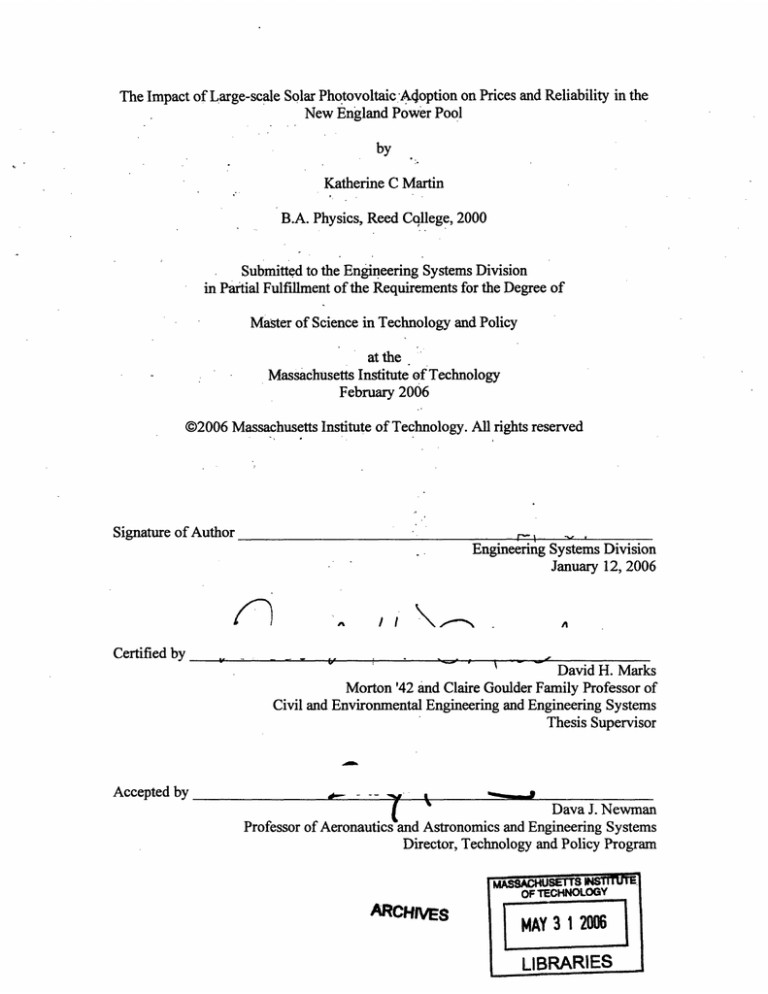

The Impact of Large-scale Solar Photovoltaic A4option on Prices and Reliability in the

New England Power Pool

by

Katherine C Martin

B.A. Physics, Reed Cqllege, 2000

Submitted to the Engineering Systems Division

in Partial Fulfillment of the Requirements for the Degree of

Master of Science in Technology and Policy

at the

Massachusetts Institute of Technology

February 2006

©2006 Massachusetts Institute of Technology. All rights reserved

Signatureof Author___

Engineering Systems Division

January 12, 2006

..

Certified by

Accepted by

-

-- -

v

II.

X

"

A

,

---

,

_

Cri

_---

David H. Marks

Morton '42 and Claire Goulder Family Professor of

Civil and Environmental Engineering and Engineering Systems

Thesis Supervisor

(T~~

Dava J. Newman

v

Professor of Aeronautics and Astronomics and Engineering Systems

Director, Technology and Policy Program

_

.....

.l

-KansasNs~t-tUTE,

OF TECHNOLOGY

ARCHI/ES

LIBRARIES

.

An

2

The Impact of Large-scale Solar Photovoltaic Adoption on Prices and Reliability in the

New England Power Pool

by

Katherine C. Martin

Submitted to the Engineering Systems Division on January 12, 2006

in Partial Fulfillment of the Requirements for

the Degree of Master of Science in Technology and Policy

ABSTRACT

The potential role of renewable energy in producing electricity in industrialized countries

has been gaining attention as issues like climate change and high fossil fuel prices more

frequently occupy the minds of the public and policymakers. The higher levels of these

technologies in power systems that are anticipated, or at least believably envisioned,

make inquiries about their likely impacts on power systems relevant. The intermittency of

technologies like wind and solar photovoltaic (PV) systems drives debates about whether

larger scale adoption of these technologies will increase the cost of maintaining power

system reliability. A more general question is simply whether these technologies will be

like conventional capacity in their interaction with the larger power system, both

physically and economically. These issues relate to the higher-profile debates about

standby charges and if they are warranted.

To address these questions, in part, for the New England power pool this study

uses detailed historical data in two ways: to analyze the potential impact of large-scale

adoption of PV on wholesale power prices and to compare the generation of PV systems

in New England to the typical operation of conventional peaking units. This study

identifies incentives for owners of incumbent, conventional generators to resist largescale adoption of PV and how these relate to debates about intermittency. In the short

term, the effect of PV on price-spikes would be similar to the installation of more natural

gas-fired combustion turbines. In this sense, incentives of owners of base-load generators

to resist PV, though real, are not specific to PV. Comparison of PV generation to typical

combustion turbine operation, however, suggests that growth of PV could exacerbate

problems with ability of combustion turbines and other "peaking" units to cover longterm costs. This comparison shows how PV could increase the costs of maintaining

power system reliability in the long-term and why owners of peaking units might resist

large-scale PV adoption. It also suggests solutions in the form of considerations for

policy design for policies aimed at encouraging the use of PV systems.

Thesis Supervisor: Professor David H. Marks

Title: Morton '42 and Claire Goulder Family Professor of Civil and Environmental

Engineering and Engineering Systems

3

4

CHAPTER I - INTRODUCTION

AND SUMMARY ..................................................................................

7

PVand price spikes- summary..................................................................................................................

8

Comparison of PV to CT units - summary..............................................................................................10

Incentivesfor incumbentsto resist large-scalePVadoption- summary...............................................11

SUMMARY OF THESIS AND DATA SOURCES .....................................................................................................

13

CHAPTER 11- THEORY ................................................................................................................................

15

Price spikes.................................................................................................................................................

15

PV in the context ofprice spikes ..............................................................................................................16

Normal and high prices .............................................................................................................................

17

PV in the context of normal and high prices ............................................................................................

18

How could PV reduce power prices? ........................................................................................................

19

CHAPTER II111

- THE NEW ENGLAND POWER POOL .........................................................................

21

CHAPTER IV - METHODOLOGY AND RESULTS ................................................................................

25

PV AND PRICE SPIKES ..... ...............................................................................................................................

25

Supportfor the methodology's assumptions.............................................................................................

26

CYCLES OF PRICE SPIKES AND INVESTMENT: OBSERVATIONS OF NEPOOL

.................................................

27

Demand, net revenues, and capacity in New England ............................................................................

28

Net revenues and capacity.........................................................................................................................

29

Price statistics............................................................................................................................................

31

Number ofprices above peaking-unit costs..............................................................................................

33

Number of scarcity events..........................................................................................................................

35

PV ANALYSIS: EMPIRICAL RESULTS ................................................................................................................

35

Would PV impact price spikes like the installation of conventional capacity?.....................................35

PV results in context of conventional capacity ........................................................................................

37

How much P V would make an impact?....................................................................................................

38

Conclusions40Conclusions

................................................................................................................................................

COULD PV REPLACE COMBUSTION TURBINE UNITS IN NEW ENGLAND?9 ......................................................

40Conclusions40

41

Why compare P V to combustion turbine units?.......................................................................................

