 observations. The data are generated according to

the equations (17), (18) and (19) with several sets of values for γ0, γ1, γ2, γ3, δ0 δ1,δ2 and

δ3. All of the above values are chosen based on satisfaction of homogeneity and stability

conditions. After data generation, four models are estimated. First, a general asymmetric

ECM; second, Godby et al. (2000) TAR model; third, a TAR model based on SEECM of

16

Banerjee (1986) and fourth, a TAR model based on Phillips and Loretan (1991) NLS

estimation of ECM. Thus estimations of the first two models are based on Engle-Granger

two-step procedure and the last models are based on simultaneous estimation of

cointegrating vectors and ECMs.

Models:

(A):Asymmetric ECM model

After estimation of cointegrating vector (1) in Engle-Granger two-step method, we can

split changes in independent variable (∆Xt) and cointegrating vector’s residuals (Zt-1) to

positive and negative components and then estimate (23).

(23)

−

( Zt −1 )− + η

∆ Y t = γ 0 + γ 2+ (∆ X t )+ + γ 2− (∆ X t )− + γsp+ ( Zt −1 )+ + γ sp

Where Z +t −1 = max{ 0, Z t −1} ,

−

Z t − 1 = min{ 0 , Z t − 1} ,

∆ X +t =max{0,∆Xt}

and

∆ X −t = min{0, ∆Xt}.

(B): Godby et al. TAR model:

After estimating cointegrating vector (1), Zt is estimated as per equation (2). Then lagged

estimated residuals are presented in the following equation as error correcting terms. The

parameters in (24) are estimated by OLS.

(24)

∆Yt= It [γ0+γSP Zt-1 +γ2 ∆Xt] +(1- It) [δ0+δSP Zt-1 +δ2 ∆Xt]+εt

Where It =1 if ∆Xt>τ and It =0 if ∆Xt≤τ. Zt-1 is the lagged residual of cointegrating

vector.16 We estimate this model based on the thresholds to be ∆Xt-1, ∆Xt-2 and zero in

accordance to the Godby et al. (2000) paper. Although we set the correct threshold is τ=0

in DGP, other thresholds are included in our estimation to investigate how a wrong

threshold selection affects estimations.

(C): TAR model based on Banerjee et al. SEECM

17

We estimate equation (13) directly by OLS, without need of estimating cointegrating

vector (i.e. equation(1)) separately. Then we can compute cointegrating vector

parameters by using the mentioned method in section 5.

∆Yt = It[γ0+ γSP(Yt-1 - Xt-1) +γ2 ∆Xt+ γ3Xt-1]

+ (1- It) [δ0+ δSP(Yt-1 - Xt-1) +δ2 ∆Xt+ δ3Xt-1] +εt

Where It =1 if ∆Xt>τ and It =0 if ∆Xt≤τ. I estimate this model based on thresholds of

∆Xt-1, ∆Xt-2 and zero. It seems that even if we know the threshold we have to use nonstandard critical values for the inference because t statistic of cointegration test is not

asymptotically normally distributed under the null. But we know that cointegration exists

by construction, therefore we can use standard F-tests in Monte Carlo simulation to make

inference about symmetry.

(D): TAR model based on Phillips and Loretan’s NLS

We estimate (16) for thresholds of ∆Xt-1, ∆Xt-2 and zero by NLS. Cointegrating vector is

estimated simultaneously along with other parameters estimation. Thus there is no need

of estimating cointegrating vector (equation (1)) primarily.

∆Yt = It[γ0+γSP(Yt-1 -β1Xt-1) +γ2 ∆Xt]

+ (1- It) [δ0+δSP(Yt-1 -β2Xt-1) +δ2 ∆Xt] +εt

Where It =1 if ∆Xt>τ and It =0 if ∆Xt≤τ. When the threshold is known, as it is the case in

our Monte Carlo experiment, we can use standard F-tests to make inference about

symmetry; otherwise we have to make inference based on their empirical distribution.

Unconstrained NLS in the TAR environment performs badly, unless we put restrictions

which are implying that some parameters can not take some values. For example stability

condition requires that -2< γsp<0 and -2 <δsp<0, otherwise model will not have a stable

18

equilibrium. From (14) we realize that γsp and δsp are γ1 -1 and δ1 -1 correspondingly, and

we know γ1 and δ1 must lie within interval (-1,1) to have a non-exploding system.17

Furthermore, we know that Engle – Granger estimations are consistent; hence we can

extract some information from OLS regression of Y on X such as sign of relationship

between X and Y and use them as some additional information for NLS estimations.

Following (17), (18) and (19), table (3) shows simulation results based on values

of γ0=1, γ1=0.9, γ2 =0.07, γ3=0.03, δ0=1, δ1=0.6,δ2 =0.04, δ3=0.36 and τ=0. Also Table(4)

shows simulation results based on values of γ0=1, γ1=0.7, γ2 =0.27, γ3=0.03, δ0=1,

δ1=0.5,δ2 =0.14, δ3=0.36 and τ=0. In this literature intercept can be interpreted as the cost

of refining crude oil and/or refinery or outlet margins (Godby et al. 2000). Therefore

equal constant terms in data generating process means that refinery margins and refining

costs will not be affected by shocks in crude oil price. Furthermore different intercepts

across regimes is not necessarily an interesting question as none of the authors focused on

it. I test the following null hypothesis of symmetry against alternatives of asymmetry for

parameters in (17) and (18), for each model in all replications and report frequency of the

rejection of null of symmetry in 5% significance level. It is possible to find symmetry in

some of these tests and asymmetry in the others, however, a completely symmetric model

is the case that we can not reject any of null hypotheses.

