7/22/2013

advertisement

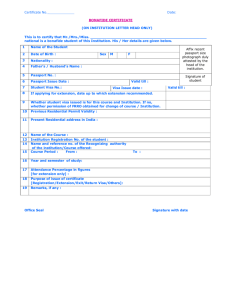

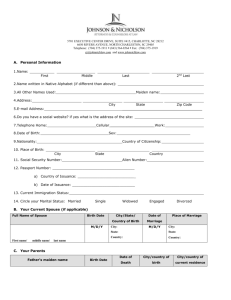

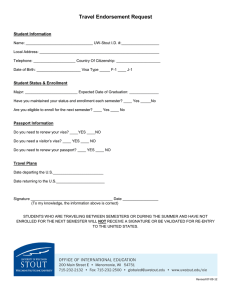

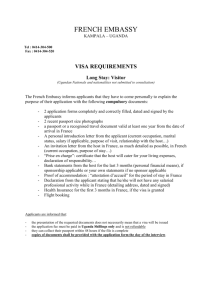

7/22/2013 FOREIGN NATIONALS TAX COMPLIANCE TRAINING “How To Optimize Your Processing of Foreign Nationals and Current Issues Update” July 25, 2013 Presenters • Jennifer Pacheco, Foreign Nationals Tax Compliance Program – NC Office of the State Controller • Michelle Anderson, University Program Manager – NC State University – International Employment and Taxation Disclaimer: The information within this presentation does not constitute tax/legal advice and each participant should seek his/her own counsel in addressing specific situations. 2 Training Agenda • • • • • • • Introduction to Foreign National Taxation Terminology Understanding Immigration Status Procedures for Paying or Compensating Aliens Treaty Benefits, Eligibility and Limitations Common Errors and Friendly Reminders Questions and Answers Appendix - examples 3 1 7/22/2013 Training Objectives You should: • Become familiar with the most relevant nonimmigrant visa classifications used by your institution • Become familiar with “non-resident alien” tax rules, and learn what a “non-resident alien” means for tax purposes • Learn the difference between temporary and permanent status, and the proper visa types for teachers, researchers, students, trainees, camp counselors, temporary employees • Become familiar with the various types of taxable compensations that can legally be paid to a foreign national. • Begin to understand what the required documentation is to process payments for foreign nationals. 4 Why are we here discussion this subject? • Per Internal Revenue Code 1441 to 1443 - Withholding On Payments of U.S. Source Income to Foreign Persons • Per IRS Publication 515: “This publication is for withholding agents who pay income to foreign persons, including nonresident aliens, foreign corporations, foreign partnerships, foreign trusts, foreign estates, foreign governments, and international organizations.” Specifically, it describes the: • persons responsible for withholding (withholding agents) • the types of income subject to withholding, and • the information return and tax return filing obligations of withholding agents 5 TRUE or FALSE? Failure to follow taxation regulations applicable to Foreign Nationals only affects the employee? 6 2 7/22/2013 Foreign National Contact • You may be wondering - WHY do I need to worry with this? – Foreign nationals have a special set of work restrictions and tax guidelines they must follow. – Ensure appropriate documents are received – Provide necessary communication to foreign nationals – COMPLIANCE ISSUES: • Each entity is at risk of very large penalties and fines • Potentially jeopardizes the foreign national’s visa status. WHO meets with your foreign nationals ANNUALLY? Does anyone? 7 Helpful Definitions • Withholding Agent (your institution) – A U.S. or foreign person that has control, receipt, custody, disposal, or payment of any item of income of a foreign person that is subject to withholding – Liable for taxes owed • Foreign National (any non-U.S. Citizen) – An individual that owes allegiance to or who is under the protection of a country other than the United States • Non-resident Alien • Resident Alien 8 Helpful Definitions Immigration United States Citizens vs. Taxation United States Citizens Lawful Permanent Resident Lawful Permanent Resident Foreign National Non-resident Alien for Tax Purposes OR Resident Alien For Tax Purposes 9 3 7/22/2013 Helpful Definitions - Immigration • Temporary (nonimmigrant) status – Limited by: • Time – duration of authorized period of stay • Scope – allowable activities • Location – employer as well as physical presence – Must have nonimmigrant intent – Generally denoted by alphabetical notation • Permanent (immigrant) status – Allows holder to remain in U.S. indefinitely – Permanent Resident can live and work wherever, and for whomever s/he chooses – no limitations based on time, scope or location – “Green card” is another way to indicate someone has permanent resident status – Treated just like a US citizen for taxation purposes 10 What Tax Status Determines United States Non-United States • • Worldwide Income – Citizen – Residents • Green Card • SPT – Entities org. under U.S. laws – W-4/W-2 • Standard Wage Withholding – W-9/1099 • 28% backup w/h • Some corporate exemptions • $600 threshold for most reporting – No treaty benefits (some exceptions) – No reporting for goods purchases – Filing deadlines • Payees: 1/31 • IRS: 2/28-4/30 11 U.S. Source Income – Not U.S. Citizen or resident – Not org. under U.S. laws – W-4/W-2 • Special withholding rules – W-8s/8233/1042-S • 30% withholding (14% on Scholarships) • No corporate exemptions • No minimum dollar threshold for payments • No reporting for goods purchased – Can claim treaty benefits or ECI to avoid or lessen U.S. taxation/withholding if qualify – Filing deadlines • Payees: 3/15 (W-2: 1/31) • IRS: 3/15-4/14 Used with the permission 2007-2013 COKALA Tax Information Reporting