Ambient Insight Premium Report The Worldwide Market for Self-paced eLearning Products and Services:

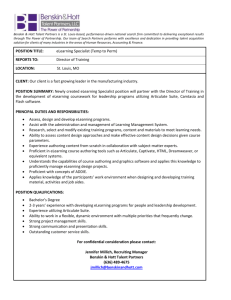

advertisement