H0N : γ 0 = δ0

(25) 0

H A : γ 0 ≠ δ0

H1N : γ sp = δsp

1

H A : γ sp ≠ δsp

H 2N : γ 2 = δ2

2

H A : γ 2 ≠ δ 2

All the inferences are made based on p-values of standard F-tests, because in our

experiment threshold is known and for SEECM inferences we are confident of existence

a cointegrating vector too.

19

The simulation results are reported in tables (3) and (4). The first six columns

report average estimates across replications. The second six columns report bias

percentage of average estimates (reported in first six columns) from true values of the

parameters. The final four columns report the test results of symmetry in various

parameters and residual sum of squares for each model.

The results in these two tables are almost the same. Thus I focus on explanation

of table (3), and mention its difference with table (4) whenever is necessary. Less biased

estimations and best results are highlighted in tables (3) and (4), which mean that for the

sake of obtaining less biased asymmetric parameters; choice of the true threshold is

crucial. Evidently a wrong selection of threshold may result in largely biased estimations.

In tables (3) and (4), the asymmetric ECM (i.e. model A) always gives biased

estimates for the constant term, short-run adjustment and speed of adjustment

coefficients. The percentage of bias is large and hypothesis testing rarely rejects the null

hypothesis of symmetry when the true model is asymmetric. Therefore model A is not

only biased but also misleadingly suggests symmetry. Meanwhile estimates of the

constant terms in tables (3) and (4) are substantially biased in the TAR model based on

Engle-Granger two-step procedure (i.e. model B). But this problem does not exist in

single equation models like C and D. Furthermore we know that the data is generated

based on similar intercepts in two regimes (i.e. γ0=δ0=1), but the null hypothesis of

equality of intercepts in two regimes ( H0N ) is rejected more often (99.7% of time in table

(3)) in model B. As a result estimations of intercepts are not only biased in model B, but

also they may result in wrong inferences frequently. However the null hypothesis of

equality of intercepts ( H0N ) are rarely rejected in NLS and SEECM (relatively 12.4% and

20

4.3% of time in table (3)). Therefore estimations of intercept in models C and D are not

only less biased but also they rarely end up with wrong inferences. However SEECM

(model C) gives better results than D. We can also correct intercept bias in EngleGranger two-step models very easily by using (Yt-1- β̂ Xt-1) instead of (Yt-1- α̂ -β̂ Xt-1) as

the error correcting term. However this modification only corrects the intercept term and

it does not affect estimations of the speed of adjustment and short-run coefficients.18

In both tables of (3) and (4), when the threshold value is correctly selected, longrun adjustment coefficients are estimated relatively with small bias percentages in all

models except model A. Furthermore the null hypothesis of symmetry in speeds of

adjustment ( H1N ) are rejected frequently in all models except model A. For instance

rejection frequencies are 94%, 95% and 99% for models B, C and D in table (3). Thus

NLS model with 99% rejection frequency, among the other models, offer more reliable

inferences.

Choosing the correct threshold value, short-run adjustment coefficients are

estimated relatively with small bias percentages in all models except in model A.

However, the null hypothesis of symmetry is rejected rarely by any of the models.

Rejection frequencies in table (3) are 5.2%, 5.2% and 8.6% for models B, C and D

correspondingly. This is mainly because of the close values of short-run adjustments (i.e.

0.07 and 0.04) in DGP of two regimes. However NLS (model D) offers the highest

rejection percentage for H 2N , amongst all models. In table (4), it is shown that with larger

differences in the values of short-run adjustments (i.e. 0.27 and 0.14), the rejection

frequency increases to 9.6%, 9% and 15.9% for models B, C and D correspondingly. But,

they are still small.

21

Godby et al.’s model rejects correctly the null hypothesis of symmetry in speeds

of adjustment more frequently in table (3); about 94% of time. However, the rejection

frequency of the null hypothesis of symmetric short-run adjustment is relatively low.

Moreover in 99.7% of time, the model wrongly infers non-equality of constant terms.

However in table (4), with larger differences between parameters, rejection frequency of

null hypothesis of H1N substantially declines to 47.9%. Also frequency of wrong inference

about the constant terms declines to 57.4%. As a result (from table(3) and table(4)) when

the error terms are white-noise, Monte Carlo experiment suggests that Godby et al.’s

model has no remarkable advantage to models (C) and (D), however it still estimates the

parameters with small biases. Although small average biases in this model are good but

they are just mathematical average of estimation biases and can not be used for making

inferences.

Banerjee et al.’s SEECM

model rejects

correctly the null

hypothesis of

symmetry in speeds of adjustment more frequently, about 95% of time in table(3).

However, the rejection frequency for the null

hypothesis of symmetric

adjustment is low (5.2%) like other models. Moreover in 4.3% of

short-run

time the model

wrongly infer on non-equality of constant terms. As a result (from tables (3) and (4))

when the error terms are white-noise, Monte Carlo experiment suggests that inference

in speeds of adjustment and constant terms might be illuminating in this model.

22

Table3: Monte Carlo simulation results for average estimation’s bias in different asymmetric models for the following values when the error terms are white

noises.

