FY 2015-2016 Budget

advertisement

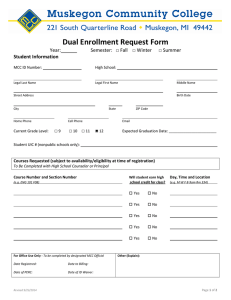

FY 2015-2016 Budget MUSKEGON COMMUNITY COLLEGE FISCAL YEAR 2015-2016 BUDGET Introduction The mission of Muskegon Community College (MCC) to be a “center for lifelong learning which provides persons with the opportunity to attain their educational goals by offering programs that respond to individual, community, and global needs” continues to be the College’s primary objective. The ability to provide desired educational programs must be continuously evaluated in conjunction with economic factors that affect the College’s funding sources and the cost to provide those services. The condition of the national, state and local economy impacts the revenues that the College receives to operate with such as federal financial aid (Pell grants and student loans), state aid and property tax revenues. In FY2010-2011 Muskegon Community College’s contact hour enrollment peaked at 132,221 contact hours. During this time period there were significant federal grant dollars available for unemployed workers to be able to attend college and learn new skills. Those funds have declined since that time, which has contributed toward a decline in MCC’s enrollment. Another factor affecting enrollment has been the improving economy with more people going back to work and therefore taking fewer classes. However during the summer of FY 2014-2015, enrollment came in better than predicted. Pre enrollment for FY 2015-2016 looks strong and we are predicting a 1% enrollment growth for next year’s budget. In FY2009-2010, the College’s property tax revenues were at their highest level of $10.2 million with the subsequent years in decline. This year we predict an increase of 1.78% or $158,059, but we have still to reach the pre-recession numbers. State Aid revenues had remained constant from 2008-2011 then declined slightly in FY2011-2012 and have since started back on an upward trend. Fortunately the voters of Muskegon County signified by their approval of a capital millage request that they were willing to make an investment in MCC’s aging and outdated infrastructure. With facility improvements and expansion, it is the belief that more students will be attracted to MCC and make it their choice for higher education. However, the capital millage only supports our infrastructural needs. To control and effectively manage the College’s expenses, a moderate tuition rate increase is proposed. This moderate increase will ensure the College operates efficiently and continues to offer our students a high-quality education at the lowest feasible cost. The FY20152016 Proposed Budget takes into consideration all of the economic challenges that will allow the College to continue to achieve its mission of meeting the community’s educational needs as efficiently and effectively as possible. FY2015-2016 Proposed Budget The Proposed FY2015-2016 budget is shown on the last page. This budget is presented on an All Funds basis using natural class categories for expenses (i.e. salaries, fringe benefits, supplies, repairs etc.). In addition, the presentation separates operating revenues such as tuition and fees and grants from non-operating revenues such as state aid and property taxes and includes depreciation expense in a separate column. This format complies with a full accrual basis of accounting and follows the presentation of our annual audit report. The College is striving to ensure that spending does not exceed available funding resources. Strategies include identifying efficiencies, working with vendors to find cost savings and pursuing other energy savings options. This budget also includes the revenues and expenses related to the new capital millage which are presented separately but are included in the All Funds totals. The FY2015-2016 budget as presented shows a $ 6,928,156 restricted surplus on an All Funds basis. This surplus is generated from the excess revenues in the capital millage budget over the interest and bond issuance expenses related to the bonds issued for those new construction projects. Revenues Total operating and non-operating revenues for FY2015-2016 budget are projected to be $37,292,716 (including Pell) . State Aid For the FY2015-2016 budget, the state aid will assumes approximately a 1.3% increase in appropriation to $9,020,700. This is an increase of $119,700 over the current year appropriation of $8,901,000. The graph below illustrates the historical trend of this funding source. State Aid (in 000’s) $10,000 $8,000 $8,369 $8,519 $8,519 $8,519 $8,257 $8,687 $8,595 $8,901 $9,020 $6,000 Property Taxes During 2014-2015 the College will levy 2.2037 mills of ad valorem property taxes on property located in Muskegon County for its operating millage. The total taxable value for Muskegon County according the Muskegon County Equalization report is increasing from $4,257,442,624 to 4,329,837,793. After four straight years of declining