41

PV's impact on price in non-price-spike hours........................................................................................47

CHAPTER V - INCENTIVES HINDERING PV ADOPTION.................................................................51

Impact ofP V on baseload unit revenues ..................................................................................................

51

Standbychargesand the impactof PV on operationof CT peakingunits.............................................

54

Recommendations for problems presented by incentives to resist P V ...................................................57

CHAPTER V - CONCLUSION

59

Further w60Further

work...............................................................................................................................................

w60

60Further

BIBLIOGRAPHY ..............................................................................................................................................

62

APPENDIX A63

A .....................................................................................................................................................

A63APPENDIX

63APPENDIX

SOLAR RESOURCE AND PV GENERATION IN NEW ENGLAND ........................................................................

63

5

6

CHAPTER

- INTRODUCTION AND SUMMARY

The potential role of renewable energy in producing electricity in industrialized countries

has been gaining attention as issues like climate change and high fossil fuel prices more

frequently occupy the minds of the public and policymakers. The manufacturing costs of

these, still expensive, alternative technologies have been decreasing partly as a result of

policies in a few industrialized countries that encourage the their use on a larger scale.'

In the United States, a few specific proposals have garnered publicity and the number of

similar projects will likely grow.2 With this attention come questions about the

interaction of non-dispatchable electricity technologies in electric power systems. At

present levels of penetration in the United States these technologies are of little concern

with regard to overall power system operation. But, higher levels that are anticipated, or

at least believably envisioned, make inquiries about increased penetration relevant.

This study explores whether large penetration of photovoltaic power systems (PV)

in the New England Power Pool (NEPOOL) would interact in the power system in a

similar way to the installation of more conventional peaking capacity. It does this by

using historical data in two ways: 1) it examines the relative timing of price spikes and

PV generation and estimates the magnitude of impact of PV on price spikes, in the short

term, for a series of hypothesized amounts of PV capacity, and 2) it compares the typical

Agreements between the Danish government and utilities starting in 1985 and the implementation of a

green certificates market through the Electricity Reform Agreement and Electricity Act in 1999 helped the

level of wind energy reach about 15 percent of annual electricity consumption (up from around zero

percent in 1985) in Demark by 2000 with slight increases after. See "Wind Energy in Denmark" at

http://www.opet.dk/windsector/wind-intro.litml

last viewed July 18, 2005. Japan and Germany used

subsidies to encourage the adoption of PV capacity that reached levels of about 500 and 200 MW installed

capacity in 2001. See "Photovoltaic Industry Statistics: Countires" at

http:/Avww.solarbuzz.com/StatsCountries.htm last viewed July 18, 2005.

2

In February of 2005, the governor's office in California released a plan that would install 3, 000

Megawatts (MW) of solar power in the state by 2018, enough to supply about 5% of the state's peak

electricity demand. The bill is SB I see "Official California Legislative Information" at

hlttp://info.sen.ca.gov/cgi-bin/postguery?bill number sb &sess=CUR&house=B&site:sen last viewed

July 18,2005. Cape Wind proposed to build 420 MW of wind capacity offshore in Nantucket Sound in

Massachusetts 2001 and the project is still a controversy in 2005. See "Cape Wind" at

!ttp:/www.caewind.org/

last viewed July 18, 2005.

7

pattern of operation of peaking combustion turbine (CT) units to the diurnal pattern of PV

production to help understand how the introduction of a large amount of PV capacity

would affect.the operation of conventional units and the need for further investment in

them. Using this analysis, this study then identifies incentives for owners of incumbent,

conventional generators to resist large-scale adoption of PV and how these relate to

debates about intermittency.

PV andpricespikes- summary

In a competitive power system, the impact of the installation of a large amount of PV on

prices should not differ from the installation of more conventional capacity, if the PV

systems can generate at the right times. One question this study addresses is whether PV,

given that it is a non-dispatchable technology, would act like conventional capacity in

NEPOOL by interacting with prices through the following mechanisms:

1) The addition of capacity could reduce the frequency and severity of price

spikes if the technology can generate during hours of capacity shortages.

2) The addition of capacity could reduce prices during non-price spike hours by

causing a lower-cost unit to set the real time marginal price.

Using historical data to address these questions is a somewhat limited approach because

the system has been evolving and will continue to evolve from the state described by

these data. But, a baseline understanding of typical system operation and how PV fits is

helpful. Carefully specifying comparisons of PV to the operation of certain types of

conventional units leads to conclusions that provide reasonable expectations for what

would most likely happen in the future.

8

PV is sometimes put forth as an option to help mitigate the problems that arise

from peak and inelastic demand because solar resource, and therefore PV's production

curve, matches electricity demand fairly well. This correspondence occurs because

humans are active mostly during daylight hours and because hot, sunny days drive air

conditioning use. Two qualifications are important to note at the outset. First, PV's

production curve does not perfectly match the diurnal curve for electricity demand. This

will be discussed further in later Chapters. Second, even if PV generation can reduce

peak demands, the effect would only be short-term and therefore a temporary patch to the

problems caused by peak demand unless investment in PV grows apace with increases in

demand.

The primary conclusions from the analysis of PV's relationship to price spikes in

New England are:

1) In the short term, the effect of PV on price-spikes would be similar to

the installation of more natural gas-fired combustion turbines.

2) A large amount of PV capacity (e.g. 1000 MW) would be needed to

impact price spikes similarly to the installation of a smaller amount of

CT capacity (e.g. 200 MW).

3) PV would not greatly impact prices in non-price spike hours in New

England because the marginal-price-setting fuel is natural gas in over

85% of hours.

These conclusions inform debates about whether renewables will increase power system

costs and what incentives owners of incumbent generators have to resist the adoption of

PV. These topics are discussed later, in conjunction with the analysis that compares

diurnal PV generation to the typical operation of CT peaking units.

9

ComparisonofPV to CT units- summary

The analysis described above is focused primarily on the short-term impacts of the

installation of a large (around 1000 MW) of PV capacity. In the short term, the

installation of any technology that can generate during scarcity hours will mitigate price

spikes. In general when there is excess capacity in a power system, price spikes will not

occur. The above analysis suggests that PV's production curve is well matched with the

historical occurrence of price spikes in New England. But, if the goal is to install PV in

place of conventional peaking technologies, it is important to consider what would

happen in the long term as well.

To address this long-term question using historical data, this study compares the

typical operation of conventional peaking units in New England to the PV production.

The primary conclusions from this analysis are:

1) In the long term, even if PV capacity grew apace with demand, PV's

inability to generate in moderately high-demand, evening hours limits

its ability to relieve scarcity conditions and therefore price spikes.

2) The magnitude of the mismatch between PV production and the

typical operation of peaking capacity is relatively small compared to

the correlation between the two between 7 am and 4 pm.

3) Daytime intermittency (e.g. cloudy but hot days) limits PV generation,

compared to typical CT generation, during a small number of hours

compared to the problem that PV cannot generate in evening hours.

4) Carefully bundling PV and other technologies to (with high

probability) fully replace the typical operation of conventional peaking

units is a possible way to introduce large amounts of PV into power

10

systems without increasing system costs due to the need for standby

units.

Little work has been done that carries out very detailed comparisons of PV generation to

the typical (not idealized) operation of conventional units in specific power systems. If

capturing the environmental and fuel-use-reduction benefits of renewable technologies

like PV become priorities, planning and designing models around these detailed analyses

could help policy makers and system operators understand how to best encourage the use

of alternative technologies. Also, evidence that the installation of certain combinations of

renewable technologies would offset the need for new conventional generators could help

local communities feel that sacrificing their backyards is worth the effort.

