“Dirt for Debt” Plans in Bankruptcy Presenter: Stephen E. Gruendel

advertisement

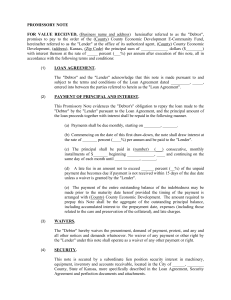

“Dirt for Debt” Plans in Bankruptcy What are the risks and is there anything you can do about them? Presenter: Stephen E. Gruendel What is a “Dirt-for-Debt” Plan and Why Should a Secured Lender Care? 1. Debtor proposes that a secured lender accept collateral in satisfaction of some or all debt. 2. Court determines the value of the collateral based on competing appraisals. 3. Plan limits the lender’s ability to realize upon repayment sources otherwise available to it to satisfy claims, if collateral not ultimately worth what Court says it is. When is a Secured Lender at Risk of Being Subject to a Dirt-for-Debt Plan? Most common fact pattern: 1. In a chapter 11 bankruptcy. 2. As part of a plan of reorganization proposed by debtor. 3. Secured lender does not support the debtor’s plan. 4. Debtor needs to “cramdown” the secured lender pursuant to the provisions of the Bankruptcy Code. Bankruptcy Requirements for a “Cramdown” Under 11 U.S.C. §1129(b) 1.Debtor’s plan must be “fair and equitable.” 2.For lender holding a secured claim, the debtor’s plan must provide either: a) Lender to retain liens and receive payments over time equal to value of collateral; b) Lender’s liens attach to proceeds if the property is sold; or c) Lender realizes the “indubitable equivalent” of its secured claim. What Does “Indubitable Equivalence” Mean? 1.The consideration provided to satisfy the lender’s secured claim must be too evident to be doubted 2.Transfer of all collateral in satisfaction of secured claim is clearly indubitable equivalent. “Common sense tells us that property is the indubitable equivalent of itself.” In re Sandy Ridge Development Corp., 881 F.2d 1346 (5th Cir. 1989) 3.If collateral valued at less than the amount of debt such that an unsecured claim exists, transfer of collateral will not affect the unsecured claim. As a Secured Lender, Why Should I Worry? Two problematic fact patterns, each of which limits recourse against other sources of payment: 1. Plan proposes to give the lender part of its collateral in satisfaction of secured debt and retain rest of collateral free and clear of liens. 2. Plan proposes to give the lender all of its collateral in satisfaction of secured debt and but limit recourse to other sources of recovery, such as guarantors. Either way, lender may be forced to accept the “dirt” as if it was as good as cash and forego sources of recovery otherwise available to it. Valuation: Where the Battle is Waged. The valuation process will determine how much credit the lender is forced to give in exchange for its collateral. In addition to usual factual questions regarding marketing costs, appropriate discount rates, condition of real estate market in general, time necessary to sell, legal questions include: 1. Whether to include entrepreneurial discount. 2. Whether to account for lender’s intended manner of disposition. 3. Whether to consider “liquidation value.” 4. Whether to require an equity cushion. 5. What is the legal standard itself? a. Evidence that the collateral is worth more than the secured claim? b. Evidence that the lender will recover the full claim? Valuation: Recent Cases in North Carolina, Part I. In re Bannerman Holdings, LLC 1. Bannerman I, 2010 Bankr. LEXIS 3742 (Bankr. E.D.N.C. October 20, 2010) Bankruptcy Court permitted dirt for debt at valuation determined by court, extrapolating value from competing appraisals. Did not account for entrepreneurial profit; minimal equity cushion. 2. Bannerman II, 2911 U.S. Dist. LEXIS 7573 (E.D.N.C., January 26, 2011) District Court reversed, expressing concerns with bankruptcy court’s extrapolation and with elimination of entrepreneurial discount. 3. Bannerman III – to be determined in late March, 2012 based on amended plan of reorganization. Valuation: Recent Cases in North Carolina, Part II. In re Sud Properties, Inc. (2011 Bankr. LEXIS 4656 (Bankr. E.D.N.C. August 23, 2011) 1. Bankruptcy Court declined to permit dirt-for-debt concept in debtor’s plan of reorganization. 2. Valuation did not reflect absence of doubt regarding lender’s ability to realize full claim. 3. Bankruptcy Court based value on manner that lender intended to dispose of the collateral. Valuation: Recent Cases in North Carolina, Part III. In re Sailboat Properties, LLC 2011 Bankr. LEXIS 1316 (Bankr. E.D.N.C. March 31, 2011) 1. Bankruptcy Court permitted dirt-for-debt plan at court-determined value of collateral. 2. Value determined based on the highest and best use for the property, assuming individual lot sales rather than bulk sale. 3. Valuation done on highest and best use notwithstanding that the lender testified that it intended a bulk sale transfer. Valuation: Recent Cases in North Carolina, Part IV. In re Clarendon Holdings, LLC 2011 Bankr. LEXIS 5313 (Bankr. E.D.N.C. October 19, 2011) 1. Bankruptcy Court permitted dirt-for-debt plan at market value determined by lender’s appraiser, even though lender’s appraiser submitted a much lower liquidation value based on a 90-day liquidation. 2. Use of a 90-day liquidation timetable for liquidation value appeared to be arbitrary. 3. Valuation in a dirt-for-debt context requires conservative valuation, but court not forced to accept liquidation value at a particular discount rate if the reasons for using such a discount rate are “arbitrary.” Preservation of Claims Against Guarantors. 1. Discharge of debtor does not affect liability of guarantors. §524(e). 11 U.S.C. 2. Debtors will likely argue that the plan provides that the dirt-for-debt provisions constitute “payment” in kind as to the liability evidenced by the court-approved amount, thus attempting to provide benefit to guarantors. 3. What will the state court judge hearing the guarantor collection action say? a. In a foreclosure, the guarantor would be liable for the amount in excess of what the bank bids, regardless of “fair value”. (NC law does not afford a guarantor the “fair value” defense.) b. Since a federal court determined the value after a contested hearing, res judicata principles may apply. What Can Be Done? 1.Marshal appraisal evidence of value in manner liquidation will be effectuated. 2.Seek relief from stay promptly. 3.Assert “bad faith” filing; attempt to have case dismissed at onset. Was the Filing Done in Bad Faith? Factors to consider: a) Debtor has only one asset. b) Debtor has few unsecured creditors whose claims are small in comparison to claims of secured creditors. c) Debtor has few employees. d) A foreclosure action already commenced as to the single asset. e) Debtor’s financial problems are essentially a two-party dispute with the secured creditor, which can be resolved through foreclosure. f) Timing of filing evidences intent to delay. Fourth Circuit Court of Appeals (MD, NC, SC, VA, WV) requires a filing to be objectively and subjectively in bad faith. The unresolved question: is a filing for sole purpose of protecting guarantors a per se bad faith filing? Comments/Questions? Stephen E. Gruendel Moore & Van Allen PLLC 100 North Tryon Street Suite 4700 Charlotte, NC 28202 704-331-3533 stevegruendel@mvalaw.com