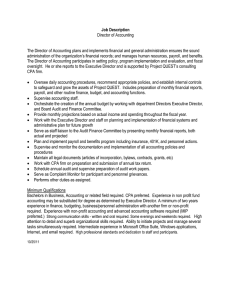

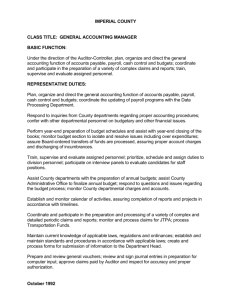

Erika R. Mumford, MBA, CPA, CIA

advertisement

Erika R. Mumford, MBA, CPA, CIA Email: ermumford@twcny.rr.com SUMMARY EDUCATION & CERTIFICATION Diverse accounting and audit background including big‐four public accounting experience and directing the audit department of a publicly traded financial services company. Higher education experience and active involvement with students, faculty, and staff. Proven achiever with a firm belief in hard work, diligence and perseverance. Qualified and trusted to handle jobs, assignments, and projects. Determined to reach goals. Learner by nature with a strong desire to acquire more knowledge, information, and skills. Analytical, I thrive on interpreting numerical information. I appreciate logic and step‐by‐step sequences and have a strong desire to understand how things come together to the end result. Strategic problem solver with a knack for evaluating situations, identifying facts, making sense out of information and data, and coming up with alternative action plans. Driven to increase productivity and efficiency. Maximizer, I am able to capitalize on my strengths and identify the strengths of others. I enjoy coaching, managing, mentoring, and teaching. Excellent communicator and able to clearly express my thoughts and ideas in a reasonable, sequential, and methodical way. AACSB Practitioner Faculty Bridge Program, June 2015 Babson College, Wellesley, MA Intensive program for experienced business professionals who meet the general AACSB accreditation standards for instructional practitioner. Master of Business Administration, Accountancy, May 2012 Utica College, Utica, NY GPA 3.91 Certified Internal Auditor, November 2006 (#62796) Institute of Internal Auditors Certified Public Accountant, May 2002 (Erika R. Johnston #087708) State of New York Bachelor of Business Administration, Accounting, May 2000 Siena College, Loudonville, NY Presidential Scholar, English Minor TRAINING EXPERIENCE Assistant Controller, Hamilton College, Hamilton, NY First‐Year International Students Orientation, Nonresident Alien Tax Forms and Compliance Training, August 2015, September 2014, 2013 & 2012. Payroll Training, WebAdvisor Web Time Entry Electronic Time Sheets Training, August‐September 2013 Business Office Staff Retreat, Excel Tips & Tricks, May 2013 PROFESSIONAL WORK EXPERIENCE Hamilton College, Clinton, NY, Assistant Controller, September 2011‐Present. Coordinate and oversee payroll, accounts payable, college credit cards, travel advances, wire transfers, and tax compliance. Researched, tested, and implemented a new payroll system and facilitated conversion to electronic time sheets, pay advices, and W‐2s. Analyze payments to nonresident alien employees, students, guest speakers, and other international vendors for taxability, tax treaty exemptions, and documentation requirements. Process tax deposits and prepare quarterly payroll tax returns, annual tax forms, and tax filings including IRS Form 941, W‐2, 1099, 1042‐S, 1042, NYS‐ 45, and unclaimed property. Write custom data extract and analysis reports using a custom report writer. Prepare and approve journal entries. Prepare and approve general ledger account reconciliations. Participate in on campus committees. Develop procedure manuals and written instructions for training purposes. Supervise staff including training, coordination and review of work, and performance evaluations. Morrisville Auxiliary Corporation / Morrisville College Foundation, Morrisville, NY, Controller / Foundation Accountant, January 2010‐September 2011. Coordinate and oversee accounts payable, accounts receivable, corporate credit cards, travel advances, W2 and 1099 processing, month‐end close, and the annual financial statement audit. Develop and document internal controls, policies, and procedures. Record and review journal entries and analyze revenue, expense, and balance sheet accounts. Prepare and review bank, investment, and other general ledger account reconciliations. Format and prepare financial reports for management. Monitor budget to actual performance. Supervise staff including training, coordination and review of work, and performance evaluations. Mohawk Valley Water Authority, Utica, NY, Finance Administrator, August 2009‐January 2010. Coordinate purchases and payment of accounts payable. Prepare monthly bank and general ledger account reconciliations. Record and review journal entries and analyze revenue, expense, and balance sheet accounts. Assist in the preparation of the monthly financial reports and the annual budget. PROFESSIONAL WORK EXPERIENCE Oneida Savings Bank / Oneida Financial, Oneida, NY, Director of Audit, December 2002‐August 2009 Develop, coordinate, and perform financial and operational audits of the bank and its subsidiary insurance and benefit consulting divisions. Verify compliance with policies and regulations. Coordinate Sarbanes‐Oxley Act compliance. Recommend operating efficiencies and improvements to internal controls. Write and present reports to management, the Audit Committee, and the Board of Directors. Supervise staff including training, review, and performance evaluations. D’Arcangelo & Co., LLP, Rome, NY, Senior Accountant, May‐December 2002 & Summers 1999 & 2000 Develop, coordinate, and perform financial and compliance audits. Prepare financial statements, disclosures, and management letters in accordance with GAAP. Supervise staff and review audit procedures. PricewaterhouseCoopers, LLP, Syracuse, NY, Experienced Associate, September 2000–April 2002 Develop, coordinate, and perform financial statement audits. Prepare financial statements, disclosures, and management letters in accordance with GAAP. Supervise staff, review audit procedures, and evaluate performance. RELEVANT TRAINING American Payroll Association Accounts Payable Disbursements & Payroll Preparing for Year‐End and 2015 & Garnishments and Child Support Withholding Arctic International LLC Nonresident Alien Tax Compliance Workshop, Scholarships and Fellowships, Non‐Employees and Guest Speakers, Non‐Individuals and Foreign Companies & Income Tax Treaties Lorman 1099 Reporting & Untangling the Complexities of Form 1040NR FAE Exempt Organizations Conference & Ethics Other Tax Conference for Small Colleges and Universities MEMBERSHIPS & BOARDS Member of the AICPA, NYSSCPA & American Payroll Association Board Treasurer, Oneida Area Day Care Center, Inc., 2006‐2009 Board Treasurer, Institute of Internal Auditors (CNY Chapter), 2003‐2005 COMPUTER SKILLS Microsoft Office, Excel, Word Ellucian Colleague for Higher Education Entrinsik Informer Web Report Writer GLACIER Nonresident Alien Tax Compliance System & Glacier Tax Prep Sage MAS General Ledger, FAS Fixed Asset & FTI General Ledger QuickBooks & Quicken Open Solutions Inc. Banking Software Report Wizard