Document 10719613

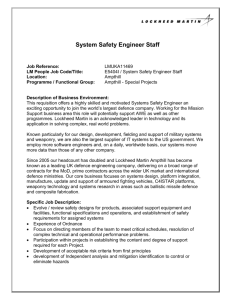

advertisement