Reviewing Australia’s Payments System Reforms – A Progress Report Cards & Payments Australasia

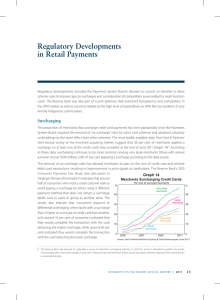

advertisement

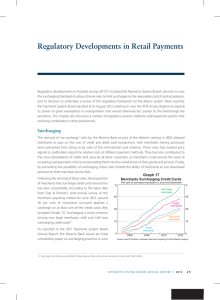

Reviewing Australia’s Payments System Reforms – A Progress Report Cards & Payments Australasia Sydney 11 March 2008 Michele Bullock Reserve Bank of Australia Overview The review process Input to the review – consultation – use of payment instruments – costs The regulation debate ATM reform The Review Process Commitment from 2002 Launched with Issues Paper, May 2007 Conference, November 2007 Consultation document, April 2008 The Consultation Process Interchange regulation most contentious Three broad positions – continue regulation – remove all regulation – remove interchange regulation Self-regulation? Use of Payment Instruments Diary study Focus on consumers First reading on use of cash Payment Share by Number BPAYOther Cheque Credit Scheme debit EFTPOS Cash Payment Share by Value Other BPAY Cheque Scheme debit Cash Credit EFTPOS Scheme debit EFTPOS Use of Cash Per cent of number of payments % Cash Other methods % 80 80 60 60 40 40 20 20 0 0-10 11-25 26-50 51-75 76-100 101-150 151-200 201-500 Payment value ($) 500+ 0 Median Payment Values Scheme debit Cash 0 EFTPOS 20 40 Personal cheque BPAY Credit 60 Transaction value 80 100 Cost of Payments Relevance to policy Joint study, 2000 Updated study, 2006/07 Aggregate Costs of Payments by Individuals Around 0.8 per cent of GDP Merchants Financial institution account overhead costs Financial institution direct payment costs Total Payment Costs* Per average transaction for each payment method $ $ 1.20 1.20 Consumer 1.00 0.80 1.00 0.80 Merchant 0.60 0.40 0.60 0.40 Financial institution** 0.20 0 0.20 Credit card EFTPOS * Resource costs excluding account overhead costs ** Including costs of currency production for cash Cash 0 The Regulation Debate What is the market failure? Have the reforms met their objectives? Are there alternatives to interchange regulation by RBA? – removal of restrictions – self-regulation Removal of Restrictions Surcharging increasing Merchants Surcharging Credit Cards Per cent of surveyed merchants % % 20 20 Very large merchants 16 16 Large merchants 12 12 8 8 Small merchants 4 4 Very small merchants 0 Jun Dec 2005 Source: East & Partners Jun Dec 2006 Jun Dec 2007 0 Merchants Planning to Apply a Surcharge Per cent of surveyed merchants % % 30 30 Very large merchants Large merchants 20 20 Small merchants 10 10 Very small merchants 0 Jun Dec 2005 Source: East & Partners Jun Dec 2006 Jun Dec 2007 0 Removal of Restrictions Surcharging increasing BUT Surcharging difficult at point of sale Pressure on interchange fees still up Removal of further restrictions? Self-regulation Nothing concrete yet Would schemes be part of it? Would it include ‘self-regulation’ of interchange fees? How to bind participants? How to include various stakeholders? ATMs Process underway Board’s preferred date October 2008 Industry targeting March 2009 Potential Advantages of New System Competition between ATM operators Transparent pricing to consumers ATMs at more costly locations Foreign ATM fees disappear? Foreign ATM Fee at Four Largest Banks* $ $ 2.0 2.0 Average foreign ATM fee 1.5 1.5 1.0 1.0 Indicative interchange fee 0.5 0.0 0.5 2000 2002 2004 2006 *Simple average of foreign fees on main transaction account at each bank Sources: Cannex; RBA calculations 2008 0.0