Null

Null

Null

Model / Values

γ0

δ0

γ1-1

δ1-1

γ2

δ2

γ0

δ0

γ1-1

δ1-1

γ2

δ2

0

1

2

HN

HN

HN

Value of coefficients

Rejection Frequency of

1

1

-0.1

-0.4

0.07

0.04

from DGP((17), (18) and

ϕ − ϕˆ

%Bias= (

)*100

(19)) (True Values)

Null Hypothesis (%)

ϕ

Symmetric ECM using

0.064

-0.271

0.531

Engle-Granger two-step

(A) Asymmetric ECM

0.013

-0.275 -0.273

0.545

0.513

99

-175

32

-678 -1181

4.4

6.3

(23)

(B) Godby et al. (24)

τ = ∆Xt-2

-0.336

0.558

0.447

98

106

-95

15.9 -698 -1018

-0.06 -0.195

0.02

τ = ∆Xt-1

0.02

-0.06 -0.185

-0.339

0.564

0.438

98

107

-86

15.1 -706

-994

99.7

5.2

τ =0

0.59

-0.57 -0.118

40

157

94

-0.415

0.075

0.0402

-18.5

-3.8

-6.8

-0.48

(C) TAR model based on

Banerjee et al. (13)

SEECM

τ = ∆Xt-2

0.791

1.24

-0.195

-0.335

0.561

0.450

21

-24

-95

16.1 -701 -1024

τ = ∆Xt-1

0.75

1.25

-0.185

-0.339

0.566

0.439

25.3 -24.5

-85

15.3 -709

-999

τ =0

5.2

1.06

1.07

-0.118

-0.416

0.077

0.044

-5.5

-6.77 -18.1 -4.01 -9.97 -11.7

4.3

95

(D) TAR model based on

Phillips and Loretan (16)

NLS

τ = ∆Xt-2

0.789

1.24

-0.194

-0.334

0.561

0.449

21

-24.0

-94

16.4 -701 -1024

τ = ∆Xt-1

1.24

-0.184

-0.338

0.567

0.439

26

-24.3

-84

15.5 -710

-999

0.742

τ =0

8.6*

1.06

1.06

-0.118

-0.414

0.077

0.045

-5.6

-6.13 -18.4

-3.5 -10.4 -11.7

12.4

99

* 8.6% in model (D) is relatively better than 5.2% in models (B) and (C).

Models A and B are based on Engle-Granger Two-Step procedure. The suggested models C and D are based on simultaneous estimation of cointegrating vector

and ECM.

Although I know the correct threshold value is zero in DGP, but I have included two arbitrary threshold values to show how a wrong threshold affects

estimations. Since the hypothesis testing under incorrect threshold does not have a known distribution, the test results are not reported for them.

23

RSS

234

232

228

227

193.4

225

225

190.7

226

225

190.9

Table4: Monte Carlo simulation results for average estimation’s bias in different asymmetric models for the following values when the error terms are white

noises.

Null

Null

Null

Model / Values

γ0

δ0

γ1-1

δ1-1

γ2

δ2

γ0

δ0

γ1-1

δ1-1

γ2

δ2

0

1

2

HN

HN

HN

Value of coefficients

Rejection Frequency of

1

1

-0.3

-0.5

0.27

0.14

from DGP((17), (18) and

ϕ − ϕˆ

%Bias= (

)*100

(19))(True Values)

Null Hypothesis (%)

ϕ

Symmetric ECM using

0.023

-0.418

0.410

Engle-Granger two-step

(A) Asymmetric ECM

-0.056

-0.422

0.480

0.331

106

-41

-78

-136

3.8

9.6

-0.418

16.3

(23)

(B) Godby et al. (24)

τ = ∆Xt-2

-0.029 -0.05 -0.372

-0.462

0.461

0.335

103

105

-24

7.6

-71

-139

τ = ∆Xt-1

-0.045 -0.07 -0.366

-0.466

0.478

0.320

105

107

-22

6.7

-77

-129

57.4

47.9

9.6

τ =0

0.20

-0.30 -0.321

80

131

-0.512

0.271

0.129

-6.9

-2.5

-0.3

8.1

(C) TAR model based on

Banerjee et al. (13)

SEECM

τ = ∆Xt-2

0.941

1.15

-0.372

-0.462

0.463

0.338

5.9

-14.9

-24

7.6

-72

-141

τ = ∆Xt-1

0.911

1.14

-0.366

-0.466

0.480

0.322

8.9

-14.1

-22

6.7

-78

-130

τ =0

47.7

9.0

1.03

1.03

-0.320

-0.513

0.275

0.136

-3.5

-2.7

-6.7

-2.5

-1.7

3.0

4.9

(D) TAR model based on

Phillips and Loretan (16)

NLS

τ = ∆Xt-2

0.935

1.15

-0.369

-0.461

0.464

0.338

6.5

-14.6

-23

7.8

-72

-141

τ = ∆Xt-1

0.910

1.14

-0.365

-0.465

0.480

0.323

8.9

-13.8

-22

7.1

-78

-131

τ =0

15.9*

1.03

1.02

-0.319

-0.512

0.274

0.136

-3.3

-2.5

-6.4

-2.5

-1.6

2.9

12.7

69.9

* 15.9% in model (D) is relatively better than 9.6% and 9% in models (B) and (C).

Models A and B are based on Engle-Granger Two-Step procedure. The suggested models C and D are based on simultaneous estimation of cointegrating vector

and ECM.

Although I know the correct threshold value is zero in DGP, but I have included two arbitrary threshold values to show how a wrong threshold affects

estimations. Since the hypothesis testing under incorrect threshold does not have a known distribution, the test results are not reported for them.

24

RSS

204

203

201

201

193.4

199

199

191.2

199

199

191.4

Phillips and Loretan’s NLS model rejects correctly null hypothesis of symmetry

in speeds of adjustment more frequently; about 99% of time in table(3). However, the

rejection frequency for the null hypothesis of symmetric short-run adjustment is as low as

8.6%. Moreover in 12.4% of instances the model wrongly infers on non-equality of

constant terms. However in table (4), with larger differences, the rejection frequency of

null hypothesis H 2N increases and rejection frequency of null hypothesis H1N decreases.

