Document 10790209

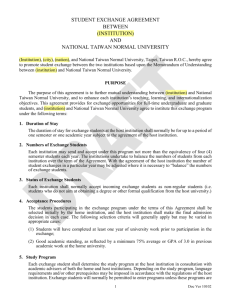

advertisement