Trip Wires and Speed Bumps: Managing Financial Risks and Reducing

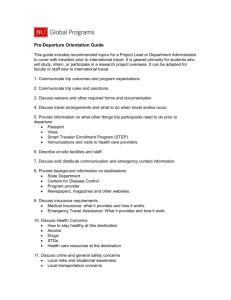

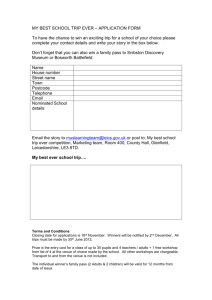

advertisement