Integrated Rapid Transit Project Progress Report No. 30 August 2012

advertisement

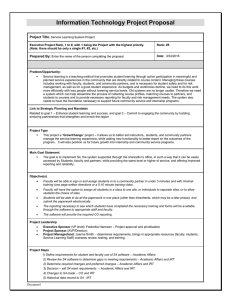

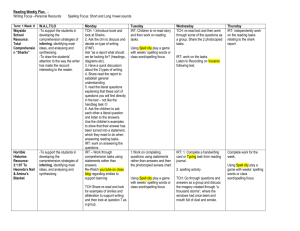

CITY OF CAPE TOWN Integrated Rapid Transit Project Progress Report No. 30 August 2012 (Incorporating July 2012) Version Date V1.1 Final 31 August 2012 Page 2 of 29 Table of Contents 1. Project Overview 3 2. Project Financial Status 3 3. Master Programme 5 4. Infrastructure 9 5. System Planning 14 Phase 1A N2 Express Service Phase 2: Metro South East 14 15 15 Business Development 15 Vehicle Procurement Contracts (VPCs) Vehicle Operator Companies (VOCs) Fare Collection Contract (AFC) Control Centre Contract (CCC) Station Management Contract (SM) Advertising Management Contract 15 16 16 16 17 17 7. Industry Transition 18 8. MyCiTi Operations 18 Operational Resources Support functions (provided by other City departments) 20 21 Communications, Marketing & Branding 22 6. 9. 10. Risk Management 24 10.1 Delays to the negotiation process of the Interim Vehicle Operating Contracts – Interim and Long Term. 10.2 Financial Management of OPEX: 10.3 Financial Management of CAPEX 10.4 Consultant appointments critical to ensure the successful completion of Phase 1A and the start of future phases. 10.5 Risks related to the procurement of contracts of various phases. 24 24 25 25 26 11. Health & Safety 26 12. General 29 Cover Picture: IRT Inner City Route Map PURPOSE The Progress Report is a document prepared by MyCiTi / IRT Project Team for the purpose of regular recording and presenting the project status to the various City of Cape Town political and administrative oversight committees, the Department of Transport, Department of Finance, PGWC as well as other key stakeholder groups and interested parties. DISCLAIMER While every effort has been made to present accurate and current information in this progress report, the City of Cape Town will not be held liable for the consequence of any decisions or actions taken by others who may utilise any information contained herein. IRT Progress Report No 30 V1 July&August 2012 Page 3 of 29 1. Project Overview The City of Cape Town’s Integrated Rapid Transit (IRT) project, referred to as M yCiTi , is planned to transform the City’s current road-based public transport system through, inter alia, the provision of Bus Rapid Transit services in dedicated right-of-way lanes, feeder bus services, automated fare systems, operating service contracts, institutional reform and the transformation of the existing public transport industry. This monthly summary progress report covers the reporting period for the month ending 31 July 2012. Comprehensive project reports are prepared on a quarterly basis. The MyCiTi Business Plan was adopted by Council in October 2010. A copy of the Business Plan is available on the City of Cape Town’s website: log on to http://www.capetown.gov.za/en/irt and click on Business Plan. Further amendments to accommodate changes in the operating environment were approved by Council in February and October 2011. The content of these amendments is also available from the above website, by clicking on Amendments to the Business Plan. This monthly report deals primarily with Phase 1A and serves to introduce the balance of the completion of Phase 1 including the initiation of Phase 2 (note: Phase 3 and 4 are not addressed – refer to the approved Business Plan for further details). 2. Project Financial Status Project Expenditure Total project expenditure on the City of Cape Town’s Integrated Public Transport System, referred to as MyCiTi, amounts to R 2,923 billion. The estimated project implementation expenditure for the completion of Phase 1A at end of 2013 remains R 4,596 billion. Table 2.1: Total Project Expenditure to Date Department / Budget IRT Implementation Capex Project Expenditure to Date R 1,969,550,461 IRT Operations Capex R 378,151,440 IRT Implementation Opex R 276,384,088 IRT Operations Opex R 299,016,780 The expenditure is as extracted from the City’s SAP accounting system as recorded at the end of August 2012. 2012/13 Capital Expenditure Report Table 2.2 below reflects the budgetary provisions for the IRT project as approved by Council. The actual expenditure reflected in the tables is as recorded (SAP accounting system) at the end of August 2012. IRT Progress Report No 30 V1 July&August 2012 Page 4 of 29 Table 2.2: Capital Expenditure (FY 2011/12) Department Budget Monthly Plan Actual (as at Aug 2012) IRT IMPLEMENTATION R 886 602 219 R 44 746 697 R 44 746 697 IRT OPERATIONS R 1125 655 212 R28 267 600 R 277 678 214 R2 012 257 431 R 73 014 297 R 84 044 502 Figure – Cumulative Expenditure as at August 2012 2012/13 Operating Income and Revenue Report The FY 2012/13 operating budgets and actual expenditure and revenue (income) as at end of August 2012 are given in Table 2.3 and Table 2.4 respectively. Table 2. 3: Operating Expenditure (FY 2012/13) Department Budget Monthly Plan Actual (as at Aug 2012) IRT IMPLEMENTATION- (City Funding) R52 949 654 R8 778 568 R7797274 IRT IMPLEMENTATION - OGD (Grant Funding) R29 380 429 R268 670 R1 403 386 R82 330 083 R11 465 238 R9 200 642 Total IRT OPERATIONS -( City Funded) R107 886 993 R28 244 387 R26 427 223 IRT OPERATIONS - OGD (Grant Funding) R189 030 871 R15 330 000 R7 597 397 R359 917 864 R43 752 387 R34 024 620 Total IRT Progress Report No 30 V1 July&August 2012 Page 5 of 29 Table 2.4: Operating Revenue/(Income (FY 2012/13) Department Budget Monthly Plan Actual (as at Aug 2012) 0 R0 IRT IMPLEMENTATION Insurance Recoveries - Total IRT Implementation Revenue 0 R0 IRT OPERATIONS Fares / user R36 100 000 R601 667 R 4 611 617 Total IRT Operations Revenue R36 100 000 R 601 667 R 4 611 617 A full reconciliation of operating costs incurred to date and a revised projection of anticipated operating costs and revenue for the complete Phase 1A together with Phase 1B and the Metro South East proposed service is being undertaken and scheduled for completion by the end of August 2012. 