Integrated Rapid Transit Project Progress Report No. 28 May 2012

advertisement

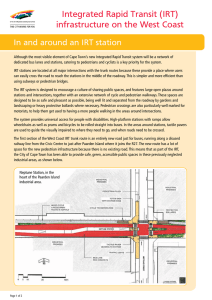

CITY OF CAPE TOWN Integrated Rapid Transit Project Progress Report No. 28 May 2012 IRT Progress Report No 28 Version Date V1.2 01 June 2012 Page 2 of 21 Table of Contents 1. Project Overview 3 2. Project Financial Status 3 Overall Project Expenditure 2011/12 Capital Expenditure Report (as at end May 2012) 2011/12 Operating Income and Revenue Report (as at 6 June 2012) 3 4 4 3. Master Programme 7 4. Infrastructure 9 Construction Summary Status 9 System Planning 12 System Planning: Phase 1A Future Phases 12 12 Business Development 13 Vehicle Procurement Contracts (VPCs) Vehicle Operator Companies (VOCs) Fare Collection Contract (AFC) Control Centre Contract (CCC) Station Management Contract (SM) Advertising Management Contract 13 13 14 14 14 14 7. Industry Transition 14 8. MyCiTi Operations 14 Operational Resources Service Level Agreements 16 16 Communications, Marketing & Branding 17 5. 6. 9. 10. Risk Management 18 11. Health & Safety 20 12. General 21 Cover Picture: Stables Bus Depot PURPOSE The Progress Report is a document prepared by MyCiTi / IRT Project Team for the purpose of regular recording and presenting the project status to the various City of Cape Town political and administrative oversight committees, the Department of Transport, Department of Finance, PGWC as well as other key stakeholder groups and interested parties. DISCLAIMER While every effort has been made to present accurate and current information in this progress report, the City of Cape Town will not be held liable for the consequence of any decisions or actions taken by others who may utilise any information contained herein. IRT Progress Report No 28 V1.2 May2012 Page 3 of 21 1. Project Overview The City of Cape Town’s Integrated Rapid Transit (IRT) project, referred to as MyCiTi, is planned to transform the City’s current road-based public transport system through, inter alia, the provision of Bus Rapid Transit services in dedicated right-of-way lanes, feeder bus services, automated fare systems, operating service contracts, institutional reform and the transformation of the existing public transport industry. This monthly summary progress report covers the reporting period for the month ending 31 May 2012. Comprehensive project reports are prepared on a quarterly basis. The MyCiTi Business Plan was adopted by Council in October 2010. A copy of the Business Plan is available on the City of Cape Town’s website: log on to http://www.capetown.gov.za/en/irt and click on Business Plan. Further amendments to accommodate changes in the operating environment were approved by Council in February and October 2011. The content of these amendments is also available from the above website, by clicking on Amendments to the Business Plan. This monthly report deals primarily with Phase 1A and serves to introduce the balance of the completion of Phase 1 including the initiation of Phase 2 (note: Phase 3 and 4 are not addressed – refer to the approved Business Plan for further details). 2. Project Financial Status Overall Project Expenditure The total project recorded expenditure to date as extracted from the City’s SAP accounting system is tabulated below: Table 2.1: Total Project Expenditure to Date Department / Budget IRT Implementation Capex Project Expenditure to Date R 1,778 032 048 IRT Operations Capex R 221 844 520 IRT Implementation Opex R 236 566 082 IRT Operations Opex R 216 983 501 Total project expenditure to date amounts to R 2,453 billion as recorded at the end of May 2012. The estimated (Phase 1A) project implementation expenditure at the completion of Phase1A at end of 2013 is R 4,596 billion. IRT Progress Report No 28 V1.2 May2012 Page 4 of 21 2011/12 Capital Expenditure Report (as at end May 2012) For the FY 20011/12 Table 2.2 below reflects the budgetary provisions for the IRT project as approved by Council on 25 January 2012 as part of the mid-year Adjustments Budget and the actual expenditure as recorded (SAP accounting system) at the end of May 2012. Indications are that the actual capital expenditure at the end of June 2012 will be 87.5% of budget. The cumulative capital expenditure and predicted expenditure is graphically illustrated in Figure 2.1. Table 2.2: Capital Expenditure (FY 2011/12) Department Budget Actual (as at May 2012) IRT IMPLEMENTATION R621 914 640 R383 037 908 IRT OPERATIONS R274 157 625 R190 636 477 2011/12 Operating Income and Revenue Report (as at 6 June 2012) The FY 2011/12 operating budgets and actual expenditure and revenue (income) as at 6 June 2012 are given in Table 2.3 and Table 2.4 respectively. Table2. 