Bachelor of Science in Business Administration

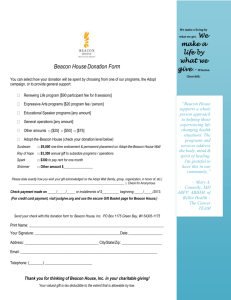

advertisement