3. Master Programme Project Progress The developed MyCiTi Integrated Public Transport Project is being driven through the following major work streams, the progress of which is briefly discussed below: • • • • System Planning; Infrastructure Provision; Business Development; and Industry Transition. All activities are programmed and monitored in various sub programmes – which are then consolidated into a Master Programme for the project. A rolled up summary view of latest revision MASTER PROGRAMME Rev K – September 2011 is shown below. DESCRIPTION VEHICLE OPERATOR APPOINTMENTS STATUS Behind 16 weeks STATION MANAGEMENT SERVICES Behind 5 weeks VEHICLE ACQUISITION Behind 6 weeks Feeder vehicle – behind schedule Trunk Vehicle tender - delayed LAND PROCUREMENT On track In line with the Master Programme. CCC - DESIGN On track In line with Master Programme CCC – CONSTRUCTION & IMPLEMENTATION On track In line with Master Programme AFC - DESIGN Behind 4 weeks Software design and implementation behind schedule AFC – CONSTRUCTION & IMPLEMENTATION Behind 3 weeks Delay to the EMV & Transit product implementation process IRT Progress Report No 30 NOTES Compensation and long-term contract negotiations have been delayed due to a longer than expected stakeholders consultation period. The SM Services tender was withdrawn ahead of the original tender date. The retender has now taken place. V1 July&August 2012 Page 6 of 29 EIA / PLANNING APPROVAL Behind 21 weeks ATLANTIS CORRIDOR – DESIGN On track The heritage process for Adderley Street trunk station plan approval has taken longer than expected in response to public comments. In line with Master Programme ATLANTIS CORRIDOR – CONSTRUCTION Behind 2 weeks Delays to civil construction projects and the open feeders INNER CITY DESIGN Behind 4 week Delayed design due to heritage constraints and changes by the client. INNER CITY – CONSTRUCTION Behind 2 weeks Delays to Inner City open and closed feeder stops. SUPERSTRUCTURES - TRUNK STATIONS & CLOSED FEEDERS NMT INTEGRATION Behind 1 week On track Inner City superstructures behind schedule In line with Master Programme Some of the major delays stem from a number of key issues and are: • VOC appointments – please refer to Risk Section for more details of the delays to date. • Adderley Street EIA Process seeking heritage plan approval of works – a number of mitigation actions are detailed in Risk Section. • Bus acquisition – two tenders are to be advertised in September which will require an expedited evaluation process and manufacturing in order to meet the original schedule dates. Phase 1A Milestones: In summary, below are the projected / revised completion dates compared to the planned dates of the various Milestones as per the February 2011 amendments to the IRT Business Plan. • • • • Milestone 1 o Planned: October 2012 o Revised/Projected: 1 December 2012 – 4 May 2013 Milestone 2 o Planned: December 2012 o Revised/Projected: 16 March to 13 April 2013 Milestone 3 o Planned: February 2013 o Revised/Projected: 11 May to 30 June 2013 Milestone 4 o Planned: November 2013 o Revised/Projected: 1 November to 30 November 2013 The document below indicates the progress of the project, based on Master Programme REV K. This Master Programme was approved in September 2011. IRT Progress Report No 30 V1 July&August 2012 Page 7 of 29 IRT Progress Report No 30 V1 July&August 2012 Page 8 of 29 V1 July&August 2012 Page 9 of 29 4. Infrastructure Planning and Design All infrastructure planning and detailed design work for Phase 1A is progressing well and is largely completed with the exception of some inner City elements which are pending heritage and environmental assessments. Measured against the Project’s overall Master Programme (Rev K – September 2011); the progress at the end of August 2012 was 89%, with the planned being 97%. Planning and design of infrastructure for Phase1B is well underway and Phase 2 will commence once the system planning exercise is sufficiently advanced to permit this. Construction Progress with regards to construction is described under the following categories: • • • Bus-ways Bus stations and stops Depots, workshops and staging areas The Phase 1A: Atlantis Corridor & Inner City – construction contract progress measured against the Project’s overall Master Programme (Rev K – September 2011) at the end of August 2012 was 63%, with the planned being 67%. Bus-ways A total of 17.5 km of bus-way has been completed between the CBD and West Coast Suburbs with another +/11 km currently under construction. Of the four remaining major bus-way contracts their progress as at the end of August 2012 was: • • • • Racecourse road – Montague Gardens Atlantis and Melkbosstrand Potsdam Road (Killarney) Blaauwberg Road (Table View) 98% 87% 26% 55% A number of smaller Projects within the CBD and environs are underway or pending the outcome of a heritage assessment or finalization of lease / servitude negotiations. These include Projects in Adderley Street, the V&A Waterfront and Sea Point. Bus Stations and Stops A total of 16 no. trunk service bus stations have been completed and are in use. The balance of 14 trunk station are currently under construction where progress has been assessed between 18% and 97% complete per station, with the exception of the bus stations in Potsdam Road where construction in pending the bus-way construction. The construction of bus stops (in excess of 500 in total) is underway and construction is on programme. Depots, Workshops and Staging Areas The construction of the Stable Depot, off Potsdam Road is complete. The extension of the Inner City Depot in Prestwich Street at the end of August 2012 was 24% complete. The Foreshore staging area is complete. Construction of the Atlantis Depot at the end of August 2012 was 64% complete. IRT Progress Report No 30 V1 July&August 2012 Page 10 of 29 Figure 1 - Atlantis Depot under construction Current use of infrastructure It should be noted that the completed bus-ways between the CBD and Table View, the trunk stations and depots (excluding the Atlantis depot) are all being used by the interim (Milestone 0) MyCiTi service that is currently in operation. The Stables Depot is complete and has been handed over to vehicle operating company (Kidrogen) who are operating their contracted component from the MyCiTi service from there. The workshop facilities are also being used for bus maintenance. Although largely affected by construction works the Inner City Depot and Foreshore staging area are in use. Figure 2 - Stable Depot, Potsdam IRT Progress Report No 30 V1 July&August 2012 Page 11 of 29 Construction Summary Status During the month of July and August 2012, the overall progress on the various infrastructure construction projects under IRT Phase 1A can be summarised as follows: BUSWAY CIVIL CONTRACTS & STATIONS 112Q-R27 North at Sandown & Sunningdale Roads Practical Completion was achieved on 30 June 2012. 