Choices/Choices II Groups Only For Grandfathered

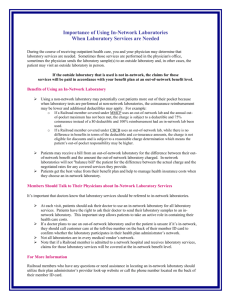

advertisement