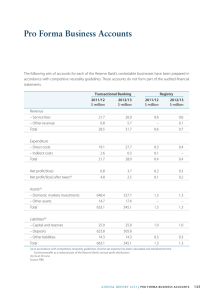

Financial Statements For the year ended 30 June 2014 9 7

advertisement