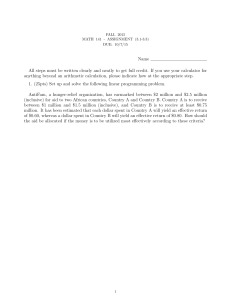

’ A G I

advertisement

Issues Note – G20 Ministerial Seminar at the Rio+20 A GREEN AND INCLUSIVE ECONOMY: THE FINANCE MINISTERS’ PERSPECTIVE G20 MINISTERIAL SEMINAR ISSUES NOTE United Nations Conference on Sustainable Development – Rio+20 June 21, 03:30 PM – 06:30 PM – Riocentro Complex– P3-4 Room 1. The need for a new development model One of the central themes of the Rio+20 Conference is “green economy in the context of sustainable development and poverty eradication” – in short, how countries can achieve a Green and Inclusive Economy, adopting development models that promote social inclusion, economic growth and environmental protection. Some advantages that a green and inclusive economy is proposed to offer on a global scale are job creation, the expansion of sustainable patterns of production and consumption, development and uptake of technologies and infrastructure that are sustainable, the transition to a cleaner and lower-emitting energy matrix. Those goals would represent common accomplishments for developed and developing countries, and require joint efforts for their achievement. The resource-intensive development model of the past will lead to rising costs, loss of productivity and prolonged economic, social and environmental crisis. It has failed to create sufficient decent work opportunities and has generated increasing systemic instability induced by the financial sector, compromising even the achievement of some of the Millennium Development Goals. If profound changes in the economic system are not put into place, “business-as-usual” behavior will continue to dominate, maintaining wasteful production and consumption patterns along with continued soil degradation, air and water pollution, deforestation, overfishing and climate change. This scenario will result in increasing water shortages and escalating prices for food, energy and other commodities, exacerbating problems such as poverty and inequality as well as malnutrition and food insecurity. The new approach offered by the notion of “green and inclusive economy” should be seen as a program to attain sustainable development. This approach should not be seen as competing with the agreed conceptual framework of sustainable development, but could bring a more integrated and more action oriented view of the relation among the economic, environmental and social pillars. A green and inclusive economy program would thus require adaptation to concrete realities and therefore the consideration of the different levels of economic, social and environmental development in different countries. A universal and uniform approach to the concept of a green and inclusive economic program is not warranted. Acknowledging that there is no single path or set of policies that can be applied to all countries for the attainment of sustainable development, „green economy‟ instruments should be neither rigid nor prescriptive. They should, on the other hand, be defined according to national priorities and capabilities. Whatever forms the understanding of green economy will take, challenges will exist in implementing policies that would fall under that category. The provision of means of implementation to developing countries is at the very heart of the development challenges facing societies today, alongside the need for developed countries to adopt sustainable consumption and production patterns. Issues Note – G20 Ministerial Seminar at the Rio+20 Green and inclusive economy strategies also present the potential to unlock new growth engines and spur global economic growth. In this context, well-designed structural reforms to improve framework conditions for green investment and innovation, coupled with appropriate technology transfer mechanisms, can help drive economic growth, jumpstarting it in a sustainable way in advanced economies and making it more sustainable in the emerging-market and developing ones. These reforms can contribute to macroeconomic stability and resilience. If properly managed, they can help ensure that broader objectives of poverty alleviation, health, education and other pressing priorities are achieved. While all Finance Ministers aim at achieving a sustained path of growth, not many are pursuing explicit sustainable development objectives. Finance Ministers must take a lead role in order to mainstream sustainable development into countries‟ economic policies. A brief summary of the instruments that may be considered by Finance Ministers for the implementation of a Green and Inclusive Economy is provided bellow. This non-exhaustive list has been gathered from studies and analysis provided to the G20 by member countries and International Organizations, such as the United Nations, the International Labour Organization, the World Bank, UNCTAD and the OECD, and does not necessarily represent the views or opinions of Brazil, the G20, UN member countries or IOs. 2. Internalizing externalities to modify private sector decisions Pricing allows the social cost of environmentally-harmful activities to be reflected in private sector decisions. Better pricing of environmental impacts can encourage sustainable production and consumption patterns, environmentally-friendly innovation, more efficient use of resources and energy, as well as contribute to improved health outcomes through a cleaner environment, with positive repercussions for human capital, labor productivity, and reduced health-related expenditures. Setting prices for environmental impacts can provide much needed fiscal resources while lowering other taxes and generating social benefits. The revenues generated by pricing externalities can be used to help lower other taxes to limit distortions or soothe possible adverse distributional consequences of reform through targeted social transfers to poor households, which is a more direct and less expensive form of support than generalized consumption subsidies (e.g. to water or fuel use). This new fiscal space can also be used to finance the adoption