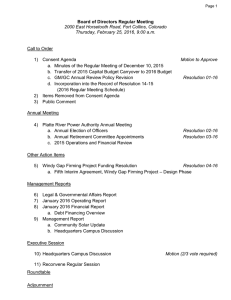

Board of Directors Regular Meeting Thursday, February 25, 2016, 9:00 a.m.

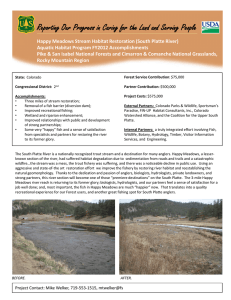

advertisement