Des Moines Register 10-19-07

advertisement

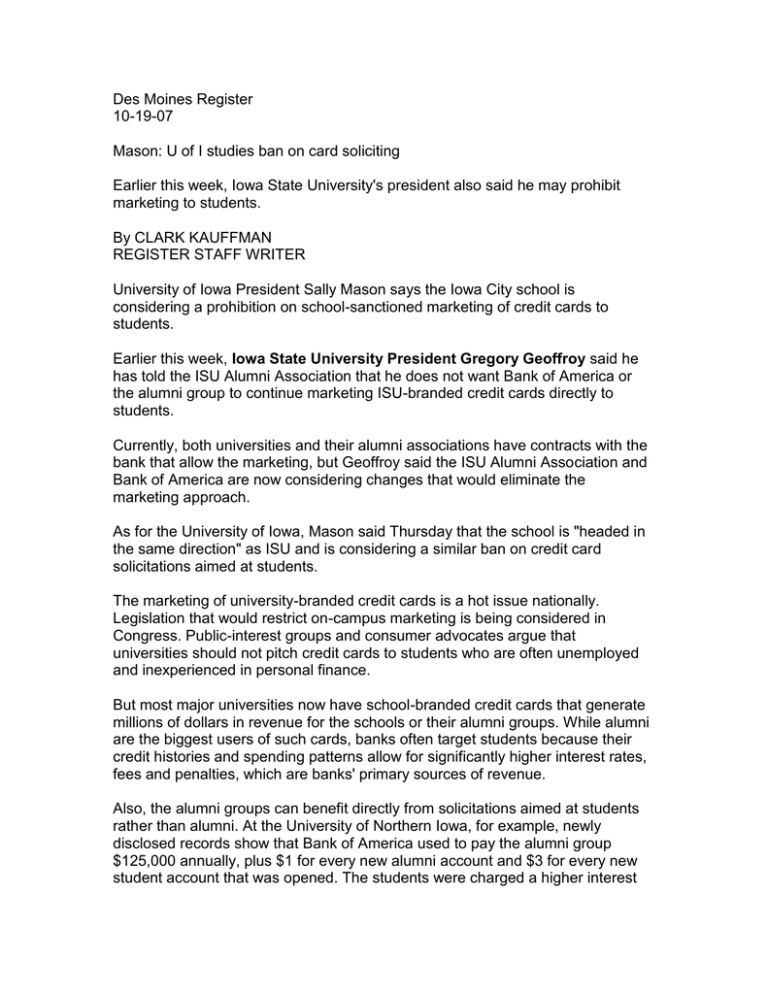

Des Moines Register 10-19-07 Mason: U of I studies ban on card soliciting Earlier this week, Iowa State University's president also said he may prohibit marketing to students. By CLARK KAUFFMAN REGISTER STAFF WRITER University of Iowa President Sally Mason says the Iowa City school is considering a prohibition on school-sanctioned marketing of credit cards to students. Earlier this week, Iowa State University President Gregory Geoffroy said he has told the ISU Alumni Association that he does not want Bank of America or the alumni group to continue marketing ISU-branded credit cards directly to students. Currently, both universities and their alumni associations have contracts with the bank that allow the marketing, but Geoffroy said the ISU Alumni Association and Bank of America are now considering changes that would eliminate the marketing approach. As for the University of Iowa, Mason said Thursday that the school is "headed in the same direction" as ISU and is considering a similar ban on credit card solicitations aimed at students. The marketing of university-branded credit cards is a hot issue nationally. Legislation that would restrict on-campus marketing is being considered in Congress. Public-interest groups and consumer advocates argue that universities should not pitch credit cards to students who are often unemployed and inexperienced in personal finance. But most major universities now have school-branded credit cards that generate millions of dollars in revenue for the schools or their alumni groups. While alumni are the biggest users of such cards, banks often target students because their credit histories and spending patterns allow for significantly higher interest rates, fees and penalties, which are banks' primary sources of revenue. Also, the alumni groups can benefit directly from solicitations aimed at students rather than alumni. At the University of Northern Iowa, for example, newly disclosed records show that Bank of America used to pay the alumni group $125,000 annually, plus $1 for every new alumni account and $3 for every new student account that was opened. The students were charged a higher interest rate than the alumni cardholders, and the alumni association collected 25 cents for every retail purchase made with a student credit card. Since May, Bank of America has not solicited students on the UNI campus. At the University of Iowa, the school is contractually obligated to "creatively and aggressively" market Hawkeye-branded cards. As part of that contract, the school agreed to promote card usage by giving the biggest-spending cardholders special access to coaches and student athletes at university functions or social events. Last month, after those elements of the contract were publicized, the university altered the credit card program to eliminate cardholder rewards that involve individual student athletes, a potential violation of NCAA rules that restrict the manner in which athletes can be used by the schools. Asked whether she was surprised to learn that the university's athletic director had signed contracts approving those elements of the credit-card campaign, Mason said, "Not having seen what was in these contracts previously, I wouldn't say I was surprised. But obviously we're looking at some of these things." Mason said the "reality is that if indeed aggressive marketing was going on, it didn't seem to be apparent to very many people, including our students." Geoffroy has said the ISU Alumni Association should open some of its records to public inspection because the group is staffed by university employees working on university business in university offices. When asked whether she holds that same position with regard to the University of Iowa Alumni Association, Mason said she thinks the school's position is consistent with that of ISU. She said the U of I Alumni Association now intends to make all of its "contracts and information" - including records unrelated to the credit cards - available to the public. UNI makes bank contract public The University of Northern Iowa Alumni Association has made public its marketing contract with Bank of America. The contract shows that from 1998 through 2002, the association collected $600,000 in royalties from the bank as part of an agreement to market UNIbranded credit cards. The association was also paid $1 for every new alumni account and $3 for every new student account. The Cedar Falls school receives no direct financial benefit from the Bank of America contract. In 2003, the contract was extended for five years. The new agreement guaranteed the alumni association $700,000 in royalties over five years, plus $260,000 in sponsorship fees. That agreement expires in January 2008. By comparison, the Iowa State University Alumni Association collects about $500,000 annually from its agreement with Bank of America, while the school itself receives about $40,000 annually. The University of Iowa Alumni Association receives about $1 million in annual revenue from the bank. About $200,000 of that money is passed on to the school. -Clark Kauffman