Solutions, LLC. Employees vs. Students Back to Immigration Requirements • A foreign national employee is one who comes to the U.S. on a temporary visa for the sole purpose of working in the U.S. • A foreign national student is one who comes to the U.S. on a temporary visa for the primary purpose of studying in the U.S. – Any employment students engage in is “incidental to their status” and is restricted – In some instances they are NOT allowed to be employed at all (e.g. their DS-2019 or I-20 indicates they are foreign-funded and does not show any support from your institution) 12 4 7/22/2013 Two Types of Policies • High-level Policies: – Define institution’s commitment to complying with IRS, immigration, federal, state, local and other regulations • Internal Operational Policies: – Day-to-day implementation policies; based on what can and cannot be done within framework of high-level policies 13 Having Written Policies and Procedures Will… • Make your job easier • Reduce frustration for everyone • Help departments and payees understand what to do and why • Will aid in more efficient processing of payments • Increase institutional compliance • Show the IRS you take compliance seriously 14 Basics of NRA Processing • Initial processing of Foreign National – Determine Immigration Status • U.S. Citizen vs. Non-Resident Alien – Perform Substantial Presence Test (Tax Status) • F, J, & M Student Exceptions – Determine Source of Income • Annual Batch processing – Renewal of paper work – Ensure the foreign national remains in status. – Changes in Tax Residency Status 15 5 7/22/2013 Majority of Visa Types you will see: Teachers, Researchers and Temporary Employees H-1B, TN, O-1, as well as all other visa categories Foreign Nationals with a valid Employment Authorization Card (EAD) may receive wages Employment is permitted only if the card has not expired Sponsored by the departments and processed through IE Students and Researchers F-1, J-1, and M-1 F-1 Optional Practical Training (OPT): must have EAD Sponsored by the Office of International Scholars (OIS) Trainees and Camp Counselors F-1 or J-1 Athlete, Artist, and Entertainers P-1, P-2, P-3 Cultural Exchange Program Q-1, Q-2 Please refer to the Visa and Payment Chart for more detailed information. 16 Procedures - Keep it Simple 6 Steps for Paying or Compensating Aliens: Step 1 – Gather Data Step 2 – Type of Payment Step 3 – “Source” of the Income Step 4 – Subject to Income Tax Withholding? Step 5 – Subject to FICA? Step 6 – Reportable and How? 17 Step 1 – Gather Data (Tax Assessment) • Data Gathering Form should be completed by each foreign national and presented with copies of the specified immigration documentation. – Used to determine: • Eligibility for payments dependent on visa type • Determine tax status is Non-resident Alien or Resident Alien (Substantial Presence Test) 18 6 7/22/2013 What Tax Residency Determines • Review of data gathered – Determines: • Income subject to tax – RA (Worldwide) or NRA (US Only) • Whether certain treaty exemption apply • Withholding certificate for treaty benefits and other tax forms – 8233 or W-8Ben – Must have a U.S TIN – W-4 19 The Substantial Presence Test (SPT) • A 183-day formula based on: – Current status and date of entry • Also expected departure date – 3-calendar years history of U.S. visits – Longer history if any visits in most recent 3 years are/were in F, J, M, or Q Status – Windstar will do this process for you. 20 HELP!!! Who NEEDS a Tax Assessment? • If your institution shares information you can learn about someone’s immigration status from: – I-9’s – Social Security Cards (Is there a notation on the card?) – Human Resource databases • For taxation purposes – you are allowed to ask for immigration information and documentation 21 7 7/22/2013 Tips for identifying a Foreign National • Publication 515 – Presumption Rules, “if you cannot reliably associate a payment with valid documentation you must apply certain presumption rules or you may be liable for tax, interest, and penalties.” • It is better to tax and have those taxes refunded by the IRS to the individual, than to not tax at all and face penalties and fines. 22 Tips for identifying a Foreign National (cont.) • A newly-arrived payee already has an SSN but has represent that they have no prior presence in the U.S. • Country of Visa issuance or foreign residence is different than county of tax residency claimed by payee. • Situations where a business entity is payee, but the true beneficial owner of the income is an individual. • A payee asking you to make payment to a charity or foundation instead of them. • U.S. Port of entry stamps or visas in an individual’s passport that are not mentioned in the individual provides to you. 23 Step 2 – The Type of Payment • The type of payment made to an alien falls into four primary categories: – Dependent personal services: Wages, Service related scholarship/fellowship/assistantship payments, travel reimbursements – Independent personal services: Consulting fees, guest speaker – Scholarship/Fellowships: Qualified/Nonqualified – Other Income Types: Prizes and awards, royalties, etc. 24 8 7/22/2013 Types of Taxable Income Wages Assistantships Scholarships Fellowships Travel Reimbursements Housing Allowances NOT Allowed to Pay Stipends or Honorariums . 