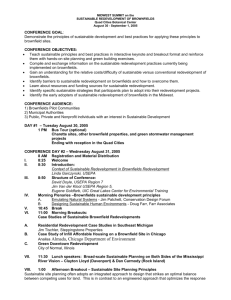

Market Failures and The Optimal Use of Brownfield Redevelopment Policy Instruments

advertisement