3: Operating Expenditure (FY 2011/12) Department Budget Actual (as at 6 June 2012) IRT IMPLEMENTATION IRT OPERATIONS R 87 813 849 R285 788 396 R 64 047 377 R 178 393 205 Table 2.4: Operating Revenue/Income (FY 2011/12) Department IRT IMPLEMENTATION Grant funding Insurance Recoveries Grand Total: IRT Implementation Revenue IRT OPERATIONS Fares / user Grant funding Grand Total: IRT Operations Revenue IRT Progress Report No 28 Budget Actual (as at 6 June 2012) R 24 773 126 - R 13 180 316 R 565 153 R 24 773 126 R 13 745 469 R36 100 000 R130 372 832 R26 750 158 R29 205 874 R166 472 832 R 55 956 032 V1.2 May2012 Page 5 of 21 Figure 2.1 – Cumulative Expenditure as at May 2012 IRT Progress Report No 28 V1.2 May2012 Page 6 of 21 Projected System Costs and Revenue Estimates The projected system costs and revenue estimates for Phase 1A are given in Table 2.5. These estimates are included in the approved Business Plan (October 2010), which can be accessed via the URL: http://www.capetown.gov.za/en/irt/Pages/MyCiTibusinessplan.aspx These estimates were based on an optimistic and pessimistic case related to modelled patronage estimates and on a planned role out of interim project milestones where interim services would be introduced. The differences between the FY2011/12 operating income and expenditure as indicated in Table 2.4 and the Business Plan estimates given in Table 2.5 are attributable to the delays in implementing optimistic interim service milestones. Consequentially this has resulted in a delay in the fare revenue stream while there has also been increasing operating expenditure on the “up-front” systems required to operationalise the roll out of the system and maintain the current interim service. The Business Plan estimates exclude interdepartmental expenditure in support of the overall IRT project. Given the experience and lessons learnt when commissioning and running the interim service, as well as changes to the number of vehicle operating companies, a complete revision and update of the IRT system’s operating cost model is being undertaken. Table 2.5: Estimated System Costs and Revenues as per Business Plan (October 2010) 2010/11 System Revenue and Costs (R mill/year) 2011/12 2012/13 2013/14 optimistic case pessimistic case optimistic case pessimistic case optimistic case pessimistic case optimistic case pessimistic case Fare revenue 19.2 6.9 134.7 101.1 268.6 201.4 297.6 223.2 Advertising, concessions 0.5 0.4 8.9 4.5 17.7 8.8 20.0 10.0 71.2 69.6 199.9 189.2 337.9 316.7 372.6 349.0 MyCiTi Operations management unit 5.0 5.0 12.5 12.5 25.0 25.0 25.0 25.0 Marketing 2.0 2.0 4.0 3.5 5.4 4.0 6.0 4.5 Revenue Costs Total payment to system operators* * Payments to system operators will include payments to contracted vehicle operators, station management, fare management and control centre service providers. IRT Progress Report No 28 V1.2 May2012 Page 7 of 21 3. Master Programme The summary sheet indicated below is based on the MASTER PROGRAMME Rev K – September 2011. It reflects the status of the main workstreams and includes the main reasons for the delays.. A comparison with the approved baseline programme yields the following summary results: DESCRIPTION VEHICLE OPERATOR APPOINTMENTS STATUS Behind 8 weeks NOTES Prospectus and long-term contract negotiations delayed STATION MANAGEMENT SERVICES Behind 4 weeks Re-tendered & re-programmed VEHICLE ACQUISITION Behind 3 weeks Feeder vehicle – manufacture programme feedback – behind schedule LAND PROCUREMENT On track In line with the Master Programme. CCC - DESIGN On track In line with Master Programme CCC – CONSTRUCTION & IMPLEMENTATION On track Delayed, but making up lost time with installation AFC - DESIGN Behind 4 weeks Software design and implementation behind schedule AFC – CONSTRUCTION & IMPLEMENTATION Behind 4 weeks Delay to the manufacturing of equipment EIA / PLANNING APPROVAL Behind 11 weeks On track Behind 1 week Adderley Street – heritage process delays plan approval of works. In line with Master Programme Delays to civil construction projects and the open feeders INNER CITY DESIGN Behind 1 week Delayed design due to heritage constraints and last minute changes by the client. INNER CITY – CONSTRUCTION Behind 4 weeks Delays to Inner City open and closed feeder stops. SUPERSTRUCTURES - TRUNK STATIONS & CLOSED FEEDERS Behind 1 week Inner City superstructures behind schedule NMT INTEGRATION On track In line with Master Programme ATLANTIS CORRIDOR – DESIGN ATLANTIS CORRIDOR – CONSTRUCTION In summary, below are the projected completion dates compared to the planned dates of the various Milestones as per the February 2011 amendments to the IRT Business Plan. The programme delays are at this stage not anticipated to impact on the planned completion date for the implementation of the full Phase 1A service as there is float to accommodate this slippage expect for Milestone 1 which has been rescheduled for 1 Nov 2012.Milestone 1 o Planned: October 2012 