Bridging the Innovation Gap Through Funding: The ... by M.S., Ohchan Kwon

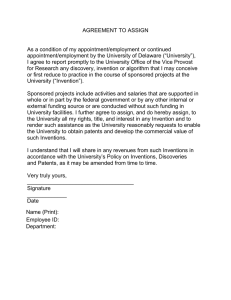

advertisement