Incentivesfor incumbentsto resist large-scalePVadoption - summary

One possible reason that owners of baseload capacity might resist large-scale PV

penetration is the reduction of revenues caused by the reduction of price spikes. In the

short term however, the installation of PV would reduce price spikes, and therefore the

revenues that baseload plants and other plants earn from them, similarly to the installation

of any new type of capacity. The incentives for baseload plant operators to resist the

installation of capacity are not different for the installation of PV than they are for the

installation of any capacity in the short term. In the long term, if the installation of PV

reduced the number of hours that natural gas set the marginal clearing price, the

introduction of PV would reduce revenues to baseload plants more than the installation of

new natural gas peaking units. In New England, with the marginal price set by natural gas

in over 85% of hours, a large amount of power is supplied by natural gas in the mid-day,

high-demand hours in which PV can generate. It is unlikely that PV would change the

marginal-price-setting fuel at any reasonable level of penetration.

11

One of the controversies surrounding the adoption of large amounts of renewable

capacity in power systems is whether or not or to what extent standby charges should be

levied to offset the costs of maintaining conventional generators that are infrequently

used but that can be dispatched when the intermittent technologies cannot generate. If

redundant conventional capacity is needed to support the use of renewable technologies

like PV, then the costs of supplying power increase substantially.

This analysis shows that the installation of large amounts of PV in New England

would not entirely offset the need for conventional peaking units like CTrunits that

generate in less than 1500 hours per year. If large amounts of PV were installed to fill

increased demand, new CT units would still be needed for system reliability mostly

because of evening hours in which peaking capacity is needed but PV cannot generate.

Thus, CT units would operate less than at present and would be less able to make up their

fixed costs, which they already struggle to cover.

This analysis suggests that planning to couple PV with storage or other generating

technologies could offset most of the need for back-up capacity because most of the

problem with intermittency stems from evening hours rather than hours stochastically

throughout the day. Designing ways to fill increases in demand with portfolios of PV and

other technologies in such a way that the portfolio would cover, with very high

probability, the typical operation of the conventional units that would be installed

otherwise seems a promising approach to planning for the increased use of alternative

technologies in power systems. In this way, arguments that standby units would be

needed that would increases costs could be met with analyses of why they would not be

necessary.

12

Summaryof thesis and data sources

This study uses hourly historical data on prices, total demand, combustion turbine unit

generation, and PV system generation. The hourly price and demand data for New

England for 2000 through 2004 are available on the system operator's (ISO-NE)

website.3 Capacity data by fuel and technology type for this time period are also available

on ISO-NE's website.4 Hourly generating unit operation data are available from the

Environmental Protection Agency's Continuous Emissions Monitoring System (CEMS).5

Hourly PV generation data are from five PV sites installed throughout New England for

2000 through 2002.6 Scaling the generation from these sites produced the generation

from hypothesized amounts of PV capacity. Appendix A reports the details of the PV site

locations, characteristics, generation, and scaling.

This study first uses these data to find evidence to support the applicability of the

key price and capacity relationships, outlined above and in Chapter II, in New England

between 2000 and 2004. Chapter III outlines relevant characteristics of the New England

Power Pool. Chapter IV then analyzes PV generation the context of the first two chapters

and finds that PV could impact prices spikes similarly to conventional capacity. Because

the installation of PV could thus impact the market signal that more capacity is needed,

the extent to which PV could supply power when needed is analyzed. Recent investments

in capacity in New England have predominantly been combustion turbine and combined

cycle generators. PV generation is compared to the typical operation of combustion

3 ISO-NE website "Hourly Historical Data" at http:/,www.iso-ne.com/markets/hstdataindex.html last

viewed July 18, 2005

4 Data derived from New England's "Capacity, Energy, Load, Transmission" (CELT) and "Seasonal

Claimed Capability" (SCC) reports available at http://www.iso-ne.comni,

trans/celt/report/ and

http://www.iso-ne.cornm/genrtion..

resrcs/snl clmd cap/index.html respectively, downloaded July 7, 2005.

5 Environmental Protection Agency's Continuous Emissions Monitoring System (CEMS) (unit generation

and heat input data) at htt ://www .epa.gov/airmarkets"ein

6

issions"#prelim

Schott Applied Power provided the PV system generation data for 2000 through 2002.

13

turbine (CT) generators in New England and the analysis found that PV could not replace

their operation entirely. If PV could not replace combustion turbine operation, it certainly

could not replace units that operate more frequently.

These results suggest that if PV were installed in place of conventional capacity,

its impact on price spikes would be limited to the short term. Once PV was installed,

scarcity conditions would likely arise when PV could not generate but:when new

conventional capacity would have, causing price spikes in a different set of hours than

those in which they now usually occur. The comparison of PV to CT units suggests PV.

would have little impact on non-price spike prices.

Chapter V discusses how these analyses highlight important considerations

regarding the integration of PV into power systems and lead to two insights regarding

incentives that incumbent operators of conventional power plants have to resist the largescale installation of PV. The first is whether PV would, by reducing high prices, reduce

the revenues of baseload generation owners significantly more than does the installation

of additional conventional capacity - or if baseload owners might perceive this to be a

problem. The second is that current and future owners of conventional peaking generators

may fear that the mismatch between PV and the typical operation of their generators

would leave their units necessary for reliability but lacking the revenues needed to cover

fixed costs. This analysis suggests that intermittency, a commonly sited challenge, may

not be the most substantial reason behind arguments that standby charges are needed.

Chapter VI concludes and suggests further research.

14

CHAPTER II - THEORY

The extent to which PV can reduce demand and how this will affect generator operation

and prices is the subject of this paper's empirical analysis. To aid this analysis, this

chapter summarizes the most relevant points of the theory and operation of competitive

power systems.

Price spikes

Price spikes are periods in which the wholesale price rises and falls quickly and when it

exceeds the variable cost of the highest-cost generating unit in the system.7 Spikes occur

when available capacity cannot cover electricity demand. In reality this does not mean a

power outage, but rather that operating reserve margins for spinning reserve or tenminute reserve cannot be maintained. In New England, price spikes generally occur on

extremely hot days in afternoon hours when demand for electricity is the highest or

during unexpected cold snaps. Extreme weather and the subsequent strain on the power

system can cause or be accompanied by equipment failure that amplifies the problems

caused by the shortage of available capacity. The revenues that high-cost peaking units,

and other units, collect during price spikes helps cover their fixed costs. These revenues

are often referred to as short-term profits or inframarginal or scarcity rents reflecting the

fact that the competitive price exceeds the variable costs of the generating units. As long

as the strategic withholding of capacity, the exercise of market power, does not cause the

high prices, they are an innate and important characteristic of competitive power markets.

When installed capacity is relatively low, price spikes will occur frequently

enough to encourage investment in new capacity. After the installation of new capacity,

price spikes will subside as long as that capacity is available during times of highest

7Stoft

2002 pg. 451

15

demand or when other capacity is off-line. When the frequency and duration of price

spikes is low, potential revenues for new plants will not be high enough to encourage new

investment. If demand grows, price spikes will again encourage investment.

