GROUP PSNSION by Sharon N. O'f.1eara

advertisement

-------~----------------~-

~----

A f.1hTlli:I1ATICt.L HODZL FOR A

GROUP PSNSION

PROGRAI':

An Honors Thesis (ID 499)

by

Sharon N. O'f.1eara

Thesis Director

John A. Beekman, ASA

Ball State University

Huncie, IN

November 16, 1984

Expected date of graduation (Fall, 1984)

r

p

Table of Contents

Page

I.

Introduction ........................................... 1

II.

Basics of a Pension Plan ••..........•..............•..• 3

III.

Classical Definition of Immunization ••.•••...•••.•••••• 7

IV.

Stochastic

I~1odels

•••••••••••••••••••••••••••••••••••••• 9

V.

Gifford Fong Theory of Immunization ••••••••••••••••••• 11

VI.

Description of the system •.......•.........•.....•.... 14

VII.

The System

A.

Description of Programs

B.

Instructions for Use

C.

Reports

D.

Calculation of Durations

,c,.

List of Programs and Their Functions

F.

Printout of Programs

VIII.

Implications of the Output ............................ 16

IX.

Conclusion ...........•......................•......... 17

x.

Footnotes .•....................................•....•. 13

XI.

Bibliography ••••••••••••••••••••••.••••••••••••••••••• 19

I

p

Introduction

The progressive increase in the number and proportion

of the retired section of the population is of growing concern today.

The probable reduction of an individual's

earning pm"er upon leaving the work force must be planned

for in the earlier stages of one's employment history.

'''hat

resources can be drawn upon to survive once income from work

is discontinued?

In the past many have survived on social

security or private savings.

Drastic decreases in standard

of living have been seen in the life styles of the elderly.

Social Security is cutting back payments as it runs into more

and more difficulties paying the increasing number of elderly.

Economic security is a serious and increasingly important

problem of the United States.

One wayan individual can

ease the worries of income after retirement is to join a

pension program either individually through IRA's or KSOGH's

or through plans offered through the place of employment.

Pension programs have grown significantly since the 1940's;

however, they date back to the 1800's.

This paper outlines

what is necessary for a defined contribution pension plan

to be successful in providing benefit payments at a future

date.

The organization is as follows: A brief outline on

the structure of a pension plan giving rise to the need for

immunization, a definition of classical immunization, followed by a more recent theory of immunization developed by

Gifford Fong.

A model of a specific pension plan will be

2

shown and a description of how to project cashflows '..:ill be

given including a computer system developed to produce the

future cashflow for the product.

Finally, the results will

be shown that are then used by an investment department for

immunization purposes.

3

Basics of Pension Plan

'From the standpoint of the whole system of social

economy, no employer has a right to engage men in any occupation that exhausts the individual's industrial life in

10, 20 or 40 years; and then leave the remnant floating on

society at large as a derelict at sea.,i

This states that

there is an obvious problem of maintaining an adequate standard of living once past the productive, employable years of

life.

There are basically four methods of meeting the pro-

blem of superannu.ated employees.

First, "the employee

could be terminated without any further compensation or any

retirement benefits as soon as the value of the employee's

services is less than the salary being paid. ,,2

This is a

disadvantage to the employee but great financial advantage

for the employer.

Another method of handling the superannuated

employee is to retain the employee at the current level ,.,hile

the company absorbs the cost.

the employer this time.

Another undesirable method to

A third method would be to retain

the employee at a less demanding position.

This being a lit-

tle better than method two because a new, younger employee

can fill the vacancy.

ing the older employee.

This also reduces the cost of maintainHowever, none of these choices seem

to be desirable for the employer or employee.

An alternative

to these methods is to establish a formal pension plan.

A

pension plan is established through employer and employee contributions into a fund throughout the working years of the

employee.

This then accumulates at a predetermined or going

rate of interest until the employee reaches retirement age.

r

I

I

p

4

He will then begin to receive payments from the pension plan

in lieu of his paycheck.

This method has become very popular

in the past forty years.

There are several advantages of pension plans to be considered.

For the employer, the superannuated employee can be

dismissed in a fair, reasonable manner without having to

worry about the cost and inefficiency of retaining him.

The

company will remain desirable for young employees in that advancements can be made.

The cycle vrould flow smoothly with

the older retiring and younger filling their positions.

Also,

the employees will feel more secure knowing provisions have

been made for them upon retirement and hopefully, 'Ilill increase

their morale and productivity.

Another advantage of a pension plan is for tax purposes.

Employer's contributions are tax deductable, a big plus for

the company.

Also, investment income is not taxed until

actually paid out.

From the employee's viewpoint, the employer

contributions do not constitute taxable income until actually

received.

At that point it is assumed the employee will be

in a lO\'ler tax bracket.

If a company is to attract new employees, it must offer

some type of retirement benefits.

If it does not, it is at

a strong disadvantage in the labor market.

Hence, pension

plans are a must for a company to survive.

Pensions are also a supplement to income after retirement.

Social Security and individual savings also contribute

to income.

However, neither is adequate to maintain one's

standard of living.

Most individuals need a combination of

'rr""'IIIIp.,. . . . .- - - - - - - - - - - - - - - - - . - . - - . - - -

!

5

Social Security, private pensions, and personal savings.

Also, it has been shown that people would rather spend their

money as they earn it rather than put it into savings and

not see it until many years down the road.

Unexpected de-

mands arise where use of the 'savings for retirement' money

is needed immediately.

savings.

A pension plan is a form of forced

This is needed if the individual wishes to maintain

a relatively high standard of living after retirement.

The need for and advantages of pension plans have been

clearly pointed out.

However, the next problem is how is a

company going to provide pension plans for their employees.

Many sources are available to choose from.

Insurance companies,

trust departments of banks, corporate trustees all offer the

service.

The insurance industry first entered into the pension

business with the issuance of the first annuity contract by

Metropolitan Life Insurance Company in 1921.3

The problem of

providing a pension plan is now passed from the company to

the insurance company or other group to handle.

The question

remains as to how is one to guarantee payments upon retirement

and how much will they be; a major concern of the employees.

The company that provides the pension plan creates a

series of long term liabilities representing the obligation

to pay a specific amount of money or provide income for a

certain amount to annuitants.

Investments must be made at

the present time to meet these future demands.

Such invest-

ments are made up of common and preferred stock, bonds, mortgages, real estate, and cash.

All of these have different

rates of return and different levels of risk.

One first must

,I

,I

I

f

6

analyze the structure of the pension plan and make investments

accordingly.

Liability determinations are based on actuarial

cost estimates. "Good pension administration includes close

monitoring of the estimates and assumptions.

The standard

list of actuarial assumptions include mortality expectation,

... , expected levels

of compensation, administrative costs,

ages of retirement, and finally, anticipated investment earnings.,,4

Until recently, many life insurance companies did not

have investment staffs that would permit them to follow the

total return concept.

A study on investment policies found,

'For most (insurance) companies, the labor, capital, and material resources employed in making investment decisions represent a negligible portion of total resources utilized by the

companies. ,5

New theories have. been developed since the 1940' s

on how to invest to get the·maximum yield and appropriate timing

for pension plans.

7

Classical Defintion of Immunization

'A portfolio of investments in bonds is immunized for

a holding period if its value at the end of the holding

period, regardless of the course of interest rates during

the holding period, must be at least as large as it would

have been had the interest-rate function been constant throughout the holding period. ,,6

Only recently has immunization of

portfolios become a major concern for insurance companies.

The above definition was written in 1971 by La,.,rrence Fisher

and homan L. Weil who then developed what is now known as the

traditional theory of immunization.

Immunization theory is

a key concept of the investment division of insurance companies and, if accomplished

successfull~

can lead to large

profits and a more flexible business.

The Fisher!Weil theory looks at an invester with x dollars now and wants y dollars at some time, t, in the future.

Any deviation from the y dollars at time t is a measure of

risk of the investment.

The Fisherl'lleil theory based their

investment strategy on the duration of an asset.

Duration is

'a number with dimension time attached to a stream of promised payments." 7 I'lathematically:

n

=:2..

j=1

t.P t

J

j

!fp

j=1

t j

-

t

0

D = Duration

Tj = Time

Pt. = Present values at time tj of promised payments.

J

From this they developed the immunization theorem.

They

first assumed interest is to be compounded continuously call this function i(t).

They then assume if interest rates

8

change, all rates change by the same amount.

In other words,

if ia(t) changes to ib(t) then

ib (t) • ia (t) + 1:l

'IIi th

these assumptions made, the immunization theorem states

the portfolio is immunized at to if duration, Dt ' of the

o

promised payments is equal to the desired holding period.

Therefore, an invester who wishes to be immunized from

interest-rate flucuations should have equal durations for

assets and liabilities.

Duration of a portfolio is a linear

combination of the durations of its components.

The invester

can match asset and liability durations by purchasing a singlepayment note whose duration is at least as long as the longest

liability and combining this with assets with shorter durations to come up with the perfect match.

This theorem should

lead the investor to at least break even if all assumptions

hold.

This theory has been developed with much more

theories now taking its place.

po~erful

I

f

9

II

I

Stochastic vs Deterministic J.1odels

,

i

The classical definition used a deterministic model when

discussing the term structure of interest rates. liThe term

structure of interest rates exhibits the relationship among

the yields on default free debt instruments of different

maturities. IIS

This deterministic model, however, is inc on-

sistent vri th the treatment of assets where the prices are

determined under the assumption that returns on the assets

are random variables, i.e. not deterministic.

Phelim Boyle

summarizes two methods to determine the price of

Fi

pure dis-

count bond at time t with maturity time s and spot rate r.

Both of these methods follow a stochastic or random model.

It should be clear that a stochastic model is better suited

to determine spot interest rates because one, it is consistent with the method used in determining returns on assets

and two, it is a natural process assuming the market is

efficient and investors act rationally.

Furthermore, a

stochastic process is "a mathematical model used to describe

a natural process. ,,9

The two methods developed in Boyle's paper are by Vasicek

ambyC~

Ingersole and Ross.

Both assume the spot rate fol-

lows a Markov or continuous process.

The Cox, Ingersole and

Ross method also eliminates the possibility of negative interest rates.

It is very important to utilize a realistic

model in determining the maturity structure of liabilities so

the appropriate assets may be selected.

This matching of the

term of the assets in relation to the term of the liabilities

r

I!

