Document 10790259

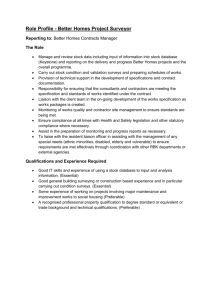

advertisement