of cleaner and more efficient household energy sources, particularly for the poor, as well as other critical priorities, such as health, education, or infrastructure development. In advanced countries, part of these fiscal resources could be used to meet commitments to provide new resources to developing countries to finance climate change and sustainable development. Taxes or cap-and-trade schemes should be examined as an alternative to command and control measures in cases where they provide cost-effective ways to close the gap between the social and private costs of market activities that is generated by environmental externalities. However, poor design or inefficient implementation of these or any policy measures can weaken their cost-effectiveness and increase the social cost of achieving the intended policy outcomes. Market-based approaches include taxes or charges on pollution, natural resource use or access to national parks, and deposit-refund systems that encourage recycling and waste reduction and improve environmental awareness. Pricing pollution and natural resources use gives consumers and producers clear incentives to search for ways to reduce the negative environmental effects of their activities, while allowing them to choose how best to do so. When a given pollutant is uniformly priced across the economy, abatement costs will tend to be minimized. Appropriate Issues Note – G20 Ministerial Seminar at the Rio+20 pricing of natural resource use can also help to address scarcity issues, providing better signals to consumers and helping reduce and manage demand in a more transparent and efficient way. 3. Fiscal Policy: the right role for subsidies Removing inefficient policy-induced tax distortions that are detrimental to both the environment and growth is a key element of a green and inclusive economic agenda. Across many countries, governments continue to support a number of activities that encourage pollution, waste or over-use of natural resources. Removing such inefficient and environmentally-harmful subsidies, while maintaining adequate levels of protection for vulnerable groups, can improve the functioning of price signals and markets, reduce pressures on public budgets, while benefiting growth, innovation, social justice and the environment. This would help restore a level playing field, promoting investments based on their full costs and benefits. Inefficient fossil fuel subsidies that encourage wasteful consumption can contribute to price volatility by blurring market signals, encourage fuel smuggling, and lower the competitiveness of energy efficient and renewable energy technologies. Often, energy subsidies can be inefficient in meeting their intended objectives: alleviating the cost of energy for the poor or promoting economic development. Action to identify and tackle inefficient agricultural or fisheries subsidies could contribute to growth by facilitating a more efficient allocation of resources and reduced waste, and to better environmental outcomes, while opening space for rural development in developing countries. Direct and indirect subsidies to the agricultural and fisheries sectors, especially if not properly targeted or designed, can increase the pressures on the environment, for instance through higher greenhouse gas emissions, nutrient balances, resource depletion and increasing the pressures on land and water resources. The potential impacts of reforms on other policy objectives should be considered in order to minimize harmful impacts to the poor. Agricultural export subsidies provided by developed economies are particularly harmful to the poorest, as they can distort and fundamentally compromise agricultural production especially in the poorest countries. Subsidies can be used to encourage greener, inclusive and more sustainable consumption and production patterns and the diffusion of green technologies with positive social impact. Some countries run programs to pay businesses or individuals for positive environmental externalities, for example through Payments for Ecosystem Services (PES) schemes. An example would be Mexico‟s Proarbol program, under which it administers a range of payments for owners of forest areas for conserving rather than using the land for agriculture. Brazil‟s Green Allowance program rewards communities living in protected areas for their commitment to contribute to the promotion of environment conservation, while encouraging the sustainable use of natural resources, promotion of active citizenship, improvement of life standards and income growth for populations in extreme poverty. Several countries run programs that are specifically directed at supporting the use of renewable energy and energy efficiency. Feed-in tariffs or renewable portfolio standards to promote renewable energy are common tools used to promote the scaling up of promising technologies. Tax reductions and subsidized loans may also be directed to support retrofitting of buildings to improve energy-efficiency and the acquisition of efficient machinery. Care must be taken to design such subsidies in an efficient way, so to avoid distortions. Given different subsidization capacity among countries, attention should also be given to negative effects on other countries capacity to develop renewable energy industries. Issues Note – G20 Ministerial Seminar at the Rio+20 4. Natural Capital Accounting “You can't manage what you can't measure”. Countries have long kept a close watch on their national income accounts to evaluate economic performance and assess the effectiveness of their development policies and plans. And yet, traditional indicators based on national income accounts such as GDP can be misleading when environmental sustainability is ignored. Green accounting extends national accounts to include the value of the damage and depletion of the natural assets that underpin production and human well-being. In particular, net saving, adjusted for the depreciation of produced assets and the depletion and degradation of the