Stabilizing Role of Fiscal Policy Roberto Rigobon MIT November 2011

advertisement

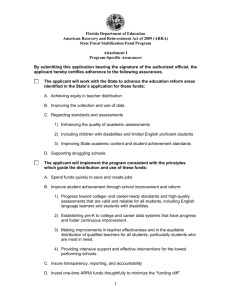

Stabilizing Role of Fiscal Policy Roberto Rigobon MIT November 2011 What are the tools for stabilization? • Which ones are the typical responses? – Monetary Policy • Interest rates and money supply • Reserve requirements – Exchange rate policy • Interventions • Capital controls • What is never answered? – Fiscal Policy Response to capital inflows? • Indeed, fiscal policy is perhaps the best tool to deal with capital inflows – Monetary policy creates a reinforcing loop – Capital controls creates other inefficiencies. – Fiscal policy creates a balancing loop and reduces the distortions. But fiscal policy is almost never stabilizing… • In general fiscal policy is pro-cyclical and therefore it is rarely stabilizing. It is destabilizing. – Revenues are volatile – Savings are difficult What is the revenue problem? • Fiscal revenues are extremely volatile in several emerging markets – Different sources of risk: • Commodity prices (exports) – This is perhaps the most important source of risk in Latin America and Africa. • Recessions – Political, financial, and social crises are an important source of fiscal risk. • Natural Disasters – El Niño, Hurricanes, Earthquakes, etc. What are the implications? • Procyclicality of fiscal policy – Cost? • Excessive cycles • Excessive volatility of the real exchange rate – Why? • Lack of insurance • Underdeveloped financial sector • Political economy Procyclical Fiscal Policy B I e r S l a S y g i r i H MC u a e P PA PO o am i e r a Mam nm B T a n a k r g u o S t n u C UC e P o y Z a g o n a l J i r m M M P o L L C e a o r o E h A CU B r D i u T r b E N r c u G C Z b a h o o e t NT h a g e u u s n B l U m C V e u o m y a w CP t S r i i r HS gMa h i o g g Z r G M a M A e s m G e a e i V o e m I T a y o a a L r A e n n l x I a Y l C n a n a n a zm e S u S A r l M i ô y o d n p s I a e T T e e a n ma t KCNMS a c a t t u u r g l l CMN i a u n a i e o i r e Ga B r a a i nmg d d d l n i e u n p l c y a d n a 1 0.8 0.6 0.4 0.2 0 -0.2 -0.4 -0.6 -0.8 -1 CS J a w J a n e ama d p d e a a n C n h S i w i t U z K e F r i l n a l n a d n d D N e e n t m h a e r r k l a n d s S F I E SSw r N n l o r a a N e d S u i n o p c r e w a y 3.5 2.5 2 1.5 1 0.5 0 Bo livia 4 Norway Netherlands Ireland Denmark Austria Bahamas, The France Israel Canada Switzerland Germany Taiwan Cyprus Greece Papua New Guinea Sweden St.Vinc&Grenad ines Malta Iceland St. Lucia Gamb ia, The Belgium Leso tho Korea, Rep. Hong Ko ng, C hina Spain Finland United K ingdo m Italy Morocco Australia Philipp ines Thailand Costa Rica Belize Japan New Zealand To go Tunisia Hungary United States Singapo re Fiji Turkey Ind ia Malaysia Portugal Pakistan South Africa Bahrain Peru Mexico Brazil Saud i Arab ia Trinidad and Tobago Chile Kuwait Paraguay Cote d'Ivo ire Do minican Rep ub lic Cameroo n Colo mb ia Argentina Indo nesia Burund i Uruguay China Venezuela Ecuador Zamb ia Ro mania 4.5 Industrialized countries Nigeria Volatility of the long run real exchange rate Developing countries 3 What are the Implications? • Exchange rate volatility and pro-cyclical fiscal policy put pressure on • • • • • Monetary policy Banking sector Investment (if irreversible) High interest rates (if risk aversion) Inefficient specialization Costs to the Economy • High real exchange rate volatility is associated with lower investment and growth, weaker banking sector, inefficient specialization, and dolarized economy. • Pro-cyclical fiscal policy is associated with lower growth, higher frequency of exchange rate crises, higher real interest rates, and less efficient tax systems. What can be done? • Classical view – Insure the risk. • • • • Transfer the risk to foreigners Future markets Contingent debt Stabilization Fund What can be done? • Insure the risk. – Transfer the risk to foreigners • What to do? – Sell the risky sector: » Commodity producing sector. • How it works? – Sell the sector to foreigners and then they bear the risk – The country consumes the annuity of the privatized proceeds • Problems: – Who will purchase natural disaster risk? – Credibility and privatization