o Projected: 1 November 2012 (See chapter 10. Risk management) Milestone 2 o Planned: December 2012 o Projected: December 2012 Milestone 3 o Planned: February 2013 o Projected: February 2013 Milestone 4 o Planned: November 2013 o Projected: November 2013 IRT Progress Report No 28 V1.2 May2012 Page 8 of 21 IRT Progress Report No 28 V1.2 May2012 Page 9 of 21 4. Infrastructure Construction Summary Status During the month of May 2012, the overall progress on the various infrastructure construction projects under IRT Phase 1A can be summarised as follows: BUSWAY CIVIL CONTRACTS & STATIONS 112Q-R27 North at Sandown & Sunningdale Roads Contract programmed for completion by June 2012, excluding stations. Operation of this route is aligned with Milestone 3. 113Q-Non Motorised Transport (Table View / Milnerton areas) Works have been completed. The contract has, however, been extended to cater for landscaping maintenance. 128Q-Racecourse Road, Milnerton Practical completion of the civil works is anticipated by end July 2012. Completion of the station buildings is scheduled for September 2012. 262Q- Atlantis & Melkbos Civil Works around Stations Station substructures were handed over to Group 5 on 28 May 2012. Atlantis & Melkbos civil works and station works are scheduled to be operational by Milestone 3. 437Q-Blaauwberg Road On programme for completion by June 2013. The focus is on the section from Pentz / Raatz to Wood Drive, as the stations are required for operations early 2013. 154Q-Potsdam Road Works commenced 27 March 2012. Relocation of containers (mostly spaza shops) north of the rail bridge is scheduled for completion by 21 June 2012. Relocation of illegal dwellings within the road reserve is now critical. 390Q-Queens Beach Works commenced in May 2012 and are scheduled for completion by Milestone 3. 390Q-Gardens Works are scheduled for completion in June 2012. 390Q Adderley A public participation process to relocate the Cenotaph is currently underway. Decision from Heritage Western Cape is due by 1 Nov 2012. Following completion of the conceptual design; further design will be on hold and is subject to the outcome of the Heritage Impact Assessment. The construction of this station is unlikely under the current Group 5 contract. Consultants have been instructed to develop kerbside bus stops as an interim solution for implementation by Milestone 1 (Nov 2012) 390Q V&A Waterfront Station Awaiting the signing of a memorandum of understanding between the CoCT and V&AW regarding infrastructure costs/lease costs. The MoU is itself subject to approval by MAYCO. FEEDER STOP CONTRACTS Advertising Contract for Feeder Stops The advertising contract has been awarded and schedule of completed bus stops will be given to the advertiser in due course. IRT Progress Report No 28 V1.2 May2012 Page 10 of 21 375Q-Table View Feeder Stops Works are currently on programme for completion by October 2012. Table View closed feeder station is due for completion by October 2012. Operation of this station is in line with completion of stations along Blaauwberg Road, i.e. Wood Drive, which is scheduled for early 2013. 469Q-Atlantis Feeder Stops On programme for completion by October 2012. 319Q- Inner City Feeder Stops Currently the contract is running 12 days behind the programme due to contractor-related issues and completion is expected June 2013 It is anticipated that 30 of the Phase 1 bus stops will be handed over to the CoCT by mid-August 2012. IRT DEPOT CONTRACTS 170Q-Stables Depot Noted that the slow progress of works remains a concern and the liquidation of Winlite, the glazing contractor, may have an impact on the completion date of the works. Practical completion is currently projected for June 2012. Handover of the depot to the operator is expected at the end of June 2012. Inner City Depot Works commenced in April 2012. Completion date to be confirmed once the impact of design changes and phasing of construction works has been resolved. The co-ordination of current Milestone 0 bus services together with construction activities has placed a risk on the delivery of a fully operational site by 1 November 2012. Proposals to temporarily relocate the MyCiTi operations off site (to Foreshore and Stables depots) from June 2012 are being explored. The relocation of Milestone 0 services would allow the contractor access to the balance of the site for completion of the majority of the works. Partial occupation can then be planned for the Inner City Depot for November 2012, providing sufficient access to facilities to operate the start-up service. 