PV in the context ofprice spikes

Although the relationship between demand, capacity, and price spikes is complex and

unpredictable there are certain relationships that hold. First, price spikes are more likely

to occur, and occur more frequently, when capacity margins are slim. Second, if PV is to

act like conventional capacity in bolstering slim capacity margins, then it must be able to

generate when capacity margins are small because of high demand.This is not trivial as

with the installation of a new combustion turbine generator because PV is not

dispatchable. Its availability during critical times relies on solar resource. Whether PV

generation usually occurs during the most critical times, or at least during those that

occurred historically, is a testable question. Third, and again due to variability of solar

resource, the generation from an amount of installed PV capacity will vary diurnally,

somewhat predictably, and from day to day. It is possible to estimate how much PV

capacity, in a given geographic region, is comparable to the installation of a given

amount of new conventional capacity. Would one need to install 150 MW or 1500 MW

of PV to (approximately) avoid the need for 150 MW of new combustion turbine

capacity? This is also an answerable question.

The above questions focus on the short-term. In power systems, the short-term

refers to the ability of the system to generate enough to fill demand in any given hour. If

PV can help mitigate capacity shortages or cause a generator not to generate in an hour, it

could impact prices in the short term. These are important concerns. It is, however,

essential to consider the long-term, which means understanding the potential impact of

PV on the cycles of capacity installation, demand growth, and prices.

16

One way to pose the long-term inquiry is to ask: could PV capacity replace the

need for new conventional capacity? Answering this question requires understanding the

typical operation of the type of conventional capacity PV would replace and how the PV

production curve for New England fits with this typical operation. Additionally, one must

again understand how much PV would replace a given amount of conventional capacity

as 150 MW PV capacity will not necessarily be equivalent to 150 MW of combustion

turbine capacity even if they operate during exactly the same hours of the day.

Normaland highprices

In this analysis the term "normal prices" means those in which investment worthy units

are setting the price. In New England in 2002, for example, the ISO identified prices

between $20/MWh and $70/MWh as normal.8 The term "high" prices loosely means

those around the high-side of "normal" (e.g. around $70/MWh) and those where peaking

units that are no longer investment-worthy (inefficient) set the RTMP. High prices occur

more often than price spikes, they occur when the level of demand requires generation

from peaking units on the steep right side of the supply curve. These are the units with

highest variable costs that include the old, inefficient ones and units that bid "emergency"

blocks of generation beyond rated capacity.

If capacity is added in the form of new peaking units that are more efficient than

some of the old peaking units, non-price spike prices will decrease in hours when the new

capacity sets the marginal price in place of the older capacity. With the addition of new

baseload capacity, prices are reduced when the same level of demand can be met without

the operation of the most expensive units previously operating to fill that level of

demand.

8

ISO-NE 2003b pg. 40

17

PV in the contextof normaland highprices

Adding PV capacity to the system-can be thought of in two ways. PV is a peaking

technology because it only generates during hours in which the sun is shining. PV will

usually not set the marginal price because its variable costs are effectively zero and units

with higher variable costs will always be operating and needed to fill the nextMW of

demand. Thus, in the hours PV generates, one could think of the PV adding to the supply

curve at the base (lower left). The addition of enough PV generation to replace that of the

highest-cost unit could reduce the price: the lowest-cost unit that does not generate, the

unit that has slightly higher variable cost than the last one utilized, sets the marginal

price. PV generation added to a power system can also be thought of as a decrease in

demand. Thus, the PV generation could cause the demand curve to intersect the supply

curve at a point where a lower-cost unit would set the marginal price.

When comparing the addition of PV capacity to the addition of a new

conventional peaking unit (like a natural gas-fired combustion turbine) it is useful to

think of PV generation as a reduction in demand. New peaking capacity will generate

when the marginal price is greater than its variable costs. It will reduce prices when it

generates if it is more efficient than other generators in the system and thus its addition

causes a lower-cost unit to set the marginal-price. But, a new peaking unit can only

reduce prices in hours when the marginal-price is greater than its variable cost. PV, like

demand-management, has the potential to reduce prices in all hours that it generates,

regardless of the marginal-price.

That said, it is most likely that PV could impact the price when demand was on

the high side of normal. Generator's bids for the supply of energy are in blocks that can

be hundreds of megawatts in size. When demand is lower, larger units (intermediate or

even baseload) units set the marginal price. For PV to impact the price in these hours, it

would need to add a lot of energy to the system. PV systems are small and these lower

demand hours do not generally occur in the middle of the day when solar resource is best.

18

Another important observation regarding the possibility of PV generation

impacting normal and high prices is that there are two central reasons that variable costs

between generating units vary appreciably. The first is fuel costs and the second is

efficiency. Coal plants' variable costs are lower than natural gas and oil plants' variable

costs because natural gas and oil are so much more expensive than coal. This discrepancy

may worsen if natural gas prices continue to rise. PV's impact on prices would be most

notable if PV generation caused natural gas to no longer be the marginal price setting fuel

in some hours. As discussed for the case of New England in Chapter IV, this is not likely

because of the large amounts of gas-fired generation that operates during the day.

Inefficiency impacts prices most during high levels of demand when the oldest, not

investment worthy, units must run to maintain system reliability. The generation from

these units is usually in smaller blocks and therefore could more easily be offset by PV

generation.

How couldPV reducepower prices?

The addition of PV capacity to a competitive power system could reduce prices in two

ways: by reducing the number and severity of price spikes and by causing a lower-cost

unit to set the real time marginal price at a given level of demand. These routes through

which PV could reduce prices are not unique to PV. Installation of other generating

capacity or use of demand side management technologies or methodologies could have

the same effect. The question at hand is whether PV, given that it is a non-dispatchable

technology, could cause reductions in prices through these mechanisms and, if so, how

substantialan effect should be expectedfor a given amountof installedPV capacity.

For the purposes of this analysis I separate the above two routes through which

PV could reduce wholesale power prices into three:

19

1) The addition of any capacity will reduce price spikes by reducing the

frequency and severity of scarcity conditions if the technology can generate

during the hours of capacity shortages.

2) The addition of capacity will reduce prices during non-price spike hours if the

PV generation causes a lower real time marginal price by altering dispatch.

a. When demand is at peak levels (usually corresponding to high prices);

b. When demand is not at peak levels (usually corresponding to normal

prices).

This analysis posits that PV capacity would act like conventional capacity in competitive

power systems by interacting with prices through these mechanisms. One way to test this

is to compare PV's generation pattern with historical patterns of demand and

conventional unit operation, Using historical data is shortsighted by nature because the

system has been evolving and will continue to evolve from the state described by these

data. But, a baseline understanding of system operation and how PV fits is helpful in

itself and carefully specifying the conditions for comparison, like specifically considering

investment worthy conventional units, increases the generality of the conclusions of the

analysis to include reasonable expectations for the fiture.

20

CHAPTER III - THE NEW ENGLAND POWER POOL

The Independent System Operator of New England (ISO-NE) is responsible for operating

markets for electric energy and reserve services in the six New England states.9

Wholesale power markets started operating in New England in May of 1999. ISO-NE

cooperates with the voluntary association NEPOOL to develop market rules for the

wholesale electricity market. As with other power pools and exchanges, the Federal

Energy Regulatory Commission (FERC) reviews all rules and tariffs. °

The New England system is a summer peaking system with typical peak hourly

demand between 19,000 MW and 23,000 MW in the summer and between 17,000 MW

and 19,000 MW in the winter. The highest hourly demand occurred on the system in

August 2005, at just over 26,000 MW. Between 1999 and 2004 about 30% of generation

in New England came from natural gas-fired generation, 28% from nuclear, 12% from

generators burning oil and gas, 11% from coal, and 4% from oil-fired generation, with

other fuel sources making up the remainder. Wind, solar, and other "small generation"

made up only 0.6% of generation."