:,

r

----------

10

I

I:"

so as to reduce the possibility of loss due to change in interest rates is of the greatest importance because, "it is

one of the three main factors within (the company's) control

which can endanger the solvancy of an office.,,10

The results of the Vasicek and Cox, Ingersole and Ross

methods make it possible to achieve immunization under the

classical definition.

There are differences in the mean

terms in the deterministic and stochastic models.

In the

deterministic model, the mean term is equal to maturity

date T.

The Vasicek model shows the mean term is less than

T but is bounded by T as T ~

term is always less than T.

the riskiness of the bend.

O{).

In the last model, the mean

Remember, the mean term measures

Hence, the stochastic models

give rise to larger investments in longer term bonds because

of the lower risk or less dramatic effect of an interest rate

change.

~---~~~~~~~--- ...

---------

11

Gifford Fong Theory of Immunization

Immunization involves the matching of the first

of asset and liability cashflow.

~oments

This protects against

parallel movements in interest rates.

Also, investment flex-

ibility is provided in that cashflo", matching is not required.

However, a problem encountered \vi th this technique is that

non-paralled shifts in interest rates are not protected

against.

A new risk management strategy was developed by

Gifford Fong and Oldrich Vasicek that addressed the risk of

non-parallel, movements in interest rates.

This is a little

more complicated than classical immunization since the second

moment as well as the first moment is involved.

The Gifford

Fong Str.ategy aims for an optimal tradeoff between risk and

return rather than minimizing the portfolio's immunization

risk.

Fong purposes to achieve this optimal tradeoff between

risk and return by maximizing the lower bound on the portfolio return.

The lower bound is a confidence interval on

the realized return for a given probability level.

The first condition necessary in the Gifford Fong strategy

is the traditional matching of durations.

Duration is the

weighted average time of all the portfolio payments, the weights

being the present values of the payment amounts.

Hathematically:

12

m = number of portfolio payments

Ci = Amount of payment due at time ti

poet) = Discount function

10 = Initial portfolio value or the sum of '

the present value of the payments.

11

Another condition that must be met is the i1ean Absolute

Deviation Constraints.

This says that the asset cash-flows

must be more dispersed than the liability cash-flO\'IS.

These

two constraints will subject the portfolio to immunization

risk from arbitrary or non-parallel shifts of interest rates.

A measure of immunization risk is denoted M2.

Mathe-

matically:

jvJ2 =

m

H = investment horizon

This is simply the second moment of future cash-flows or the

',.,eighted variance of times to payment around the horizon date. 12

For a portfolio that adheres to the above two conditions:

2

m

2t

m

2t

M =

(ti-D) V At (t. - D) V Lt

i=1

i=1

1.

D = Duration

VT = Present value

AT = Assets

LT = Liabilities

or the difference of the future cash-flows of assets and liabilities.

Traditionally jvJ2, immunization risk, is minimized.

Fong optimizes the riSk/return trade-off by maximizing the

lower bound of a rate of return confidence interval.

Define

Ds as a random variable representing an arbitrary change of

13

interest rate.

Therefore the change in value of the port-

folio assets and liabilities is _M2Ds'

The rate of return of

the asset portfolio is

R = "R - aM 2 Os

R = Rate of return random variable

1\

R = Target (expected) rate of return

a = Constant varying by duration of the asset

portfolio

The confidence interval for R can be represented as:

1\

R=R+k\r R

R = Confidence level.

Fang suggests maximizing the lower bound of this confidence

interval also written as

~

- k

a M2'\) s

"

Maximizing this is the same as minimizing M2 - )..P.

The use of linear programming and the duality theory will

accomplish the task of immunization.

----------------------------14

Desription of the System

It is necessary to give a simple example on how to

project cashflows and describe what implications can be

made from the output.

I have chosen to use a group pension

plan called the Growth

Gua~

project cashflo\vs.

Contract (GGC) for which to

The structure of the GGC is as follows:

X denotes the deposit period

for a group, usually 12 months.

Y denotes the holding period.

The company holds the money

Y months at a guaranteed interest rate. Y usually ranges

from two to five years.

Z denotes the disbursement period

of the money back to the insured.

Zxpenses can either be deducted from the account, credited,

or separately billed.

Benefit payments can be made throughout

the X-Y-Z periods, prorata,

or not

paid at all, LIFO.

There

are four combinations of billing/benefit payout options.

are accounted for in the system.

All

The system contains a main

program to project the cashflows, many subroutines used by

the main program, a database of all sales made from July, 1983

to the present, and several matrices containing fund balances,

deposits, disbursements, and interest earned.

It is of vital importance to keep the system updated each

month with all of the new sales, fund balances etc. to receive

an accurate cashflow projection.

invalid conclusions may result.

If this is not properly done,

To keep it current, user-

friendly programs are included to add new sales, insert fund

balances, and make adjustments.