113Q-Non Motorised Transport (Table View / Milnerton areas) Works have been completed. The contract has, however, been extended to cater for landscaping maintenance. 128Q-Racecourse Road, Milnerton Practical completion of the civil works is anticipated by September 2012. Completion of the station buildings is scheduled for end October 2012. 262Q- Atlantis & Melkbos Civil Works around Stations Station substructures were handed over to Group 5 on 28 May 2012. Station Top Structures completion projected for January 2013. 437Q-Blaauwberg Road On programme for completion by June 2013. The focus is on the section from Pentz / Raatz to Wood Drive, as the stations are required for operations early 2013. Noted that construction of Boy de Goede being delayed due to re-location of Eskom cables that are required. All Eskom related works are now underway and construction of the actual works around the station can commence shortly. 154Q-Potsdam Road Works commenced 27 March 2012. Completion for Civil works projected for September 2013. 390Q-Queens Beach Works commenced in May 2012 and are scheduled for completion by March 2013. Approximately 1 months delay has been experienced due to relocation of services which will affect the end date. 390Q-Gardens Works were completed in July 2012. Station to be handed over to the City ASAP. 390Q Adderley A public participation process to relocate the Cenotaph is currently underway. Decision from Heritage Western Cape to be confirmed, once public participation process is completed. Following completion of the conceptual design; further design is on hold and subject to the outcome of the Heritage Impact Assessment. The construction of this station has been removed from the Group 5 contract. Consultants are developing kerbside bus stops as an interim solution for implementation by Milestone 1 (Nov 2012). 390Q V&A Waterfront Station Waiting for the signing of a ‘Servitude Agreement’ between the CoCT and V&AW regarding infrastructure costs/lease costs. Finalisation of agreement is now critical to achieve sign off from Council before 2012 year end. FEEDER STOP CONTRACTS Advertising Contract for Feeder Stops The advertising contract has been awarded. Once details of the contract have been supplied to infrastructure, arrangements shall be made to hand over completed stops. 375Q-Table View Feeder Stops Works are not currently on programme, but the contractor is still projecting completion by October 2012. Table View closed feeder station is due for completion by October 2012. Operation of this station is in line with completion of stations along Blaauwberg Road, i.e. Wood Drive, which is scheduled for early 2013. 469Q-Atlantis Feeder Stops On programme for completion by October 2012. IRT Progress Report No 30 V1 July&August 2012 Page 12 of 29 319Q- Inner City Feeder Stops Currently the contract is running 13 days behind the programme due to contractor-related issues and completion is expected June 2013 Note that confirmation of routes and stops required for Milestone 1one is critical if it is to be co-ordinated with infrastructure delivery. IRT DEPOT CONTRACTS 170Q-Stables Depot Handover of the depot to the operator was achieved in June 2012. Inner City Depot Works commenced in April 2012. Completion date to be confirmed once the impact of design changes and phasing of construction works has been resolved. The co-ordination of current Milestone 0 bus services together with construction activities has placed a risk on the delivery of a fully operational site by 1 November 2012. . The relocation of Milestone 0 services would allow the contractor access to the balance of the site for completion of the majority of the works. Partial occupation can then be planned for the Inner City Depot for November 2012, providing sufficient access to facilities to operate the start-up service. Noted that the contract budget is to be increased due to various design changes and risk realisations in the ground. BAC meeting to be arranged accordingly. 43Q – Atlantis Depot Contract commenced on 9 January 2012. The contractor is currently four weeks behind programme. Completion is projected for December 2012 as per programme. The overall status of IRT Phase 1A Infrastructure for the Inner City and Atlantis Corridor is indicated in the table below showing current progress versus planned progress: IRT Progress Report No 30 V1 July&August 2012 Page 13 of 29 IRT Progress Report No 30 V1 July&August 2012 Page 14 of 29 5. System Planning Phase 1A The planning for the rollout of Phase 1A is complete and roll out has been programmed for over five major 1 milestones. Milestone 0 is currently operational. The remaining milestones will be rolled out as follows: Milestone Milestone 1 Description of services provided Updated Plan Milestone 0 plus The permanent Inner City feeders covering Planned: entire inner city areas plus a link to Hout Bay. December 2012 9m feeder busses will be operational. Existing Interim feeders in Table View will Revised/Projected: continue in support of the Table View Trunk 1 December 2012 – 4 May 2013 service Plus: Milestone 2 Permanent Table View feeders to serve the Table View trunk and provide a distribution service within the Table View area. Opportunity to commence City to Montague Gardens trunk along Racecourse Road supported by a feeder btw Montague Gardens and Century City Planned: March 2013 Revised/Projected: 16 March to 13 April 2013 Plus: Atlantis Trunk via Melkbosstrand to Montague Gardens and Cape Town Feeders within Atlantis serving trunk and local travel desires. Planned: June 2013 Revised/Projected: 11 May to 30 June 2013 Milestone 3 Plus: Trunk from Bayside to the CBD is extended from Bayside to Du Noon. Planned: November 