As a result when the error terms are white-noise (tables(3) and (4)), Monte Carlo

experiment suggests that inference in speeds of adjustment can be informative in models

B, C and D, but inference on short-run coefficients might be misleading, albeit NLS still

reveals short-run asymmetry more frequent than the other models. While some of the

investigated models (B, C and D) estimate short-run adjustments, on average, with small

biases, but all of them are weak in detecting the asymmetry by using statistical

inferences.

6.2. When error terms are non white noise stationary:

What happens to the estimations, if the existing error terms show some degree of

persistence between periods? I generate the second data set based on the assumption that

current disturbance terms are dependent to the last period’s disturbance terms.

(26)

Yt=γ0+γ1Yt-1+γ2Xt+γ3Xt-1+ε1t

if ∆Xt >0

(27)

Yt=δ0+δ1Yt-1+δ2Xt+δ3Xt-1+ε2t

if ∆Xt ≤ 0

(28)

Xt=Xt-1+ε3t

(29) ε1t =ρ1ε1t -1 + ν1t and ε2t =ρ2ε2t -1 + ν2t and ε3t =ρ3ε3t -1 + ν3t

25

ν1t, ν2t and ν3t are generated randomly by using random normal distribution generator

with mean zero and standard deviation 1. Meanwhile ρ1, ρ2 and ρ3 are less than 1 to

satisfy stationarity of error terms.

I start with specifying the ECM for one of the above regimes. For instance

standard ECM for equation (26) is presented as per equation (9). Remember equation (9)

is derived based on the existence of a cointegrating vector β=1 and satisfaction of the

homogeneity condition:

∆Yt= γ0+ (γ1 -1) (Yt-1 - Xt-1) +γ2 ∆Xt+ε1t

But there is an autocorrelation structure according to (29). In this case the least squares

estimations of (9) are inefficient, hence the model must be corrected.

Remedy:

From (29) we have an existent autocorrelation problem in ECM (9). One remedy for the

existent autocorrelation is to include higher order autoregressive terms in the regression.

To show this, we can modify the model by subtracting ρ1∆Yt-1 from both sides of (9) to

obtain white-noise errors.

(30)∆Yt - ρ1∆Yt-1 = γ0 -ρ1γ0 +(γ1 -1)(Yt-1 - Xt-1) -ρ1(γ1 -1)(Yt-2 - Xt-2)+γ2 ∆Xt -ρ1γ2 ∆Xt-1 +ν1t

As a result, (30) is rearranged in the following format.

(31)∆Yt = γ0 -ρ1γ0 +(γ1 -1)(Yt-1 - Xt-1) -ρ1(γ1 -1)(Yt-2 - Xt-2)+γ2 ∆Xt -ρ1γ2 ∆Xt-1 +ρ1∆Yt-1+ν1t

Meanwhile from (28) we have Xt=Xt-1+ε3t, and according to (29) there is an

autocorrelation problem here. We can rewrite (28) as (32).

(32) ∆Xt=ε3t → ∆Xt= ρ3ε3t -1 + ν3t → ∆Xt= ρ3∆Xt-1+ ν3t → ∆Xt-ρ3∆Xt-1= ν3t

26

As result controlling of autocorrelation requires adding higher lag orders into the

standard ECM equation. This remedy first proposed by Phillips and Loretan (1991) for

the models which are estimated by NLS.

Therefore we use this type of remedy for our NLS estimations. In models which are

estimated by OLS, however, we use the usual remedy of adding lags of variables (not

adding more lags of error correcting structure) to the model.19

Models:

I compare four previously mentioned models (i.e. models A, B, C and D) and add more

lag structure to them to resolve autocorrelation problem. For our specific DGP, according

to (31) we have to include first and second lags of error correcting terms and first lag of

dependent variable and present and lagged independent variables to get white noise error

terms in NLS models. In OLS based estimations (i.e. models A′, B′ and C′) we add 3 lags

of dependent and independent variables, however, adding more lag structure does not

change the estimates of parameters of interest more significantly in our case.

(A′): Asymmetric ECM model

After estimation of cointegrating vector (1) in Engle-Granger two-step method and

obtaining the residuals from equation (2), we estimate (33) by OLS.

3

3

3

3

i =0

i =0

j=1

j=1

(33) ∆ Yt = γ0 + γsp+ (Zt −1 )+ + γsp− (Zt −1 )− + ∑ γ+2i(∆ Xt −i )+ + ∑ γ−2i(∆ Xt −i )− + ∑ γ+4 j (∆ Yt − j )+ + ∑ γ−4 j (∆ Yt − j )− + εt

Where Z+t − j = max{0, Zt − j} , Z−t − j = min{0, Zt − j} , ∆ X +t = max{0, ∆Xt} and ∆ X −t = min{0,

∆Xt}.

(B′): Godby et al. TAR model:

After estimating of cointegrating vector (1) and obtaining the residuals from equation (2)

we can estimate the following by OLS.

27

(34)

3

3

∆Yt= It [γ0+γSP1 Zt-1 + ∑ γ2i ∆Xt-i+ ∑ γ4j ∆Yt-j+γ3 Xt-1]

j=1

i =0

3

3

i =0

i =0

+(1- It) [δ0+δSP1 Zt-1 + ∑ δ2i ∆Xt-i+ ∑ δ4j ∆Yt-j+γ3 Xt-1]+εt

Where It =1 if ∆Xt>τ and It =0 if ∆Xt≤τ. Zt-1 is the lagged residual of cointegrating vector

in equation (1) (i.e. Yt-1- α̂ - β̂ Xt-1). The model is estimated for the thresholds of ∆Xt-1,

∆Xt-2 and zero.

