HISTORY OF ECONOMIC IDEAS HEI

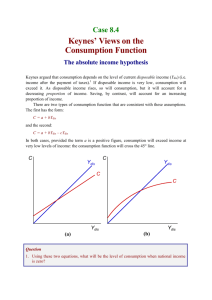

advertisement