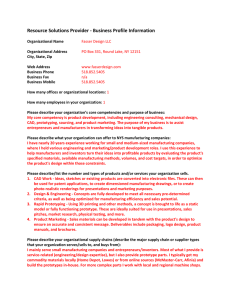

Service Bundling Opportunities for a 3PL in the Value Network

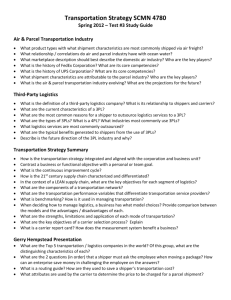

advertisement