- PiE

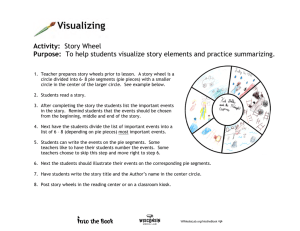

advertisement