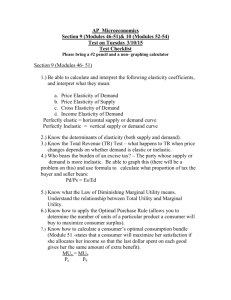

The Elasticity of Taxable Income with Respect to

advertisement