--------~--.-------.--

------.--.---~

~~~~~-

15

Several assumptions must be made before the cashflow

can be projected.

First is the amount of monthly deposit

expected in future months.

divided by the X period.

~ust

This is simply the total sale

If a policy is prorata, an assumption

be made as to how much the monthly benefit ?ayments sre

expected to be.

This is calculated by the underwriting

department based in past experience.

The deposits and bene-

fit payments should be monitored to see if they are deviating

from the original assumption.

~ade

If so, an adjustment should be

through the ADJUSTMENTS program.

This step is as im-

portant as keeping the database updated if accurate cashflows

are to be projected.

The main program ',viII take the sale from the database

and project a ten year cashflmv for each one.

accumulated to produce the final reports.

Totals are

From the results

the investment department can easily see the total dollar

amount 0::' inflows that are expected and how and when disbursements from benefit payments and maturities are made.

Also, the present value of the inflows and outflows, 1'1 ( 0) ,

the first and second moments, and D1- and D2, duration, are

shown for each case and in total.

Ultimately, matching of

the second derivatives (D2) is desired.

Following is a

printout of the system and brief explanations where needed.

GGC CASHFLOW PROJECTIONS

August, 1984

Introduction:

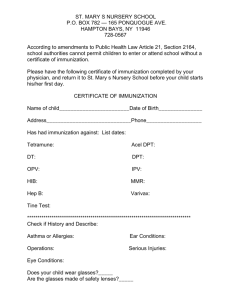

This system is designed to project the cash flows for the GGC sales

since July, 1983. The cash flows are projected ten years into the

future. Each sale is processed individually while the sum is accumulated.

A projection consists of three streams:

1).

2).

3).

inflows consisting of deposits only.

outflows consisting of expenses, benefit payments and

maturities.

an accumulation of the fund balance.

The final report contains an i ,flow monitor, out flow monitor, total

projection and, if opted, projections for each individual record.

One may request the projection from any point in time from July of

1983 to ten years past the current month. Any projection made starting

Detween July, 1983 and the current month uses the final balances as of

the projection date. If a projection is requested for a future date, the

most current fund balance is used to start the cashflow streams. Only

sales existing at the projection date are used to produce the streams.

Uhderwriter Responsibilities

For this system to be accurate, the Underwriters must be sure to

update it each month. Their primary responsibilities are to add the new

sales each month, add fund balances for the existing records, ,md make

adjustments that are necessary.

There are eleven possible adjustments, two of which require

monitoring the benefit payments and deposits. The changes would be made

to the benefit payment assumption field and expected monthly deposit

field if they consistently vary from the original assumptions.

All adjustments can easily be made using the "Adjustments" program

and new sales are entered using the "Newsales" program. Both are user

friendly.

Using the System

The system must be run on an IBM PC equipped with an APL chip. To

begin, insert an APL disk in disk drive A and hit control, Alt, Delete at

the same time. Next, clear the workspace by typing) )CLEAR. Take out

the APL disk and insert the cash flow disk. Load the program by typing

)eOPY CASHFLOW. It will take a minute or two to complete this step. A

final important step that must be done before running any of the programs

is to tie the files so they can be accessed. This requi res two commands

as follows:

'DATA' 11 (QUAD)

'NAMES' n, (QUAD)

.,

FTIE 100

FTIE 200

-1-

The quote is the uppercase k and the quad is the upper case 1.

system is now ready to run any program.

The

The options are:

Newsales - to add new sales

- to enter monthly fund balance

Adjustments - to adjust existing records

Program - to project the cash flows

New~al

Newsales and newbal should be run together monthly. 'Program' may be

run at any time. Adjustments are stored for one period only.

**All adjustments for one month should be made at one time to prevent

losing ,ny of the net changes.

Records in Database

1983:

Policy if!

Company Name

Carpenter's Severence & Annuity

Frisch's Restaurant (12.55%)

Total Petroleum

Hanna Mining

Michigan Consolidated Gas

GWL Savings (12.56%)

GWL Savings (12.69%)

Tab Merchandising

8oscov's Department Store

Hydrotex

Rexham Corp.

Cassentino

Mobile Home

Anaheim Union H.S.

Pepsi-Cola

Oakland Unified School

Nabors Alaska

Cameo

American Petroleum

---=~-~-------------------------

Records in Database

1984:

Policy II

Company Name

Hudson Screw

Housing Authority of st. Louis

General Hospital of Everett

Robert C. Wilson

Schweiger Industries

City of Springfield

Sherwood Enterprises

Electro Corp.

Pool Arctic Alaska

KLA Instruments

Boscnv'.s Department Store (12.85%)

First Michigan Cap. Corp.

Frisch's Restaurants (13.15%)

Harrison & Crossfield

Whiting Corp.

Georgia Kraft

Fieldale Corp.

National Asbestos

Tandin

St. Judes (13.85%)

St. Judes (13.9%)

Cleveland Newspaper Pub.

Harrison & Crossfield (14.07%)

Intercity Transit

Washington Forge

Manville (14.41%)

Accent Displays Inc.

American Petroleum

Panhandle Motor Services

Pro jection :

AJRPOSE:

CALCULATION OF

DISBURSEMENTS:

CALCULATION OF

FUND BALANCES:

CALCULATION OF

DURATION:

To project casn flow streams for each sale and

accumulate totals for all sales since July, 1983.

User may choose any date to make the projection.

Any date prior to 7/83 will give all zeros. Any

date past the date the 1st fund balances will start

at the date of the most current fund balance.

Durations can be calculated if user desires. The

floating point arithmetic required for these

calculations slows down the system considerably.

Be prepared to spend an afternoon running

"Projection".

1.

Benefit = LIFO, Expenses = BILL

Disbursement vector =

2.

Benefits = LIFO, Expenses = DEBIT

Max (.15, .00038 X FB)

.00038 X 2000 + .0003 (FB-2000)

3.

Benefits = PRORATA, Expenses

Ben % assumption X FB

4.

Benefits

2+3

°

= PRORATA,

FB

FB

2,000

2,000

= BILL

Expenses - DEBIT

FB (X+l) = FB(X) + Dep (X+l) - Disb (X+l) +

[FB(X) + Dep (X+l) - Disb (X+l)] X (Int/12)

(Y\

DO

=

L.

~t.

1;)1:

t.=o

01

=

'"

~

-t.;o

02

=

t

t v

A. t

."'-

L

-1..=0

1.."" \Jc

1\ to

~t.. ~

C"'-"'''- ~

PURPOSE:

Same as setproj except fund balances for current

month have been entered and are used as beginning

fund balances.

Mjustments:

PURPOSE:

To change a factor of a record in the database.

Changes can be made to:

-

Policy number

-

Company name

-

Policy type

-

X-Y-Z period

Interest rate

-

Effective date

-

Expense payment

-

Annual benefit percent assumptions

-

Expected monthly deposits

FUNCTI ONS CALLED:

V-period, 2-period, Interest, Expenses

START

Type ADJUSTMENTS

PROGRAM:

-6-

Projection

Variable Table and Their Function

Accumulators:

INt

SP

NOEP, NDIS8, NF8

DEP, OISB, FBV, INT, MAT

ROEP, ROIS8, RFB

Interest

Single premiums

Deposits, Disbursement, Fund balance of new sales

Deposits, disbursements, fund balance, interest and

maturities for current sale

Deposits, Disbursements, fund balance of renewal sales

TOTDEP, TOTDISB

TOTFB, TOTINT,

TOT:-tAT

Accumulate total

SORTPOL

DRTD, DRTl, DRT2

MORTO, MDRTl, MDRT2

AORTO, ADRTl, ADRT2

ARORTO, AMDRTl, AMDRT2

t-blds policy numbers as they are read from "DATA"

DO, 01, 02 for outflows at credited interest rate

DO, 01, 02 for outflows at market interest rate

DO, 0, 02 for inflows at credited interest rate

DO, 01, 02 for inflows at market interest rate

DURO, DURl, DUR2,

~RO, MDURl, MDUR2,

ADURO , ADUR l, ADUR2,

AMOURO, AMDURl, AMDUR2

Temporary variables to accumulate durations as they are

being calculated. Assigned a position in above vectors.

DURANS

MKTINT

PRANS

Answer if want to calculate duration

If calculating duration, holds market interest rate

Answer if print each sale

SIZE

Size of database

counter for files, general

J,I

FLAG

Used in calculating remaining time i.e. projection date

- effective date

T

Time

Ramaining time of policy

Remaining time from 7/83 i.e. projection date - 7/83

Sale information read from "DATA"

INFO

x, y,Z

Nl

N

·ZTYPE

Zl

OZ

Q

Count

X,Y,Z periods

Total time of policy - X+Y+Z

Remaining time of policy

Type of dibursement for Z period

Number of quarterly deposits

Original Z period

Month starting disbursement period i.e. (X+Y+l)

Counter used to determine when to make quarterly

dibursement

INSlRUCTIONS TU USE GGC

CASHFLO~

Starting the system:

C!1Jy IBM PC's with an APL chip can run the system. One is located outside of

Luke Girard's office, one Is on lOth floor by David Wolpo, and one on 6th

floor by Paul Er ickson' s 0 f f ice.

To begin insert the APL disk in drive A. This should be located right next to

the PC. Boot up the system by hitting CTRL, ALT, DEL at the same time. About

45 seconcs later a message "see describe" will ClPppt'r. ('1 ear the screen by

typing )Clear- )1s the uppercase semi colon. Remove the APL disk and insert

the GGCCF APL disk. Loao new workspace by typing )LOAD CASHFLOI'I. If

"workspace not compatible" appears type )COPY CASHFLOW. This takes about two

minutes. Next insert the MATRICES Disk in drive A ana type )COP\ MATRICES.

All information is now loaded. Reinsert the GGCCF APL disk in drive A.

The sy~.tem is now ready to run. Type INSTRUCTIONS for general instructions on

how to enter information. There are several options available.

All APL characters are founa on a STSC APL sheet located near the P.C.

IMPORTANT

Before starting two commands must be typed!

'DATA'

'NAMES'

OFTIE1OO

C FTIE 200

'is uppercase k

o is uppercase

L

This rust be done to be able to access the files.

~tion

1:

Add new sales. Type NEWSALES to begin. The user is prompted to

enter all of the pertinent information fur each sale. If a mistake

was entered several things can be don~ to correct it. If it

occurred before the 'Is this a new or rpre~~l ~ale?' question hit

CTRL ESC. This exits from the program. To re-enter simply re-type

NEI'ISALES. If the error occurs after that question the followin\,i

must be typed.

1.

OFDROP

100

-1

2.

OFDROP

200

-1

is uppercase L

is uppercase 2

3.

is uppercase )

[ is i key

a number will appear - say X

4.

F~~TRIX

FBMAlRIX [100il)

[100;

l)~X-l

(one less the number shown above)

A new sale can now be entered.

---~---------------------

----------------------

Optlon 2:

Make adjustments to existinG sales. Type ADJUSlMENlS to begin.

The user is given eleven options on different adjustments to make.

Several may take a couple of minutes to complete. The adjustment

Is complete when the questions, '00 you want to make another

adjustment?' appears. The best way to corr~rt pn error is to make

a negative adjustment or re-enter the ~riginal assumption. This

should zero out any changes that were made.

Option 3:

Enter new fund balance. Type NEWBAL to begin. This program enters

fund balances, deposits, cisbursements, and interest into different

matrices. The matrices are FBMATRIX, DEPMATRIX, BENMATRIX,

l~lMA1RIX.

If error occurs, the appropriate matrix entry must be

found to search for policy number which is the first column of all

matrices. Type FBMAlRIX [(0 + 100);5lJ ~is the uppercase I.

Locate correct policy and count which entry is X. Type FBMATRIX [X

(from above step); j to locate the incorrect entry. Count its

position, say y. To correct the entry type FBMATRIX [X; YJ ~pew

entry~ lhis must be oone for all matrices that may have receiveo

the incorrect answer. Also, if a deposit was entered wrong and a

was or single premium salE, SPMATRIX must be correcteG in a similar

fashion.

Option 4:

Pro,iect cashtlows. Type PROGRAM to begin. A series of questions

follows. Once the answers are entered the projection begins. It

may take an afternoon to run. All reports are produced after the

projection is complete. I suggest beginning it in the morning. If

for any reason it must be stopped hit CTRL BREAK (Upper right

corner). This interrupts the program. Corrections can be made to

the programs. Type ~ t) LC to continue ~ is the J key, (lis

uppercase L. Be sure not to change any variables like X, Y, Z, J,

or totals. If PROGRAM is stopped and restsrttd by typing PROGRAM,

the whole process is started over. If )RESET is typed the position

is lost.

~ D lC does not work.

---------------~-----~---

-------~-----------

Reports Generated from Projection

Illustration:

Inflow Monitor

1. Outstanding future deposits at beginning of period $5,000

2.

3.

4.

5.

6.

New sales in month

Renewed sales

Adjustments

Expected in-month deposits

outstanding future deposits at end of period

1,000

2,000

500

(1,500)

7,000

Illustration:

Outflow Monitor

Cash Items

Actual

1. Funds at beginning

$25,000

2. Single premiums

2,000

3. Annual premiums

1,700

4. Disbursements

(300)

5. Maturities

(1,000)

6. Interest credits

3,000

7. Funds at end of period $30,400

Projected

~25,000

o

1,500

(350)

(900)

2,900

$28, 150

Disbursement

Cashflow

Movement

~

a

2,000

200

50

( 100)

100

$2,250

Non-cash Items (excludes single premiums)

8.Newsales

9. Renewal sales

10. Adjustments

$1,000

2,000

500

11. Total movement

$5,750

-

------~

-------------------------

-

-------

----------

-

-----------

The inflow monitor will show what the forward commitment position ought to be (7,000) and hm'l it changed.

The

outflOl'l monitor will show how much the company should have

invested and disbursed (30,400) and how it changed.

It will

also show why the future disbursement cashflows have changed

since the beginning of the period.

These monitors, however,

do not show changes due to changes in disbursement assumptions.

To keep track of adjustments, in adjustment report can

be produced.

only.

This will show the adjustments for that month

It is displayed for 120 time periods to show the net

monthly change.

Adjustments are broken down into changes due

to adjustment in:

X period - total deposits expected

Benefits - total benefit payments made

Interest - change in interest rates

Expenses - How expenses paid

Y period - Holding period

Z period - Disbursement period

Calculation of Durations

DO =

~

vt

n

D1 = £.

t=O

D2

=

n= number of months remaining

in contract

At=Assets

At

t=O

tvt A

t

~

t=O

111 = D1 .;. DO

112 = D2 .;. DO

Zero, first, and second moments, Duration 1, and Duration

were calculated for assets and liabilities. They were also

calculated at the interest rate stated in the contract as well

as a common market rate for all contracts. The user determines this rate. They are displayed as follows:

2

Outflows

Credo Int.

DO

D1

D2

111

112

Market

Inflows

Crect. Int.

Market

- - -

--~~--

-----

-----~---

Program

Function

System translation

APL keyboard

Turnprinter

start printer on/off

Start

start printer

stop

stop printer

Printrep

Displays cashflo\\' for each sale

Duration

Prints durations, DO, D1, D2,

M1, M2, for each sale

Totals

Prints final totals for all sales

In monitor

Inflow report

Out monitor

Outflow report

Adjrep

Displays total adjustments

made to database and the net

change in position

Instructions

General instructions to

use system

Program

Core program to project cashflows and make adjustments

Projection

Projects cashflow for each

sale 10 years into the future

Totsp

Stores totals for single

Newsp

premium sales

Rensp

separately

X1

Determines remaining time

X2

X3

Y1

Y2

13

from projection date to end

of contract.

Sets x, y, z

to appropriate lengths.

---------~~-~----~~---

-------------- -----

Program

Function

Adj:.lstments

Allows changes to be

made in database

Y period

r1akes adjustments to

Z period

specific items.

Interest

Expenses

New sales

Add sales each month

Ne'tlbal

Updates fund balance each

J

month

Set proj

Set proj 1

Determines which fund balance

Set up of database

How records are stored

to use to start projection

Data

Contains numerical information

Names

Contains company names

FB matrix

Matrix of all sale fund

balances.

Size 100 x 50

Similar matrices for deposits, disbursements, interest, adjustments, single premium deposits

;;s TtnTh.:lS to:. TI Oll[ J J

:,i![I1T!"II;L':'TlCti Ihe.[,;

:,1';'$ ~ lit< Ii< ,j 1 2 3~;t1

j

I)

C'

~'H

OF'OiE lZ.

f\!'L

'i!Fapi I tITH[JJ

:.WHINTH '::I'HJfi;OS[~

:jiltS

'j

i>,' p((OHOEH:':tI,OH)' 1 'J:DPh[

1::4r:l ~J

!1",7

:m~i;,HHSLATI

:,fllIf!:ITEP all

liTOf: 0)

ilOP

,lim I ~ Tn OH

eN 3

1~6

~\'\i

cH

V> "-Q.c)..\..J-=-~..s.

C~<':::'h.--\ \ev...)

Qc.......~r....

~~>r

":::::"c_\~

'" fllhTH.

[1]

l...l

III

ttl

I~l

ILl

(71

tSl

[C;)

(1('1

[:11

~,~T1H1i~"~LNTIDh 1

TuihfilhTU 0"

0 .... 1';'i.

fl"fC'tOfH .. I' 'OO.J

ft~ ..t"S.afH"" 200.J

A SIT ~~il~ILISI

-\

"

liPlhrO[71··.·)j·U.. ·',.,C~···

liPlHf((71 a '2;·.j'Ut'·';(."",

I(r'flro,,]a']' '/'U.' "';C2'"

.,PJllfL;!.91a'1')/·Utn,"LlfO'"

II HMO[ 91-' 2' )/' I1H1" 'Pie UTA" •

[~,,1

.ttl"r"[~5]a·1')/·IA'·'ULLn"·

ttj)

lIJJhf2[:;Sl=·2"/'J);..··UI11U·"

[U)

M~.llf1f;"I4.~,"?)

C!.]

• 11:) ~( " 'ttC'.,IHfO(U)·

lit:

(1~1

iltl

(19)

(l,)

:t1)

(t~l

ldl

(<<I

l,';

l'l •• Ir.ruU;~,~)

I' rl,l~',··~~ .. *IHrOI;il'

lihfll •• flhfC(3't,51

II' 217.:. ,. '

.,J'I •., · ••• (11I7U<7 • • " "I,"'" CASHILOY PROJICTIOK",

IIJ"I./'atd,tl117U" " ,

IIJall1'.'d,Ulli6hn," "),"PPOJ1CTlOH rOI '·.(I'tl.IttTH),·'I",,,r'tIAI)'

d.",tl1l7£"lf"aJ11S(Ot\JiUl, , '.'T:lTAL SRUI ',(111"'0(60.,,])

.'.,(111""111>,' ', .. u.n,'

x-/-l" ,1111"'0(11,12)1, '-' ,(IPIK'C(j4,1~l>, '-' ,(I'I"'O(17,IB1I,'

IKTlJlST IATI. ',(O«IPI"'O(19',5)1'100»,' ,/,

,llt-ll,'/',tllhrO(l2,331),'

1)I.""SI5 ',(11),),'

UM PUelMT ASSUJ1'.1 ·.(I((.PIMr0[3bt,~1).100)'.'·/·'

l~~)

l\lJ~~hSa"')I'~~I~TIOH'

l .. :.l

"'a.,(1)1';'6t,

.ltQ,d:117bt·

[ ..... j

~ ':'

:.

:~~l

[

,,)

D:"l

[ jll

[jtl

[;:.)

bt

['>f)

2

3

4

5

6

7

8

,

39

~

41

4a

43

«

10

II

U

13

14

15

16

17

1B

U

20

21

22

23

24

25

26

un.

27

',('NO

2B

;1

~t~,tl117tt'

',(5 0 IHf[O',32)

•••. 1111 n, UtOSITS

",t", [lli7b" III ~.u'SIt1["tS . ,(I 0 '~ISi(0"l211

4t i. (1: 17f.t' 'Uh1l IIHl..:tlt" ',(' 0 InIOt,l2])

j t 2.11H7bt'

32

33

~

~

~

n

~

dti,UBif."

i~

Dt'

dt.i.[1117U'

~l

~ta..[ll17~'L~

6)

,j'd.(1117f.t(~

n

o

I"ICTIVI

45

46

47

4B

4'

~

~

12

53

M

~

~

"

~

59

W

61

~

63

---------------------------------------------------.-.--------------------------------------------------------------------------------------------------------'~lf[32.\lSl)

0

v ,lIISiJ32.nl51)

!ltl1,[:)~71'(~:O InD2.\3~1)

:)

t·.i,{I~l7tt'

4~j)

.. tll,llh7t>t'

.7

1.'1 ll'4:. ll,)

:4.'] Qfj,{1J17tt'

;.

dtj.[1;17tt·.~

[i

jt ..

~4

QfJ,[lJ1-t.t\~

[H)

I'~)

,jt.i,11J17t,t'

.".1:):;,,·

(it)

lt~,[!l1i~t'

08

69

70

71

72

73

74

75

76

77

7B

79

BO

BI

B2

B3

B4

85

86

B7

~O

91

'2

9J

'4

91

96

97

'B

"

100

--------------------------------------------------------------------------------------------------------------------------------------------------------------U H[Ht7.d51)

[!~.:t,t\~ j

V

II'lSili7tdS)J

Hli[b7t\3~,))

!'J'

j{~

1(6

lv7

lOB

10'

110

111

112

113

114

115

II.

117

liB

II"

(47]

l4:l)

------------------------------------------------------------------------------,

,Jtllo,[l)1-d'!o~' HU[lC'f t llto)

Jt.i,U~17lt'';. V 111~.B{1"ttl1i])

i .. :..~

~&~

r",..,;.,C {,

"r":I"l~I,'~l'

'P..--\",~

~l'lJj

~11

I~l

L)

I.J

:~l

loJ

17J

lil

1,1

dUr<..o..;'\\.<:'r......

~\c:j...,<

,~

~<:J...-"""""\--....

~."-\'<-

.

.. t1ul·[Dl

o "u ...·Tl~lI'i

Qtli,il117tt'

... ,l11176t'lIukHTlOHl

O\JTrL3US'.115,' ',,'ltirLOWS'

"'i,l1H7ot'I.',lld1lTINT11OO)',"'·

UU, INT.

MARUT

UU. INT,

~aUT'

.... 11117 .. "",<~.' ",<9 l HITOIJ1.,<9 l 'MDlTOIJ1',(~" ",<9 l '~UTOIJ1',' ',192 oAMUTOIJI'

dtd,l1117ot'Dl',"f' ,),,9 1 UUHJ1).(~ 1 IHUTHJH,(iP' '),182 IADITHJ1),' ',(82 IAHUTHJ1J

~•• ,111l7"·U·,17" ",<10 I HIT2lJII,<lO I U1J)1UI JII , 15,' '),(9 I '.DtTllJI),' ',<92 'AMUU[JI'

.... ,111l7bt'DllloO',(7,' ",<72 nU •• TlJII,ll,' '),<7 2 'MDUI~TlJI),17.' '),172 oAMDUIATlJI),'

',<72 ,AMDUiATCJII

1II•• ,(l1I7.t'~21I1O',(7,' '),17 2 nUI.TUJI),'

',17 2 'M~UIATUJI),(7.' ",(72 ,ADUIATUJI., ,

',<72 oAMDUIATUJII

•

(lvl v

lITO