25 Step 3 – The Source of the Income • Source of income is determined in the following manner: – Compensation paid to employees and independent contractors, income is sourced to the country where services are performed. – For non-compensation payments such as scholarships/fellowships, grants, prizes and awards, the source of income is the residence of the payor regardless of who actually disburses the funds. 26 Step 4 – Is the Payment Subject to Income Tax Withholding? • Resident Alien – (similar to U.S. Citizens) – withholding tax rules and rates • Non-resident Alien – U.S. sourced income is taxable with a few exceptions. – Federal Tax Rate 14%-30% – NC Tax Rate 4% – Contractors with ITINs ($1,500 threshold) – Tax Treaties 27 9 7/22/2013 Windstar A valuable software that stores all your foreign national information and produces your tax documents. Functions of Windstar: – Runs the Substantial Presence Test – This software can produce: W-4 W-8BEN 8233 W-9 – Produces 1042-S and 1042 forms. – Assists with electronic 1042 submission file. – Runs useful reports. 28 Step 5 – Payment Subject to FICA? Non-resident Alien • The only aliens exempt from FICA are the following Nonresident Alien visa holders: – – – – F-1 J-1 M-1 Q-1 • The above visa holders are subject to FICA taxes for the entire year (January 1) they become resident aliens. 29 Withholding Federal Income Tax • Form W-4 for NRA’s – The following employees may claim any number of legitimate dependent exemptions • Residents of Canada, Mexico and South Korea • Business Apprentices and Students from India for spouses and for children who are U.S. citizens or resident aliens • Nationals of American Samoa and Northern Mariana Islands – Must write “NRA” or “Nonresident Alien” above dotted line - on line 6. 30 10 7/22/2013 Treaty Benefit Eligibility and Payments to NRAs • The U.S. has treaties with over 60 countries around the world affecting payments to foreign nationals • Offer tax exemptions within the U.S. for foreign nationals who were or are tax residents (not citizens) of a treaty country and meet specific criteria 31 Considerations When Granting Treaty Benefits • • • • U.S. tax status: NRA or RA Required Social Security Number or ITIN Country of tax residency (may not be country who issued visa) Primary purpose of visit as evidenced by – DS-2019 for J Exchange Visitors – I-797 approval notices for H-1B, O-1, Q – I-20 for F and M visitors • Status of the organization (educational, research, medical, etc.) • Type of Income Paid – Conducting research, teaching, training, other paid activities Used with the permission of Windstar Technologies, Inc. 32 Considerations When Granting Treaty Benefits (cont.) • Benefit Limitations – Retroactive Loss of Benefits – Prospective Loss of Benefits – One-Time Use • Requirement to Re-establish Residency – Back-to-back Rule – Combine Benefit Period • Saving Clause and Exceptions Windstar will denote exceptions to consider 33 11 7/22/2013 Step 6 – Determining if a Payment is Reportable and How Nonresident Alien • Payments are reported to the federal government in the following manner: – Forms Issued • W-2 – Taxable Employment Income • 1042-S 1. Any treaty-exempt income 2. All other U.S.-Source Taxable Income and Taxes Withheld – Form 1042-S Resident Alien • Payments reported in the same manner as U.S. Citizens. – Forms Issued • W-2 – Taxable Employment Income • 1099 1. Non-employee Compensation 2. Other Income • 1042-S – Any treaty-exempt income NO Form 1099 34 Deposit Requirements: Mandatory eFiling of 1042-S forms begins for TY 2014 35 Common Errors & Friendly Reminders • W-8 BEN Validity Periods (TBD – FATCA) – If TIN included, then forever unless facts change, or if no payments are made to NRA for 1 year. – If no TIN (but caution if TIN require to be valid claim), then valid the year receive plus 3 full calendar years. – Only valid for the treaty payment being made • Are you aware of the proposed changes in the Foreign Account Tax Compliance Act (FATCA) and the new form W-8BEN-E? – How is this going to impact your business practices? – Do you need to file for a FIRE System Account? 36 12 7/22/2013 Common Errors & Friendly Reminders • Form 8233 with Certifying Statement from NRA – TIN Required • Can attach copy of SSN application receipt – Must submit to IRS within 5 days of accepting – IRS has 10 business days to reject treaty • Special Handling is required for payments to F-1 and J1’s from other universities/community. • Required to ensure F-1 or J-1 is still in status. 