price. What can be done? • Insure the risk. – Future markets • What to do? – Stabilize price fluctuations in future markets • How it works? – The country agrees on a price for exports in the future. – If the spot price is above the agreed price, the country experiences a loss in the financial asset. The opposite if the spot price is below. – Notice that the returns on the financial instrument are negatively correlated with the spot price change. • Problems: – Volumes cannot be stabilized – Future markets are sometimes illiquid – Futures for long run horizons are extremely illiquid What can be done? • Insure the risk. – Contingent Debt • What to do? – Interest rates indexed to commodity prices or natural disasters • How it works? – The interest rate is indexed to the risk. – A negative shock implies a reduction in interest payments. The opposite if there is a positive shock. – Notice that the interest rate payments are negatively correlated with the risk source. • Problems: – Partial insurance at best. – Very costly – the country has to have enough debt. – Market does not seem to like this instruments What can be done? • Insure the risk. – Stabilization Fund • What to do? – Self-insurance: Save in good times and withdraw in bad times. • How it works? – Use savings to stabilize resources in bad times. The opposite in good times. – The returns on the savings should be negatively correlated with the risk factor • Problems: – Partial insurance at best. – Very costly – the country has to save. – Important problems of design. What happens in practice? • Risky sectors are rarely sold • Future markets are extremely limited. – Specially in commodity markets. – Good and liquid in the short run, but not in the long run • Contingent debt – Experiences have been very negative – Even in cases of hurricanes where moral hazard does not exist • Most countries end up implementing a Stabilization Fund. Stabilization Funds • What is the experience in the world? – Horrible – Really Horrible – Appropriability: • Most stabilization laws are changed frequently. – Specially when the resources saved are too large – Defeating their stabilization purpose. – Governability: • Most stabilization funds are associated to one risk source instead of overall fund. • This includes: – The asymmetric debt financing – The saving versus expenditure rule – Stochastic process: • This determines the expenditure rule. Hence, the proper estimation is crucial. Stabilization Funds • Appropriability – When the resources are too large, the political temptation to change the law and withdraw more resources is too big. • Governability – Stabilization funds should stabilize government revenues, and not the flows of each source of risk • Stochastic Process – Estimation of the stochastic process is rarely part of the design. Most stabilization funds just use moving averages as rules and become saving rules instead of expenditure rules. Appropriability • What can be done? – Invest resources better • Most funds invest resources in US Treasury Bonds. Why? • Wouldn’t be better to invest in assets that are negatively correlated with the source of risk? – Cap on funds • Recognize that there is a political economy problem and limit the resources accumulated ex-ante – Implies that full stabilization is impossible – Have discussion on how the non-saved funds are going to be spent. Governability • What can be done? – Have one stabilization fund for all fiscal revenues, independently of all the sources of risk. – Delegate key parameters in the expenditure rule to an independent institution. • The “discussion” process is more important than the rule itself. • Chilean case Lessons • Fiscal risk can be very damaging to investment and growth. – Pro-cyclicality of fiscal policy. – Real exchange rate volatility. • Most stabilization responses are not available. – Therefore, stabilization funds are the preferred policy. • Most stabilization funds have been incorrectly desgined – Appropriability. – Governability. – Stochastic process. • Key insights about design – – – – Better investment policies. Cap on the funds. One fund for aggregate fiscal revenues. Independent fiscal council to determine key variables in the rule (buy in)