~~~"-,~~~~~~-~

JI""""'r-..-\'.)

v

~.ST[~TIHhSL"TIUH

[ ~)

7uliltU I",n

Of lilt S:t-

[ .1

t 5,)

c,-'<

1..2 ''-L'\.

\'>(\21\\2. '-\ \()Y'-

0'

TGT ... E

[11

1 j:

-"\c::;"'\-C:..,,--' ;:;

I ... 1

n

1

Ott

t'

t+f,I1l1ii,.,

t.t,(lH-:-tt'

[U

[:I

t.t.{ljl"'t"

[>l

t.t,lll1:tt'

f •• ,[ 1117t.,

[;I

';;1

l<

l:d t.t,[1117b"

TOTALS"

a

o

3

• ,

6

1

8

,

10

II

u

13

I.

u

16

17

18

u

20

------_.. ----------------------------------------------------._---------------------------------------------------------------------------------

~111

t •• ,i.ll17t."H'O~lTS

1:2)

[ 1 j}

t •• ,lljliil"DISiulS1HlhTS

•••• (1.l

[1.1

[1;)

t't,[!111,,'TOTHL 10TlillT ',110 ITOTIHT[0',231)

''', [1117." I"now HJU;r, ',( 1 0 '1.~JUSnO"231)

no' ' fL'hUwLHh(1

',(70 ITOTDIP(Oh23))

',(7!;) ITOTDIS8[Ol,,2]])

, ,<7 0 .TorUtol ,,23])

1:t.)

.+.,{lH70'·lJurLOW"ltJUST. ',(70 IOAIIJUSnClh23])

.tr.II117t."

21

{ltl •• t,llll7."

2.

a6

a8

.7

ft.'

:1-)

a3

C1;}

-,

n

30

31

32

33

3t

3'

36

31

38

3'

.0

tI

u

t3

u

.,

"

-------------------------------------------------------------------------------------------------------------------------------------------------------------

•••• {Sl17{"

-----------'

~~':,)

•••• (111";,,,7 <> ,TJTUPl23t\.25H

•••• (lJ17b'(1 C 110T&ISeCl3+,25])

[tLJ •••• 1111it.h7 0 .TOTrH2;'+\251J

{d) •••• [1H7t'" 0 'TOTlHn23+,2~])

~2 .. } .t,.[111';itl7 0 11Hl!JUSf[23t~2~1)

(~~)

l'.t.ll117it17 0 IOHlIJUSU23f\251)

IE: "r,[;1171':.'·

5{

~, .. ]

t.,.(1)l7t"

51

.~

:- 2.

7:.