43Q – Atlantis Depot Contract commenced on 9 January 2012. The contractor is currently three weeks behind programme. Completion is projected for December 2012. The overall status of IRT Phase 1A Infrastructure for the Inner City and Atlantis Corridor is indicated in the table below showing current progress versus planned progress: IRT Progress Report No 28 V1.2 May2012 Page 11 of 21 INTEGRATED RAPID TRANSIT SYSTEM - PHASE 1A ATLANTIS CORRIDOR & INNER CITY - CONTRACT PROGRESS SUMMARY OVERALL PROGRESS 1 Report date 2 Overall Progress - Design of new contracts 3 Overall Progress - Awarded Contracts 31-May-12 Planned 91% 54% Actual NOTE 87% Progress Measured against 53% Intergrated Rapid Transit System PROGRESS ON AVERAGE DESCRI PTI ON CONTRACT CONTRACT PLANNED CURRENT WORK DAYS START END PROGRESS PROGRESS AHEAD/BEHI ND DESI GN & TENDER BALANCE OF THE ATLANTI S CORRI DOR CONTRACTS > R27 North - Sandown & Sunningdale (112Q) HHO > Racecourse Road - Montague Gardens (128 Q) HHO > Atlantis & Melkbos (262 Q) HHO > Potsdam Road HHO > Blaauwberg Road HHO COMPLETE COMPLETE CONSTRUCTION CONSTRUCTION CONSTRUCTION 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 0 I NNER CI TY CONTRACTS > Thibault Square (Hans Strijdom & Heerengracht) (86 Q) > Adderley Street > Gardens Centre > V&A Waterfront > Queens Beach GI BB GI BB GI BB GI BB GI BB COMPLETE PRE-TENDER(HIA) COMPLETE TENDER CONSTRUCTION 100% 46% 100% 46% 62% 100% 0% 100% 31% 62% FEEDER STOPS > Tableview Feeders > Inner City Feeders > Atlantis & Melkbos Feeders HHO GI BB HHO CONSTRUCTION CONSTRUCTION CONSTRUCTION 100% 100% 100% 100% 100% 100% 0 0 0 I RT DEPOTS > IRT DEPOT - Stables > IRT DEPOT - Atlantis > IRT DEPOT - Inner City Final design HHO HHO GI BB CONSTRUCTION CONSTRUCTION CONSTRUCTION 100% 100% 100% 100% 100% 100% 0 0 100% 100% 100% 100% 100% 100% -224 -63 0 CONSTRUCTI ON CI VI C TO TABLE VI EW TRUNK > BUSWAYS - ATLANTIS CORRIDOR CONTRACTS COMPLETE > BUS TRUNK STATIONS (INCLUDING WORLD CUP STATIONS) COMPLETE > IRT DEPOTS - Inner City & Foreshore COMPLETE BALANCE OF THE ATLANTI S CORRI DOR CONTRACTS BUSWAY > R27 North - Sandown & Sunningdale(112Q) HHO > Racecourse Road - Montague Gardens (128Q) HHO > Atlantis & Melkbos (262Q) HHO > Potsdam Road (420Q) HHO > Blaauwberg Road HHO > NMT HHO CONSTRUCTION CONSTRUCTION CONSTRUCTION CONSTRUCTION CONSTRUCTION CONSTRUCTION 14-Jan-11 20-Feb-11 25-Oct-11 27-Mar-12 09-Sep-11 14-Jan-11 04-Jun-12 05-Sep-12 14-Sep-12 06-Sep-13 21-Jun-13 15-Dec-11 99% 83% 0% 0% 0% 100% 98% 83% 0% 0% 0% 100% -2 0 0 I NNER CI TY CONTRACTS BUSWAY > Thibault Square(86Q) > Adderley Street > Gardens Centre > V&A Waterfront > Queens Beach COMPLETE PRE-TENDER CONSTRUCTION PRE-TENDER PRE-TENDER 19-Aug-10 17-Sep-12 09-Jun-11 31-Aug-12 31-Aug-12 22-May-11 26-Jul-13 05-Jun-12 29-May-13 08-May-13 100% -38% 94% 0% 0% 100% 0% 94% 0% 0% 0 0 0 0 0 TRUNK STATI ONS > Trunks Stations(Civic 2&3, Thibault,Adderley Gardens, V&A, Queens) ALL > Trunks Stations( Omuramba, Ascot, Table View Feeder) ALL > Trunks Stations (Sandown, Sunningdale, Melkbos, Atlantis) ALL > Trunks Stations (Potsdam & Blaauwberg) ALL PART CONSTRUCTION 01-Nov-10 CONSTRUCTION 01-Sep-11 CONSTRUCTION 01-Sep-11 CONSTRUCTION 04-Jul-12 29-Aug-12 28-Feb-12 22-May-12 30-Apr-13 40% 71% 78% 0% 37% 65% 78% 0% -10 -8 0 0 FEEDER STOPS > Table View Feeder > Inner City Feeder > Atlantis & Melkbos Feeders HHO GI BB HHO CONSTRUCTION CONSTRUCTION CONSTRUCTION 29-Jul-11 26-Oct-12 17-Aug-11 19-Jun-13 28-Sep-11 15-Oct-12 67% 45% 69% 67% 40% 69% 0 -22 0 I RT DEPOTS > IRT DEPOT - Stables HHO CONSTRUCTION 04-Mar-11 21-Mar-12 128% 98% -76 > IRT DEPOT - Atlantis HHO CONSTRUCTION 09-Jan-12 12-Dec-12 46% 38% -19 > IRT DEPOT - Inner City Extention GI BB CONSTRUCTION 23% 9% -22 IRT Progress Report No 28 GI BB GI BB GI BB GI BB GI BB 10-Apr-12 12-Dec-12 V1.2 0 0 May2012 Page 12 of 21 5. System Planning System Planning: Phase 1A A comprehensive systems plan has been developed for Phase 1A of the IRT project, and this continues to undergo review and refinement as demand and behaviour comes to the fore. Phase 1A scope and routings have not changed and the full service is on schedule for operation by November 2013. Table 5.1 gives an estimation of the projected daily passenger trips for Phase 1A: Table 5.1: Predicted vs. observed passenger trips (revised December 2011) Milestone roll-out towards full Phase 1A Passenger trips per day (predicted) Average passenger trips per day (obtained from bus observed boarding surveys – includes transfers) Milestone 0 15000 +/- 18 000 Milestone 1 80000 N/A Milestone 2 94000 N/A Milestone 3 148000 N/A Milestone 4 (Full Phase 1A) 180000 N/A Note: 1 Passenger trip = 1 individual trip on a specific bus (.3x1 + .35x1 + .28x2 + .07x3) Future Phases The proposed extensions of the IRT System that are currently under review include Phase 1B, 1C and Phase 2. a) It is proposed that Phase 1B comprise of the following services: Trunk service between Du Noon to Century City via Montague Gardens Feeder services from Summer Greens, Edgemead & Richwood to Century City Feeder service between Montague Gardens to Maitland