(C′): TAR model based on Banerjee et al.’s SEECM

We estimate equation (13) with a modification for autocorrelation by OLS.

3

3

(35) ∆Yt = It[γ0+γSP1(Yt-1 - Xt-1) +γ ∑ γ2i ∆Xt-i+ ∑ γ4j ∆Yt-j]

i =0

j=1

3

3

i =0

i =0

+ (1- It) [δ0+ δSP1(Yt-1 - Xt-1) + ∑ δ2i ∆Xt-i+ ∑ δ4j ∆Yt-j] +εt

Where It =1 if ∆Xt>τ and It =0 if ∆Xt≤τ. In this model the thresholds are set to be ∆Xt-1,

∆Xt-2 and zero.

(D′): TAR model based on Phillips and Loretan’s NLS

We estimate (16) for thresholds of ∆Xt-1, ∆Xt-2 and zero with a modification to control

autocorrelation problem.

(36) ∆Yt = It[γ0+γSP1(Yt-1 -β1Xt-1) +γ20 ∆Xt+γSP2(Yt-2 -β1Xt-2) +γ21 ∆Xt-1 +γ4 ∆Yt-1]

+ (1- It) [δ0+δSP1(Yt-1 -β2Xt-1) +δ20 ∆Xt +δSP2(Yt-2 -β2Xt-2) +δ21 ∆Xt-1 +δ4 ∆Yt-1] +εt

Where It =1 if ∆Xt>τ and It =0 if ∆Xt≤τ.

Having DGP equations (26), (27), (28) and (29); table (5) shows simulation

results based on values of γ0=1, γ1=0.9, γ2 =0.07, γ3=0.03, δ0=1, δ1=0.6,δ2 =0.04, δ3=0.36 ,

τ=0 , ρ1=0.5, ρ2=0.5 and ρ3=0.2 . Also Table (6) presents simulation results for values of

γ0=1, γ1=0.7, γ2 =0.27, γ3=0.03, δ0=1, δ1=0.5,δ2 =0.14, δ3=0.36 , τ=0 , ρ1=0.5, ρ2=0.5 and

28

ρ3=0.2

I test the following Null hypothesis of symmetry against alternatives of

asymmetry for parameters in (26) and (27) for each model in all replications and report

frequency of the rejection in 5% significance level after the experiment is completed.

H0N : γ 0 = δ0

(37) 0

H A : γ 0 ≠ δ0

H1N : γ sp = δsp

1

H A : γ sp ≠ δsp

H 2N : γ 2 = δ2

2

H A : γ 2 ≠ δ 2

All the inferences are made based on p-values of standard F-tests. The simulation results

are reported in tables (5) and (6) and are nearly the same. Thus I focus on explanation of

table (5), and point out its differences with table (6) whenever it is necessary.

Less biased estimations and best results are highlighted in tables (5) and (6). The

highlighted results reveal that for obtaining less biased asymmetric parameters; choice of

the true threshold is crucial. Selection of a wrong threshold may result in largely biased

estimations.

Like the white-noise error terms case, the asymmetric ECM (i.e. model A′) in

tables(5) and (6) give biased estimations for constant term, short-run adjustment, and

speed of adjustment coefficients. The biases are large and hypothesis testing rarely rejects

the null hypothesis of symmetry when the true model is asymmetric. Therefore model A′

is not only biased but also misleadingly suggest symmetry.

Estimations of constant terms are generally biased with opposite signs in TAR

model based on Engle-Granger two-step procedure (i.e. model B′); even if we find the

correct threshold value. But single equation models like C′ and D′ estimate constant term

with smaller biases (look at bias percentages for γ0 and δ0 in all models). Meanwhile the

null hypothesis of equality of intercepts (i.e. γ0=δ0) is rejected more often in model B′

than models C′ and D′ (look at under column H0N ). In table(5), under correct choice of

29

threshold, B′ rejects null of symmetry (equality) in intercepts, 65.7% of the time,

compare with 9.7% and 17.8% in models C′ and D′. But we know that true values of

intercepts are 1 for both regimes. As a result estimations of intercepts are not only biased

in model B′, but also they result in wrong inference of non-equality of intercepts most of

the time. Therefore estimations of intercept in models C′ and D′ are not only less biased

but also they rarely end up with wrong inference. However SEECM (model C′) shows

better inferences than NLS (model D′) for constant terms. Remember that we can correct

Engle-Granger two-step method to get unbiased estimations for intercept by the method

which is already mentioned in subsection 6.1.

When the threshold value is correctly selected, long-run adjustment coefficients

are estimated with small biases, always by NLS model (D′) (see bias percentages under

γ1-1 and δ1-1 in tables 5 and 6). Furthermore, the null hypothesis of symmetry in speeds

of adjustment ( H1N ) is rejected frequently in all models except model A′ in table (5).

Since the data are generated based on asymmetry in speeds of adjustment, the best model

must offer the highest rejection frequency of null of symmetry. Rejection frequencies are

58.6%, 59.1% and 62.3%in models B′, C′ and D′ correspondingly. Among all these

models NLS gives the highest rejection of H 1N . However table (6) with new sets of

parameters, suggest that null hypothesis of symmetry is rejected frequently merely by

NLS. Look at column under H1N in table (6).

In tables (5) and (6), when the choice of threshold value is correct, short-run

adjustment coefficients are estimated with relatively small bias percentages in all models

except in model A′. Meanwhile the null hypothesis of symmetry is rejected rarely

30

amongst all the models. Rejection frequencies are 3.5%, 2.8% and 4.8% for models B′,

C′ and D′ correspondingly in table (5). However NLS (model D′) gives the highest

rejection percentage for H 2N , among all models (4.8% and 9.9% in tables (5) and (6)).