:L;'; •• t,111l7t..·

12!1

,.t,~l:~:'lt\;"

r.t.t~:H7th"

.tt,(1117~'\7

.+,,[ll17L',7 (I ITOTI"~[4at~2:1)

t'tf.ilJl7t'(? (I IIAL-JUI)TLtet\,51l

tt.,[Ll':'i.t'7 () H""JUST[2;.,25])

,."l1,,1'd'

.tr,[U1:t,.t·

15

16

7t

:)

t1

~)

i.J

1t.

l'+f,l1B-e"

L;t.-]

[::-:'1

[t: 1

[<11

.·,,[:l1';d\~

..:' .TuiHf(';'?Q':5)

f'tt.I~J17t":

~. .T~T:I£h:13·\~5))

.

loU)

rt:J

[ttl

5.

55

,.

57

58

5'

60

61

62

63

6.

65

66

67

68

6~

10

11

71

1a

7!

80

81

82

8J

8.

85

86

87

8a

8'

,g

'I

,.

'2

'3

~.

!5

Ivl

1':)2

H.'3

lOt

105

106

101

106

10!

110

III

112

113

II.

115

116

117

118

~i

[::7)

~ ;. ~

[ tel

53

ITOTtlHt6tdSl,

( t!T~nlSHtSt\,,51l

G eTOrrS[4&+,2:1)

~;

,)

11

~]

52

..... I!H-d."! v ITLTH~ 7~~\2~1:

•• r.lll_:>;'I: ( CTCT;h;{';ltl"Sl :

,..,.[1:17:"" v Il .. lJ1.51l"3·'.'~JI

t' .... [~;l-t.t

tt. [ l l l ' t ! '

f'f.i:;~-t.'

.tt.{lJ~-:'t.·

1 (, 1~"lJJ~n73·'t'51J

;,

3,

I(,i!

1U'

------------------------------------------------------------------------------------------------------------------------------------------.---------• "I - "'.

J't· ;, ... , :"

I

--........

...- ,- ,...... .,...,..

....

~

~

~

-~

~

~~

~

~~=t:=

~~ ..so '11

~"

~.........

00

~

0

J

::1

5

r-5

~

-• .-- •

.

•

.-•

~~

...

~

~~

.::...:::.

.~

'")

-X -X

0

•

r~

;: ;.

,.

~

~~

\.

,.

<,

r-

~~

;:: ;::

• .; .;

i •• • t

· ........

........... '"

•..

,r.

"J

....-

_

~

"•

~

£

~

t

•

J

~

.. , ", •

'". '"

-

"r

• "'

• :;;

f""

~

w

~

~

::

~

w

.

;::;

~

"

w

r

7

;::

~

w

w

...

~

~

~

~

W

W

A

Q

Q

GO

"

~

,

;;

;;

;;

;0

'"

'"

'"

'"

~

...'"

::

~

~

~

;::

;;:

w

...

Q

...'"•

i:

~

~

'"

•

W

'"

~

~

•

•

~

'"

..

W

;;:

,

Q

X

...

'"

'"'"r

.

•

~

W

~

'"

'".

'"

~

~

W

-• '.

-...

~

~

'"

Q

0

..."

W

...

W

~

..'"

0

'"

...;;;

a

...;;;

,~

"3

-

'"w

~

.. -"

..."

w

~

~

..• • w

z

w

'"

"'

J

~

:

w

"

"

~

w

~

~

;:i

w w

~

•

...r ...

W

~

~

~

~

A

~

-...

...wz "

w

~

w

.

~

~

~

-"'

"......, .: '"

~

~

'"

w

"

f!

~

M

-

~

~

~

;;;

'"w

'"...

~

•

~

w

~

~

;:

'"

....~

V

0>

':

w

..."'

-

W

r

~

~

a

---

f-

N

"- ". '" • ~

., •

. ~ . ;::. . '"

"....

, ,. • ." ,.• ,." ,.• f.; , ...w .." ...w ,. ;;:7i ,. ,. ;:. ,. w

• ,",

-- -. .• ;:;

e."." ,.o .. .. :;.. :; .. ,.; " - ; .... ~ .,.• .. ...:

'

."". ...,, ~

- .

• " r u •

- .. ~ ~ -• '" ! ~ • j:.. " ;- .. ., - .. •

," ," :; ,.;

.;

u

~

;:

· .• - - .. .• .• .•

- . -.

- f-

'1 ,.)

,~

0

f-

~

~

~

~

~

,~

f-

.

-.. ..-; -"'.-..• - ..-..'.' .. .. .... ..

-~

"

'"

;:::

~

'

~

~

~

f-

~

~

.,

-..

~

"'

," .,

•

~

~

f-

.. ,,' .. ..

,~

'.

?

('uJI"I.!HITO.

[ II

Sa~l1t"'U"USU.TIOH

ttl

lu'Of1lNT1I 0"

( i)

( .1

OP\iIt 17,

,. 4 In , •.

,. •• !l1I7"·

,. •• IIII7U·

.... !l1I7U·

( :1

101

111

III

191

at"i.[1l1;~t'

~g.ttH7bt'

[ III

( 121

( III

lUI

(151

,. •• 11117'"

,..;.(lH7£"

,..g.(1117.:t'

I.

2.

3.

t.

5.

6.

)t,. gt St, I .9tii) 1) t( 1;( 101 , . , t , B) 1) t(

,"I ••t 1l; (.,.,8) 1 )tUg( III (.9tl8)])

"'1

(,al

TOT... L"J.-a

.... (1111 ... •

(191

•TlluUIMlll orr

2,;')

( 211

•• U'IIIKlKI. '1' .I"YIAII

7.

tI'

or

".18 0 1I0rn((TIHI'\)II.IS,' '1

'.(8 0 ,5'[ITIHI.2111

',11 OIl(70rDlf[ITIHI'21IHSf[ITI"I'211)))

I •• (8 0 ,,(fOrDl SI[ (T1 "1'21 1)-( 70THAn I TI HI' ZI I)) I •• 1 '

1'.<80 ITOTHAn(TI"I'2)1).·)'

'.180 ITOTIHn(TI"I'2)]1

-----11 1(,,+,,8_1) t( IV[ HI (.,+ ,,8)))

fUNDS AT 11'1""1"'

SIH.LI 'JI"IUtIS

A"KUAL .JI"IUNS

IISICISIHHITS

HAruJITllS

IKIIIIST CJIIITS

i*~.[1117t.t'

~ It.]

'11(01

I

".<8 °'70TALI

rUKts AT INI or '1i1OD

g.g.[lH~U·

( 221

( 2;)

l,t)

[ 251

( £6)

,.,.!l117"·

r ,7)

[ ~81

( 29)

nOI

tlll

OUtfLOW 1II"I70J rOJ

CASK ITltIS"

-----------.

~1I.t!1l7tt·

,. •• llIl7it·

( hI

~

1

•

~~.l1l1at·

MOM-CASK ITltlS. IIXCLUDIS SI"'LI 'JI"IU"51'

.... (Ill? .. •

g"51.tl117it'

i·IIJI1117o,'

.... 11117•• '

,. •• [1117 .. '

,. •• (1117 •• '

r,.rl111U·

---------------,

e.

9.

10.

HIW SALIS

JIHI'~L SALIS

ADJU5TH1HTS

II.

TOTAL IIIVIHI"T

",<8 0 '( .I"DIP))

'.180 "'/IDlP))

'.(8 0 '('/IAIJU5TII

------,

... ].oJ''''

(ll

l'

f .. lhTS III •• !UoUOwtl or ... .suSlHENTa MAL .. TO

•

Ii)

ST,:,.iT

: il

... l 11. "

tt)

lrtl.,l1117i1ot'

"t).,£1 117ct, ,

t!ll

(0.1

111

1;1

1il

11<']

11'1

11.1

[,ll

[UI

(151

U 31

1

«

.~~

IHrL6WS AliP OUTFLOw.

.

AIIJUSTHlhT IUr.lIlClWH rOI

',(t1'110HTtU.'/'.UpnHU

'''',,(1117 •• ·•

"".(1117,,·UI. AUlIST"'HT5 All CHAH'" IH X nuOt Ahb/OllXUtTlb ~HTHL~ DlPOSIT5.'

',.h. (1111 .. · "". Mn MUlIST","TS tIIlDl TO THI liH1I1T PIiClIIT ASSUIII'TIOH.'

L".[,I,7"'loT. oil .DJUSTKlHT5 tIIlDI TO IHTII15T '.TI. ,,,ol •• Tllt,'

"",,[,1l7,,·bl. AU ADJUST",oT5 tIIlDi TO THIIAUH;IIILLIII'.'

..... 111'7.'·'111 •• 11 .bJlI;~lhTS HaDI TO CHo"_1 THI HOLtlh' filIOD.'

...... [1117U·ZUI. loll obJUSTtllHTS ""DI TO DISIUISI.I.T flIIOD.·

1" •• 11117."

...... [1117.,·

.... 11117 .. ·

0

1

a 3 f 5 •

7

8

9 10 11

U

13

(1'J

ll'

at"'.(l1l7.t·

ll7]

l,.t,.tl1l7.t'''U.

11.1

"'.• 11117"·Uh.

U

15

16

17

18

19

ao

at

ill

a3

2.

25

2f

27

28

29

3

-----_ . _-_ .. '

"'T.

ll'i)

",t",llln,.'

[20]

"tA.[lH~.t'I)(f.

[l'l

"' •• 11117.,','11.

[«I

...... [,I17.'·ZPU.

12,'j]

,..".(ll17U'

'.

"".1,117.,'

['tl

~~

."

D.

33

• ,I 5 0 IIADJUST[O .. 331J

'.(501.IHADJ[O •• l31.

• ,15 0 IIHTAU(O .. UlI

·.I50Il.'ADJIO •• 331.

'.I50ItADJuSTIO•• 331.

·.150IZitbJUSnO.. 3311

:It

3'

3'

37

3i1

39

to

u

42

43

..

f'

t'

f7

fa

n

50

51

52

53

5f

55

"

57

58

59

iO

.1 .a

£3

Of

1,51

•••• 11117.t···········································•••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••~ ••••••••••••••••••••••••••••••••••••••••••••••••••••

1l,1

"71

(.81

..... ,I1I170tl' 0 IIADJUSnU •• :lt1l

"",.!l1I7o.tl50 IUHMUI31.. :ltI.

.... (1117i." 0 II.TAtJ(33 •• ~fl.

