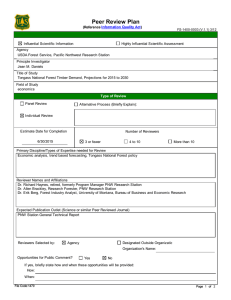

Timber Products Output and Timber Harvests in Alaska: An Addendum

advertisement