Godby et al.’s model rejects correctly null hypothesis of symmetry in speeds of

adjustment frequently (about 58.6% of time) in table(5) and less frequently(about 41.1%

of time) in table(6). However, the rejection frequency for the null hypothesis of

symmetric short-run adjustment is extremely low in both tables (5) and (6). Although this

model in 65.7% of time wrongly infers on non-equality of constant terms in table (5), but

this problem is partly mitigated in table (6). As a result (from tables (5) and (6)) when

the disturbance terms are stationary and auto-correlated, Monte Carlo experiments

suggest that inference in speeds of adjustment, constant terms and short-run coefficients

can be misleading in Godby et al. model.

Banerjee et al.’s SEECM model rejects correctly null hypothesis of symmetry in

speeds of adjustment frequently in table (5) (59.1% of time) and infrequently in table (6)

(42.4% of time). However, the rejection frequency for the null hypothesis of symmetric

short-run adjustment is extremely low in both tables (5) and (6). Moreover in 9.7% and

11.8% of time the model wrongly infer on non-equality of constant terms in tables (5)

and (6). As a result (from tables (5) and (6)), when the error terms are auto-correlated

stationary, Monte Carlo experiments suggest that inferences on long-term and short-term

adjustment coefficients might be relatively less illuminating in this model.

31

Table5: Monte Carlo simulation results for average estimation’s bias in different asymmetric models for the following values, when there is an autocorrelation in

the error terms.

Null

Null

Null

Model / Values

γ0

δ0

γ1-1

δ1-1

γ2

δ2

γ0

δ0

γ1-1

δ1-1

γ2

δ2

0

1

2

HN

HN

HN

Value of coefficients

from DGP((26), (27),

Rejection Frequency of

1

1

-0.1

-0.4

0.07

0.04

ϕ − ϕˆ

(28) and (29))(True

Average %Bias= (

)*100

Null Hypothesis (%)

Values)

ϕ

Symmetric ECM using

0.009

-0.138

0.355

Engle-Granger two-step

(A′)Asymmetric ECM

0.011

-0.152

-0.135

0.356

0.356

99

-0.52

66

-408

-789

4.2

4.3

(33)

(B′) Godby et al. (34)

τ = ∆Xt-2

0.04

-0.08 -0.079

-0.185

0.359

0.285

96

108

21

54

-413

-615

τ = ∆Xt-1

0.018 -0.06 -0.074

-0.187

0.372

0.292

98

106

26

53

-431

-630

τ =0

0.409 -0.39 -0.039

-0.237

59

139

61

41

65.7

3.5

0.049

0.024

30

41

58.6

(C′) TAR model based on

Banerjee et al. (35)

SEECM

τ = ∆Xt-2

0.348

0.65

-0.079

-0.185

0.36

0.288

65

35

21

54

-415

-620

τ = ∆Xt-1

0.302

0.69

-0.074

-0.188

0.373

0.295

70

31

26

53

-434

-638

τ =0

0.565

0.54

-0.039

-0.238

43

46

61

40

2.8

0.049

0.026

30

35

9.7

59.1

(D′) TAR model based on

Phillips and Loretan (36)

NLS

τ = ∆Xt-2

0.27

0.64

-0.12

-0.294

0.381

0.302

72

36

-20

26

-445

-654

τ = ∆Xt-1

0.26

0.64

-0.119

-0.267

0.373

0.296

36

-19.4

33

73

-434

-639

0.516

0.5

48

50

τ =0

4.8*

-0.081

-0.362

0.049

0.026

19.1

9.5

30

35

17.8

62.3

*4.8% in model (D′) is relatively better than 3.5% and 2.8% in models (B′) and (C′).

Models A′ and B′ are based on Engle-Granger Two-Step procedure. The suggested models C′ and D′ are based on simultaneous estimation of cointegrating

vector and ECM.

Although I know the correct threshold value is zero in DGP, but I have included two arbitrary threshold values to show how a wrong threshold affects

estimations. Since the hypothesis testing under incorrect threshold does not have a known distribution, the test results are not reported for them.

32

RSS

193

184

178

178

150

176

177

148

188

188

157

Table6: Monte Carlo simulation results for average estimation’s bias in different asymmetric models for the following values, when there is an autocorrelation in

error terms.

Null

Null

Null

Model / Values

γ0

δ0

γ1-1

δ1-1

γ2

δ2

γ0

δ0

γ1-1

δ1-1

γ2

δ2

0

1

2

HN

HN

HN

Value of coefficients

Rejection Frequency of

from DGP((26), (27),

1

1

-0.3

-0.5

0.27

0.14

ϕ − ϕˆ

(28) and (29))(True

%Bias= (

)*100

Null Hypothesis (%)

Values)

ϕ

Symmetric ECM using

0.01

-0.3

0.403

Engle-Granger two-step

(A′)Asymmetric ECM

0

-0.308

-0.303

0.46

0.353

100

-2.7

39

-70

-152

5.5

7.3

(33)

(B′) Godby et al. (34)

τ = ∆Xt-2

-0.029 -0.05 -0.092

-0.199

0.467

0.332

102

105

69

60

-73

-137

τ = ∆Xt-1

-0.020 -0.08 -0.098

-0.184

0.473

0.302

103

108

67

63

-75

-115

τ =0

0.225 -0.28

78

128

45.9

41.1

7.9

-0.21

-0.395

0.265

0.136

30

21

2.0

2.7

(C′) TAR model based on

Banerjee et al. (35)