and Salt River Rail stations via Koeberg and Voortrekker Roads. The system planning team is scheduled to complete the viability assessment of Phase 1B towards the end of July 2012. b) The System Planning Section is currently investigating options of linking Hout Bay & Imizamo Yethu to Wynberg and, if found viable, this route will be defined as Phase 1C. Viability assessment for Phase 1C is scheduled to be finalised towards the end of October 2012. IRT Progress Report No 28 V1.2 May2012 Page 13 of 21 c) The roll-out of Phase 2 (Metro South East) express services is being planned internally and progress thereof will be reported in future reports. System viability of this express service is scheduled to be finalised towards the end of August 2012. The preparation of tender documents for professional services appointments for planning and design of the full metro-wide system has now been completed. This appointment includes the conceptual design of the Lansdowne/Wetton Corridor (Start of Phase 2 Proper) which will link Khayelitsha and Mitchell’s Plain to Wynberg and Claremont. Tender documents are to be advertised on the 15th June 2012. It is planned that the professional appointment will be concluded in September 2012. 6. Business Development Vehicle Procurement Contracts (VPCs) Following the delivery of the 10 additional 12-metre high-floor trunk-service vehicles in late February 2012 and the handing over to the vehicle operators in March 2012, the original 42 trunk service buses are being put through a comprehensive “bumper-to-bumper” maintenance check. This is in addition to regular scheduled maintenance. The City’s contract for the supply of 190 x 9-meter, low-entry feeder buses is under way and delivery of the first 23 vehicles by June 2012 remains on schedule. These buses are being assembled in Elsies River, where approximately 120 local personnel have been employed at the assembly plant. Figure 6.1 - Optare SR buses on the assembly line in Elsies River and a completed feeder service bus finished in the MyCiTi livery. The tender for the balance of the Phase 1A fleet and the Phase 2 express service fleet are currently under preparation, with the call for tenders programmed for the end of July 2012. Vehicle Operator Companies (VOCs) The interim VOC contracts were extended from 1 May 2012 to allow sufficient time for the negotiation of the long-term contracts for vehicle operations (VO), expected to run for 12 years. The Prospectus describing the long-term contracts was issued to the VOCs during this month. This is now followed by a period for addressing comments and points of clarity prior to the start of the final stage of formal negotiations with the VOCs. The process of drafting the long-term contracts was also started during the reporting period. IRT Progress Report No 28 V1.2 May2012 Page 14 of 21 Fare Collection Contract (AFC) A total of 355 442 transactions were took place during May 2012 – an increase of 161 938 from April. However, although some technical challenges were resolved during May, a number if issues remain which are in the process of being resolved. A comprehensive process was undertaken to validate the integrity of the AFC system. A full report is to be submitted early in June 2012. The rollout of the ABSA retail footprint, although ongoing, remains challenging. Control Centre Contract (CCC) During May 2012 the location of the passenger information boards at the main trunk stations and the location for the installation of the network video recorders on the 12m buses were resolved. The installation of all the ITS equipment on the 9m first production bus was completed. Extensive technical testing of the Control Center system was started in May 2012. Station Management Contract (SM) The Station Management tender was re-advertised on 26 April 2012 and a compulsory briefing session held on 10 May 2012. The date for submission of tenders (originally set for 15 June 2012) has been extended to 29 June 2012 to allow tenderers to deal with additional CoCT requirements. The principal additional requirement, included in Notice 1, is for tenderers to provide for the use of credit and debit card facilities required for the payment of transit products. The SM Contract, once awarded, is programmed for commencement by midFebruary 2013. Advertising Management Contract The preferred service provider was appointed by the City’s BAC on 2 May 2012, subject to negotiations. It is anticipated that the contract will take effect by early July 2012. 