37 Common Errors & Friendly Reminders • Employment Income – Claiming incorrect personal exemptions • Resident Alien – Single – Married filing separately – Married filing jointly – Head of household • Non-Resident Alien – Single – Married (either alone, with spousal exemption, or filing separately) – Form W-4-Single 0 or 1 (unless an exception applies) • Payment of Stipends – Taxable vs. Non-taxable • Form 8233 – Institution files vs. IRS files 38 BEST PRACTICE!!! Best practices in making payment to non-resident Aliens (NRAs) • Implement policies and procedures for meeting IRS due diligence. – Recommend posting them to your website • Keep up-to-date on rules and forms procedures – they change frequently! Immigration risk for your institution • Unauthorized workers performing services – Non-sponsored employees performing services for your institution – Foreign nationals not authorized to perform independent services – Have you established a process to ensure your departments know who they can and can’t contract with? 39 13 7/22/2013 Summary • • • • • • • • Determine the foreign national's U.S. tax status – SPT Perform due diligence with NRA Complete and file all required IRS forms Withhold on and report income correctly to avoid unnecessary assessments, fines and penalties Provide tax benefits to students, professors, researchers, medical residents, trainees, interns, and independent contractors Remember treaty benefits should only be provided to foreign national’s who have either an ITIN or Social Security number Be fair but when in doubt be conservative. Better to tax and let them request a refund than not to tax at all and be fined. Be prepared for an IRS audit – where is your audit trail????? 40 Contact Information • Any questions that are not handled within the presentation will be responded to via email. • Follow-up questions can be submitted to Jennifer Pacheco, with the NC Office of the State Controller, at jennifer.pacheco@osc.nc.gov or 919-707-0764. • For additional training opportunities please visit: – http://www.osc.nc.gov/Foreign_Nationals/training.html 42 14 7/22/2013 THANK YOU! 43 Appendix The Appendix will not be covered during this training. This is provided as additional resources. 44 NEW I-94 Admission Process! • CBP changed process in April/May 2013 – No longer issuing the I-94 card to most foreign nationals entering the U.S. from abroad – Passport stamp instead with limited information – Foreign national can go online after entry to www.cbp.gov/I94 to enter information and print out admission information – I-94 number and information is still required by USCIS for the I-9 process, for drivers licenses, SSN applications, etc., so ask your foreign national employees for this print-out! 45 15 7/22/2013 Original I-94 Card 46 New I-94 Admission Document 47 F-1 Visa (Students) Documentation required for payments: • Allowable payments • Immigration Documentation: – Passport (Some passports will have more than one page) – Visa – I-94 card (now I-94 admission number) (Small index looking card with entry date stamped on it. A foreign national CAN NOT legally work without this card.) – I-20 ( Approval notice for F-1 status) • Taxation Documentation: – NC-4 – W-4 – W-8BEN – 8233 (If applicable) You will collect the same documentation not only for employment, but also to pay scholarships, fellowships, and travel reimbursements. Can not be paid as an independent contractor. Should not ever be issued a 1099. 48 16 7/22/2013 F-1 Visa CPT (Curricular Practical Training) Documentation required for payments: • Immigration Documentation: – Passport – Visa – I-94 – I-20 (I-20 must have the employers information listed on page 3 of the I-20. Without this notation the employment is not legal.) • Taxation Documentation: – NC-4 – W-4 – W-8BEN You will collect the same documentation not only for employment, but also to pay travel reimbursements. Should not be paid as an independent contractor if in NRA tax status. Should not be issued a 1099 in NRA tax status. 49 F-1 Visa OPT (Optional Practical Training) Documentation required for payments: • • Immigration Documentation: – Passport – Visa – I-94 – I-20 (must state that they are on OPT) – Valid EAD Card (Employment Authorization Document) Employment must be related to their field of study listed on the I20. Taxation Documentation: – NC-4 – W-4 – W-8BEN You will collect the same documentation not only for employment, but also to pay travel reimbursements. Should not be paid as an independent contractor if in NRA tax status. Should not be issued a 1099 in NRA tax status. 50 J-1 Student Visa Documentation required for payments: • Immigration Documentation: – Passport – Visa – I-94 Card (now I-94 admission number) – DS-2019 (Approval notice: Must show student sub-category) • Taxation Documentation: – NC-4 – W-4 – W-8BEN – 8233 (If applicable) You will collect the same documentation not only for employment, but also to pay scholarships, fellowships, and travel reimbursements. Can not be paid as an independent contractor. Should not ever be issued a 1099. 51 17 7/22/2013 J-1 Visa (Curricular Practical Training) Documentation required for payments: • Immigration Documentation: – Passport – Visa – I-94 – DS-2019 (Must show student sub-category) • Taxation Documentation: – NC-4 – W-4 – W-8BEN – 8233 (If applicable) • Letter from Institution attached to DS-2019 You will collect the same documentation not only for employment, but also to pay travel reimbursements. Should not be paid as an independent contractor if in NRA tax status. Should not be issued a 1099 in NRA tax status. 