...... 1111"tl5 0 IlxPADJ[33 .. 3f1l

..... lIlla .. 5 0 IIRUUSnU •• 3fll

..... 11117.t<5 0 Iu.UUSn33 .. 3tll

...... 11l1nt'

' ..... 11117'"

'7

••

"

70

-- .... _- .. -.

(,,9)

(>01

[311

(l,,]

l),1

,j

t~.)

'

~t~,,(1117i.·

(;;'~l

,..'"L1117t.h5 (, iIMDJUSTtoot,,3t)

'h••• (lU1£h5" 181KMDJ[~'t,,3'))

loth,llh7ttt~" 'WT"DJ(b't~3.1)

[:);1

'4:0]

[tl)

[t,1

(tj]

(t.l

r .. !ll

72

73

7t

75

7.

77

78

79

110

81

sa

83

at

8'

86

87

88

81

90

91

92

93

,.

95

9£

97

~8

.. ----...... - .. - .. --.. -------.. -------------.... - .. - .. - .. ---.................. ---.. ----.. ---... ------... ---...................... - ... ----.. --------.---.--.----... --.-- .. --- ... ---.. -----.. - .. ---.............. .

tiro)

!:s71

[:St.]

71

H/\,'

".".ll117c.h5" II>':PkIlJ{6';t,,34),

tttt.,01171i.t{5" 1(i4bJtJSTt"i\34))

Ltt.1l117U,5 0 IZMDJIJSn6' ... J.U

~.t.(1)17~t· •

..... [11l~"· lul 102 10J 1(,t

10. 107 108 109 110 111 112 113 lU IU 116 117 118 119'

h.h.tl111Dt· .... • .. -- .. -- .. - ...... • ...... • .. • .. --.... • .. ---.... ---.. ---- .. --- .. ----....... ---- .............. --........ --.. ---.... -------....... --... '

htt.ll117tt(5 U Il"~JUST(lOVt\l~l)

~"'.. (1117c.h5 \J .UII"~J[lW ... 19])

,,,5

r ...

4: hll,,(1l17;t'5 ) .JtI:~:'J[E·O',l:»

41 j,.h,(1117.t;5 0

I:

~I

t,.h,[1l!i~1l5

t,

I:

I,

H'F.::I~JC1C'O'~Bl·'

h'h,C1l176~(5 I) .,~~JUSTC1':")'d9J)

STOP

0

~Z~PJU';TC1C":"\Bl)

.'

' ••••••••••••••••••••••••••••• + ••••••••••••••••••••••• + ••••• ~ •••••••• + •.

''..

'.

~:'

:I

{,I

I"~

,:

"t

rLOU

c~s~

r~CJECTIl~

.'

~'

AUr.JS T, 1 B4

,~£tIUHL

I Ii; fileT! 0:15

~'

'.

•

'.

Blr~iE

'.

:1

'.

:11

'..

:\1

:i1

'.

'.

~lJ

'.

m

:11

STHiTIH' THE SISTI:t

rln

rOLLOI.IIl~:

•

A:L

'.

~~5WIRS ~U;T

I

BE IN

'.

'.

'.

i)

:)

il

\I

)

')

;IAMZS . Oin [

2~·1~

rO!M or ( OR N OT~IRWIS[

"

),

'.

A~L

:·.-iT!S Ht.:ST Bi It;TIF.ID IH IiUf'SIR rORM.

I,

:~tlt,

Z PUIOD

~JS7B!

£tiTHED 1:1

FU:ItHAGIS HU';Y BE Wit.If. Itl

COr1F"tff

tlH~IS

MUST BE LESS THAt!

~5

I

~tCE~SID,"

~ LE!I~TH

2,000.001 = 20(0)

ti.!.

~LL

.~

?

TO 5E

.'

i~O

T~E

TII~

Ei:·C' Ul!.L O:CUR.

'.

, IJ '.

) "

r:LES HL5T 3I

or;;I

,·t·~T~"

•

I)

I:

T~I

;tOlIT~S

DIC:I~AL

tlor

IE':'RS.

rOrt.

':HANC7£FS LON'.,

.'.'.'

.'

~'

.'.'

.'.'.'

..'.'

'

.'.'

.'.'

•••••••••••••• *.*.**.* •••• ** ••••••••• + •• *•••• *•••••• * ••• * •••••••••••• '

./VV.J..\..~

<-\.c..\ ~\").:;'1 V'<' 'l. ~ S

'II~",,,'I(OJ

'Ill'" .. II

' ..................... _ .. _ . . . . . . . . . . . . . . . . . . . . . . . . _ _ .. _ _ _ _ . . . . . . . . _ _ _ .. _ _ _ _ _ _ _ . . . . . . _ _ _ _ _ _ .. _ _ _ _ _ _ _ .... I

CA~HfLO~ f~OJICTIO~ I~STPUCTIOUS:

ALL ):. \, Z tIJl Ol'~ IIUST BE ENTIUI'

'I

'I

IN MOIlTHS tWT

1

V.. Ln RlSrOUSIS TO QUIS TI ONS I

'I

FOP NO

ALL DATIS MJST BE lIlTH£!- ttl NUttSIR F(lUI.

ALL PUCIIlTS Ml'ST U EtlTEf.U III DICItIHL FOUl.

ALL ~ALAtl':ES MUST BE WTERED IN THOUSAtIDS.

I!AIIIS MUST BI LESS THAt! 2S CHARACTEP.S,

"

\ rop

YIA~f"

I'

I'

\'[$

U

'I

'I

'I

'I

1 ..... - -

__

........

__

.....

__

.........

_______

...

_________________

..

__

......

I'

I'

I'

I'

I'

I'

I'

__

.......

_________

'

'JIlTER CURHIIT HOIlTH:' 0 CHOtITH.O

,'!IITIF. CUF.RItlT YEAR:' 0 CYIAhO

'HA\I[ THI FUIlD BALAUCES BtIN IUTEEID rOf, THI S DATI?' 0 EUTAtlSfO

i'WHHT HOIITH DO YOU IoIAIIT TO HOJECT CASHFLOIolS nOll?' 0 PHOtnH.O

i'I~AT YEAF. 1'0 \'OU IoIAUT Til PROJECT CASHfLOWE nOli?' 0 PYEAhO

i'IO lOll IoIAIlT TO AH HlloI HOtlTHLY rUtiD BALAUCES?' e HrBAUSfO

IHHAIlS=' Y' ) /' t;r~'SAL'

'11£ THIFE IlW SALIS TO ADD?' 0 IISAIlS.D

IIISAIIS= ')" )/' IlIWS~LlS'

'm TH[FE AL'JUSTHWTS TO BI HA»I?' 0 ADJAIISHI

IIA~JAUS= ' Y' ) /' AL'JUSTH£UTS'

~s.o

1(( PrIHR )CYEAP.) vi I PYEA~=CYEAR) AI PI10tlTH1CHOIlTH) ) )AI ItlTAUS=' Y' ) )/' SETfP.OJ'

((( PrEAF >C YEAR )Vl I PYEAR=CYEAR)"'I Pt10UTH1Cll0UTH» )AI ENTAIIS-' U' » /' SITPROJ1 '

tlOJECTl Oil

liMO/UTOi

TI1OIlITOR

oP;OJEOiOlltJl

'. PiOHerl jll

, IInTl~LlZ~TIOfl or ~';'I.lHlI>:

rnHHTOUISetT,nntrC n',H.12';'~0

:N;H,OfO) rC;ltITtE'kJ

Sf.12'~.O ~ A';CUMI.!LHTI SI'I.lE HIMIU~~;.

lil'IPHDISBHlret12(p(\ ~ ~';':UI~Ul~TI tiEW SHl!S.

itEPtfDI5Bt~fEt120,0 " ~(C~MJlATI iENE~HL S~LES.

~JH?CLtlC0p0 ,. TO SCI,; tl POLl:~ IiU~BU.

m';,tMDR70t~I,n)tHt'Dn:tl,j,jpO ~ VI:T,jR or DUFATIOH ••

•

'.

DlT! +tl)iiTitHH;lt;'~H T1tlN'.O

Di:it"DRT2tADfT2t~~~iTitlCOpO

,

:,ur,)tM;'UF.:'t DUH Hl~Wi1 t : 1;1 2tt1!'U',2t,U'UPOt;'tlD~P( tHD JU tA:1DWH to

;DUP. •• AH~L'Rl.tO

il"NS~l'j);'

'PO

teU ,J':;;!T 70 ':ALUl"iI D"'.HTlOH~'"

!1~~S~10);'DURAn~tC'

l\',~N;~IC'''''<i'W'AnS:''I',')!'''WH~T

ii, (CUt.~:iS= I 'f' J ,•. ( AfIS~1(') \ ..

!("n';~l'J)i"

I

!IITIP.lST iAn DO tOU ',"HIT TO US[-'"

:1~:"!'IrtT"C

I

'DO ~(U "H',T TO HlilT THE :"SH HOl'

rop

Efj':H RICORD''''

:1 i\i1tf5.!.'j)/' fR~aS"O'

! flU; HAt· fRO!1 't'~T,' ;'!,D 'HA:-<ES'.

:1 SIZEtGrSI ZE lC'O ~ 51:r cr !'iH~P~SE.

JH ~':O:iU!IT!R "JR F!C'jR:S,

sl ~tI5=1':;)j' J+S')l

;OCP:i\ Jl( SIZ[[ 2l:' )/' .(,'

,itlNI7IALIZI 'JAR!APLIS fe.

DlPt iB"1 tlTtl"!AT" t'l SB"120~')

E~(H U~CRD.