revenue from this funding source as depicted in the following graph, finally property values are beginning to rebound. There are signs of new housing construction in the county as well as increasing residential sales. The FY2015-2016 property tax revenue budget is projected to be $9,033,059 for the College’s operating millage. The College will levy an additional .34 mills for the new capital millage. The capital millage will generate an additional $1,322,182 in property tax revenues. Property Taxes (Operating Millage Only) (in 000’s) $12,000 $10,000 $8,000 $6,000 $9,277 $9,697 $9,963 $10,188 $9,809 $9,227 $9,098 $8,983 $8,958 $9,033 Tuition and Fees As previously mentioned, tuition and fees have become an increasing portion of total revenues over the last decade. In the proposed FY2015-2016 budget, this funding source represents approximately $16,510,161. An increase in the contact hour tuition rate beginning with the fall semester of 2015 is proposed as follows: In-district Out-of -district Out-of-state Current Rate $96.00 $178.00 $244.00 Proposed Rate $99.00 $184.00 $256.00 This increase would generate approximately $435,024 in additional revenue for FY2015-2016. The FY2015-2016 budget assumes that the registration fee will remain at $35.00 per student per semester and that the technology fee will remain at $20.00 per contact hour. However, this budget includes a recommendation to include a $5.00 per contact hour infrastructure fee. This fee will allow the College to enhance its services and quality of instruction while keeping the College infrastructure at an acceptable level, and, at the same time, providing for the maintenance and future support of new areas of the college. High School and Career Technology sponsors will be exempt from this fee. In addition, various course fee increases are also being proposed to offset the rising costs of consumable supplies and other expenses necessary to operate. These increases in the infrastructure fee and course fees are expected to generate approximately $420,310 and $20,000 respectively in additional revenue for FY2015-2016. The graph below illustrates the historical trend of tuition and fees since FY2006-2007. Enrollment for FY2015-2016 is budgeted to increase 1% from the current year estimated actual to 11,430 students. Tuition and Fees $18,000 $16,000 $14,000 $12,000 $10,000 $8,000 $6,000 $9,857 $10,755 $11,605 $13,499 $14,531 $14,531 $14,583 $14,893 $15,436 $16,510 Headcount 14,000 13,333 13,150 12,000 12,142 12,647 12,247 11,548 11,435 10,000 $1,000 $900 $800 $700 $600 $500 $400 $300 $200 $100 $0 Tuition Fees 11,317 11,430 In-District 2015 Tuition Rates Cohort College Comparison $117.00 $125 $100 $75 $90.90 NW MI CC $94.00 Lake MI CC $99.00 Muskegon $99.50 Kellogg CC $102.00 Monroe CC $102.00 St. Clair Jackson CC * Tuition rate represents the current summer (or proposed) 2015 rates In-District 2015 Tuition Rates Surrounding College Comparison $110 $100 $90 $80 $70 . $91.00 $94.00 $95.00 $99.00 $100.00 $104.00 $108.00 Contact Hours 150,000 130,787 132,221 122,766 125,000 110,068 115,106 118,089 110,666 108,452 109,536 100,000 Grant Revenues This funding source includes federal, state and local grants that MCC has been awarded and uses for specific restricted purposes. This category includes, Pell, Upward Bound, Perkins, TAA NOVA CAD/CNC, Michigan Incentive Tuition Program, and the Michigan Economic Development Grant.to name a few. All Other Revenues The remaining revenues consist of commissions generated from book store sales, rent, investment income, and miscellaneous departmental revenue. These revenues total $700,573. Expenditures Total FY2015-2016 operating expenditures are budgeted at $45,186,316. Expenditures consist of categories such as wages, fringe benefits, contractual services, supplies, utilities, repairs and maintenance, rent, equipment, travel and depreciation. Wage and fringe benefit costs comprise the largest portion of total expenditures at $26,592,529. Faculty and staff are the “materials” needed to create our “product” of college educated students. Annual wages increase in accordance with contractual agreements include wage and step increases. Retirement and medical costs, even with the recent healthcare and retirement reform changes, continue to rise each year and have a significant impact on the ability to balance the budget. Salaries and Wages The budget for salaries and wages is based on projected staffing levels and current contractual agreements. The FY20152016 budget includes the assumptions based on contract negotiations with our Faculty Association and our Clerical unit. Fringe Benefits The employer contribution to the state retirement system is an average of 25.96 % of wages in FY2015-2016. Medical, dental and vision costs continue to rise and are projected to increase another 12 % next year. Other benefits such as life insurance, unemployment and workers compensation insurance are projected to remain