52 J-1 Visa (Optional Practical Training) On or Off-Campus Employment • Academic Training J-1 – During or after completion of their academic degree for a total of 18 months – Employment must be related and appropriate to the level and field of study – Commence within 30 days of completion of their academic program – Postdoctoral students are eligible for 36 months – Authorization is by written approval from Responsible Officer (RO) – NO EAD is required • Documentation required for payments – See previous slide 53 J-1 Visa (Student Intern) Documentation required for payments: • Immigration Documentation: – Passport – Visa – I-94 – DS-2019 (Must show student intern sub-category) • Taxation Documentation: – NC-4 – W-4 – W-8BEN – No Treaty (Be extremely careful when entering this category into Windstar) You will collect the same documentation not only for employment, but also to pay travel reimbursements. Should not be paid as an independent contractor if in NRA tax status. Should not be issued a 1099 in NRA tax status. 54 18 7/22/2013 H1-B, E-3 & O-1 Visas Documentation required for payments: • Immigration Documentation: – – – – Passport Visa I-94 Card I-797 (Approval Notice) • Taxation Documentation: – – – – NC-4 W-4 W-8BEN (NRA) or W-9 (RA) 8233 (If applicable) (Be careful with these treaties. Make sure you review the loss clauses before issuing the tax treaty.) Remember once a foreign national applies for permanent residency they are no longer eligible for tax treaty. 55 TN-Visa (Canada/Mexico) Documentation required for payments: • Immigration Documentation: – Passport – I-94 Card (Must have duration of stay. Only eligible to be employed for the dates listed on the I-94 card.) – I-797 (May or may not have an approval notice) • Taxation Documentation: – NC-4 – W-4 – W-8BEN (NRA) or W-9 (RA) 56 Employment Authorization Documents Documentation required for payments: • Immigration Documentation: – Passport – Visa – I-94 Card – EAD Card • Taxation Documentation: – NC-4 – W-4 – W-8BEN (NRA) or W-9 (RA) You must review the authorization code. Taxation requirements correspond with the authorization codes. Link to EAD codes: http://www.uscis.gov/portal/site/uscis/menuitem.5af9bb95919f35e66f61417 6543f6d1a/?vgnextoid=f3c02af9f0101310VgnVCM100000082ca60aRCRD 57 19 7/22/2013 Employment Authorization Document - Codes 58 Employment Authorization Document - Codes 59 Employment Authorization Document - Codes 60 20 7/22/2013 Scholarships – Per Publication 970 • Qualified – A scholarship or fellowship is tax free (excludable from gross income) only if you are a candidate for a degree at an eligible educational institution • It does not exceed your expenses; • It is not designated or earmarked for other purposes (such as room and board), and does not require (by its terms) that it cannot be used for qualified education expenses; and • It does not represent payment for teaching, research, or other services required as a condition for receiving the scholarship (with a few small exceptions) • Non-Qualified – Scholarship Fellowship payments issued to nonresidents for tax purposes, are subject to 30% federal withholding with the following exceptions; • Under IRC section 1441 (b) a reduced rate of 14% is granted to F, J, M, and Q visa holders. • Income that is exempt from Federal Withholding due to a Tax Treaty Exemption. 61 Scholarships – Qualified vs. Non-Qualified 62 Please note this chart is from the 2011 Publication 970 21 How To Optimize Your Processing of Foreign Nationals and Current Issues Update ADDITIONAL RESOURCES July 25, 2013 Helpful Foreign Nationals Tax Compliance Resources • Foreign National Tax Compliance Website – http://www.osc.nc.gov/Foreign_Nationals/ • Information: Updated Policies and Procedures – March 2011 • Windstar User Website • Windstar List Service • Tax Treaty Benefits for Foreign Nationals Performing U.S. Services (purchase from Windstar) • NC State University Website – • http://www7.acs.ncsu.edu/hr/payroll/fntax/ Foreign National Tax Compliance Training Curriculum – http://www.osc.nc.gov/Foreign_Nationals/training.html • NCSU – Foreign National Taxation & Immigration Compliance Conference – http://go.ncsu.edu/fnticc • NCSU HR Academy Classes – http://www.ncsu.edu/human_resources/tod/coursedetail.php?&id=121 • Easy-to-read tax treaties and View from the Crow's Nest archives at www.windstar.com • www.irs.gov click on Individuals, click on International Taxpayers • www.nafsa.org for information on government procedures affecting foreign students and exchange visitors • IRS Publications (www.irs.gov) – 15, Employer's Tax Guide (page 17) • http://www.irs.gov/pub/irs-pdf/p15.pdf – 515, Withholding on Non-resident Aliens and Foreign Entities – 519, US Tax Guide for Aliens – Internet Search Engine (Google) NC STATE UNIVERSITY FOREIGN NATIONAL INFORMATION FORM (Page 1) All questions below must be answered. (1) Last or Family Name First (2) Social Security # Middle (3) NC State ID # (4) LOCAL ADDRESS IN U.S.: Address Line 1: (5) FOREIGN RESIDENCE ADDRESS: Address Line 1: Address Line 2: Address Line 2: Address Line 3: City: City: Postal Code: State: