Bismarck Farm and Ranch Guide, ND 02-03-07

advertisement

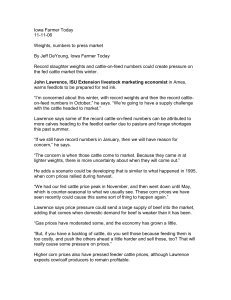

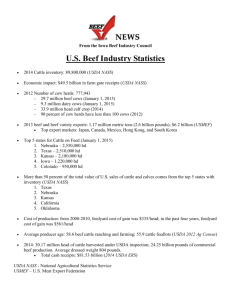

Bismarck Farm and Ranch Guide, ND 02-03-07 Beef cattle expansion ‘snuffed out' for time being By Jeff DeYoung, For Lee Agri-Media LEWIS, Iowa - If recent data is any indication, any build-up in the nation's cow herd is over. Cow and heifer slaughter have been up in recent months, John Lawrence, Iowa State University Extension livestock marketing economist, told producers at the recent 4-State Beef Conference. Beef cow slaughter was up 17.9 percent from a year ago, although Lawrence says very few cows were sent to town in 2005 because the industry was in the expansion phase of the cattle cycle. “After mid-year, cow slaughter really accelerated,” he said. “I think we've snuffed out expansion, at least for a while.” Heifer slaughter increased over the fourth quarter of 2006, Lawrence added, meaning more heifers are heading to the feedlot rather than into the breeding herd. “We had 16 percent more heifers on feed in October 2006 than we did the previous October, according to the last (USDA) Cattle on Feed Report,” he said. A combination of factors appears to be driving the trend, according to Lawrence. One is the lack of pasture in much of the Southern Plains; the other might be higher corn prices, which sent feeder cattle prices sharply lower over the last four months of 2006. He said demand for corn from the ethanol industry will continue to play a factor this year and in the near future. “Estimates indicate usage is going to grow from 5.5 billion bushels up to 10 billion bushels, and last year we grew 10.7 billion bushels in this country,” Lawrence said. “We currently have 63 plants either operating, under construction or planned in Iowa, with 11 more near our borders. That's going to require a lot of corn.” He said development of cellulosic ethanol production also is growing, adding another source of cellulose is distillers grains with solubles (DGS). Most of this ethanol co-product is used by the livestock industry. “They can pull out the cellulose and make ethanol,” Lawrence said. “It could reduce the amount of DGS for feed.” He added most forecasts indicate a surplus of DGS, with supply much greater than current or short-term demand. “Ethanol is growing past the federal mandate, and the supply will increase as long as it is profitable,” Lawrence said. “Profits will be driven largely by gasoline prices, corn prices and plant operating costs.” Some land could be coming out of the CRP and into crop production, he noted. Existing pasture also could be transformed into crop ground, Lawrence said, which could result in cow-calf producers reducing herd sizes even more. Beef demand appears to have leveled off recently, he said, although demand for Choice cattle remains high due to the lack of available product. In 1996, Lawrence said 61 percent of cattle graded Choice or above. That percentage was down to 56 percent last year. “In the late 1990s, we had about a $6 spread between Choice and Select cattle, and now that's about $10, and it hit $20 for about a month last summer,” he said. “There's a pretty good premium out there for Choice cattle because the percentage of Choice and Prime cattle is going down.” Since the USDA approved instrument grading for beef in the packing plants, Lawrence said the number of yield grade 4's and 5's is increasing. “We are seeing cattle that are leaner inside the ribeye and fatter outside, and that's not a good thing,” he said. “We've really seen a change in this since 2002.” With instrument grading, a USDA grader on the fence about a carcass can look at the machine to help make the decision, he added. “Because they were missing some of the yield grade 4's, the packer was paying more. Now that they aren't missing as many because of the better accuracy, producers are receiving less.” Some export markets are starting to pick up, although problems still exist with Japan and South Korea, Lawrence said. “While Japan is an issue of age verification, South Korea is more of an issue with the definition of boneless.” South Korean officials have rejected shipments of U.S. beef after finding extremely small fragments of either bone or cartilage in the beef, he said. “South Korea has zero tolerance, and that tells us that they really don't want our beef. We've quit shipping beef there because we don't want shipments coming back.” Lawrence said he expects mandatory country-of-origin labeling (COOL) to be implemented somewhat sooner than planned. After the program passed as part of the 2002 farm bill, mandatory usage was pushed back three times, eventually settling on 2008. With a Democrat-controlled Congress, he believes COOL could be on the fast track to implementation as early as late 2007. Lawrence said now that the National Animal Identification System has become voluntary rather than mandatory, its future is somewhat uncertain. “I think that's a voluntary program for the foreseeable future.” He said the USDA also is working on the assortment of product labels in the market. “The culture of agriculture involves a high level of trust. But, in the business world, if you can't prove it, it didn't happen,” Lawrence said. “Producers are going to have to adapt their practices to a changing world, and if they said the product is natural, they are going to have to be able to prove it.”