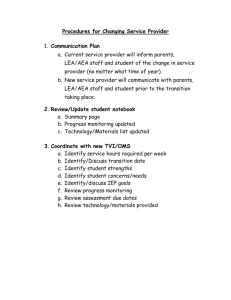

GUIDANCE Funds under Title I, Part A of the

advertisement