Successful 3PL Selection

advertisement

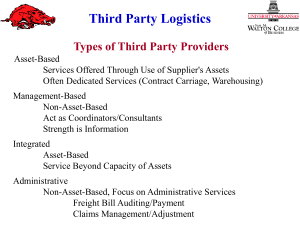

Successful 3PL Selection The First Step, Requirements Definition by Hugh D. Kinney, Jr. a white paper from The Progress Group © 2013, The Progress Group, LLC No part of this document may be distributed, reproduced or posted without the express written permission of The Progress Group, LLC The Progress Group, LLC | 1200 Abernathy Road, Suite 1700 | Atlanta, Georgia 30328 |770.804.9920 | TheProgressGroup.com Successful 3PL Selection: The First Step, Requirements Definition By Hugh D. Kinney, Jr, The Progress Group Companies choose to outsource warehousing and transportation operations for a variety of reasons. Once the decision to outsource is made, partnering with logistics focused companies that have built core competencies in logistics operations management is a great technique for strengthening a company’s capabilities relatively quickly with minimal investment of capital resources. However, outsourcing these critical, customer facing activities does not mean that a company is relieved of management responsibility and oversight and it does not mean that a company can successfully outsource the functions without developing and communicating detailed knowledge and operational requirements. Clear definition of operational requirements in terms that 3PL partners can understand and use to design effective operations is critical to selecting a 3PL partner, receiving the most cost effective pricing, and managing an ongoing 3PL relationship. Many well managed companies, even ones that have previously outsourced operations, do not take the time or expend the resources to clearly define their operational requirements in a format that can be effectively utilized by potential 3PL partners. The data that can be easily reported from financial systems and some execution systems is typically not adequate for designing effective operational processes, warehouse layouts, and transportation networks. In most cases, data from corporate databases must be “translated” into operational information that can be utilized to design cost effective warehousing and transportation solutions. Failure to clearly define and communicate operational and performance requirements results in longer time to select a partner, higher contract pricing, longer and more difficult contract negotiations, implementation problems and delays, and higher probability of performance failures and relationship dissolution. For example, a company that is Figure 1. Inbound Item Profile outsourcing warehouse operations may specify that they receive 20 truckloads per week that contain a total of 200 items. A 3PL needs much more detailed information in order to produce a best price bid. How is the load configured? Is the freight palletized? Do the pallets have more than one item? What is the profile of items per inbound load (How many loads with one item, two, three, etc.)? Figure 1 provides one view of the inbound order profile. Is the freight on slipsheets that must be transferred to pallets? Is the freight floorstacked which will require hand unloading and sortation? Is the product lot controlled and must lots be separated on unique pallets? Will Advanced Shipment Notification (ASN) EDI transactions precede physical receipt of the goods? Does the product, either unit load or case, have machine readable labels which can be scanned into the WMS? Accurate answers to these questions will dramatically impact the labor and space required to efficiently and effectively manage inbound operations and the cost of the operation. Information regarding outbound operations can be much more complex and difficult to quantify for a potential 3PL partner. Customer order characteristics can vary by product line, business segment, season of the year, promotional calendar, and other reasons. Averages may be very deceiving to both the user and the 3PL if orders are not homogenous and if profiles are not fully quantified and understood (See Figure 2). For example, if Page 2 Figure 2. Outbound Lines per Order outbound orders are comprised of both case picks and full pallet picks, the resulting average mix may vary significantly from day to day or customer to customer. Activity details by operation or function must be provided in order to design efficient operations and achieve the most competitive rates. These activities should be quantified in terms and units of work that the 3PL associates will perform, whether eaches, units, cases, pallets, etc. Inventory requirements and movement characteristics impact storage technologies and space utilization (See Figure 3). Typical company data which is normally tracked and available may include total dollars, units, cases, and dollar turnover. For parts distribution operations, units may be the appropriate storage metric, but for most operations, some form of pallet storage is Figure 3. Item Activity – Inventory Summary also appropriate. Specifying the total skus and pallets stored for potential 3PL partners is necessary but not sufficient for an effective warehouse layout. Acceptable stack heights by sku and details of planned inventory and movement by sku are critical to efficient layout and space utilization. In the case of a food manufacturer, the reported inventory may be 250 skus and 5,000 pallets with and average stack height of 3 (and the method of computing the average stack height is questionable). Twenty pallets per sku with a stack height of 3 may indicate that 4-deep floor storage would be an efficient layout and a 3PL may quote this business on that basis. In reality, a significant amount of the inventory stacks single high and a very limited number of skus comprise the majority of the inventory. A combination of deeper floor lanes and selective use of pallet rack would render a significantly smaller space footprint and a more economical price for the user. Transportation requirements can quickly lose validity when consolidated or averaged. In order to receive accurate pricing for comparison and partner selection purposes provide 3PLs or potential transportation partners with detailed shipment data. If shipment details are not maintained in corporate systems, establish a process for accumulating detailed samples or utilize your freight payment provider data if your company contracts freight audit and payment services. Minimum shipment data should include date, source location, destination location, mode, lines, cartons or pallets, weight, and cube. An annual sample is best but if the volumes are very high, a sample of the lowest, highest, and “average months should be provided. Identifying the shipment mode in the data files will enable providers to determine opportunities for savings through shifting freight between modes if appropriate. Page 3 Service and quality performance requirements set the foundation for service level agreements that will be negotiated into the contract and can be a distinguishing feature between potential 3PL partners. Transaction and cycle times may be critical to an operation’s effectiveness and should be defined and communicated. Inbound dock to stock time may be critical in a high turn environment but less critical in a seasonal inventory build scenario. Outbound order to shipment cycle times are important service elements but requirements vary between products and industries. Time requirements for system updates and information reporting such as normal reporting vs recall reporting should be specified based on necessary transaction processing. Operational quality metrics such as order accuracy, inventory accuracy, and damage reporting and allowances must be specified. Specification should include the data sources, computation formulas and the acceptable performance thresholds for these metrics. Other requirements to clearly communicate include expected growth, IT integration, reporting, and special needs. Specify the expected volume growth in order for providers to plan space, equipment and labor to accommodate expected activity levels. IT integration requirements may include EDI transaction sets and formats, utilization or integration with ERP systems, web access requirements, and transmission of data to client’s customers or carriers. Specify daily, weekly, and monthly activity and inventory reporting requirements. Most 3PLs will have a standard suite of reports which should also be reviewed and utilized when appropriate. Finally, specify any special needs such as security requirements, return processes, damage handling, lot management, and other processes that may be required to effectively manage the business. Outsourcing logistics operations to an experienced 3PL partner can result in significant benefits to a manufacturing or distribution entity. Many companies do not take the time or expend the resources to clearly define their logistics requirements. As a result, the cost is higher than it should be, service levels suffer, operational transition takes longer and incurs more problems with startup, and the relationship starts out with mistrust and potential animosity. Proper definition and documentation of logistics operations requirements ultimately leads to better 3PL partner selections, operational transitions, and partner relationships. About The Progress Group The Progress Group is an independent management consulting firm delivering strategy to implementation services in logistics/supply chain, operations design, performance management and program management. Our clients benefit from our depth in experience, thought leadership, analyticsbased thinking and always objective client advocate viewpoint. Founded in 1991 by industry leaders, we partner with our clients to enhance competitive position and improve performance. The Progress Group is headquartered in Atlanta, GA. For more information, visit www.TheProgressGroup.com. Page 4