2013 Interim feeder between Du Noon to Montague Gardens (this can be introduced earlier as part of milestone 2 or 3) Revised/Projected: 1 to 30 November 2013 Milestone 4 Figure 3 : Phase 1A planned roll-out programme 1 Milestone ‘0” refers to the current interim MyCiTi service which consists of trunk services between the CBD and Table View and selected feeder services in the CBD and in Table View. IRT Progress Report No 30 V1 July&August 2012 Page 15 of 29 Phase 1B & 1C The system planning team are currently finalizing operational details for the completion of Phase 1 of the project. This includes the following: • • • Trunk (main-line) services between Du Noon to Century City via Montague Gardens; Feeder services from Summer Greens, Edgemead & Richwood to Century City; and Feeder service between Montague Gardens to Maitland and Salt Rive Rail stations via Koeberg and Voortrekker Roads. N2 Express Service The roll-out of Phase 2 (Metro South East) express services is being planned internally and progress thereof will be reported in future reports. The system planning team has finalised the viability assessment of the Express Service and is currently being incorporated into the Business Plan which will be submitted to the relevant portfolio committees and COUNCIL for approval in October 2012. In addition an interim express BRT service between the MSE and CBD is proposed to be fully operational by December 2013. Phase 2: Metro South East Phase 2 is defined as the Metro South East (MSE) area and is a region of high public transport demand in the metropolitan area. A number of high priority public transport corridors serving the MSE have been identified and the systems planning team are now focussing on these. The high priority corridors include rapid transit (trunk) services to and from the MSE along the following: • • • • Wynberg / Claremont; Bellville via Symphony Way; West Coast, Montague Gardens, Atlantis via Nigeria Way (Langa) and Jan Smuts Drive; and CBD (via Klipfontein Road) 6. Business Development Vehicle Procurement Contracts (VPCs) The supply of 9 m low floor feeder buses under Contract 371G/2010/2011 is well underway with the City accepting delivery of the first 46 buses. The production of buses will continue to March 2013. The supply of components supply via sea and air freight has been a critical time related issue which affected initial production progress but with the bus production now beyond the start-up phase supply logistics has improved and no longer a major area of concern. The project team will however continue to closely monitor production rates. The buses are being assembled in Elsie’s River where approximately up to 180 local personnel have been employed at the assembly plant. Tenders for the balance of the Phase 1A fleet and the Phase 2 Express service fleet are planned to be advertised at the end of September 2012. The issue of a National Treasury Notice on 16 July 2012 regarding designated sectors for local production and content requires that all new buses must meet specific a percentage of local production and content. The City’s tender documentation is being amended to ensure compliance with these new requirements and a number of meetings have been held with the Department of Trade and Industry (DTI) and a representative from NAAMSA in order to clarify a number of issues. IRT Progress Report No 30 V1 July&August 2012 Page 16 of 29 Vehicle Operator Companies (VOCs) The process of negotiating the long term VOC contracts for Phases 1A and 1B started in May 2012 with the issue of the Prospectus. This was followed in June 2012 with the issue of the draft contract documents to each of the three VOC’s and the City’s initial proposal of the kilometre rates. Negotiations continued during the reporting period with a view to finalising negotiations by mid October 2012. Agreement by the taxi industry of early compensation is a prerequisite for the finalisation of the negotiations of the long term agreements. Fare Collection Contract (AFC) During July, the final design of the Transit Products was completed and the manufacturing of the first set of 30 gates was started. By the end of July, 81% of the software development for the intelligent flat and EMV distance based fares solutions was completed with 13% of the hardware installed – this hardware installation related particularly to the current interim flat fare solution. During August, factory acceptance testing (FAT) was successfully completed on the first 30 gates (see Figure 6.2). Six additional ABSA retailers were added to the existing retail network and all ABSA ATMs activated for use by ABSA account holders for value loading/pin changes. Furthermore, ABSA have also installed 11 cash receptor machines for use by any myconnect card holder for value loading/pin changes. By the end of August the software development for the intelligent flat and EMV distance based fares solutions was completed, together with the training plan and manuals. Figure 6.2 - Fare Access Gates – Factory acceptance testing (FAT) completed Control Centre Contract (CCC) During July, whilst installations continued on the buses and in the stations the final design of the SOAP interface, which allows for the integration between the control center and fare media equipment to enable distance based fares to be correctly calculated was completed. During August, site acceptance testing (SAT) on the buses and in the stations was started. Although the passenger information boards (PID) have been temporarily configured to show the time only (see Figure 6.3), the final design of the PID ‘look & feel’ was completed which means that configuration relating to bus departure times can start in September – displaying the time electronically, which is automatically synchronized with the network time server thus displaying the correct time as per 1026 100% of the time, which reduces the risk of having to keep analogue clocks correct as per 1026. By the end of August, 81% of the software development for the full solution was completed with 45% of the hardware installed on the buses, 45% in the stations and 95% at the TMC for System Controlling. IRT Progress Report No 30 V1 July&August 2012 Page 17 of 29 Figure 6.3 – Passenger Information Display (PID) showing time Station Management Contract (SM) The Station Management tender closed on 20 July 2012 and tender adjudication continued through the rest of the reporting period. It is envisaged that, provided that lengthy negotiations are not required and there are no appeals, the contract will be awarded in December 2012 and after a period of mobilisation, the contractor will commence operations in March 2013. The delay in the commencement date of the Station Management Contract has necessitated the advertising of a short-term tender for the maintenance of landscaping along MyCiTi routes and at stations. The maintenance of landscaping is included in the Station Management Contract, which will commence only in March/April 2013, while the current maintenance contracts for this landscaping end in September 2012. The landscaping tender was advertised on 3 August 2012 and will be awarded in 1 October in time to allow for a continuity of the landscaping maintenance function. A further contract to secure retail leases to retail businesses to occupy and trading outlets at specific stations is being developed in time for the date of opening of the Gardens station in November 2012. Advertising Management Contract The preferred service provider was appointed by the City’s BAC on 2 May 2012, subject to negotiations which continued during the course of the reporting period. It is anticipated that the final contract award will take place in September 2012 subject to any appeals. Business Plans The business development team proceeded with the process of drafting business plans for Phases 1B and 2A Express as well as updating the current Phase 1A business plan incorporating the council approved amendments to date. The Phase 1B and 2A Express business plans are required for council approval in order to proceed with further detailed planning and infrastructure implementation. IRT Progress Report No 30 V1 July&August 2012 Page 18 of 29 7. Industry Transition The City has finalised the process of legal verification of the qualifying operators’ personal and banking details. We are in the process of requesting the Provincial Regulatory Entity for the cancellation of the affected operating licences and physical scrapping of minibus-taxi vehicles before effecting payment of compensation. In respect of VOC A, Transpeninsula, additional costing surveys that the City needed to undertake in order to conclude the compensation offer for these associations have been completed. These survey results will now be applied to the compensation model to conclude compensation offers for operators forming part of VOC A. 8. MyCiTi Operations Since its launch in May 2010 until August 2012, over 3.8 million passenger journeys have been made on the MyCiTi rapid transit system, many of whom use its rapid bus service on the dedicated bus lanes. This includes transport services during the Soccer World Cup, passengers who made use of MyCiTi buses during events at the Cape Town Stadium and those who made use of event services offered with chartered buses. Between January and August 2012, the counting of passengers using the system has been dependant on the recording of the validations made using the myconnect card (as opposed to counting paper ticket sales). There is an indication that passenger numbers have dropped on the Inner City and Trunk services since December which are confirmed through surveys and passenger counts. Passenger numbers did however increase in July for the airport when compared to the May and June figures, with the figures remaining steady on the other services in comparison to June. This may be the end of a cyclical trend we can expect to see through the winter months. The following graphs outline the number of passengers using the system. MyCiTi Airport Service: passengers per month 14000 12000 10000 8000 6000 4000 2000 0 IRT Progress Report No 30 V1 July&August 2012 Page 19 of 29 Passenger journeys based on ticket sales: MyCiTi (excluding airport and event services) (Assumption: 33% of passengers use only feeders. 66% use trunk + feeders or only trunks.) Total passenger journeys counted. Different trips taken by a passenger on one journey counted as one. 350000 Paper Tickets EMV Validations Passengers per month 300000 250000 200000 150000 100000 50000 0 The following table indicates the present on time buses against the set schedules. Transport for London bus norms aim to achieve an on time % of 85% or more: Table 8.1 - Performance data for August 2012. T1 % On-Time (2 min early to 5 min late vs. time table time)* Airport F1 F14 F15 F16 July to September 2011 Average 87% 97% 88% 79% 57% 67% 72% 78% 78% 79% October to December 2011 Average 88% 99% 92% 75% January to March 2012 Average 87% 95% 90% 75% Averages 89% 98% 91% July-12 81% 88% 86% Averages 88% 98% 93% 84% 92% 83% April to June 2012 August-12 Averages 88% 96% 93% 82% 86% 83% *Note that times are indicated in minutes according to international standards. The variances would occur between the time range of 2.59min early and 5.59min late. IRT Progress Report No 30 V1 July&August 2012 Page 20 of 29 % on-time departures 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% T1 Airport F1 F14 F15 F16 IRT services Ave. July - Dec 2011 Ave. Jan - July 2012 Aug-12 The following graphs indicate the results of observations undertaken using on-the-ground monitoring as well as camera analysis at the TMC to assess the VOC’s % compliance against the contract. Average Operational Service Compliance auditing results undertaken by daily monitoring of the contract 100% 80% 60% 40% 20% 0% Jul-12 Aug-12 Sep-12 Infrastructure Oct-12 Nov-12 Dec-12 Vehicles (non-technical) Operational Resources Despite progress having been made on obtaining permanent staff for the IRT organogramme, there are still key vacancies which require the support of the outsourced consultants, especially as a result of the operations planning presently being prepared for the launch of Milestones 1, 2 and 3. With the fleet increasing in size as a result of the City’s receipt of the 9m Optare feeder buses, the incorporation of a dedicated STS resource structure for IRT is being proposed to ensure the fleet vehicles