7. Industry Transition The Industry Transition team has now concluded its calculations of compensation to the affected minibus-taxi operators. A first round of compensation, namely early exit compensation (EEC), has been proposed and is subject to the approval of the City’s Chief Financial Officer. This round of compensation has been offered as a result of operators, especially in the Table View area, experiencing low ridership numbers as a result of the MyCiTi services. The number of operators who would qualify for EEC has been determined by the City ensuring that there will be a sufficient number of vehicles available to service the existing demand. These operators have decided to exit the minibus-taxi industry in exchange for EEC. They will also surrender their vehicles where these are of a value of NOT more than the national taxi recapitalisation value of R63 100, for scrapping. A further round of compensation, namely, early compensation (EC), will follow and will apply to operators with a vehicle whose value is greater than R63 100. Final Compensation (FC) will then commence in line with the implementation dates for Milestones 1 - 4. 8. MyCiTi Operations From the its launch in May 2010 until May 2012, over 3.6 million passenger journeys have been made on the MyCiTi rapid transit system, many of which were on the rapid bus service on the dedicated bus lanes. The 3,6 IRT Progress Report No 28 V1.2 May2012 Page 15 of 21 million passenger journeys include transport services during the 2010 FIFA World Cup, the use of MyCiTi buses during events at the Cape Town Stadium and the use of event services offered with chartered buses. Between January and May 2012, the counting of passengers using the system has been dependant on the recording of the validations made using the myconnect card (as opposed to counting paper ticket sales). The AFC contractor is still verifying the validation figures February to May, and as a result accurate figures will only be available once these have been reconciled. In May 2012, IRT operations celebrated its first year anniversary. On Sunday 27th May the public could travel for free with the result that an estimated 25,000 passenger journeys occurred on the system. This can be compared with a typical Sunday of approximately 4,000 passenger journeys and 12,000 passenger journeys on a typical weekday. Indications were that people from areas not currently covered by the existing system used MyCiTi to try it out. Table 8.1 - Performance data for May 2012. T1 Average 87% Average 88% Average 87% Average 89% Average 89% % On-Time (2 min early to 5 min late vs. time table time)* Airport F1 F14 F15 July to September 2011 97% 88% 79% 57% October to December 2011 99% 92% 75% 72% January to March 2012 95% 90% 75% 78% Apr-12 99% 91% 80% 89% May-12 98% 91% 79% 87% F16 67% 78% 79% 93% 81% *Note that times are indicated in minutes according to international standards. The variances would occur between the time range of 2.59min early and 5.59min late. The following graphs indicate the results of the contracted observations undertaken on a daily basis using onthe-ground as well as camera monitoring at the TMC. November 2011 - April 2012 1200 1000 Infrastucture Transgressions 800 600 Vehicles Non Technical Transgressions 400 200 0 Nov-11 IRT Progress Report No 28 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 V1.2 May2012 Page 16 of 21 % Departure Transgressions More than 2min early & more than 5 mins late 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 T1 - % Departure Trangressions T2 - % Departure Transgressions F1 - % Departure Transgressions F14 - % Departure Transgressions F15 - % Departure Transgressions F16 - % Departure Transgressions Operational Resources Despite progress having been made on obtaining permanent staff for the IRT organogramme, there are still key vacancies which require the support of the outsourced consultants, especially as a result of the operations planning presently being prepared for the launch of Milestones 1, 2 and 3. Service Level Agreements Law Enforcement - the following graph indicates the number of unauthorised vehicles observed on the CCTV cameras using the red lane on the R27 between the Civic station and Table View. An overall reduction in transgressions can be seen as a result of law enforcement through the use of fines. Total number of vehicles recorded in IRT red lane by SSU cameras 450 400 350 300 250 200 150 100 50 0 Number of vehicles in IRT lane IRT Progress Report No 28 V1.2 May2012 Page 17 of 21 9. Communications, Marketing and Branding The primary communication focus for May 2012 was as follows: MyCiTi’s first birthday celebrations including a free ride day on Sunday 27 May. This was well received by members of the public and buses were well utilised, with additional buses required to meet the need of people wanting to experience the system. Traffic signal layout changes featured in our “Respect the Robot” ad campaign. We prepared four-page anniversary newspaper wraps to appear in the community newspapers in our footprint area giving information and history about the project. Preparatory work also began for the unveiling