environment, indicates whether well-being can be sustained into the future. Accounting for natural capital would also measure the economic contribution arising from public and private spending in environmental preservation and conservation, assessing increases in natural capital and ecosystem services provided to society. Substantial progress has been made by the international community since Rio 1992 in developing a methodology for natural capital accounting. The System of Environmental and Economic Accounting (SEEA) has been adopted by the UN Statistical Commission in February 2012 as an international standard to enable countries to incorporate into their national accounts the value of material natural capital like land, forests, minerals and energy. But Wealth Accounting also needs to include natural capital assets providing services that are not measured in markets and whose value and importance to the economy is not easily understood, such as clean water, habitats for fisheries, climate regulation and flood protection. Work is underway to extend the SEEA for these critical ecosystem services. Valuing the environment and incorporating natural capital into national accounts can lead to better economic policy everywhere. Natural capital in the Wealth Accounts, also provides detailed statistics for better management of the economy, like accounts for the sectoral inputs of water and energy, and outputs of pollution that are needed to model scenarios for economic planning and public policy formulation. Ecosystem accounts, for example, can help countries rich in biodiversity design a management strategy that maximizes the contribution to economic growth while balancing tradeoffs among ecotourism, agriculture, subsistence livelihoods and other ecosystem services like flood protection and groundwater recharge. 5. Green and Inclusive Public Procurement The acquisition of goods and services by public entities represents a significant part of the economy - about 15% of global GDP, depending on the methodology employed. The potential impact of the adoption of social and environmental criteria in public procurement can be significant, favoring, for example, the acquisition of products with extended lifetimes, their reuse and recycling, reduced consumption of raw materials or energy, or that benefit small producers or extractive communities. These purchases would not only change the profile of public demand, but could also induce private agents to adopt a more sustainable behavior on their production and consumption patterns, of private agents, creating economies of scale for the dissemination of new technologies, affecting production methods on the economy as a whole. The Rio+20 Conference offers an opportunity to highlight the strategic role green and inclusive public procurement policies can provide to sustainable development. Purchasing policies are the result of countries' sovereign decisions, defined though internal legislative processes as well as international treaties agreed upon by each country – there is no one-sizefits-all model to implement green and inclusive public procurement. Political commitments should be complemented by practical frameworks to implement a transformation on the patterns of public demand for goods and services, ensuring the necessary safeguards to prevent the use Issues Note – G20 Ministerial Seminar at the Rio+20 of these policies to impose illegal barriers to trade or imposing social preferences on other countries. 6. Green infrastructure investments and the need to improve access for all Getting infrastructure “right” is at the heart of green and inclusive economic policies. The large majority of G20 countries have identified improving infrastructure as part of their structural policy agendas, and the demand for better, greener and more inclusive infrastructure is pressing in most developing countries, as adequate infrastructure is a prerequisite to sustained economic growth and for sustainable development. The poor suffer most from the implications of insufficient or poor quality infrastructure, which also hamper efforts to promote environmentally-friendly consumption behavior. Adequate infrastructure provision and management in water, transport, energy and sewerage can help resolve environmental pressures such as water scarcity, local air or water pollution or pressures on land use. Underinvestment, on the other hand, can undermine sustainable development efforts. Examples include ageing and poor quality water infrastructure with significant leakage from pipes; inadequate public transport systems which encourage the use of private car transport and increase local air pollution; and poor electricity grid quality, which can hamper the penetration of electricity from renewable sources and encourage the use of back-up diesel generators. A key challenge is to make infrastructure both resilient to climate change and as resource efficient and low-emission as possible. Environmental Impact Assessment (EIA) of major infrastructure investments can help in this sense, including enhancing the climate resilience of infrastructure if the EIA guidelines are suitably adjusted. A lack of consideration for environmental impacts may prove extremely costly if it locks countries into inefficient technologies (due to their excessive carbon, land, or water intensity) or patterns of development that prove vulnerable to changing climatic or other environmental conditions. Developing countries cannot be burdened with the sole responsibility to increase investments in green infrastructure. Developing countries, which need to expand their infrastructure significantly to sustain economic growth and to promote universal access to adequate public services, have an opportunity to leapfrog dirty technologies and avoid unsustainable development patterns. – In that sense, following the principle of common but differentiated responsibilities, developed countries are called upon to expand their financing for sustainable infrastructure, particularly in less