stable. Total fringe benefit costs for the operating budget for FY2015-2016 are projected to be $8,566,401. Capital Expenditures Proposed expenditures for computer and equipment purchases and building renovations are included in the appendix section of this document. Those items that meet the capitalization criteria will be depreciated over their useful life. (see attached spreadsheet) Budget Balancing Strategies Given the challenges facing colleges today, along with increasing operating costs and fringe benefits, several budget balancing strategies were incorporated into the FY2015-2016 budget. The highlights are listed below: Implement a $3.00/$6.00/$12.00 tuition rate increase for in-district, out-of-district and out-of-state rates respectively generates $435,024 in revenue Implement a $5/contact hour facility fee generates $420,310 in revenue Implement various course fee increases generates $20,000 in revenue Inclusion of a new Medical Assistant program generates $28,122 in net revenues Inclusion of new CNA program-generates $28,728 • • • • • Each year the College must report to the Higher Learning Commission certain financial information that discloses the financial condition of the college. Ratios are computed based on our reserves, net operating revenues, return on net assets and debt in addition to an overall composite ratio. We have computed these ratios for the FY2013-2014 and FY2014-2015 CFI Zone Above CFI 1.1 to 10 Outcome No Review FY2010-11 2.7 FY2011-12 1.3 FY2012-13 2.1 In 0 to 1.0 - - - Below -4.0 to -0.1 Financial Panel Review if >= 2 consecutive yrs Financial Panel Review in any 1 yr - - - FY2013-14 2.10 FY2014-15 1.5 - The Higher Learning Commission and bond rating agencies take into consideration an organization’s plans to maintain long-term financial stability. The budget balancing strategies that are included in the FY2015-2016 budget provides an opportunity for the College to remain a financially sustainable institution into the future. Conclusion The FY2015-2016 All Funds budget is presented on the following page for your consideration. This budget represents a coordination of efforts by all departments that have looked for ways to reduce costs and achieve efficiencies and continue to allow the College to provide educational opportunities to its students. 2015-2016 Budget Assumptions This year’s budget assumes… • a one percent enrollment increase. • filling three of the four vacant faculty positions from the 2014-2015 retirements ( one • the Dean and Mentor of the Muskegon Early College will be assumed by MCC. position is vacant because it was moved from being outsourced by Ellucian). • one half of the Dean and Mentor’s salary and fringes will be reimbursed by the MAISD. • filling two replacement custodial unit positions. • hiring one utility position for the downtown center. • the vacant Manager of the Testing Center position will be filled. • the hiring of a Medical Assistant/Health lab parapro. • the Medical Assistant Program will be implemented in the winter semester. • a tuition increase of 3.00 per contact for in district (3.13%) 96/99, a 6.00 dollar increase for out of district (3.37%) 178/184, and 12.00 per contact hour for out of state (4.93%) 244/256. • a five dollar per contact hour facility fee will be charged to all students except students • Blue Cross will increase by 12%. sponsored by High Schools and Career Tech Centers. • faculty and clerical negotiations amounts are figured into the budget. • includes operating costs for the new science wing and the downtown centers. • state aid will increase 1.3% ($119,700). • property tax is projected to go up 1.78% ($158,059). • a 2% across the board salary increase for exempt APS and a step increase for hourly APS. • a 2.73 percent average salary increase for the custodial unit per the 2011 contract. MUSKEGON COMMUNITY COLLEGE 2015 - 2016 CAPITAL Control # Dept # Description of Equipment 31 10-20-73060-2823 5 year SSL Certificates 19 10-20-73060-2821 10GB Fiber Conditioning Cables G01 10-20-73060-2821 13 10-20-73060-2836 Cisco 7942 Phones P20 10-20-73060-2821 Physics Laptops 39 10-20-73060-2821 Geology Lab laptop replacements plus roll around storage /charging cart. Permanent Technology and Projector Life Cycle Replacement RT01 10-20-73060-2834 Polycom Setup (estimated 4/22/2015) 32 10-20-73060-2834 Replacement of MCCVMS07, 08, 09, and 10 Devices with mobility and ability to add SC06 10-20-73060-2821 apps and software that are required as part of the lecture/labs, then to be able to wirelessly broadcast to the instructor or classroom at $1,350 each. X01 10-20-73060-2821 Added $12,500 per classroom 11 SAN Purpose / Comments Increasing the duration of SSL certificates will reduce overhead of IT Department for implementation and will save 26%. These cables will allow for bandwidth increases to 10GB to the edge network closets with newer Cisco 3750X switches in them. 15 Laptops and one roll around storage/charging