Zip Province/Region Country: (6) Country of Citizenship: (7) Country that issued Passport: (8) Passport #: Expiration Date (9) Visa # (control number): mm/dd/yy (10) Have you been to the United States before your arrival at NC State University? If yes, see Page 2. ο Yes ο No. (11) IMMIGRATION STATUS: ο U.S. Immigrant/ Permanent Resident ο F-1 Student ο J-1 Exchange Visitor ο H-1 Temporary Employee ο J-2 Spouse or Child of Exchange Visitor ο Other: (12) IF IMMIGRATION STATUS IS J-1, WHAT IS THE SUBTYPE? CHECK ONE: ο 01 Student ο 03 Trainee ο 12 Research Scholar ο 02 Short Term Scholar ο 05 Professor ο Other: ____________________________ (13) WHAT IS THE ACTUAL PRIMARY ACTIVITY OF THIS VISIT? ο 15 Student Intern CHECK ONE: ο 01 Studying in a Degree Program ο 05 Observing ο 09 Demonstrating Special Skills ο 02 Studying in a Non-Degree Program ο 06 Consulting ο 11 Temporary Employment ο 03 Teaching ο 07 Conducting Research ο 12 Here with Spouse ο 04 Lecturing ο 08 Training ο 21 Summer Work/Travel (14) WHAT IS THE ARRIVAL DATE OF YOUR FIRST VISIT TO THE UNITED STATES? / / . Month Day Year (15) WHAT IS THE START DATE OF YOUR VISA FOR THIS PRIMARY ACTIVITY? / / . Month Day Year (16) WHAT IS THE PROJECTED END DATE OF YOUR VISA PRIMARY ACTIVITY? / / . Month Day Year (17) WHAT IS YOUR JOB AND DEPARTMENT? (18) WHAT TYPE OF STUDENT? (19) IS YOUR SPOUSE IN THE US? ο Yes ο No ο Undergraduate ο Masters ο Doctoral ο Other Ex: RA / TA of Chemistry (20) COUNTRY OF TAX RESIDENCE: (Have you lived in any countries other than your home country?) ο Yes ο No If yes, country and dates of residency? . to / /______ Month Day Year . (21) ARE YOU A CITIZEN OF ANY OTHER COUNTRY OTHER THAN YOUR COUNTRY OF BIRTH? (i.e. Do you have a passport from another country or are your parents citizens of another country?) ο Yes Country:_________________ / / . Month Day Year Number of dependents ο No If yes, what country? __________________________ I hereby certify that all of the above information is true and correct. I understand if my status changes from that which I have indicated on this form I must contact the Office of International Taxation immediately. Signature: E-mail address: Date: NC STATE UNIVERSITY FOREIGN NATIONAL INFORMATION FORM (Page 2) PREVIOUS HISTORY PLEASE LIST ALL VISA IMMIGRATION ACTIVITY FOR THE LAST FIVE (5) YEARS AND ALL F, J, M, OR Q VISAS SINCE 1/1/85: Date of Entry Date of Exit Visa Type Immigration Status Subtype (if on a J-1visa) Primary Activity of Visa Did you use treaty benefits? / / / / ο Yes ο No / / / / ο Yes ο No / / / / ο Yes ο No / / / / ο Yes ο No / / / / ο Yes ο No / / / / ο Yes ο No / / / / ο Yes ο No / / / / ο Yes ο No / / / / ο Yes ο No / / / / ο Yes ο No HOW TO COMPLETE THE FOREIGN NATIONAL INFORMATION FORM: 1. Name: List full name 2. Social Security Number: Enter either the social security number issued the US Social Security Administration or ITIN (Individual Taxpayer Identification Number). If you have not received your social security number yet, leave blank. 12. Specific details for J-1 Visas: Check the appropriate type that matches your DS-2019. 13. Actual Primary Activity: Check one activity 14. Actual Entry Date into the United States: Must include month, day, and year of the first time ever into the US. Approximate if you don’t know. 3. Campus Temporary ID#: Enter your Employee/Student/Faculty Identification Number issued by NC State University. 15. Start Date: The start date of your first visa for this primary activity. 4. Local Street Address: List your US mailing address 16. End Date: The projected end date on your DS-2019 or I20. 5. Foreign Residence Address: List your permanent residence in your home country. 6. Country of Citizenship 7. Country that issued Passport: Enter Country that issues the passport not the country where it was issued. 8. Passport Number and Expiration Date 9. Visa #: The control number located in the upper right hand corner of your Visa. 10. Original entry to the United States: If you have been to the US before this time, check yes. 11. Immigration Status: Check the type of immigration status you currently hold. If you check U.S. Immigrant/ Permanent Resident and have a “green card”, you may proceed to the bottom of the form, sign and date. 17. Occupation: Describe in general the services you are being compensated for. 18. Check appropriate box if applicable. 19. Is your spouse in the USA?: Check appropriate box. Enter number of dependents in the USA other than spouse. 