of the new MyCiTi 9m vehicles from the assembly plant in Epping. Preparatory work is also underway for the implementation of the new distance-based fare system and the annual increase of MyCiTi fares. The communications team has also produced a number of printed items for distribution to our passengers, the public and stakeholders, via hand outs within the stations, conductors on the buses on our birthday, and also through the brochure stands which are outside the kiosks. These items include: DL brochures – four-panel fold out brochures detailing fares and routes. Stakeholder guides – A5 booklets containing background information on the service, as well as details of future routes. myconnect comic – a single double-sided page in comic format with information on how to use the myconnect card. In addition, posters and stickers have been created at the request of the operations team, including: “How is my driving” sticker for the back of all the buses. “Queries, Complaints or Compliments” sticker for inside the buses. Stop to Start Soon laminated poster to be erected at all stops around Table View and the City Centre that have been built but are not yet operational. Various events notices for events happening at the Cape Town Stadium. Poster for all stations advertising the Birthday Free Ride day. MEDIA RELEASES Media releases issued from 1 – 31 May 2012: MEDIA RELEASE, May 3: City’s Park-and-Ride facilities cater for residents across Cape Town MEDIA RELEASE, May 9: Congratulations to our myconnect competition winners! MEDIA RELEASE, May 14: Moving Cape Town’s Cenotaph and the proposed MyCiTi Bus Station Adderley Street MEDIA RELEASE, May 15: Statement by the Mayoral Committee Member tor Transport, Roads And Stormwater, Councillor Brett Herron MEDIA RELEASE, May 15: Residents invited to MyCiTi Public Meeting in Hout Bay on 17 May MEDIA RELEASE, May 15: City’s Annual Report for 2010/11: this City is working for you MEDIA RELEASE, May 16: MyCiTi turns 1, with a day of free bus rides MEDIA RELEASE, May 23: Cllr Herron to hand out MyCiTi birthday tickets ahead of Sunday’s ‘Free Ride’ day MEDIA RELEASE, May 24: Transport and road closures for the 8 Nations Tournament MEDIA RELEASE, May 24: MyCiTi turns 1, with a day of free bus rides (RE-ISSUE) MEDIA RELEASE, May 25: MyCiTi Free Ride Sunday: Cllr Herron visits Civic Centre station MEDIA RELEASE, May 28: City launches first branded 9metre MyCiTi feeder buses MEDIA RELEASE, May 30: First MyCiTi buses roll off Epping production line MEDIA RELEASE, May 31: Conductors will no longer operate on MyCiTi feeder buses in the inner city The May edition of the MyCiTi e-newsletter focused on the free rides for the birthday celebrations, an extract from Cllr Herron’s speech at the City Meets Business event and a piece about Rustenburg’s BRT developments IRT Progress Report No 28 V1.2 May2012 Page 18 of 21 10. Risk Management A comprehensive risk register is prepared on a monthly basis for the City’s review and approval. Mitigation measures are agreed upon and action is taken in line with the detailed recommendations contained in the report. The overall risk profile for May 2012 has decreased during the reporting period. The major risk listed in the Risk Assessment Report is the following: 1. Financial management of OPEX: o Risk Operational expenditure to meet planned cashflow spending targets The operational cashflow targets are being pushed out by various factors. o Mitigation Regular monitoring and updating of the overall cashflow is required and is in the process of being implemented. 2. Financial management of CAPEX: o Risk Capital expenditure to meet planned cashflow spending targets o Mitigation Regular monitoring and updating of the overall cashflow is showing a significant improvement in meeting the targets. 3. Risks related to the procurement of contracts of various phases: o Risk The procurement of contracts for future phases, in addition to the demand of Phase 1A can put the procurement department under severe pressure. Not meeting procurement dates can lead to delays and underspending. o Mitigation Regular monitoring and updating of the procurement programme, which now includes the future phases, will minimize the potential delays. 4. Potential delays to the procurement of the VOC interim and Long term agreements: o Risk The current process for the long-term agreement is programmed to be completed by the end of November 2012. This is based on multiple variables that cannot be accurately quantified. The City needs to negotiate the inclusion of Milestone 1 items in the interim contracts with the VOCs. The focus on the long-term process will be less and might even stop during the period of negotiation. o Mitigation Assessment of the situation at the end of August 2012 will indicate the most optimum route to follow. Planning for multiple outcomes ensures a proactive approach. 