cart for laptops. Will be stored in locked room between classes. Life Cycle replacement of 7942 two line phones. Student use technology, won't be surface pro 3's. The replacement of projectors, document cameras, and related equipment for classroom instruction Dan Knue, Respiratory Therapy Life Cycle Replacement of Physical Host Servers. Student use technology, won't be surface pro 3's. Physical Plant 76010 Physical Plant $ 6,000.00 $ 14,000.00 $ 15,000.00 $ 16,000.00 $ 26,400.00 $ 35,000.00 $ 45,000.00 $ 63,000.00 $ 150,000.00 $ 225,000.00 $ 66,000.00 $ 12,500.00 $ 12,000.00 passenger, and is considered a safety issue by $ 36,000.00 Mixed Equipment & Remodel? Part of switch replacement requirements to get current network speeds. Eliminated $270,000 so added back, added $1,000 for cart. Only replacing failing and needed phones, but should expect higher failure rates. Lab computers needed for Physics Instruction Projectors are getting too old. Resolution is too low, cost of bulbs for older model projectors is high. Removed 6 from remodeling additions. Needed for distance education to Traverse City. Keeps server technology current and avoids overloading next year's replacements. Discussion about laptop vs. desktop. The current SAN was purchased 5 years ago (Colleague ERP, Blackboard, Email, etc.) that rate. Prolonged use creates risk of outage and technology suitable to teaching and learning centralized storage and capacity for all services and individual drives are failing at an increased snow blower attachment, and hydraulic system upgrade for the Tool Cat. 22 1,700.00 The Storage Area Network (SAN) provides bucket option, 68 inch angle broom, 60 inch data loss. This unit is to service the main campus and the current older tool and attachments will be stationed at the Downtown Center. Replace rusted out dock lift for the old Reduce maintenance costs for current lift and the point that they could soon fail. bookstore, kitchen, and custodial supplies. receiving docks. Old lift arms are rusted to OIT Est. Cost $ stabilize systems after a cert change Classrooms need to be outfitted with the construction and renovation areas Toolcat 5600 G-Series power unit, 62 inch 76010 Reduce labor and discount. Takes too long to Classroom technology for Current new run on equipment in the MCC Data Center. 19 OIT Comments insure that we have a functional lift for the Install an Oil Cooler System on the HEC 24 76010 Physical Plant elevator. The elevator oil tank temp runs high during heavy use times. This could shorten the Extend the life of the elevator pump system. life of shaft seals and the elevator pump system. 2015 Ford Transit Wagon 3.7L Ti-VCT engine, 27 76010 Physical Plant automatic, 12 passenger low roof height van to MCC's current fleet van is a 2004, 15 replace the current 15 passenger van in the fleet inventory and add one additional van for college staff and team use. New 76010 Physical Plant Kitchen Remodel our insurance carrier. Chairs in Fund 10 MCC classrooms $ 160,000.00 Application/CRM and Catalog Software account for applications. Add catalog software $ 200,000.00 TOTAL Update student application software to better to help improve student success. $ 20,000.00 $ 1,103,600.00 Muskegon Community College Statement of Revenues and Expenses FY 2015-16 All Funds Budget Operating Revenues Tuition And Fees Federal Grants Local Grants And Donations State Grants Sales, Services & Rentals Other Income Total Operating Revenue Operating 16,510,161 869,886 5,050 942,500 588,925 448,845 19,365,367 Depreciation Fitness Center One Time Grants 8,700,000 - - Operating Expenses Salaries And Wages Fringe Benefits Advertising, Legal, And Other Professional Services Material, Supplies, Postage, Books, Program Cost Dues, Professional Development, Travel Utilities, Energy Cost, Rent, Insurance Repair And Maint. Capital And Capital Under $5,000 Financial Aid And Scholarships Bad Debt Other Expenses Depreciation Total Operating Expenses 18,026,128 8,566,401 3,105,344 1,939,778 657,318 1,469,949 1,396,050 1,666,177 400,000 65,571 37,292,716 2,020,816 2,020,816 297,245 Operating Income/(Loss) (17,927,349) (2,020,816) (297,245) Non-Operating Revenues/(Expenses) State Aid Property Taxes Interest Income Interest Expense Capitalized Interest Pell Revenue Pell Disbursement Transfers (Net) Gains And Loss Total Non-Operating Revenues/(Expenses) Net Income /(Loss) 9,050,700 9,109,059 43,190 (240,600) 7,000,000 (7,000,000) (35,000) 17,927,349 - 2013 & 14 Bonds 8,700,000 142,319 24,926 130,000 - 69,600 (69,600) (11,615,010) 41,250 8,700,000 615,817 9,050,700 10,431,241 43,190 (1,126,965) 180,000 7,000,000 (7,000,000) (35,000) 18,543,166 546,217 6,928,156 1,322,182 (886,365) 180,000 (2,020,816) (297,245) 8,700,000 16,510,161 869,886 5,050 9,642,500 588,925 448,845 28,065,367 18,168,447 8,591,327 3,261,594 1,941,878 657,318 1,511,199 1,396,050 1,666,177 400,000 65,571 2,020,816 39,680,377 26,250 2,100 - All Funds Total