FLA';""

DUpet DUR1" I,IjP.2 .. HDUROt hI", F. ~ t HL'U' Z"'j

~IURC.A~DU&O"~Deil"AMD~?lt~D~R2"AMDU'2"O

171ro.. orHAD 1')0, J " FE;,r Ii£!.: RI';CH

,um 0:'( J Hi I Niu( Ot '. 5l

~1(P,I~R-(ilNrOt32,~3:;jI12).\Pt~NTH-(iIHrDti6,27l)

TlMEH(flEAR-';3H12)-,ltl0H7H-7)

t(T,vJ!' ,JtJ+l'

II T:O'/ HOG?'

fCl:1HitFErl~nll(l v· LCO'; 11

i

Fcrla';MHMitTRIX[\O+\I)O);1

Tli~I·i}l

I.SOiTPOL(J::P[LH~T(Jl,/·fi(llt'l".5AL:Jl'

XttltlfJtl1,12l ~iti!NfetH,15l ¢ Zt2ltifCC17,18l oj

l~ i=:2)/' f+1"O

1

ad !-.()(C')I • );1

liFLAG:1)1' .(0:1:1'

1«(I-X"»)/' X2'

1(jLH'~:1}i '.~anM'

1\;, T·:O ;.,)./' ),3'

i'II',T-{)O)i':I'

.( 1L;'~=1.' /. "(C.iN'

ll,T-'i,:.); 't2'

I I(fL.i'~:i)/' .CO. IN'

I"

II

1(T.'j) :~)}/'

I ,"

I"

i';'

....\\,.\.,'f\.~

FC'''')'' -; \~ \t\,.~

I

:l1t ..,·Y·Z

r'UlrU(~ ~

'~"'"

~ l~\

T-Z· ... O'/'Z.. Z'

:! ;.(.).' .;:+ T'

t nes I TS:

1l

( T,:t:;;\l ~

!

, '{t , • .'.-

.

~.;' ~~ 1~"" F;1CrlTH=( i I II rOt Le. 271 ) )": P I [~S =1 t ! IIrot ,2. 33 ~ ) I ) / ' ;0(+0'

~

1.1

»~UP:i(

;.'I'!,·HH;J+{HllrOC~2+\41)·

Ii

j ItI'l

~ II

I ~ : - 1 ' ) /' .. :.up ,

.~! [1;Ev~S

'jl [ ..n'.:!S

£lL~n.

11(( I :1 ;I~C ? 1~ • 1 . ) ,(

W;HITS Life:

!Hr cC35; JII • 1 • I );' , "DO .

:·1

[,011: rI[ 1'11+\!BC I1-HH 1+1])+( DC 11+ »Ef[ 1'(1) (\ (~I :IrOL 19h 51) +1.)

1m 1+ 1J +\ FE[ l+ 1J ore, Il ) " DI 3B[1'1 j - HH I'll.

1'1-1

I\Ui "~L20!1'

", t'!J:'Cfo :"_::i "iUi~"')

+;u:

:~!...

1JI,.,

I

~':S.l~! HI.·~

LISS THi.tl 2'»0 £,·.F£!!S[ r.KER IS

.O.)OZ~

ItSI FACTOR IS

.co·n.

?]s' l' )vl.IHrC(~5:~'2' .1.1/'''~3'

:H

, UCfZ: it fBI I H"CJO Ii . t, I S~t I +lHO. lSf ( 3. aI -4' FBC 11 ) .

ItlBC 1J :':00';)/' DISH I +l1h 3. BE -4) 2veO) +\ rec 11-,,':00)' 3[ -4'

r![I+l]+!r3CI:+~[PCI+I]-DISECI+1J)+(rBCI1+D!PLI+1J-EISEtI+1J)I(ltINfO[13+\5JI+12)

IHTL l'll+'. FE[ l+l;-F3[ IJ )+\ Dl ;B[ 1'1J-UP: 1+1:)

IH·I

II Ln.' HOCF:!'

-+,U;1

!

E-,r£rt;ts

~lLLED.

EnlE!'l TS

HOi~TA:

.; Illre[ 3: ... 2' ) '\ I !Ircc :: 5]" • 1 • ) ),. ... H •

, 3: .'! SEI 1+ l1H ': it IIroc 3~+ \ 5] )+12) ~ BC 11

18[1 '1: +\ r:c 1: • I Ii CI .lJ - rI SEt 1+ 1: )+ ( i H : 1 +n Fe 1,11- ~ I ; DC I • 1 J ." ( : 11 Ni CC 13. \ ~ J ) ~ 1, )

tan 1,11 h r Bt I'll- fEe : 1 ) +\ t, I SEt 1'll-LEFt I·t: i

I,

£ItlErITS

I

I

P~QP~T~:

:ii iEt t h20':,vl/' DI SEt 1 +11+1 • ~ Sf ( • ')'),)3£, FBI III •• FBI Il ,( 111 lifO, 36, \ SJ) +1,) ,rBI! 1 :-:~00)/'~! S3[ 1 +1 , .. , . :-(C'3~; :(-(0)+( ': fEr Il-"X'i)" 'X:3)' HC 11 ,( : illlrO[ ~f', 5l )+12) •

m l+ 13 +', i,[ : J d' 1Ft I + U - r I ',Be : +11 ) .. fEI I]' Hit I • 1 J -" I SEC I'll ) « ': i lilT ~I 13- \ 5l )+12)

1~17:1+1:h F~r t'I:l-HC Il-"\ I'I',HI'll-HHI'll,

IH'I

l'I~:1

!~IJ:·

;

'~LC:H'

r"1

:f['II,;.}(~?J

Z:t: '

:,~

):+.1 t'FO[ 17,! ~J

\ Qt.\.i+l

! l(n·V',' DISS:Q+llHBtQJ'

I\O;::V)/''':lJt'~'

:

! t\ZT,F[: I'J/'ZI+l'ZH2J'

t ~IS3[(;JH:~T[QJHP;Q-Il+::1

!

FEtOl.\ HtQ-l1-tlS3tQl) ,( 1'( «tl:IFOt 13'\~] )-'),01 HI2))

l~af~:~I~O~~T~.)/'''LOatB'

~ (OJtiTH

i ')+Q'1

j :1':1-1

; HSHJJH1ATt ll.FEtQ-1)+ZI

: II ZI ;. t li ' Ht Cl H n: Ci-iJ -~ I Ht 01 ) ~ i !. « ( i lilT J[j 91 ~ 51) -, (11 ; +1 ~) " '

; H:l:l) .. 'f£tC.J.')'

:: i(:1 =1. ," -t::I!')'

: L;Or£:(OjIlT.CCLH7·1

:;+Q.l

, mQJ+r~[Q-ll"I",<',iItlfOtU'\~J '-':', :'IH:2;)

: ii :C~;1T;4Ji'''L~jPB'

; tiZl:J'.;·-tteOFA'

L!70 Iii, :1'1 i.' ' :'1 SF( C' 1]+ rot Q-iJ'')'

:; ttCt+ i

] i( QU ~ ~u "'1 ILl 2':';1 '/ ' .. S I 7':'

I

~f

;;j)1H: 2\

~I~S=~C·).

'''0

I

it~, ~~1·'LtH·I.":,="I')

• ... 1 ...

I . . 1'''S:~·tl'

•

., 1'1

(O:lT:l~

I )(t~+2.) )/'''CGtlTl'

WRO'DUiO-DISEtl+11'(I+(I'«11~fOtI9'\5]1+12»))*t!'I)

.DU.iJ+ ADU .0. U PC 1+ i 1. ( i +( 1 +( i t I tlf OC 19. \ 5] )+ 12 i ) ) *( I '1)'

,

HH1'Uf,0+~t~DCF.C+:, EH I' U' i 1+( ! +( m,T! tf~+12) ) ) .', P 1)

1~U.OH~IUFO' D:

I +1»(1+( 1 +(:'U1.11 IITH2) »~( 1+1)

ose

~UP.l HUH' !'1 SS[

i • U ~ 1 '( 1+ ( l' « i (;frot : 3+ \ ~] It 1 Z) ) ) .( 1+1 )

1 ~!UF1Ht'LF1 +arc I +1] >!>( it( 1", (il'Ucr 1'3+ \5J )+12):' )*, : +1)

<, ,~HI'UH+;.rDURt'1 u::. 1] ,< 1'\ 1+: l' (J:K1'1 :IT+12) l'*( 1+1)

D: Sf: 1 -1] , I ,( 1+ ( 1+ ( MK Tl tiT H <:) ) ) ,,~ IT 1)

fl?;, +! j F;" DIS E{ I'll • ( I ~.2) x '< ! ;( 1+ " ( t itirOCi ? ~ 5] )+! 2) ) i.( 1+ 1)

,!'UR:+~r un- [oIpc I +1] x( 1*2)' (1;( 1 +( \ tItlfCt 19T\ 51 )+1Z<') ).', 1-1)

~MI"Ji1+;'Hl'UP2· [If( i -I ~"; I ~ 2» ( 1 t( 1- ((lY.TI:rTf! 2 l ) ) *( 1+1)

:1~U32tlli:UF~' D: SEc!'1] x; 1.. 2) xi 1 t( 1+(lIKTI tIT;1Z») )*( I +Ii

1'1 -1

!( Iii :1 ••

.,:OtlT'

(Ctli1:HTNJ:HUP.O >, :lDH0CJ)+I:Dl'F.O ,: HrRT('{~]+A:'UIi') c' ;'1~ai:[JJ+;';!L"~?'1)

m:t Jl+toL:U ~ MjHH JHM['~H ? iljR7H JJ.,lC'LRl ,~ HI'!:RTi ~ J] h:1[':B

mZlJl+I'a2, 11HTlC.JJ.IIIUIi2 .' iiiiT2U:.kDIJR2 ~,

•

, !IJFIT+;,T1+HTO to t'UP.HT1tLRi2~HT')

Hi UI;'T'Aa 71 +AHTO 0 H1'l!?HT1+~[ H2HIDH')

,<DL~! '1'1'~11-

»"

IiDUfH7.tlH'1H~HT) I) ~:t·U~~T1+tJDU~;il['iT(

~Il: 'J; ~;+ HtIHTHliH:'ijo) :

~':II".'P ~T1'"MH;: i .. :1H70

H'OS!T5, "I.E'"R;Et:E:lTS.,'ATl.i: TIE;:

.'lit'I:E'T! £?+T'j,t-IP'HP ,) TOTD1SE+l0n:3t+DI;S

J,

,,';':J;!LL~:E

4

I: ;Hrs+ 707fB' rs ) T07M .. T+ n'Tll"T.ll~T

I: TCT"LlTuTIII:-+T~TI"T'I"T

II I. Fa_IIS"J' I, 'fJlIITREP'

I: iIJ=\SIZtr.l-l»,'TCTALS'

t 'II"F0C55l·'I')!'.SU3'

II ~ ;,CUI'ULHE FI'lIiJilL ~EPOSI n,

II 1'.\ I:&FO[55l~'I' ',., ltlrO[55l~'2' »,"·;lI}'

II HH+HIP·~[F

r

1~I;B+i~ISB'DlS~

II m· E18. F3

i: !IExL).':'1

~ 'SIIlGLE

,I' AC':UHIJLATE ~I~' ~[FnITS,

II ;~B:tIHP'NHi'IIf

C N~15B+N~15B'DlSB

,: Ilfe.HB' FB

il JtJ'l

,I ~ ACCUMULAil SI:t';U HEllI JMS,

,I SIII';L£ :2« IIIfOr j ] &' 2' )v( LUG[ 7J =3» /' ';f'+SP' Hi'

,I

.LCO?

q

x, i

."1

'.+I.-T

t'

I

!

