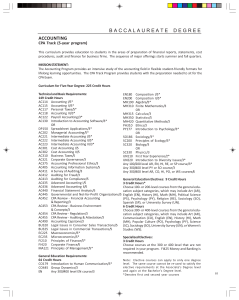

~=J:l= An L.

advertisement