5. Delays to the implementation of the NDOT data structure: o Risk The delayed response from NDOT on the information required for the implementation of the data structure, delayed the EMV / distance-based fare collection implementation. o Mitigation An interim data structure will be implemented, but might not be ready in time for the rollout of Milestone 1. The use of the flat fare system is possible as an interim solution, but is not ideal. IRT Progress Report No 28 V1.2 May2012 Page 19 of 21 NOTE: the above figure reflects a summarized risk profile index for this project. IRT Progress Report No 28 V1.2 May2012 Page 20 of 21 11. Health and Safety Building & Civil Contracts The activities on construction sites are subject to the requirements of the Occupational Health and Safety Act No. 85 of 1993. It is a condition of every contract that the contractor ensures that all work will be performed, and all equipment, machinery and/or plant used, in such a manner as to comply with the provisions of the Act and the regulations promulgated thereunder. Each contractor is required to appoint a competent person whose duty it is to enforce compliance. The Health and Safety practitioner appointed by the City of Cape Town considers, for approval, health and safety plans submitted by contractors; monitors compliance; issues instructions to bring about improvements where required, and prepares monthly reports, of which the table below is a summary: Table 11.1 - Summary of Building and Civil Works: OH&S Compliance Report CONTRACT CONTRACTOR PERCENTAGE GENERAL COMPLIANCE APRIL MAY 2012 2012 112Q/2010/11: Atlantis IRT Corridor: R27 from Blaauwberg Road to Sandown Road (North). Martin & East 94.7% 93,4% 128Q/2010/11: Transport Corridor along Racecourse Road from R27 to Omuramba Road Exeo Khokela Civil Engineering Construction 94.5% 100% 154Q/2011/12: Atlantis IRT Corridor: Potsdam Road from Blaauwberg Road to Usasaza Road, Dunoon Martin & East N/A Primary – 91% General – 41% 262Q/2010/11: Atlantis IRT Infrastructure: Trunk Route Stations, Roadworks and Services in Melkbosstrand and Atlantis Martin & East 82.6% 100% 375Q/2010/11: IRT System Phase 1A: Construction of Bus Stop Infrastructure in Table View and Milnerton Civils 2000 86% 63% COMMENTS Final audit and consolidation to be done in June Full score for administration; however prohibition issued for unsafe excavations Start-up audit conducted – prohibition excavations Prohibitions – excavations and traffic safety Prohibition – scaffold stairs Prohibition – excavations and pedestrian accommodation 437Q/2010/11: Atlantis IRT Corridor: Blaauwberg Road from R27 to Potsdam Road Martin & East 85.4% 88,1% 469Q/2010/11: IRT System Phase 1A: Construction of Bus Stop Infrastructure in Atlantis and Melkbos Exeo Khokela Civil Engineering Construction 86.1% 61% Prohibition – lifting equipment 390Q 08/09: IRT Major Station Superstructures Contract Group 5 89.6% 90.6% N/A 391Q10/11: IRT Open Feeders Bus Stops Contract Group 5 89.8% 96.5% N/A Note: The “Percentage General Compliance” refers to a score based system of independent “Safety Agents” assessing compliance with OH&S requirements, which include, inter alia: on-site construction practice, provision of safety and protective equipment, on-site documentation etc. IRT Progress Report No 28 V1.2 May2012 Page 21 of 21 Operational MyCiTi Contracts Full health and safety (H&S) assessments of the VOC operations continue. The overall station compliance on essential H&S items is good, with minor operational issues, such as light bulbs not working, affecting the compliance results. The following graph and table indicates the overall average H&S compliance of the stations, depots and workshops up to the end of May 2012. Items are classified according to their impact on the system and are accordingly rectified by the VOCs in the week following the assessment. Monthly Health And Safety Assessment Comparison 100.0 95.0 90.0 85.0 80.0 75.0 TransPeninsula 70.0 Kidrogen 65.0 60.0 55.0 50.0 45.0 40.0 November Vehicle Operator TransPeninsula Kidrogen December January February March April May February March April May 81% 74% 80% 79% 80% 81% 83% 77% Project Office As required in terms of the Occupational Health & Safety Act, the monthly inspection of the project office facilities and environment was undertaken in May 2012 - no non-compliance issues were noted. 12. General The following general issues are noted: Additional staff members have been appointed to the City IRT Team; it is anticipated that all IRT staff appointments will be substantially complete by the end of July 2012. Agreement was reached with NDOT on a schedule for regular quarterly meetings for the future (on system planning, funding and other crucial matters) IRT Progress Report No 28 V1.2 May2012