!t~

FLAC.!

?

~ X2

j X.O

i 1'f-/)

j FLAG.!

?

.,-

"

'J')

I Tt T- ~

~

HO

~

o 11

Itl-T

Tt;)

rLA';H

.., ~ 12

It·)

TtO

,

, fLACt!

• 13

, HT-~

:.{~

; I

I

Z.

,

~DJUSTIIWTS

i LOOP: '£!ITER PCLlCY rlUMHR OF iE"OH TO BI ADJU3TU:' v POLIO

1 '[tITER

,

I

j

'

!

l'

I

~'

f

t '

TIPE OF ADJU:iTN[II;IOU UI~H TO tIMKEI'

1- POLICY MUHBI~'

2- CONPA!lY MilHE'

3- POLICY TlPE, I. E..... eH'

~- X PIRIOD'

S- l PIRIOD'

6- Z rIPIOD'

7- I~TI~IST RilTE CREDITED'

8- [FFICTIVE D~TI'

9- PA~~\[tIT or nPttlSES'

10- AtitlUAL BUIUIT PEReEliT A~SVHPTI ON'

11- HQIITHU DEPOS I T ~SSUHfT\ Otl'

r~~;·o-

,.

.- .. ---- ..--.---------

II SIZE.OFSIZI 100

~ SORTPOLHBMATRIX[(0+\10C);il

~~ SEARCH FOR POLICY TO BI ADJUSTED.

II CHEn II( POL=SOR ;POLC 11 ) / '·HOUND'

II 1.1+1

t(li(SIZE[21-1»/'.CHECt'

~ 'POLICY ~OT rOUND.' 0 .[~D

~FOUND:ADJ.arR[AD 100.1

,I TH ( PtIAR-( iADJ[ 32. 331 ) )( 12) +( PMONT'I-( tADJ[ 26.27] » E. \ ~\ ..<\'

II ~ eHAUGE POLICY HUMEn:

tl

,,~~

~ t(AHS~I)/·.T~Q'

I 'EIlTER HEW POLICY HUMBER:' 0 ADJ[OI\S].O

II •ENTER COMPAlft HAME- NO Mon THAll 25 CHARACTERS I' 0 t1At1E+O

al ADJ OFREPLlln 100.1 3.", ... ".'" ",u,d

,~ep..",

':1 CHAR.HDJ[O+tSl.' '.25~(NAMI.2Sp' ')

CH .. R DFREPLACE 2C·0.1 ..... ,.,. ~•.., ''''"......~ N ....""

; SORTPOLCI1.tADJCOI,51

~I FBHATRIXtl;1].iAIJCO+,S]

'II +EIlD

~!I ~ CH-AHr,Ic6i1p·~tlytIA!i[:--------· -- .. _ - -.. , _ ...- ... _ ...

i!1 T',)Olt( AtISfl2)!'HHREI'

l~ 'RtItlT!R THE POLl C¥ IIUNBER I' ¢ FCLHI

II 'EIlTIR tiEW COHPArlY tI~tlI- NO Mon THAt! 25 CHilFACTIi.;:'

II ADJ+FOL,' '. 25I'OIAMI. 25p' ')

11 ADJ OFREPLACE 2,)0, I 3~"r' ""~ ~~,,,,,) ,~ ""'''0.''

HltD

,

'j

NAflEHI

_I

i i '1- .. GeM 2- r,·~Cl 3- r,~C2 '4-- iP'F 5- SOClr- ~ ADJC7HO

,iii ~DJ OFRULH~! 100. I

iii 'I S THIP.I A tnl,J x PUIOD rOR ~IW Tl'PI or POL I ~l'?' ,) R£S.O

D

l(iES='Y')!'~rol'

II

~EtlD

il'l ~ CHAIlr,E x PERI o~:

:1'1 lOUR :11 AtlS~4)," .rl '.'E'

- - - - - - . - - - - - - --.'

11 FOR: '£tiTER !III.! i pnIC~I' 0 TI.~"!:I

ill FRIX+~AIoJt11.12)

!I t« no ),,( AtlS=4) )," flDJC 11, 12H 21'( rtrlP ,2': " ")' :I.t .. ~ Co, t .-<.,..'''It <\" •• "'" < '<h' Cl'·~"\ k",." .

11 i( ( TiO) ,.. ( AIIS= 11 )) I • "~J[ H+\~ HT£,IP 1 • :l.,,~ •• , "',,' (\.,...," ...

:1 i«Ti')"(~tlS=11\'·\HS=')·'\)I'At'JtlI.12J'2"(TEllP.2p" ")' .,,,,,,, ",-.0) ,,,,,,,~,

~ l(TiO)/'A~J OFi[Ft~(£ 1)0.1'

'I t(TiO)/'.WD'

1~1

ot(T-O(C,).··:... ~-T'

,-:. "'~\".n'- ,\ ......... ~

~ """(,)l\.

r

I

I

..

OLI·:'U'I .. 0,0 0 1I[·.H~'12·:-IC'

. LOCf1',~ (1j\:IITi( Y.'1 ')1' QLbUttCOUHTHIHr'JC42'\4l'

: COUltTtCOUHT'1

II(COUHT1(X·1»;'.LOOF1'

, AUI l1,12l t 2,( TlMP, 2~' ')

I l(AHSall)/'APJ[42'\41tTIHP1'

)(tIA1oJ111.121

I 1« T-X)(O)/'XtX-T'

~ 1«T-(IIIPJ[11.12]»)0)/'X.0'

; CO~"T.2

:LOOP2:I(COUHTJ.(X'1»/·HE1JD£P[COUHTl.I~DJ[42'\41'

COUHTHOUtlT'l

t< COUIITH X'l»/' .LOilF 2'

I ADJUST-I AP.'UST' (HUIPIP-OLHIP)

",0'

(,\.~

. ,.. N' <"

i

.1

t .1.1

"'v • ,""",,,\

,

APJ DrREPLACI 100.1

~IID

' _ _ ' ___'"

II1'JI'I( ANS"S)/·.SIX'

I 'IHTlR NIW Y FUlOP:' 0 TlHPtl:1

1

I ADJt14.151.21·(iIHF.21· ... ·) I.

I APJ DFRIFLACI 100.1

~

; HND

;SIXil(~1I5~65ii";MH' ... ....-.

: 'JIITER MEW Z PUIO:>:' 0 TEHPHI

I ADJ[17.1e1'2p(TEHF.~p' .)

1 APJ DrUPLA(E 100.1

1.....

J

nr ... J

fit. Iv

l--!.E~D

1 S[I.iJ::i: i!'A'ISJl7>I'.[I '"T'''-'--' ,- ,

l 'IHTER HIW HITUST iATE TO BE CRiD I TED:'

~ ADJt19+\SltSp(TlHF.Sp·

.)

~ ADJ DFRtrLACE 100.1

: .11111

J

'.1...<>

I Y\ T~ r e.)

(I

TEtlFtO

t-

. lIfiHT:t(AIISJlB)/·.IIINI·

~

~

'IHTU MOHTH

or

"EW EFUCTI VE DATE;' 0 "E"INtO

AtJ[ 26. 27]t2,( "E1oItI. 2,' .)

'111T1E PIIY or "IW EFnCTI VE DATE I' 0 NE1Jt-tO

APJt 2~. 301t2,( HEWP. 2,' .)

f, 'ENTER YEAR

"lW ErrlCTIVE DATE;' 0 ~E1JY.~

-II ADJt32. 331t2pOIIIll. 2p' .)

~ ADJ DFREPLACI 100.1

.EMP

. I KIHE:IIIUl5J19)/'.TIH'

'---"" - ~I 'ENTER 1 IF EXPEH<;[S ARE BlUED OR 2 IF DEBITED;'

m Al·J DHIPLACl 100,1

Eo ~pel\~g~

~I

~I

or

11

J

fl .'"D

-teN

~

"HESSZt;:)

-..J

,il TIllite AtlSJl10)/ · - t U E V E H ' - - · - n - - - .

'l 'ENTU IIEIoI ANNUAL BEliEF! T PUCEIIT. ASSl:HPTI 011;' 0 TEMPt;:)

~il

5\,11.1

~\J"1

,,~, l~

-('~I..Of ~\

~"- .~',CI('Io

~I

FJOJECTlOII

L",...".,,", "'"

~l

OSA'Jt"~ISB

,,",oR

C)IO ""'" .... t>"~"

t\'~'Nr.'-'~'"

IiI ADJ[36'\Sl.5,(TEHP,5p' ')\:lJ"'r\ "'.w

jll PJilJI';TI011 ("., ...\1 .• -' "'I ,.......' """~.,.".,,

("",~"'C"'.)~

,.jll ADJ DFRtPLACE l00.5'JI

ill

tlS;&'J£'+D1SB ~hv\ l' 'I:.'ol:r'::.tC""'.f'\'~

~l OADJUS,.OA'JUST.( IIS~VE-J~AVt) N"~

m- "!liP

1'1 ELE'.'EII:;I( All 3J111 ), •• tllD'

,

",""'"-"",,

In 'tIlTER AMe:':IIT Of M!lIITHL{ HJOSITS EXPECTED I

III T[~P1.4r(T[HPI.4P' ')

~

~

jjl

'IS THERE A HE~ X FERIOD ALSO?' 0 RES.O

112ES='I')I'.FOI'

.n

'

~

TEI1Fl.O

q

9tfUI0~~DJ

, IfEP.1J1>

Slltl

"tlSt 1v

?P.CJECTIOtl

OSiI'JIHI';B

;\DJt 14. 1~) t 2t ( TEMP. 2~' .)

"DJ DFHPLACI 100. ~·.'I '1.""'"

PROJECT! eN

",.,~ l"'\\""'~ ,,"I'

M5,WEt I>! 5B

YADJUS Tt'j~DJ'JS T+ ( ~: ~~'E-OSA',IE)

i "0

~zpnlottOJ

" ZPUIOD

I S'!I"I

I AN~t10

I PJOJICT! at!

I OS:~VEHI 5B