Des Moines Register 07-09-07 Dividend data indicate widening rich-poor gap

advertisement

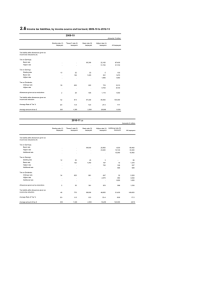

Des Moines Register 07-09-07 Dividend data indicate widening rich-poor gap GARY MAYDEW The Wall Street Journal and other publications have made much of a recent study by the Congressional Budget Office showing that real earnings for households had increased from1991 to 2005. Commentators claim the data show that income inequality is not increasing. However, two trends are troubling: - More of our gross domestic product is going to investors and less to labor. The Bureau of Economic Analysis reported that compensation to labor declined from 59 percent in 2000 to 56.5 percent in 2005. - Since 1983, the share of dividends received by high- income groups has increased, while the share received by the bottom 40 percent of taxpayers has decreased sharply. As the chart illustrates, the share of dividend income received by the bottom 40 percent of taxpayers fell from 20 percent to 8 percent from 1983 to 2004. The share received by the top 10 percent increased sharply (their share of dividends in 2004 was more than 50 percent higher than in 1983). What is really astounding is the share received by the top 1 percent of taxpayers. Their share of dividend income almost doubled during that period. Indeed, while Wall Street likes to tout widespread ownership of stocks, in 2004, the average dividend income reported by middle-income taxpayers (in the 40 to 60 percentiles) was only about $290. If one divides those dividends by the 1.6 percent dividend yield on the S& P 500 stocks for 2004, the average stock holdings for middle-class taxpayers would amount to only about $18,000. So much for widespread ownership of stocks. Globalization and free trade are likely to continue to increase the percent of GDP received by investors at the expense of workers. Suppose the share of GDP received by workers drops another 2.5 percent by 2010. At the current $13 trillion level of GDP, such a shift would transfer more than $500 billion from workers to investors, more than $3,000 per household. Policymakers need to monitor this current trend toward investors reaping more of our GDP because it exacerbates income inequality. Several steps could be taken to mitigate the effect of this trend. They include: - Reducing the employee's portion of Federal Insurance Contributions Act taxes, which finance Social Security, and making up the difference from the general budget. Low-income workers pay proportionately more in payroll taxes than their high-income employers. - Making more taxpayers eligible for the earned income credit and increasing its rate. - Providing more generous grants to workers losing jobs due to globalization. - Retaining the federal estate tax. A recent article in Atlantic magazine reported that social mobility in the United States actually trails that of many European countries, contrary to our cherished belief that we are the land of opportunity. Restoring a greater share of GDP to labor would help us regain that title. GARY L. MAYDEW is a retired Iowa State University accounting professor.