are managed and maintained correctly. IRT Progress Report No 30 V1 July&August 2012 Page 21 of 29 Support functions (provided by other City departments) Transport Information Centre: A key focus to enabling the system to improve relies on the feedback from the general public. Data is being compiled from calls being received from the public at the Transport Information Centre. The majority of comments and complaints are related to the implementation of the EMV card (as reflected in “Fare and myconnect queries”). Despite there being no SLA in place as yet, a good working relationship has been established. IRT Monthly Stats 30 July 2012 - 26 August 2012 Number of calls taken during the month per item 80 70 60 50 40 30 20 10 0 Reasons for call Strategic Surveillance Unit - the following graph indicates the number of unauthorised vehicles observed on the CCTV cameras using the red lane on the R27 between the Civic station and Table View. An overall reduction in transgressions can be seen as a result of law enforcement issuing fines but 141 fines were still issued in August against the 175 cars noted in the dedicated lanes. A SLA agreement is still to be drafted, however a good working relationship continues. Number of vehicles observed on IRT red lane and Fines issued 450 400 350 300 250 200 150 104 100 88 45 42 50 141 131 64 83 79 51 19 0 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Number of vehicles in IRT lane Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Fines issued Law enforcement - A good working relationship continues with Law Enforcement whose duties cover both IRT passenger infringements monitoring as well as other by-law enforcement. The officers were able to charge a IRT Progress Report No 30 V1 July&August 2012 Page 22 of 29 total of 537 passengers who boarded for free as a result of the on-bus equipment not working. No direct fare evasion was observed during the month. Law Enforcement Inspections - August 2012 Total inspections 1400 1200 1000 800 600 400 200 0 1 - 5 Aug 2012 6 - 12 Aug 2012 13 - 19 Aug 2012 20 - 26 Aug 2012 27 - 31 Aug 2012 Weekly inspections Tappings Payments Roads and Stormwater – Our facilities department have found the long lead times for any repairs and maintenance difficult to work with and further attention is needed to develop an SLA that would ensure better cooperation between the departments Cleansing - A good working relationship has been established despite and SLA being needed. Traffic Services incl. Transport network operation and signals – A good relationship has been established with support in enforcing the IRT lanes being particularly good. An SLA has been drawn up and is being finalised in conjunction with the Transport department. 9. Communications, Marketing & Branding Tasks undertaken for August 2012 were as follows: The MyCiTi communication team planned and facilitated a public information session about future routes in Walmer Estate, Woodstock and Salt River. The public were allowed the opportunity to view maps and interact with engineers working on the project and have their questions answered. Preparations included: • • • • • • Venue bookings, set up of expo stand and attendance registers, enquiry books Production and distribution of leaflets Production and distribution of street pole posters Preparation of PowerPoint presentation for engineering team Advertising/Advertorials produced and placed in main daily newspaper News releases sent out to community newspapers The advertising campaign has introduced the City’s five pillars’ theme in its brand-focused advertising, to link closely to the City’s core messages. This has been introduced through a conversational-type advertising style, which speaks to not just the system but the wider benefits of an efficient public transport service for Cape Town. The new look includes the darker blue that is being used to brand the 9m feeder buses, as well as following a more conversational layout. This ties in with our publicity around how MyCiTi brings people from different walks of life together and gets conversations started that would not necessarily have had the opportunity to occur previously. Media releases Media releases issued between 1-31 August IRT Progress Report No 30 V1 July&August 2012 Page 23 of 29 • • • • • MEDIA MEDIA MEDIA MEDIA MEDIA RELEASE, RELEASE, RELEASE, RELEASE, RELEASE, August August August August August 1: MyCiTi services suitable for passengers with special needs 6: MyCiTi info session for Walmer Estate, Woodstock, Salt River on 22 August 2012 10: MyCiTi extended hours of operation for Ajax-CT home games 16: Update on MyCiTi Blaauwberg Rd roadwork’s 20: MyCiTi info session for Walmer Estate, Woodstock, Salt River on 22 August 2012 Website Work continues on the new MyCiTi website, which is being populated with the necessary relevant information before being launched. Several content meetings were held between the web developers and the Joint Venture, namely String, HWB and Switch. There have been delays in the launch of the site as a result of delays in provision of information for the trip planner functionality. Announcements The scripts were written and circulated for the announcements on the buses, namely upcoming stations on the route (to be broadcast in the buses) as well as safety announcements, (on buses and in stations). Direct MyCiTi market research: Work has commenced with market research focused on users and non-users of the MyCiTi service in the existing and future MyCiTi geographic footprint areas. MyCiTi DVD Series: The MyCiTi DVD series has been completed and circulated to the project team and consolidated versions of the MyCiTi DVD series will be launched in September. Newsletter The August edition of the MyCiTi e-newsletter focused on new cycle lanes planned for the city, linked to the roll out of future MyCiTi bus routes, universal accessibility, and future integration with rail. MyCiTi tip of the month Make sure that you save the toll-free number 0800 65 64 63 on your cellphone so you can always contact the Transport Information Centre for help. It's available in English, Xhosa and Afrikaans and operates 24/7. IRT Progress Report No 30 V1 July&August 2012 Page 24 of 29 10. Risk Management