The Energy Clearing Price (ECP), hourly wholesale price, reported by the ISO" is

the time-weighted average of the Real Time Marginal Prices (RTMP) that the ISO

calculates about 6 times an hour.3 The lowest-cost MW of generation that would be

dispatched to fill an incremental increase in demand or an incremental change in needed

operating reserves sets the RTMP.

9 The New England power pool includes Connecticut, Maine, Massachusetts, New Hampshire, Rhode

Island, and Vermont.

10ISO-NE, "Overview of ISO New England," at http://www.isone.com/iso news/Information Kit/01 Overview of ISONewEngland.pdf last viewed June 23, 2005

" ISO-NE, "Sources of Energy in New England, 1999-2004," at http://www.isone.com/iso news/Information Kit/08 Energy Sources in New England.pdf last viewed June 23, 2005

12

2 ISO-NE website "Hourly Historical Data" at http ://ww.iso-ne.com/mnarkets/hstdata/index.htnl

viewed July 18, 2005

13 ISO-NE website "Five-minute Prices" at http://www.iso-ne.com/markets/Smindata/index.html

last

and see

Bushnell and Saravia 2002 pg. 4 for some discussion.

21

One of the ISO's actions to reduce the abuse of market power is to set prices

during periods when demand plus reserve margins near available capacity. Prior to 2001,

the ISO determined the price during scarcity periods on a case-by-case'.basis. In 2001,

under FERC's encouragement, they implemented a price cap, similar to' markets like PJM

and California, of $1000/MWh during scarcity periods when reserve margins cannot be

maintained at all or without importing power at $1000/MWh from neighboring regions.

In 2000 there were 10 hours at or above $1000/MWh, in 2001 there were 15 hours, 3hours in 2002, and in 2003 and 2004 the price did not reach the cap."4

ISO-NE made a few important changes to market design between 2000 and 2004.

A notable one is the adoption of Standard Market Design (SMI)) in March 2003. This

made NEPOOL's wholesale markets consistent with the FERC's recommendations

intended to increase efficiency and reliability in wholesale power markets nation wide.

The ISO implemented locational marginal Pricing (LMP), a pricing system to encourage

efficient use of the transmission system when congestion is a problem. Congestion costs

are assigned to locations throughout the system via marginal costs calculated at each

location. In the following discussion, the electricity clearing prices (ECP) from 2000

through February of 2003 are compared to system load-weighted real time-prices starting

in March 2003. The locational price differences in New England were modest in 2003

and 2004 and accounting for them would not affect the results of this analysis.'5

The ISO's resource adequacy standard is the common "one day in ten years"

criterion. The ISO designs and operates the bulk power system such the likelihood that a

lack of generating resources will cause an outage is no more than one day in ten years on

average for non-interruptible customers.' The ISO schedules and operate power plants to

ensure energy and reserves to meet this goal. The ISO maintains about 1,700 MW of

'4 Calculations from hourly historical price data posted by the ISO at http://www.isone.coin/M arkets/hstdata/index.html

5 ISO-NE 2005 pg. 112

16 ISO-NE, "Overview of ISO New England," at http://www.iso-

ne.comn/iso news/Information Kit/()I Overview of ISO New England.pdflast viewed June 23, 2005

22

reserves. This is enough to replace the sudden loss of energy from the largest power

source in 10 minutes and the subsequent loss of the second largest generation source

within 30 minutes.1 7

In New England, one of the procedures designed to maintain reliability during

unexpected conditions is Operating Procedure Number 4 (OP-4), "Actions During a

Capacity Deficiency". The procedure.is a number of steps to increase available supply or

reduce real-time demand for electricity so that reserve margins can be maintained. If all

the steps of the procedure are implemented, some of which include public notice to

encourage consumers to conserve power, load relief of between 2,600 and 3,600 MW

results.18 The ISO has also implemented small demand-side response programs to help

create some interaction between those with interruptible load and the supply side. '9

As a means to encourage investment in generating capacity when and where it is

needed, ISO-NE is in the process of implementing an improved capacity market. This

improved market is called LICAP, which stands for "Locational Installed Capacity

Market". This type of capacity market will reward capacity that is available during

scarcity conditions by basing the price in the capacity market on reserve margins.20 The

smaller the reserve margins, the higher the price. In this way, the capacity market should

encourage the installation of capacity that can generate when and where it is most needed

for reliability. This type of capacity market is constructed to bolster reliability and to

correct a problem with previous capacity markets: that they did not result in much of a

market.' If PV and wind could enter into this type of capacity market, it might help

encourage their installation when their production curves best match the demand pattern

of the regional electricity system.

17 bid

18

19

Ibid.

ISO New England - Demand Response at http:_www.iso-ne.con/enrtioi

resrcs/drindex.htnl last

viewed September 25, 2005

20

See Cramton and Stoft 2005 for a full explanation of LICAP.

21

Cramton 1999

23

24

CHAPTER IV-

METHODOLOGY AND RESULTS

PV and Price Spikes

To analyze PV in the context of price spikes, I developed an algorithm to compare

historical PV generation from varying levels of capacity to historical changes in demand

and price during price spikes. The algorithm steps through the historical data hour-byhour for each year. In each hour, it subtracts the hypothetical PV generation from the

region's total load. It tests whether the hour's price was a price spike (over a threshold)

and then tests whether both the load and price were increasing up to that hour from three

hours before and whether the price and load decrease after the hour for two hours ahead.

If the price is increasing with load up to that hour or decreasing with load after that hour

the algorithm moves on to set the new price in that hour. It does this by assessing whether

the new load with PV generation would have either prevented a load increase that

occurred in the previous hour (and the associated price increase) or caused the load to

decrease sooner as in the next hour.

The algorithm compares the load decrease from PV to the entire load decrease in

either the previous or next hour. The price is only changed to the lower one of the

previous or next hour if the PV generation is enough to lower the load completely below

the level of either the previous or next hour's lower price. Partial decreases in load do

not change the price. This keeps the algorithm conservative. If a price is changed, in the

next hour, the new load and price are used.

In hours in which the price is below the threshold, the methodology assumes that

the reduction in demand caused by the PV generation does not affect the price. This also

means the analysis underestimates PV's potential impact on wholesale prices because

decreases in demand in some hours when the price was below the threshold would also

have resulted in lower prices. It is not a serious understatement, as discussed below,

25

because PV at the level of about 1000 to 2000 MW would have little effect on normal

power prices (e.g. those below $70/MWh in 200222).

This methodology creates a "new" set of hourly data for price and load for the

power system. Changing the amount of "installed" PV capacity will alter the amount of

hypothesized PV generation by scaling the generation of the PV sites accordingly.

Because this methodology uses real, historical, PV generation that is

contemporaneous with the load and price data, it reflects how well PV generation

matched historically with load and high prices in New England. Some of the matching is

coincidental and not necessarily indicative of what might happen in the future. But, New

England will likely remain a summer-peaking system. It is also likely that when capacity

margins again become slim, price spikes will mostly occur in the.summer as they did in

2000 through 2002. In this sense, this method is useful in determining whether PV

generation might be expected to impact price spikes at all and, if so, how much PV

capacity would have an appreciable effect. Because the analysis uses real PV data, it also

takes into account the typical capacity factor for PV systems in New England given the

available solar resource.

Supportfor the methodology's assumptions

The methodology for estimating.PV generation's impact on price spikes assumes that, in

hours above a threshold, if demand were reduced in an hour to or below the demand in

the previous hour, then the electricity clearing price would not have changed from the

previous hour. This assumption holds reasonably well if, in these highest price hours, an

increase in demand is the most important driver of the increased price. A number of

factors support this assumption for the hours with the highest prices and loads.