developed countries, as well as to strengthen international cooperation conducive to investment and technology transfer, development and diffusion. Renewable energies are now competitive with fossil fuel based energy, especially in some contexts (e.g. where the hydropower endowment is large, where electricity is produced offgrid). The competitiveness of clean energy technologies and renewables would be further enhanced with appropriate carbon pricing, innovation and economies of scale. Fortunately infrastructure is also a domain in which substantial synergies can exist between economic, social and environmental goals. Universal access to clean water and sanitation is good for social welfare and economic growth, but also for the environment. Better public urban transport reduces congestion and air pollution, with large economic and health benefits. In many cases, there are additional initial investment costs to ensure that new infrastructure minimizes resource and energy demands. But the additional benefit of building Issues Note – G20 Ministerial Seminar at the Rio+20 greener infrastructure should not be ignored, particularly when considered alongside potentially lower operating costs or the full long-term costs and benefits of the investment. 7. Inducing greener behavior through regulatory and information policies Reliance on markets and market signals is not sufficient for inducing a transition to a green and inclusive economy because sometimes markets do not exist or cannot easily be induced to work properly. Market failures – such as natural monopolies, missing markets, coordination failures, indivisibilities, network effects, information asymmetries, knowledge spillovers or behavioral biases (such as those due to habits, lack of awareness or preferences) can undermine the incentives embedded in price signals. In other cases, changing prices, removing subsidies or increasing taxes may be politically difficult. The financial sector has the potential to influence private sector agents to adopt sustainable practices. Recognizing this capability, several national and international voluntary initiatives have been undertaken in recent decades in order to establish sustainability standards for financial institutions, in order to limit the access to funding for activities that don‟t follow social and environmental guidelines. At the international level, the “Equator Principles” were established in 2002, binding participant Financial Institutions not to provide loans to projects where the borrower will not or is unable to comply with their respective social and environmental policies and procedures. Self-regulation by the Financial Sector may not be enough to incorporate social and environmental issues to Financial Institutions policies and strategies, risk management and daily operations. States, acting through financial regulatory bodies, can establish additional standards of sustainability applicable to all financial institutions, aligning the guidelines for access to financing to the overall national sustainable development strategy. The Brazilian Government, for instance, has required financial institutions to request from borrowers applying for rural credit on the Amazon Biome documentation to ensure compliance with environmental laws and regulations, such as environmental license and permits. Universal access to financial services is another essential condition for sustainable development. Microcredit, credit unions and innovative financial products can enable the formation of new businesses, increasing employment and income. Governments can play a central role to strengthen access to financial services to disadvantaged populations, creating an adequate regulatory environment that reduces the bias against small entrepreneurs, particularly those on the informal sector. Voluntarily, companies have been routinely publicizing actions that reflect their concern for social and environmental sustainability. The practice of publishing sustainability reports by companies is aimed not only to inform their shareholders, but also to the media, employees, government, consumers and civil society in general. It should be emphasized that these reports encourage and disseminate sustainable experiences, stimulating and spreading the adoption of good practices on the private sector. The release of sustainability reports could be made mandatory to state enterprises, development banks, pension funds sponsors, and publicly traded companies. Regulatory directives could establish guidelines for the disclosure of objective, timely reports on companies‟ social and environmental performance, according to internationally accepted standards. This measure could contribute significantly to the inclusion of these topics in the strategic agenda of large organizations, and could rely on existing international experiences, such as the work undertaken by the Global Reporting Initiative. Issues Note – G20 Ministerial Seminar at the Rio+20 Further Reading International Labour Organization (2012). Working towards sustainable development: opportunities for decent work and social inclusion in a green economy. Geneva: International Labour Office. OECD (2011). Towards Green Growth. Paris: OECD Publishing, Organisation for Economic Co-operation and Development. http://dx.doi.org/10.1787/9789264111318-en. UNCTAD (2010). World Investment Report 2010: Investing in a Low-Carbon Economy. New York: United Nations. UNEP (2011). Towards a Green Economy: Pathways to Sustainable Development and Poverty Eradication. Nairobi: United Nations Environment Programme. www.unep.org/greeneconomy. UNEP (2012). Global Environmental Outlook 5: environment for the future we want. Nairobi: United Nations Environment Programme. www.unep.org/geo/ United Nations Secretary-General‟s High-level Panel on Global Sustainability (2012). Resilient People, Resilient Planet: A future worth choosing. New York: United Nations. World Bank (2012). Inclusive Green Growth: The Pathway to Sustainable Development. Washington, DC: World Bank.