A comprehensive risk register is prepared on a monthly basis for the City’s review and approval. Mitigation measures are agreed upon and action is taken in line with the detailed recommendations contained in the report. The overall risk profile for July and August 2012 has decreased marginally during the reporting period. The major risks listed in the Risk Assessment Report are the following: 10.1 Delays to the negotiation process of the Interim Vehicle Operating Contracts – Interim and Long Term. Prim ary Risk The current process for the 12 year VOC agreement is programmed to be completed by December 2012 to be operationalized by March 2013. The overall negotiation process has been re-evaluated taking into account alternate options should the initial discussions not be successful. If there is a need to adopt these alternate options the Milestone dates could be exceeded. M itigating m easures Assessment of the situation at the end of August 2012 indicated that the roll out sequence had to be rescheduled to accommodate the industry transition process. The Milestone roll out programme was adjusted and is in the process of being approved. There is a secondary negotiation strategy should the current negotiations with the VOC’s end in deadlock. The roll out might need to be adjusted, but it will not have an effect on the current operations. If the secondary negotiations should fail, there are two contingency plans in place to ensure that the process continues. The failure of the secondary negotiation process will have a more significant effect on the roll out programme. Secondary Risks Metered taxi operations at proposed Adderley Street interim stop to be relocated. The negotiation process has not started yet. M itigating m easures Resources to be allocated to start the negotiations with the Adderley Street metered taxi operators. As an alternate mitigation measure, the operating licences for this route could be reviewed. 10.2 Financial Management of OPEX: Prim ary Risk 1 Not spending as planned, due to delays that exceed the allowed float in the Master Programme. Severe delays are currently experienced on the payment of Compensation to the VOC's and the payment of scrapping allowances. In addition the cost of scrapping and the amount of vehicles to be scrapped are increasing. Not spending the funds, result in the IRT Phase 1A project deviating from its projected cashflow, which can lead to the underspending of funds allocated to a specific financial year. Under-spending can result in a reduction in future funding allocations. IRT Progress Report No 30 V1 July&August 2012 Page 25 of 29 The risk rating of this particular risk item has increased, due to uncertainty regarding timelines for the negotiation process. M itigating M easures All effort is being made to expedite the industry transition negotiations. An on-going delay on reaching an agreement on Compensation is currently being experienced. The City is actively pursuing individual operators to urgently finalize the compensation agreements. Early compensation for operators who agree to the terms of the long term contract will be allowed. The additional cost envisaged for the scrapping of vehicles to be quantified as soon as possible. Prim ary Risk 2 The operational cost was assessed and taking the SLA’s (Service Level Agreements) into account, revised to be within the available budget. The implementation of the project has brought about an increase in operating cost, which currently remains manageable. There are still elements of the operational process that needs to be clarified and finalised through inter-departmental SLA’s and the Station Management Contract. The increasing deficit between income and expenditure is however of concern. M itigating m easures The City is in negotiation with NDOT to clarify the utilization of funds with regards to on-going operational costs. The operational expenditure model will be updated to determine a more accurate projection, as soon as there is clarity on the implementation of the SLA’s. Other mitigation measures include a review of the fare revenue model and the business plan. 10.3 Financial Management of CAPEX Prim ary Risk The actual costs of the planned infrastructure projects are exceeding original estimates, resulting in deviation from projected spending targets. The overall contract may exceed the original estimated budget if the proposed savings identified, are not realised. Not spending as planned, due to variations in the contract value or delays can lead to underspending of funds allocated to a specific financial year. Under spending can result in a reduction in future funding (DORA) allocations). In order to proceed with multi-year procurement processes to achieve the projected project spend, guarantees of future funding allocations from N.D.O.T. is crucial. M itigating m easures The capital costs of the projects were updated, indicating that the committed contracts are being managed predominantly within the revised spending targets. This has been achieved through on-going value engineering and on projected saving targets for each project component. The actual capital expenditure is tracked monthly and evaluated against projections of the overall cash flow to highlight possible risk areas in advance. The cashflow is reported on a monthly basis. 10.4 Consultant appointments are critical to ensure the successful completion of Phase 1A and the start of future phases. Prim ary Risk IRT Progress Report No 30 V1 July&August 2012 Page 26 of 29 Appointment of the current consultant teams responsible for the design and management of the infrastructure projects are coming to an end prior to the construction contracts concluding. If the contracts are not extended it may result in a break in continuity in the design / management of the implementation process. To ensure a continued roll out of the infrastructure, there should be an overlap between the current team and the teams to be procured via the tender process for the future phases. M itigating m easures The consultant appointments that can be extended will be adjusted according to the City’s Procurement Policy. Other contracts will be re-tendered. 