22

ISO-NE 2003b pg 40 The ISO considers prices between $20/MWh and $70/MWh (in 2002) as "normal".

26

First, capacity shortages cause high prices. Because demand is inelastic and

supply is fairly consistent from hour-to-hour (barring the relatively rare unexpected

generator outage), high prices are well correlated with high demand. The hours with the

highest levels of demand are those in which demand intersects the steepest part of the

supply curve or those when demand exceeds supply. A small change in demand in these

hours can drastically affect the price and variables like the spot price of fuel that day have

a smaller impact in comparison.

Some of the ISO's actions stress the importance of the level of demand in these

situations. For example, the voluntary and emergency demand-side response programs

are designed to alleviate demand during these conditions. About 350 MW participated in

ISO-NE's demand response programs in 2004.23Additionally, the OP-4 procedures are a

measure designed to allow the ISO to decrease demand quickly, typically by about 1000

MW 2 4 but possibly up to 3,600 MW25, when capacity margins are thin. The high prices

are a result of scarcity conditions that threaten the reliability of the power system and the

ISO would presumably not put so much effort into being able to reduce demand or

increase supply in these hours if it would not help.

Cyclesof price spikes and investment:observationsof NEPOOL

Three types of evidence from the data for NEPOOL between 2000 and 2004 support the

applicability of the key relationships between price and capacity. The first is trends in

price statistics between years as new capacity was added and demand statistics remained

fairly constant. Second is the number of times, annually, the price exceeded the variable

costs of investment worthy peaking units. The third metric is the number days on which a

scarcity event occurred.

23

ISO-NE 2005 pg 92

24 Analysis

25 ISO-NE,

of historical changes in demand before OP-4 procedures were implemented.

"Overview of ISO New England," at http://www.iso-

ne.coniso.

news/Information

KitO I Overview

of ISO New. Enland.pdf

last viewed June 23, 2005

27

Demand, net revenues, and capacity in New England

As Table 1 shows, peak demand increased slightly from 2000 to 2002 and then decreased

in 2003 and 2004. Average demand remained fairly constant during the five-year period.

shows box plots of the demand in New England for the five years. The variation

Figure

in the highest demand levels is driven mostly by hot weather in the summer. Heat waves

and cold snaps with fairly unpredictable severities are one of the major drivers of price.

spikes along with, but less frequently, unscheduled power plant outages and transmission

and distribution system contingencies.

25000

o-%20000

A

x 15000

C

i 10000

E

aQ WO

5000

2000

2001

2002

2003

2004

Figure 1 Box plots depict the distribution of hourly demands over the five years. Box plots show mean

(cross), median (central line),

25 th and

7 5 th

percentiles, upper and lower fences, far out values, and

maximum demands (triangles). Most statistics are stable over the five-year period.

Table I Demand statistics for New England between 2000 and 2004

Average

Minimum

Maximum

1st

Quartile

Median

3rd

Quartile

2000

2001

14182

14376

8528

8772

21916

24959

11980

12069

14600

14643

16007

16316

2002

2003

2004

14546

14754

14881

8747

8820

9020

25344

24330

23750

12128

12537

12635

14828

15016

15175

16410

16696

16830

MW

MW

MW

MW

MW

MW

28

Net revenuesand capacity

ISO-NE's annual State of the Market Reports (SOM) and other analyses26 found, in each

year, that the market would not have covered the fixed costs and competitive return on

investment of new gas-fired combined cycle or combustion turbine units in New

England. In 2002, for example, they found that a representative natural gas-fired

combustion turbine unit with heat rate of 10,500 Btu/kWh would have net revenue from

the energy market of $25,000/MW, revenue from the capacity market of about

$10,000/MW and ancillary services revenue of about $5,000/MW. The total revenue is

thus about $40,000 but annual fixed costs for a new combustion turbine were between

$60,000 to $80,000/MW at that time. 27

This analysis of net revenues suggests that no new capacity should have been

installed in New England between 2000 and 2004. But, between 2000 and 2003,

generating companies brought 17 new gas-fired or gas/oil capable combined-cycle units

and 12 new gas-fired or gas/oil capable combustion turbines (CT) on-line. These

additions represent about 7000 MW, which is roughly the amount total capacity increased

in New England between 2000 and 2003 (there were other additions and units that shut

down or were de-rated). Total capacity and combined-cycle and combustion turbine

capacity remained about the same between 2003 and 2004.

Capacity increased from about 24,200 MW28 in 2000 to 31,100 MW in 2003 and

then slightly to about 31,300 MW in 2004. Table 229shows the changes in capacity by

generator primary fuel and technology between 2000 and 2004. Figure 2 shows the trends

in capacity additions by fuel and technology type compared to the installed capacity in

26 ISO-NE

2003a and 2005 and Joskow 2003 pg. 57-68. In each year, the ISO considered the relevant ECP

or LMPs and found that the costs of a new, representative, gas-fired combined cycle or gas-fired

combustion turbine would not have been covered in that year.

27

ISO-NE 2003a pg 44

28 Summer-rated without net purchases and sales and non-participant capacity.

29 Data derived from New England's "Capacity, Energy, Load, Transmission"

(CELT) and "Seasonal

Claimed Capability" (SCC) reports available at http://www.iso-ne.con/trans/celtreport/and

http://www.iso-ne.cornm/genrtionresrcssnl .clmd. cap/index.html respectively, downloaded July 7, 2005

29

2000. This figure depicts the rise in gas-fired combustion turbine and combined cycle

capacity.

Table 2 Capacity additions in New England from 2000 to 2004 (internal resources only and excluding net

interchange).;

(MW)

Capacity

2000

Capacity

2001

Capacity

2002

Capacity

2003

Capacity

2004

4359

3089

2814

4466

3479

4344

3053

2805

3657

3947

4340

3064

2803

3535

3963

4368

3437

2786

3301

3533

4347

3386

2779

3077

3570

10758

10410

10301

9620

9427

1412

3171

5

3457

2570

216

4536

4473

460

6455

4650

541

5873

5647

520

-299

Nuclear

ydro

Coal Steam

Oil Steam

Gas/Oil Steam,

Sub Total

Gas Combined Cycle

Gas/Oil Combined Cycle

Gas Combustion Turbine

Gas/Oil Combustion Turbine

305

296

297

299

Turbine

872

822

851

668

680

Sub Total

5766

7361

10616

12613

13019

Combustion

Combustion

Refuse

Wood Steam

123

28

0

105

107

26

0

153

101

26

0

139

100

40

576

420

101 .

25

583

373

Wind

0.5

0.5

0.7

0.7

0.7

Other

0

0

0

7

38

24228

25455

28588

31181

31299

Oil Combustion

Oil Internal

Gas/Oil Internal

TOTAL

1%nn

'MW

.- ....

1.

-

v'(GCT)

. ..........

.

Us

0o

200.

,,f

8

0

Cu~~~~~

100

In

And

.

.

(Total)

baead

(OCT)

0

LL.

tiv

I----

2000

...

.

- -

2001

.

.

,

__

2002

-1

2003

2004

Figure 2 Trends in capacity by technology and fuel type compared to levels of capacity in 2000. GCT=Gas

Combustion Turbine, CC=Combined Cycle, OCT=Oil Combustion Turbine.

30

Price statistics

Given the consistent demand, annual price statistics responded as expected to the addition

of capacity in New England between 2000 and 2004. Three types of evidence point to

this conclusion. First, fuel-cost-adjusted average prices decreased in 2003 and 2004 with

the addition of capacity (and the less extreme weather). Second, median prices remained

roughly constant and average prices 'conditional on the demand being in higher quartiles

decreased more than average prices when demand was in the lower quartiles. Third,

volatility decreased.

