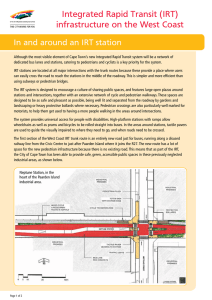

Integrated Rapid Transit Project Progress Report No 5 – April 2010 C

advertisement