10.5 Risks related to the procurement of contracts of various phases. Prim ary Risk The procurement of the last contracts in Phase 1A can overlap with the procurement of the contracts required for the future Phases. Procurement of too many contracts simultaneously, with a limited amount of procurement staff in Supply Chain Management, can result in delays in the procurement of the contracts. Delays to the start of contracts can result in under spending in the particular financial year. M itigating M easures The procurement programme for Phase 1A was updated. A Procurement Programme that includes all of the future phases was compiled, to indicate the potential impact. The allocation of resources to the multi-phased programme will enable the IRT team to plan resource utilisation in the critical months ahead. 11. Health & Safety Building & Civil Contracts The activities on construction sites are subject to the requirements of the Occupational Health and Safety Act No. 85 of 1993. It is a condition of every contract that the contractor ensures that all work will be performed, and all equipment, machinery and/or plant used, in such a manner as to comply with the provisions of the Act and the regulations promulgated there under. Each contractor is required to appoint a competent person whose duty it is to enforce compliance. The Health and Safety practitioner appointed by the City of Cape Town considers, for approval, health & safety plans submitted by contractors; monitors compliance; issues instructions to bring about improvements where required, and prepares monthly reports, of which the table below is a summary: CONTRACT IRT Progress Report No 30 CONTRACTOR PERCENTAGE GENERAL COMPLIANCE July August 2012 2012 V1 COMMENTS July&August 2012 Page 27 of 29 128Q/2010/11: Transport Corridor along Racecourse Road from R27 to Omuramba Road Exeo Khokela Civil Engineering Construction 76,8% 80,9% Prohibitions – working in or next to trafficked lanes 154Q/2011/12: Atlantis IRT Corridor: Potsdam Road from Blaauwberg Road to Usasaza Road, Dunoon Martin & East 67% 89,4% Prohibition – pedestrian accommodation 262Q/2010/11: Atlantis IRT Infrastructure: Trunk Route Stations, Roadworks and Services in Melkbosstrand and Atlantis Martin & East 98% 96,5% Prohibitions – working next to trafficked lanes 375Q/2010/11: IRT System Phase 1A: Construction of Bus Stop Infrastructure in Table View and Milnerton Civils 2000 92,1% 84,5% 437Q/2010/11: Atlantis IRT Corridor: Blaauwberg Road from R27 to Potsdam Road 469Q/2010/11: IRT System Phase 1A: Construction of Bus Stop Infrastructure in Atlantis and Melkbos Martin & East 62,3% 78,1% Prohibition – excavations repeated Exeo Khokela Civil Engineering Construction 56,4% 87,6% 87% Group 5 Prohibition – lifting machine (repeated) Traffic accommodation An improvement in hazard compliance noted during the August ’12 site inspections. 80% 390Q 08/09: IRT Major Station Superstructures Contract none Administrative H&S systems compliance remains high. 391Q10/11: IRT Open Feeders Bus Stops Contract Group 5 75.3% A significant increase in hazard compliance on the Feeder Stop sites assessed during August ’12. 95% Administrative H&S systems compliance remains high. Table 11.1 - Summary of Building & Civil Works: OH&S Compliance Report Note: The “Percentage General Compliance” refers to a score based system of independent “Safety Agent’s” assessing compliance with OH&S requirements, which include, inter alia: on-site construction practice, provision of safety and protective equipment, on-site documentation etc. IRT Progress Report No 30 V1 July&August 2012 Page 28 of 29 Operational MyCiTi Contracts Full OH&S assessments of the VOC operations continue. The overall station and depot compliance is good. Kidrogen low score in May on their depot was as a result of their transition between their old and new Stables depot and paperwork, updated procedures etc not being in place. A meeting was held with the MyCiTi OHS team and the City of Cape Town Corporate and HR representatives to address the low OHS assessment scores experienced for some of the stations since the beginning of the OHS assessment process. The current methodology for scoring the items in the OHS assessment form was reviewed and a revised methodology was agreed upon by all parties. The higher risk items will in future be weighted more heavily to counteract the effect of non-compliant low risk items significantly reducing the total assessment score. This revised methodology will be implemented from September 2012 for all stations and depots. The following graphs indicate the overall average H&S compliance of the stations and depots to date. The Kidrogen depot assessment was not conducted for August 2012 as Kidrogen were in transition between the shared Transpeninsula depot and their newly constructed depot in DeNoon. The Kidrogen depot assessments will resume in September 2012, as they have now taken possession of the new depot. Monthly H&S Assessment Comparisons of VOC Stations Vehicle Operator TransPeninsula (IRT Bus Stations) Kidrogen (IRT Bus Stations) GABS (Depot) TransPeninsula (Depot) Kidrogen (Depot) November December January February 82 90 83 78 80 81 70 75 March 80 79 April 81 82 May 83 77 77 96 65 June 82 74 July 80 77 85 85 August 83 80 88 85 Monthly Health And Safety Assessment Comparison 100 95 90 85 80 75 70 65 60 55 50 45 40 November December January TransPeninsula (IRT Bus Stations) February March Kidrogen (IRT Bus Stations) April May GABS (Depot) June July TransPeninsula (Depot) August Kidrogen (Depot) Project Office As required in terms of the Occupational Health & Safety Act, the monthly inspection of the project office facilities and environment was undertaken in July & August 2012 - no non-compliance issues were noted. IRT Progress Report No 30 V1 July&August 2012 Page 29 of 29 12. General The following general issues are noted: Additional staff members have been appointed to the City IRT Team; it is anticipated that all IRT staff appointments will be substantially complete by the end of August 2012. Agreement was reached with NDOT on a schedule for regular quarterly meetings for the future (on system planning, funding and other crucial matters) IRT Progress Report No 30 V1 July&August 2012