Bargaining in the Absence of Property Rights: An Experiment

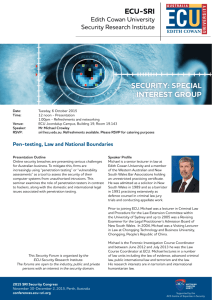

advertisement