Table 3 reports unadjusted price statistics.30 Table 4 shows price statistics

adjusted for fuel prices.3 1' 32 Comparisons of Table 4 columns one to two and three to four

show that the increase in unweighted and load-weighted average prices between 2000 and

2004 is largely due to the increase in fuel costs between the years. The ISO noted this in

their 2004 State of the Markets (SOM) report. As expected with the addition of new,

more efficient, generators in 2002 through 2004, the fuel-cost-adjusted average prices

decreased in 2003 and 2004. The improved efficiency of marginal-price setting units

contributed to these decreases.3 3

The relatively small changes in median prices between years and the changes in

standard deviation, suggest that the reduction in volatility in later years occurred because

30 The ISO reports these in their State of the Markets (SOM) report and uses them to analyze price volatility

(ISO-NE 2005). The numbers I report differ slightly from those the ISO reports. I calculated the statistics

from the hourly numbers posted on the ISO's website and do not know why the statistics differ. They do

not differ enough to change any conclusions in either study.

In their 2004 State of the Markets Report, the ISO reports unadjusted price statistics and those adjusted

for changes in natural gas and oil prices. They calculate these by altering the five-minute real time prices

3'

according to which fuel was marginal and the spot price for that fuel compared to its price in 2000. The

prices in Table 4 were adjusted by factors reported in the 2004 SOM (ISO-NE 2005). In that report the ISO

normalized the bids of marginal-price setting units for each 5-minute real time price between 2000 and

2004. The annual scale factors that resulted from the SOM analysis are used here.

These tables and subsequent charts and tables report the Energy Clearing Price (ECP) from 2000 through

February 2003 and the Real Time Locational Marginal Price at the Hub (RT-LMP) after March 2003. In

March 2003, New England implemented locational marginal pricing (LMP) and, because locational

differences in price during this period were moderate, the Hub RT-LMP is comparable to the ECP before

March 2003. ISO-NE 2005 pg. 112 notes that accounting for locational differences would not appreciably

change the results of this types of analysis.

32

33

ISO-NE 2005 pg. 31-34

31

of the reduction of high prices to lower prices that Were still above the median. The

addition of combustion turbine capacity would be expected to affect prices when demand

and prices were high enough that these new units operated. Figure 3 shows the relative

changes in prices compared to 2000 conditional on the demand being within various

percentiles. The graph shows the decrease in fuel-adjusted mean ECP between 2001 and

2004. It also shows that there was a larger relative decrease in mean ECP given that

demand was above the 75th or 9 0 th percentile than in the unconditional mean ECP or the

ECP given that demand was below the 2 5 th percentile. The new generating units affected

prices more when demand was high because that is when they operated.

Table 3 Price statistics for New England between 2000 and 2002 (unadjusted)

Median

Inter

2000

2001

2002

2003 ^

2004A

Avg

43

40

36

51

52

Stdev

132

45

24

23

23

Max

6000

1000

1000

998

920

quartile

Median range

Min

39

21

-3

19

35

-6

1.6

33

1

17

48

0

50

17

0

$/MWh

absolute

deviation

16

14

12

13

..12

-

-

-

Table 4 Price statistics adjusted for fuel prices and load

Adj.*

Avg

43

Load-

Load-

Weight

Avg**

46

Weight

Adj. Avg

46

SOM-

Stdev

30

Adj.

Stdev

30

based

weights

1.00

2000"

Avg

43

2001

40

45

43

49

45

50

0.89

2002

2003

2004

36

51

52

44

42.

42

38

53

47

44

24

23

23

31

19

19

0.80

1.23

1.25

^

^

54

43

I/MWh

*Adjusted for changes in natural gas and oil prices in

proportion to the fraction of hours each fuel was marginal

** The load-weighted average of electricity clearing prices

^ The real-time locational marginal prices for the New England

hub are used after the implementation of LMP in 2003

"Prices over $1000/MWh were dropped to $1000/MWh

32

a

1.

i

1.2

8o~

0

.- ECP

IDem

%

1 He~~~~~~~~~~ . .......................-.-

:D

.8..

~-

.

................

_____

--

.-

0.4

2000

Mean

....... ECP

Mean ECP I Demanc>75th %

C' 0.6 .--

0

~~Mean

1-5

2001

2002

23

Mean ECP I Demand>90th %

2004

Figure 3 Comparison of mean energy clearing prices between years conditional on the demand being

above a given percentile.

The volatility, as measured by unadjusted standard deviation in column two of Table 3,

was $132/MWh in 2000 and by 2004 was about $23/MWh. In the year 2000, the ISO still

set the price cap during price spikes rather than capping all spikes at $1000/MWh.

Adjusting the spikes above $1000/MWh (one reached $6000/MWh) in 2000 to

$1000/MWh makes the statistics more comparable between years. When this and

adjustment for fuel prices is done as in Table 4, column six, the standard deviation in

2001 was about $50/MWh and it fell to about $30/MWh in 2002 and down to around

$19/MWh in 2003 and 2004. This is consistent with the trends in added capacity.

Number ofprices above peaking-unit costs

Another way to observe the changes in price spikes is to observe the number of prices

over a certain threshold each year. Setting the threshold above the variable cost of the

highest cost investment worthy peaker in the system in the earliest year and adjusting the

threshold for natural gas prices gives a comparable measure of how often price spikes

33

occur in each year. Figure.4.shows the relationship between capacity margins34 and

number of prices over fuel-price adjusted thresholds of $70/MWh and $100/MWh in

2000. Capacity margins are measured as the difference between capacity and peak

demand in a year as a fraction of peak demand. As expected, the year with tightest.

capacity margins, 2001, was the year with the most price spikes above the threshold.

700.

X

# of Hours> $70MWh

2001

600.

S

W

500

2003

2002

X

0

X

X

'r 400.

2000

2 300.

It

20015

E

# of Hours > $100/MWh

Z

200

2001

10001

0

2003

U

,21)02

82004

2000

f

-

0.1

0.2

-

0.3

.

o0.4

Capacity Margins

(Cap - Peak)/(Peak)

Figure 4 Number of hours above fuel-price adjusted thresholds of $70/MWh and $100/MWh in 2000

versus capacity margins in New England. Capacity margins are measured as the difference between

capacity and peak demand in a year divided by peak demand.

34 The capacity numbers used in this analysis indicate the amount of internal resources, in summer-rated

capacity. New England is a net importer of power from the surrounding areas of New York and Canada.

Although total net imports into New England changed during the period, the maximum amount imported in

a single hour did not change. This amount remained close to 2600 MW for all years. Because imports can

only alleviate capacity shortages relative to the amount that can be imported in a given hour, and that

number was constant for all years in consideration, imports do not appreciably affect the results of this

analysis.

34

Numberof scarcityevents

As capacity increased, the number of days with scarcity-events decreased, as measured

by implementation of OP-4 procedures. The system operator implemented OP-4 actions

on eleven days in 1999, six days in each year between 2000 and 2002 and only on two

days in 2003 and three in 2004. On 3 of the 5 days that the system operator implemented

OP-4 in 2003 and 2004, scarcity conditions occurred in the winter as opposed to three of

the 29 days in 1999 through 2002. The 2004 SOM suggests that the OP-4 conditions that

occurred during these winters did so because of unexpected cold snaps when capacity

was off-line for scheduled maintenance. The scarcity conditions were not due to capacity

shortages that reflected overall levels of capacity like those in summertime hours when

nearly all units are available. The conditions were not severe and prices did not rise to the

$1000/MWh cap as in the summers of 2000 through 2002.