20. Tax residence is where you last paid taxes as a resident and can be different from legal residence. Do not include the USA. North Carolina Foreign Visitor Information Form This form must be completed before you can receive any form of payment. All applicable questions below must be answered. The following documents must be attached to this completed form: 1. copy of Passport; 2. copy of Visa; 3. copy of I-94 Departure Record; 4. copy of Social Security card or ITIN card; 5. copy of Form I-20 or Form IAP66/DS2019. PERSONAL / PASSPORT INFORMATION Last or Family Name: ________________________ First: _________________ Middle: ____________________ U. S. Social Security No. or Individual Taxpayer Identification No.: _________________ Student No.: ___________________________ Date of Birth : ____/____/_____ month/ day/ year E-mail address: __________________________________ U. S. Telephone No.: (Work)____________________ U. S. Telephone No.: (Home)________________________ Country of citizenship: _________________________ Country that issued passport: _______________________ Passport No.: _______________________ Passport Expiration Date: ____/____/____ month/ day/ year Visa No.: (control number in upper right corner of stamp in passport): ______________________ ADDRESSES U.S. Local Street Address: Foreign (home) Residence Address (should not be P.O. Box) _______________________________________________ Street _______________________________________________ City _______________________________________________ State Zip Code ________________________________________________________ Street ________________________________________________________ City Province / State Postal Code ________________________________________________________ Country CURRENT IMMIGRATION STATUS [ ] U.S. Immigrant/Permanent Resident [ ] F-1 Student [ ] H-1B Temporary Worker [ ] J-2 Dependent [ ] J-1 Exchange Visitor [ ] Other: _____________ --IF J-1 Exchange Visitor, what category? [ ] Student [ ]Professor [ ] Research Scholar [ ] Short Term Scholar [ ] Other: __________________ PRIMARY ACTIVITY DURING THIS VISIT (Choose only one) [ ] Studying in a degree program [ ] Observing [ ] Demonstrating special skills [ ] Studying in a non-degree program [ ] Consulting [ ] Clinical activities [ ] Teaching [ ] Conducting research [ ] Temporary employment [ ] Lecturing [ ] Training [ ] Here with spouse What is the actual date you entered the United States? (This date is stamped on your visa and I-94 Departure Record) _____/ ____/ _____ month/ day/ year What was the start date of your immigration status for the current activity? (In many cases, this is the date you entered the U.S.) _____/____/______ month/ day/ year What is the projected end date of your primary activity? (In many cases, this is the completion date on your immigration document.) _____/____/ ______ month/ day/ year If you are a student, at what level do you study? [ ] Undergraduate [ ] Masters Form NRA 001 [ ] Doctoral [ ] Other: ________________ Describe the activity that will result in U.S. income (i.e. professor of physics, consulting, teaching assistant, food service worker, scholarship, contest prize, etc.) ________________________________________________________ Name of department providing the income: __________________________ Amount: ______________________* Payment Type: [ ] Other_____________________ [ ] Wages [ ] Scholarship [ ] Honorarium * For Wages the amount should be the estimated annual income (Calendar Year). TAX EXEMPTIONS INFORMATION Is your spouse in the U.S.? [ ] Yes [ ] No Is your spouse employed? Do you want to claim an exemption for your spouse if legally allowed to do so? [ ] Yes [ ] No [ ] Yes [ ] No Do you have other dependents in the U.S. you would like to claim exemptions for? [ ] Yes [ ] No If so, how many? _______ RESIDENCY VERIFICATION What country did you live in before this visit to the U.S.? ____________________________________________ Did you pay taxes as a resident of that country? [ ] Yes [ ] No Did your tax residency in that country end prior to this visit to the U.S.? [ ] Yes [ ] No If yes, when? _____/____/_____ month/ day/ year U.S. IMMIGRATION HISTORY (If the answer to either of the questions below is yes, please complete U.S. Immigration History, Part 2.) Have you ever had another immigration status in the United States? [ ] Yes [ ] No Have you ever been present in the United States before this visit? [ ] No [ ] Yes U.S. IMMIGRATION HISTORY, Part 2 Please list any F, J, M, or Q visa immigration activity since January 1, 1985 and all other visa immigration activity only for the past three calendar years. Date of US Entry Date of US Exit month/day/year month/day/year Visa/Immigration Status J-1 Subtype Primary Activity Have you Taken Any Treaty Benefits? ___/__/___ ___/__/___ _____________ _________ ____________ [ ] Yes [ ] No ___/__/___ ___/__/___ _____________ _________ ____________ [ ] Yes [ ] No ___/__/___ ___/__/___ _____________ _________ ____________ [ ] Yes [ ] No ___/__/___ ___/__/___ _____________ _________ ____________ [ ] Yes [ ] No ___/__/___ ___/__/___ _____________ _________ ____________ [ ] Yes [ ] No ___/__/___ ___/__/___ _____________ _________ ____________ [ ] Yes [ ] No I hereby certify that all of the above information is true and correct. I understand that if my status changes from that which I have indicated on the form I must submit a new Foreign Visitor Information Form. Signature: _____________________________________________ Date: _______________________________ Consent and Authorization to Release Information I, __________________________________ (name) hereby authorize the North Carolina entity listed to release information contained on the Foreign Visitor Information Form to Windstar Technologies, Inc., P.O. Box 800, 1504 