Financial Guide Charter Schools For

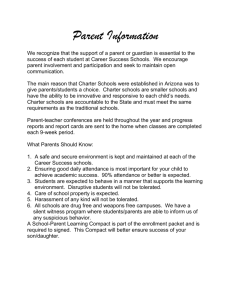

advertisement