ThomasNet Industrial News Room, NY 05-08-07

advertisement

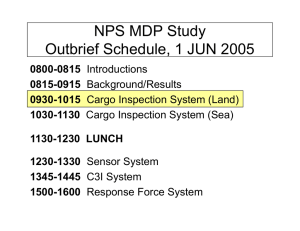

ThomasNet Industrial News Room, NY 05-08-07 Confronting Toxins, Terrorism and Other Cargo Threats By Fred White Theft, construction and congestion have threatened reliability of transportation systems for decades. Although shippers have learned to adapt to and work around these obstacles, unpredictable delays, longer transit times and higher costs associated with inspections may make the past look like the good old days. Transportation capacity constraints — which occur at freight terminals, seaports, motor carrier hubs and airports, as well as on roadways, railways, airways and waterways — are afflicting several supply chain areas in the world as the practice of global sourcing has increased. But that’s only part of it, four university researchers recently explained at IndustryWeek. Unpredictable delays, longer transit times and higher costs associated with inspections will make the past look like the good ol’ days, according to Ted Stank (University of Tennessee), Thomas J. Goldsby (University of Kentucky), Michael R. Crum (Iowa State University) and Joel Sutherland (Lehigh University). On the Surface In the United States, the current administration is aware of the challenge. In December, President George W. Bush issued an Executive Order called “Strengthening Surface Transportation Security” (via Logistics Management), in which he instructed the Secretary of Homeland Security in coordination with the Secretary of Transportation to “assess each surface transportation mode and evaluate the effectiveness of current federal security initiatives.” The Department of Homeland Security (DHS) said the initiative would help improve surface transportation security. The Homeland Security Act of 2002 provides the basis for DHS responsibilities in the protection of the nation’s critical infrastructure and key resources (CI/KR). However, the National Infrastructure Protection Plan (NIPP) says that “private sector owners and operators undertake CI/KR protection restoration and cooperation activities and provide advice, recommendations and subject matters expertise to the Federal Government.” What this means: companies must spend time writing guidelines for enhancing security and time with government officials to discuss them, as well as turn over company information. The NIPP Executive Summary also offers a list of actions to increase protection: • Hardening facilities; • Building resiliency and redundancy; • Incorporating hazard resistance into initial facility design; • Initiating active or passive countermeasures; • Installing security systems; • Promoting workforces surety programs; and • Implementing cyber-security measures. In the Air “When auditors for the U.S. Congress looked at what a proposed law calling for physical inspection of all cargo shipped on passenger aircraft would cost, they came up with a final table tab of $3.6 billion over 10 years,” according to Air Cargo World’s managing editor, Robert Moorman, in March. Moorman also pointed to House legislation that would phase in 100 percent inspection by the end of 2009. Moreover, “the White House opposes screening provisions, saying the technology does not now exist to handle the level of physical inspection required without impeding ‘the legitimate flow of commerce.’” The time could come when all cargo shipping shifts away from passenger airlines. Although the laws outlining the details of inspection depend on Congress, the execution of inspection may also be contingent on how quickly scientists and engineers transform workable plans into usable products that can, for instance, detect toxins and “weapons of mass destruction.” Near the Water For U.S.-based retail container ports, traffic is on the rise and is expected to break an all-time record in July, according to the monthly Port Tracker Report by the National Retail Federation and Global Insight, as we note in "Shipping: What to Look For in 2007 and Beyond". The ports surveyed in the report — including Los Angeles/Long Beach, Oakland, Tacoma, Seattle, New York/New Jersey, Hampton Roads, Charleston, and Savannah — handled a cumulative 1.28 million twenty-foot equivalent units (TEUs) in February, the most recent month for which traffic is available. What does this mean for port security? Port Tracker author and Global Insight economist Paul Bingham last month told Logistics Management: The remaining disruptive threat at the ports this year […] is the beginning of implementation by the U.S. DHS of the Transportation Worker Identity Credential (TWIC) program at ports. “The TWIC implementation issue bears watching because it is not yet clear exactly what will happen to the port truckers or even the long shore work force due to the new security requirements and background checks required to obtain a card to have unescorted access to work within port terminals.” Lockheed Martin has arranged for “all workers with unescorted access to secure areas of vessels and maritime facilities to successfully complete a background check and carry a biometric credential,” according to an announcement. This could expand into other industries, as well; nuclear and chemical industries come to mind. Theft The terrorist threat is not the only headache for shippers and their insurers. “It is estimated that combined losses suffered by the trucking industry, insurance companies and the railroads surpasses $10 billion in the U.S. annually,” according to the California Highway Patrol. These transportation thefts largely go unnoticed by consumers — though part of the cost of products they buy must reflect the losses. Creative minds with a technical bent have brought some useful technological products to help protect manufacturers’ interests. For example, global positioning systems, and a silent tracking device hidden in a protected vehicle have helped foil thieves. The device uses 2006’s non-story of the year, radio frequency identification (RFID) technology. Likewise, the U.S. Navy is using Gen2 RFID readers and tags as part of its ATAC (Advanced Traceability and Control) program, which manages the movement and tracking of Navy and U.S. Marine Corps retrograde materials from overseas back to Naval Aviation Depots and commercial vendor repair facilities in the U.S. Material Handling Management reports that the use of RFID technology enables the Navy to “substantially reduce the costs and improve the performance of its retrograde materials management operations compared to traditional barcode technology.” The leading issue in global transportation management, in addition to capacity constraints, is increased security, according to Stank, Goldsby, Crum and Sutherland. Weigh in: Does the threat of terrorism have a direct impact on your company’s transportation and logistics?