Providence Hwy, Norwood, MA 02062-0800 for the following purpose: technical software support for THE INTERNATIONAL TAX NAVIGATOR SYSTEM. Signature: _________________________________________ Date ___________________________ Visa and Payment Chart for Schools/Agencies Type of Visa Status Appropriate Activities Can Expense Be Reimbursed B‐1 Business Visitor or B‐2 Visitor for Pleasure (sometimes classified as a “Visitor‐No Pay”) E‐3 with Agency, for Australians only F‐1 Student Guest Lecturer; Guest Researcher if doing own research (not for Agency Benefit). Cannot be agency employee. No work authorization. Work authorized professional employee, can only work at Agency. May be employed on‐campus up to 20hrs/wk during classes, and full‐time when school is not in session or during annual vacation. May be employed on‐campus in field of study up to 20hrs/wk during classes, and full0time when school is not in session or during annual vacation. Work authorized in field of study. May be full‐time or part‐time. Eligible to receive reimbursement for travel expenses and per diem, in limited circumstances. Work‐related expenses can be reimbursed. Work‐related expenses might be reimbursable if DSO (Designated School Official) authorizes them. Work‐related expense might be reimbursable if DSO authorizes them. F‐1 Student with Scholarship or assistantship or fellowship F‐1 student with Work‐related expenses might Curricular Practical be reimbursable if DSO Training (CPT) authorizes them. F‐1 student with Optional Work authorized only if student has OPT Work‐related expenses might Practical Training (OPT) EAD card and student is working in field be reimbursable if DSO of study. May be full‐time or part‐time. authorizes them. Part‐time OPT is 20hrs/wk or less. F‐1 Student, not at your Work authorized only if student has CPT Work‐related expenses might school authorized by school in field of study, or be reimbursable, if other an OPT EAD card and student is working school’s DSO authorizes them. in field of study. H‐1B with School/Agency Work authorized processional Work‐related expenses can be employee, can only work at reimbursed. school/agency Can the Agency Pay Person? What documents are needed to process payment? Eligible to receive honorarium in limited circumstances: otherwise no payment. Yes, with E‐3 approval notice of I‐94 card. Yes, with Form I‐20 explicitly endorsed by DSO, visa, passport, and I‐94 card. Yes, with Form I‐20 explicitly endorsed by DSO Yes, if student has CPT authorization of Form I‐20. Yes with Form I‐20 explicitly endorsed by DSO, visa, passport, and I‐94 card. PLUS, an OPT EAD card. (EAD means Employment Authorization Document) Yes, with Form I‐20 explicitly endorsed by DSO, visa, passport, and I‐94 card. PLUS, a CPT authorization on Form I‐ 20 or an OPT EAD card. Yes, with valid visa, passport, I‐94 card and/or I‐797 ( H‐1B approval notice). Type of Visa Status Appropriate Activities H‐1B with another employer, but coming to your school/agency Work authorized at your school/agency only after H petition for NCSU is filed with immigration service, in limited circumstances. Otherwise, no work authorization Work authorized only with EAD card. Otherwise, no H‐4 work authorization. Work authorized exchange visitor (student, researcher, scholar, post‐doc, etc.) at School/Agency Guest Lecturer or Researcher. Cannot be School/Agency employee. No work authorization. H‐4 with EAD card J‐1 with School/Agency J‐1 with another entity J‐2 with EAD card O‐1 with School/Agency Work authorized‐but only with EAD card. Otherwise, no J‐2 work authorization. Work authorized professional employee, can only work at School/Agency Work authorized professional employee, can only work at School/Agency TN with School/Agency, for Canadians and Mexicans only WB or WT‐Visa Waiver Guest Lectures; Guest Researcher if (sometimes classified as a doing own research (not for “Visitor‐No pay”) School/Agency benefit). Cannot be School/Agency employee. No work authorization. Can Expense Be Reimbursed Can the Agency Pay Person? What documents are needed to process payment? Work‐related expenses can be Yes‐after H petition for school/agency reimbursed, after H petition is filed with immigration service, in with school/agency is filed with limited circumstances. immigration service, in limited circumstances Work‐related expenses can be Yes, with EAD card. reimbursed. Work‐related expenses can be Yes, with visa, passport, I‐94 card and reimbursed. Form DS‐2019 Eligible to receive reimbursement for travel expenses and per diem, in limited circumstances. Work‐related expenses can be reimbursed Work related expenses can be reimbursed. Work‐related expenses can be reimbursed. Eligible to receive reimbursement for travel expenses and per diem, in limited circumstances. Eligible to receive honorarium in limited circumstances; otherwise no payment. Permission from sponsoring agency for person to be at school/agency as Guest Lecturer or Researcher is required. Yes, with EAD card Yes, with O‐1 approval notice. Yes, with TN I‐94 card. Eligible to receive honorarium in limited circumstance; otherwise no payment.