Alaskan Airlines SYST660 Airline Operating Costs and Airline Productivity Lorenzo Flores

advertisement

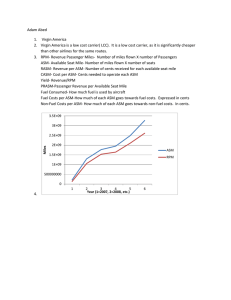

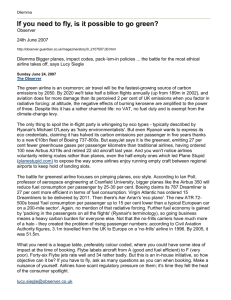

Alaskan Airlines SYST660 Airline Operating Costs and Airline Productivity Lorenzo Flores Alaskan Airlines Overview It is a Network Legacy Carrier (NLC). It is covering regional (Horizon), domestic, and international services. Has different types of aircraft (Q400s & B737s) Has premium class & mileage program It is codeshare member (one world) Alaskan Airlines Terms RPMs = Revenue Passenger Miles ∑(# of PAX per flight i)(distance flown by flight i) ASMs = Available Seat Miles ∑(# of seats per flight i)(distance flown by flight i) RASM = Revenue per Available Seat Mile (total revenue)/ASM CASM = Cost per Available Seat Mile (total operating expenses)/ASM Yield = average fare paid per passenger per mile (passenger airfare revenue)/RPM PRASM = Passenger Revenue per Available Seat Mile (passenger revenue)/ASM Alaskan Airlines Terms Fuel Consumed = Amount of fuel consumed over some time Fuel Costs per ASM = Cost of Fuel per ASM (total fuel cost)/ASM Non-Fuel Costs per ASM = Non-Fuel Cost per ASM Wages, landing fees, depreciation and amortization, maintenance and other operating expenses Alaskan Airlines Chart I Airline Traffic, Output and Performance Billions of Miles/Passenger Flown 25 1,000 0,900 20 0,800 0,700 15 0,600 RPM 0,500 10 0,400 0,300 5 0,200 0,100 - 0,000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 ASM SYST LOAD FACTOR Alaskan Airlines Chart I - Analysis After 9/11 , ASM and RPM slowly have recovered. Along with the increase in ASM supply, the airline has managed to maintain a System Load Factor of about 80% in the past 10 years. Alaskan Airlines Chart II Total Operating Revenue and Expenses $1 400 $1 200 Millions of Dollars $1 000 $800 OPS REVENUES $600 OPS EXPENSES INCOME Before Taxes $400 $200 $0 2001 -$200 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Alaskan Airlines Chart II – Analysis Total Operating Revenues and Total Operating Expenses have high correlation, which mean there is a thin margin of profitability. In 2008, due to the increase of the price of oil the, at the end of the fiscal year the airline end up with deficit. Alaskan Airlines Chart III Operating Revenue & Cost per Output $0,070 $0,060 $0,050 Cents $0,040 RASM $0,030 CASM Yield $0,020 PRASM $0,010 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 $0,000 Alaskan Airlines Chart III – Analysis RASM, CASM, Yield, and PRASAM have a high correlation. In 2008, there is a significant increase on CASM due to the escalation in oil price. Alaskan Airlines Chart IV Fuel & Non-Fuel Operating Expenses $1 200 100 $800 $600 Millions of Gallons Millions of Dollars 90 $1 000 80 70 60 50 40 $400 30 20 $200 10 $- 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 FUEL OPS EXPENSE NON-FUEL OPS EXPENSES SDOMT_GALLONS Alaskan Airlines Chart IV – Analysis The Non-Fuel Expenses are major operating costs and they out weigh Fuel Expenses. Both expenses had a similar behavior. Alaskan Airlines Chart V Unit Fuel & Non-Fuel Operating Expenses $0,0600 $0,0500 $4,000 $3,500 CENTS $0,0400 $0,0300 $0,0200 $2,500 $2,000 $1,500 $1,000 $0,0100 $- $0,500 $- US Dollars $3,000 Fuel Operating Expenses per ASM Non-Fuel Operating Expesnes per ASM Jet Fuel Prices Alaskan Airlines Analysis of Fuel Price Effect on Expenses: Oil is the variable cost with more weight in total operational expenses. Effect on Airline Finance: The profitability of this industry depend s directly on the price of oil. Effect on Airline Network Structure: Since airlines do not have any control on price of oil, the industry has had to improved efficiency and keep the costs from growing in other areas. (e.g. increasing Load Factor to reduce costs).