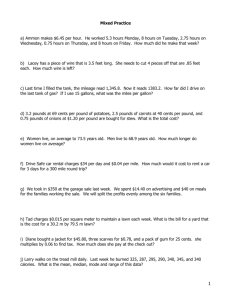

CattleNetwork.com, KS 11-28-07 FOCUS: Deferred CME Hogs Offer Price Protection Opportunity

advertisement

CattleNetwork.com, KS 11-28-07 FOCUS: Deferred CME Hogs Offer Price Protection Opportunity KANSAS CITY (Dow Jones)--The deferred Chicago Mercantile Exchange lean hog contracts--May through December 2008--offer producers an opportunity to lock in profitable prices, and some analysts recommend they do so on at least a portion of their hogs. Others say higher prices for the summer and fall lean hog futures contracts may occur in March and April, so producers need to weigh their options according to the level of risk they are willing to accept. Joe Kropf, analyst with Kropf and Love Consulting in Overland Park, Kan., said "absolutely, I am encouraging" producers to lock in prices on at least a portion of their hogs for next summer and fall, adding "the sooner the better." Ron Plain, agricultural economist at the University of Missouri, also is recommending producers take protection on their hog prices for next summer and through the balance of the year by selling futures directly or contracting through a packer. He said his price forecasts for next summer are about 10 cents per pound below the current futures prices. Plain predicts second quarter cash hog prices to average about 60 cents per pound on a dressed basis, third-quarter prices at 58 cents and the fourth-quarter at 48 cents. The June lean hog contract closed Tuesday at 75.82 cents, August was at 72.40 cents and December '08 hogs ended the day at 66.70 cents. A veteran livestock dealer in the western corn belt said he has encouraged his producer customers to protect their prices by selling futures, especially since slaughter rates have been consistently running sharply above a year ago so far throughout the fourth quarter. He said futures prices for the second half of 2008 climbed during the middle of November to levels that made sense for producers to sell, with July at 75 to 76 cents per pound, October at 67.00 to nearly 69.00 cents, and December '08 in the upper 60s cents per pound. At the same time, the CME two-day cash index was averaging around 49 cents. The latest break-even price for farrow-to-finish operations as calculated by John Lawrence, agricultural economist at Iowa State University, is 47.62 cents per pound on a live basis. This converts to about 63.50 cents a pound on a dressed, or carcass, basis. Closing prices for the October and December '08 lean hog contracts Tuesday are already down 2.37 cents and 2.75 cents, respectively, from their contract highs hit Nov. 20. Still, producers can ensure a profit on their hogs at the current prices and protect the equity they have built up over the previous four years, the dealer said. However, there also may be lost opportunities for increased profits should prices move even higher this spring. Rich Nelson, analyst with Allendale Inc.,said although his economic models suggest that all summer hog contracts are overpriced by about 5 cents per pound, he feels that the market could move up even more in a seasonal rally in the spring. "Prices should rally in March and April, and we recommend that producers do take price protection at that time," he said. Kropf suggests that producers consider locking in prices now on at least half and possibly up to 75% of their planned marketings for the summer and last half of 2008. If prices do move higher this spring than the current quotes, producers can then sell more hogs, he said. Kropf said he doesn't foresee the coming year as a repeat of 1998 because domestic demand and export sales are much better than then and slaughter capacity is much larger. Nevertheless, production is so large that any hitch in demand or the unexpected loss of a processing plant could result in a sharp downturn in prices. Producers must decide for themselves how much risk they are willing to take, Kropf said. Source: Curt Thacker, Dow Jones Newswires; 913-322-5178; curt.thacker@dowjones.com