SEECM

τ = ∆Xt-2

0.587 0.806 -0.095

-0.204

0.470

0.334

41

19.4

68

59

-74

-139

τ = ∆Xt-1

0.581

0.78

-0.1

-0.186

0.479

0.308

42

22

67

63

-77

-120

τ =0

42.4

7.1

0.762 0.734 -0.211

-0.399

0.267

0.141

24

27

30

20

1.0

-0.6

11.8

(D′) TAR model based on

Phillips and Loretan (36)

NLS

τ = ∆Xt-2

0.553 0.792 -0.306

-0.491

0.472

0.336

45

21

-2

1.8

-75

-140

τ = ∆Xt-1

0.557 0.764 -0.314

-0.459

0.478

0.307

44

24

-4.7

8.3

-77

-119

τ =0

9.9*

0.704 0.674 -0.252

-0.552

0.269

0.14

30

33

15.9 -10.3

0.3

0.2

20.2

69.3

* 9.9% in model (D′) is relatively better than 7.9% and 7.1% in models (B′) and (C′).

Models A′ and B′ are based on Engle-Granger Two-Step procedure. The suggested models C′ and D′ are based on simultaneous estimation of cointegrating

vector and ECM.

Although I know the correct threshold value is zero in DGP, but I have included two arbitrary threshold values to show how a wrong threshold affects

estimations. Since the hypothesis testing under incorrect threshold does not have a known distribution, the test results are not reported for them.

33

RSS

238

231

237

237

214

234

235

211

235

236

225

Phillips and Loretan’s NLS model rejects correctly null hypothesis of symmetry

in speeds of adjustment more frequently, 62.3% and 69.9% of time in tables (5) and (6).

However, the rejection frequency for the null hypothesis of symmetric short-run

adjustment is extremely low in both tables (5) and (6). Moreover in 17.8% and 20.2 % of

time the model wrongly infers on non-equality of constant terms in tables (5) and (6). As

a result when the error terms are non white-noise but stationary, Monte Carlo

experiments suggest that inferences in speeds of adjustment and constant terms can be

relatively illuminating, but inference in short-run coefficients can be misleading for low

rejection frequency of linearity. However NLS still reveals short-run asymmetry more

frequent than the others.

6.3. Other simulations:

In addition to the above simulations, three other sets of simulations are

performed; the simulation results are available upon request from the author. The first

group of Monte Carlo experiments deals with different sample sizes. In a separate set of

experiments, I have shown that power of the null hypothesis of symmetry is increasing by

sample; however, estimation bias shows no tendency to decline with the sample size,

similar to results of Holly, Turner and Weeks (2003). As a result we have faced with a

special type of small sample property.

The second group of Monte Carlo experiments deals with estimates, bias

percentage and rejection frequency of the following null hypothesis for cointegrating

vectors (i.e. βs). According to what is mentioned in subsections 6.1 and 6.2, Monte Carlo

experiments furnishes us with the estimates of cointegrating vectors in all models.

Remember in the models based on EG two-step procedure we estimate cointegrating

34

vector primarily and then estimate ECM, therefore we have a single estimate for β in all

models A, B, A′ and B′. When we estimate cointegrating vectors simultaneously in two

regime models (models C, D, C′, and D′ ) we have estimates of two βs for the relevant

regimes. As we generate data based on true values of β =1, we can test these null

hypothesis H0: β=1 (for models A, B, A′ and B′) and H′0: β+ regime=β- regime=1 (for models

C, D, C′, and D′) for the known threshold τ=0. The simulation results indicate that βs

estimates of NLS are slightly better (less biased) than other models. Furthermore the true

null hypothesis of H′0 is infrequently rejected by NLS, compare with frequent rejection of

H0, especially when the error terms are autocorrelated.

The third group of simulations deals with symmetric DGP. The results indicate

that simultaneous estimation of cointegrating vector and ECM performs as good as linear

models (bias percentages are about the same). Furthermore hypothesis testing of null of

symmetry in NLS model does not work as well as OLS based models; however, they

generally confirm existence of a linear (symmetric) DGP. Meanwhile to ensure that we

are dealing with a nonlinear model we can perform a nonlinearity test, like RESET which

traces nonlinearity at the beginning, to avoid misleading inferences.

7. Conclusion:

It seems that part of the estimation bias in asymmetric parameters reflects the bias

associated with Engle-Granger estimations in small samples. As it is shown in the

simulation results, in none of the cases asymmetric ECM and Godby et al. model (2000)

(i.e. most of the studies presented in tables 1 and 2) which are based on Engle-Granger

two step estimation of cointegrating vector, have a substantial advantage to the others.

Furthermore, constant terms are estimated with large bias in models that are based on

35

Engle-Granger two-step procedure; although there is simple remedy for that. But, single

step estimations of ECM like SEECM and NLS are relatively superior based on their bias

percentage and inferences.

Among all the models in table 1, asymmetric ECM usually returns the most

biased estimations and wrong inferences of symmetry; however, TAR ECM returns better

estimates and inferences. TAR ECM model (Godby et al.(2000) model in table1) estimate

speeds of adjustment and short-run run coefficients with small biases when the error

terms are white-noise. While error terms are auto-correlated, this model can usually

estimate short-run adjustment coefficients with small bias. Experiment results show that

when error-terms are auto-correlated, TAR ECM models might support more often

symmetry than asymmetry. However, simultaneous estimations of cointegrating vector

and ECM by SEECM and NLS methods result in relatively smaller bias and stronger

inferences, when the error terms are white-noise. But, when we include auto-correlation

into the data, SEECM returns larger bias in speeds of adjustment estimation in some

cases. Nevertheless, NLS returns relatively better results, almost in all cases.