PV analysis:empiricalresults

WouldPV impactprice spikes like the installationof conventionalcapacity?

The first goal of this analysis was to determine if PV could impact price spikes in a

manner similar to conventional capacity. If, for example, PV never generated or only

generated small amounts during hours that price spikes occurred, then it would have no

or limited impact on the occurrence of price spikes. If this were true, installing PV could

not impact investment cycles as they now occur. The results of the price spike analysis

for 1000 MW of PV with a threshold of $70/MWh in 2000, adjusted for fuel prices for

later years, show that PV could have historically lowered demand in price spike hours. It

is worth stressing that this analysis shows that, historically, 1000 MW of PV in New

35

England could have generated enough.to stop the increases in demand that occurred

...

between some of the highest priced hours from 2000 and 2002.

Table 5 Number of prices above fuel-adjusted thresholds with and without PV for all year and just the

summer. PV data were only available for 2000 through 2002.

.

All year_

_-

___

# Prices above*

# Prices above*

# Prices above*

200 /MW

150 $/MW

100 $/MW

2000

Actual

13

.2001

40

2002

2003

2004:

With PV Actual

5

23

With PV Actual

18

66

70$'MW

With PV Actual

59

430

With PV

357

650

.552

472

51

20

77

6

33

13

453:

t10

113

4

274

62

_

28

13 _

*Thresholds are adjusted or fuel prices, numbers are for 2000.

353

28

62

51

143

106

Summer only (May 1st through September 30th)

# Prices above

# Prices above

# Prices above

200 /MW

2000

2001

2002

2003

2004

# Prices above*

_

Actual

10

21

12

1

0

150 $/MW

With PV Actual

15

2

26

10

5

30

2

0

i

$100/MW

With PV! Actual

34

11

66

17

17

63

14

3

,

# Prices above

70 $1MW

With PV Actual

30

103

40

195

37

248

41

42

With PV

65

141

169

Table 5 shows the number of hours with prices over varying thresholds for 2000

through 2002 with and without the added PV capacity. The thresholds.are reported for

2000, all other thresholds are adjusted for fuel prices. That is, if the threshold is

$100/MWh this means $100/MWh in 2000 and the other years are adjusted by the

weights shown in Table 4. As expected, based on the rough correlation between PV's

production curve and electricity demand, the PV reduces demand enough to prevent

increases in a higher percentage of the hours over $200/MWh. Table 6 shows the

percentage change in number of prices above the thresholds with the addition of PV.

Most of the hours above $200/MWh occurred in the summer and in the middles of the

day between 2000 and 2003.

36

Table 6 Percent reduction in number of hours over thresholds caused by the addition of PV for all year and

the summer

All year

Threshold

150 $/MWh 100 $/MWh

200 $/MW

2000

2001

2002

70 $/MWh

17

15

25

11

26

34

22

18

39

62

30

54

% Reduction in # of hours over fuel-price adjusted threhold

Summer only (May 1st through September 30th)

200 $/MW. 150 $/MWh 100 $/MWh

Threshold

2000

2001

2002

70 $/MWh

37

28

32

12

39

41

27

35

43

80

52

58

% Reduction in # of hours over fuel-price adjusted threhold

Table 7 shows price and load statistics for the years with and without PV. The

median prices change little because the algorithm affects only prices originally above the

median (above the threshold) and reduces some of those prices to new prices that are still

above the median.

Table 7 Price statistics, adjusted for fuel prices, with and without PV

Adj.

Average

2000

41

45

2001

44

2002

42

2003

2004

42

PV Adj.

Average

40

44

44

Adj.

-

Median

39

40

41

39

PV Adj.

Median

39

*40

41

Adj.

Stdev

40

30

50

31

19

19

PV Adj.

Stdev

19

38

-

21

$/MWh

PV resultsin context of conventionalcapacity

Comparing the results of the above analysis to the variation in capacity levels and

frequency of high prices in the years 2000 through 2004 is a way to determine when the

impact of PV might be considered appreciable. A PV-induced change in number of high

prices or in price statistics that is similar in magnitude to that caused by historical

37

fluctuations in conventional capacity between years should be considered significant

enough to affect the investment economics of the market. The historical fluctuations in

years are also due to weather and other variations in conditions. These are iot taken into.

account in an analysis that estimates how much an historical year would have differed

with the installation of PV.,Nevertheless, changes from year-to-year do give a benchmark

..

for order of magnitude of change thatis significant.'

The changes between the years 2001 and 2002, which included the addition of .

capacity as well as variations in weather and other factors resulted in a86 percent

reduction i the number of prices over $200/MW, about 45 percent reduction in prices.,.

above $150/MW and $1.00/MW, and about a 25 percent decrease in those above

$70/MW. 3 5 These numbers are similar in magnitude to those from the.PV analysis shown

in Table 6, Although the numbers in Table 6 are not directly comparable to the changes

between years that actually occurred as weather and capacity changed, the order of

magnitude is roughly comparable and roughly the same.

. .

...

...

How much PVwould make an impact?

.

The second goal of this analysis is to determine the level of PV capacity that would start

to have an appreciable effect on high prices. Table 8 shows sensitivity analysis for the

amount of hypothesized installed PV. About 1000 MW of PV in each year impacts prices

similarly to the fluctuations between years that occurred historically. 1000 MW of PV has

considerably more impact than 500 MW in most years and 2000 MW has a similar

impact to 1000 MW. This is because the typical increase in load between hours is around

800 MW so generation from 1000 MW of PV is just enough to prevent many of these

increases.

35 As usual, these are adjusted thresholds so $1 00/MWh is $1 00/MWh in 2000 or $89/MWh

in 2002.

38

Installing 1000 MW of PV would represent about three percent of the total

installed capacity in New England. In Germany where aggressive subsidy programs have

encouraged the entry of PV, installed PV capacity (grid-connected) is about 800 MW36

and this is about 0.7% of the total installed capacity of about 120 GW37 . Notably, in

2004, Germany installed about 370 MW of PV systems. It is not out of the question that

areas like New England might, at some point for some reason, install hundreds of MW of

PV per year. Were this to happen, even a cursory understanding of the expected affect of

this new capacity on power system dynamics would be useful. This analysis shows that

the installation of large amounts of PV could affect the dynamics of price spikes and

investment in a regional power system.

Table 8 Number of hours over prices of $200/MWh, $100/MWh, and $70/MWh adjusted for fuel prices for

varying levels of PV capacity. Percent differences from actual number of prices over these levels are also

shown.

MW PV

2000

1000

Results

2000

Results for

Results for

Results

for

2002 f

Hours above

$200/MWhII

5

62%

5

62%

11

11

Actual

13

2000

1000

26

28

35%

30%

94

106

34%

26%

507

.553

22%

15%

500

50

34

35

15%

13%

123

125

14%

13%

569

591

12%

9%

Actual

40

2000

1000

2

6

85%

54%

33

51

57%

34%

304

353

36%

25%

9

31%

65

16%

401

15%

13

0%

67

13%

420

11%

50

Actual

62

63

70/MWh

333 23%

357

18%

Sor

500

50

500

15%

15%

$100/MWh

43

35%

59

11%

6%

5%

66

77

14%

7%

433

143

13

374

401

650

472

Number of hours above threshold

Percent change from actual

36

Solarbuzz, "Fast German Solar Energy, Power Industry and Market Facts," at

Ittp://www .solarbuzz.corn F astFactsGernany.h

37 Energy

tmn,last viewed September 22, 2005.