Furthermore, all of the results in the tables 3, 4, 5 and 6 testify on undeniable importance

of the choice of threshold value. Bias increases when we select incorrect threshold

values.

Finally it seems that asymmetric ECM and TAR ECM models that are based on

Engle-Granger two-step are affected and can be improved by NLS estimations, however,

for other nonlinear procedures which do not use the above mentioned approaches a

further investigation is needed.

36

Appendix 1:

Suppose we have two different samples of one data set. Sample one with T1 observations

and sample two with T2 observations. Therefore we use X1 and Y1 for sample 1 and X2

and Y2 for sample 2. As a result we have Y= Y1+ Y2 and X= X1+ X2 with T = T1+ T2

observations. If Y1 and X1 are cointegrated with a cointegrating vectorβ, as well as Y2

and X2 we have the following relations.

(I)

Y1= βX1 + υ1

where υ1 is stationary

(II)

Y2= βX2 + υ2

where υ2 is stationary

We can show that Y and X will be cointegrated with the same cointegrating vector. We

can rearrange (I) as

Y-Y2= β(X-X2) + υ1

Thus

Y=Y2+ β(X-X2) + υ1

And then replace (II) in the last relation and we have

Y=βX + υ1+υ2

We can replace υ = υ1+υ2, and it is stationary. As a result we have the following

cointegrating vector.

(III)

Y= βX + υ

37

References:

Bachmeier, L. and Griffin, J. “New Evidence on Asymmetric Gasoline Price Responses”, Review

of economics and Statistics, 85 (2003) 772-776.

Bacon, R.W. “Rockets and Feathers: the asymmetric speed of adjustment of UK Retail Gasoline

Prices to Cost Changes”, Energy Economics, vol.13 (3) (1991) 211-218.

Balke, N., Brown, S. and Yucel, M. “Crude Oil and Gasoline Prices: An Asymmetric

Relationship?” Federal Reserve Bank of Dallas Economic Review, (1998) First Quarter 2-11.

Banerjee, A., Dolado, J., Galbraith, J. W. and Hendry, D. F. “Co-Integration, Error-Correction,

and the Econometric Analysis of Non-stationary Data”, Oxford University Press (1993), reprinted

2003.

Banerjee, A., Dolado, J., Hendry, D. F. and Smith G.W. “Exploring Equilibrium Relationships in

Econometrics through Static Models: some Monte Carlo Evidence”, Oxford Bulletin of

Economics and Statistics, 48(1986) 253-278.

Bettendorf, L., Van der Geest, S. and Varkevisser, M. “Price Asymmetry in the Dutch retail

gasoline market” Energy Economics 25(2003) 175-190.

Borenstein, S., Cameron, A.C., and Gilbert, R. “Do Gasoline Prices respond symmetrically to

Crude Oil Price Changes?” Quarterly Journal of Economics, vol 112(1997) 305-339.

Borenstein ,S. and Shepard, A., “Sticky Prices, Inventories, and Market Power in Wholesale

Gasoline Markets”, RAND Journal of Economics, vol33(2002) 116-139.

Brown, S. and Yucel, M. “Gasoline and Crude Oil Prices: Why the Asymmetry?”, Economic

and Financial Review , 3rd Q (2000) 23-29.

Cook, S., Holly, S. and Turner, P. “The power of tests for non-linearity: the case of Granger-Lee

asymmetry”, Economics Letters, 62(1999), 155-159.

Enders, W. and Granger, C. W. J. “Unit-Root tests and asymmetric adjustment With an Example

using the Term Structure of Interest Rates”, Journal of Business & Economic Statistics, July

(1998) 304-311.

Enders, W. and Siklos, P.L. “Cointegration and Threshold adjustment”, Journal of Business &

Economic Statistics, April(2001) 166-176.

Engle, R.F. and Granger, C.W.J. “Co-integration and Error Correction: Representation,

Estimation and Testing”, Econometrica, 55(1987) 251-276.

Ericsson, N.R. and MacKinnon, J.G. “Distributions of error correction tests for Cointegration”,

Econometrics Journal, 5(2002) 285-318.

Fan, J. and Yao,Q. " Nonlinear time series Nonparametric and Parametric methods”, Springer

Verlag, (2005).

38

Galeotti, M., Lansa, A., and Manera, M. “Rockets and feathers revisited: An international

comparison on European gasoline market”, Energy Economics, 25 (2003) 175-190.

Godby, R., Lintner, A.M., Stengos, T. and Wandschneider, B. “Testing for Asymmetric Pricing in

Canadian Retail Gasoline Market”, Energy Economics, vol 22(2000) 251-276.

Granger,C.W. and Yoon, G. “Hidden cointegration” University of California, San Diego,

Department of Economics Working Paper, 2002.

Hamilton, J. “What is an oil shock?” Journal of Econometrics, 113(2003) 363– 398.

Holly, S., Turner, P. and Weeks, M. “Asymmetric Adjustment and Bias in Estimation of an

Equilibrium Relationship from a Cointegrating Regression”, Computational Economics 21(2003)

195-202.

Karrenbrock, J. “The behavior of retail gasoline prices: symmetric or not?” Federal Reserve Bank

of St. Louis, July/August 1991, 19-29.

Phillips, P.C.B. and Loretan, M. “Estimating long-run economic equilibria”, Review of Economic

Studies, 58(1991), 407-436.

Rodchenko, S. “Oil price volatility and the asymmetric response of gasoline prices to oil price

increases and decreases”, Energy Economics, vol 27(2005) 708-730.

Shin, D. “Do product prices respond symmetrically to changes in crude prices?”, OPEC Review ,

summer (1994) 137-154.